FIN600/ FINA6017 Financial Management Assignment Sample

Question

Instructions

The basic requirement is to undertake a general financial analysis, comparing financial position and performance over the two most recent financial years, of an ASX listed company. Your Learning Facilitator will provide the details of the ASX listed company. The annual report for the chosen company should be available on the company website and/or will be provided by your Learning Facilitator. The analysis should consider each of the following financial ratios: - profitability and market performance

- Efficiency,

- Liquidity,

- Capital structure

Note: You are to use the ‘consolidated’ data in conducting your analysis. You are only required to look at the most recent financial report. For those ratios which involve averages, you will calculate an average for the most recent year only, the prior year ratio calculation will NOT consider average calculations.

This assignment will contain two elements: 1. Schedule(s) of relevant ratios and other useful calculations

- The detailed calculation of relevant ratios and other useful calculations should be included, as one appendix, prepared using Excel. An example template is provided under the assessment 2 information, Assessment 2 Appendix template.xls.

- You will be advised by your facilitator as to which ratios to calculate.

- You are advised to show the formulae used in determining particular ratios and other figures.

2. A written report The written report is the main element of this assessment. A sample template is provided under the assessment 2 information, Assessment 2 report template.doc. The written report should:

- Explain what is revealed by the ratios and other calculations, in the context of the company’s profitability, asset efficiency, liquidity, capital structure, and market performance.

- In particular, any important changes over the two financial years should be identified, discussed and, where possible, explained.

- Provide an overall assessment of whether the company, over the recent financial year, has been better than the previous financial year, in the perspective of existing equity investors (shareholders).

In preparing this report, you should:

- analyse the financial statements of the business;

- identify key ratios and apply ratio analysis; - argue the case of why the organisation may or may not succeed in the future and what the business should be doing to help it succeed;

- consider the impact of the political and competitive environment on the business;

- include external factors that need to be taken into consideration and the likelihood of a merger or acquisition;

- provide a recommendation, that is, would you invest in this company after your own analysis or under what circumstances would you buy/save the business?

SOLUTION

• Introduction

• Background and Business

Bega Cheese is an Australian Diversified food company with its manufacturing site and headquarters located in New South wales, Victoria and Queens. It was established as an agricultural business in the town of Bega located in New South Wales by suppliers of dairy in Australia. The company subsequently got public in 2011 and got listed in Australian stock exchange. More than half the shares that are currently outstanding in the market, is owns by the farmers of Bega Suppliers. Currently, it is one of the largest companies in the dairy industry of Australia and was responsible for supplying more than 750 million liters of milk for the year ending 2018 (begacheese.com.au 2021).

The primary source of income for Bega is its spread product like along with packaged dairy products and other grocery products with their flagship “Bega” brand owning 15.7% of the Australian cheese retail market. The other major food brands operating under the brand name Bega include Farmers Table, “Picky Picky” and Zoosh. Fronterra is a major distributor of all Bega dairy products under long term agreement. The 1/3 of Bega’s revenue results from export activities of the nation. The Cheese products of the brand are exported to over 40 countries around the world and distributed across Australia where they are easily available in all general stores and supermarkets (begacheese.com.au 2021).

Other business segment of the company comprises of core dairy ingredients such as cream cheese, cheese and powered milk and nutritional products produced under the Bega Bio nutrients brand which contributes to 9% of the total revenue of business. In the year 2017, Bega announced its sponsorship to mumbulla foundation 2017 gala dinner. In 2019, it won a legal dispute against Kraft Heinz over their peanut butter packaging. In 2020, they raised considerable amount of fund to purchase Kirin’s suite of dairy products (begacheese.com.au 2021).

• Company Analysis

• Current Financial performance, Key financial highlights, Economic outlook

For the year ending 2020, the Bega Cheese has performed in a sound and stable way which is why it is critical to assess the financial statement of the company. Against the backdrop of increased uncertainty imposed by covid 19, Bega successfully overcame all odds and strengthen its cash reserves while extending their helping hand in unprecedented times. The challenging year even though have left every industry shook and broke, Bega managed to survive and build resilience through is effective planning and strategy execution. The culture and experience of the business has once again reflected on the firm’s strong financial outlook and financial efficacy over the years (begacheese.com.au 2021).

Financial highlights/events of 2020

• For the year ending 2020, the company successfully increased its revenue by 5% to $1.49 Billion compared to the performance of 2019.

• While the revenue has been steadily increasing, the increasing competitive environment of milk and dairy supply chain has normalized PAT and EBITDA that amounted to $236.4 Million, a reduction of 18% (Kourtis, Kourtis & Curtis, 2019).

• The overall production of the business was drastically impacted by prolonged drought and competition in supply chain which reduced productivity by 2% to 298 thousand tonnes. Bega cheese is persistent in reviewing its infrastructure and integrating it with supply profile and the market.

• Year 2020 was the year of focusing on strengthening the balance sheet of the business and improve cash management which helped the company in reducing its net debt to $236.4 Million as at 30th June.

• The EBITDA of business amounted to $103 Million which is towards the upper end of guidance (Setiawan & Amboningtyas, 2018).

Economic Outlook

• The group is well positioned as it enters the financial year 2021 with improved profit contributions from the recently commissioned lactoferrin facility at Koroit.

• Further, the company is expecting to benefit from reduced debt and working capital which would further strengthen its potential acquisition ability.

• Innovation in the product category would depend on the performance of existing products including Simply Nuts and Vegemite (AREAS, 2018).

• The dairy category of the business would continue to strengthen the company’s performance even further and would enable it to reach new highlights of success while driving more revenue in the long run.

• In the opening quarter of 2021, the prices of milk were lower than 2020, majorly onset by the Covid 19 pandemic which reduced the demand of dairy products (Mitrovi, Kneževi? & Veli?kovi?, 2015).

• Ratio Analysis

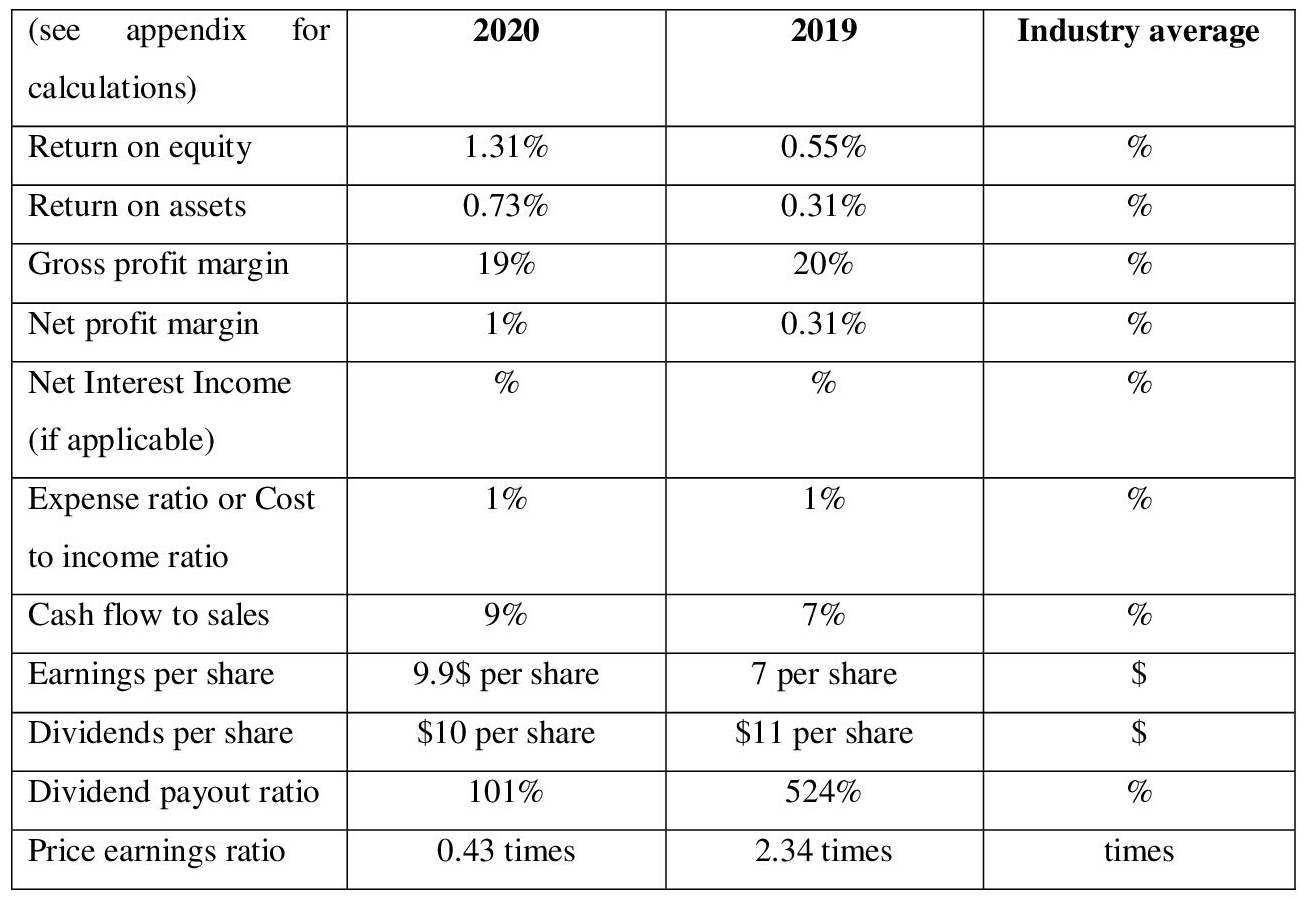

• Profitability and Market ratios

As can be observed by the table above, it represents the financial outlook of Bega Cheese for the years ending 2020 and 2019 to observe its trend and comment on its changing financial positioning. First thing to be observed is a steady growth in the ROE of business. ROE represents the returns that the company is generating from the effective investment of its equity share capital. As can be seen, even though the increase is marginal in nature, it indicates that the company’s expertise to improve its revenue stream from successful investment strategy has increased over a period of one year, and if the management continues to operate in the same pace, then the revenue stream would increase further in the future (Kanapickien? & Grundien?, 2015).

Further, the ROA, which indicates the returns from the total asset, has also increased to a marginal level from 0.31% in 2019 to 0.73% in 2020. This would not have any significant impact on the overall growth, but in general, a growing trend is a good indication and suggests that the assets of the company are effectively increasing its productivity and hence are able to generate better revenue based on the performance (Arkan, 2016).

However, the gross profit, which indicates the income of business after covering for the cost of goods sold, depicts a marginal trend, by falling to 19% in 2020 compared to 20% in 2019. Even though the decline is not drastic compared to the uncertainties that the business went through, if the reason behind the decline is not properly monitored, it would eventually leverage the entire operations of the company and would make the operations highly vulnerable. Usually, a declining trend is observed when the growth in COSG is higher than the revenue, or revenue has significantly declined, or sometimes a combination of both (Olariu, 2016).

The expense ratio seems to be in a constant state indicating the fact that the expenses have been kept effectively under control even under uncertain times like the pandemic, which has put a dent the overall performance of the business. The company needs to significantly focus on increasing its income, and be better able to cover for all the outstanding expenses, which at the moment, it relatively lower than the industry standard and is certainly an area of concern (Nofiana & Sunarsi, 2020).

The cash flow to sales ratio reflects a positive trend by increasing to 9% in 2020 compared to 7% of 2019. This means that the company has improved its cash retaining capacity and is saving more from total sales rather than spending in on operational activities of the firm. However, compared to the industry standard, the ratio is relatively lower, and means that the company is struggling to retain majority of its revenue and is rather spending a lot in its operations (Ball et al., 2015).

Further, the EPS of the business also reflects a increasing trend from 7 per share in 2019 to 9.9 per share in 2020. This means that the company has successfully invested its share in the market to improve its revenue stream. A n increasing EPS is always a good indication and suggests that the company is able of skillfully managing its revenue from and increase it using outstanding equity.

Dividend per share marginally declined which was expected as the company faced much hardship dealing with the impact of covid 19 virus. Finally. The P/E ratio of the company stood undervalued for the year 2020 compared to its value of 2019. This means that the shares of the business are being traded lower than the market value which is an ideal situation for buying shares (Ichsani & Suhardi, 2015).

• Efficiency ratios

Efficiency ratios helps in assessing the ability of company to work efficiently and use its resources in a way that would generate the highest value for the company and decrease cash outflow as much as possible. Efficiency ratios are critical for the interpretation of company’s performance as it provides insight into the ability of business to effectively manage all the internal resources while keeping check on cash outflows in the process (Olesen et al., 2015).

As can be seen from the table above, the asset turnover of the business has a marginal declining trend and reduced to 0.51 times for 2020 compared to 0.99 of 2019. Even though it would not have drastic or immediate negative impact on the performance of business, a declining trend is indicative of the fact that the efficiency of total assets to generate and improve revenue has reduced, and hence the company needs to invest in the in improving its productivity and ensure that the assets are in demand and strengthen the balance sheet of business.

Day’s inventory is the number of days that the company rakes to sell its entire inventory and replace it with new one. As can be seen from the chart above, the days inventory of the business is relatively higher than the industry average. Investors usually prefer investing in companies with short inventories days as the revenue generation in these companies are usually high. Even though the days inventory of Bega Cheese has a declining trend, it is not very impressive compared to some of its competitors (Bunker, Cagle & Harris, 2019).

Days debtor on the other hand, indicate the amount of time it takes for a business to collect its receivable from debtors. As can be seen, the days debtor’s ratio of Bega cheese reduced from 46.24 days of 2019 to 36.33 days in 2020. This is a good indication and suggests that company is improving its capability of collecting its debts on time and to reduce the chances of incurring bad debts. It can undertake many initiatives to further improve its collection period like providing early bird discount. Times inventory of the business also has a declining trend which is not a good indication and suggests that the number of times an inventory is sold within a financial year has been reduced, primary due to pandemic Covid 19.

Time receivables turnover is the number of times a company collects its receivables from debtors. As can be seen, the times receivable of Bega Cheese for 2020 amounted to 2.51 compared to 7.89 of 2019, a downward trend which is not very preferred by investors as it means that the company is not putting much effort in collecting its receivables (Garanina & Belova, 2015).

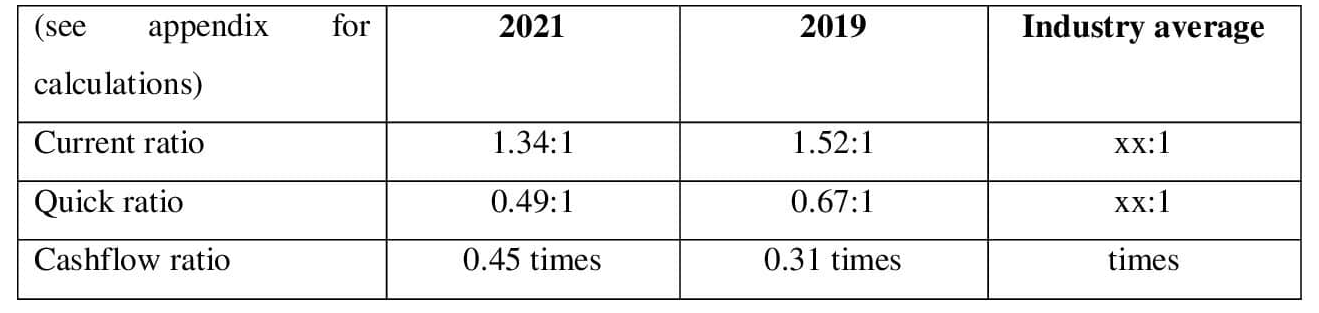

• Liquidity ratios

Liquidity ratio helps in assessing the short-term solvency of companies. The first and foremost liquidity that can be observed from the table above is current ratio. This ratio helps in comparing marketable assets with short term debts of the company. Current ratio of Bega Cheese for both the years is observed to be higher than one which means that the current ratio is higher than current liabilities and hence the business is capable enough to cover for all short-term debts without raising external source of funding (Saputra, 2019).

Quick ratio on the other hand helps in assessing the liquidity of business after deducting the inventories from current asset. As seen, quick ratio for both the years has been lower than one which means that the company is not capable enough to meet for its debts if the inventories are excluded from the current assets of the company (Alipour et al., 2015).

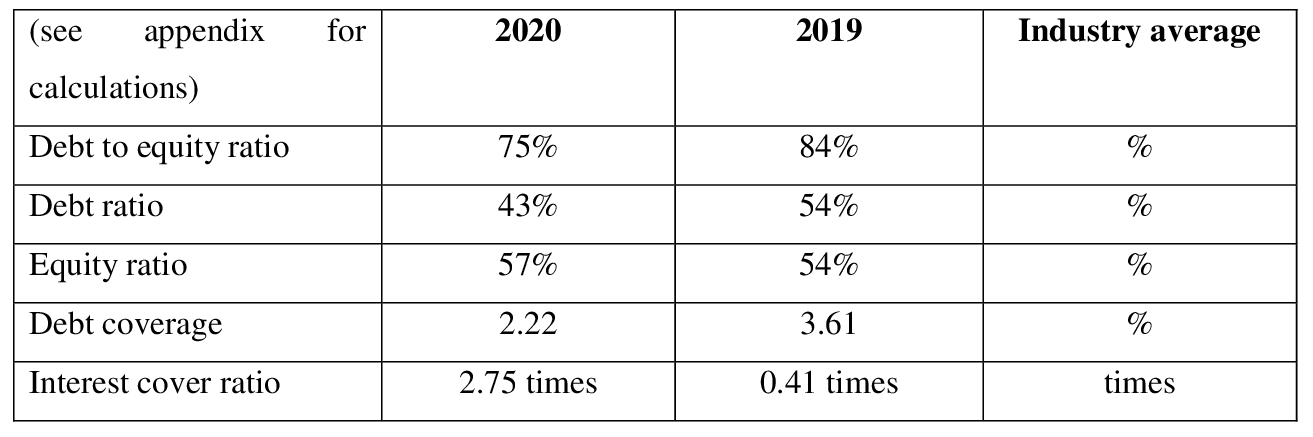

• Gearing ratios

Gearing ratio helps in gaining insight into the liquidity of company. Debt to equity ratio of the business amounted to 0.75 for 2020 compared to 0.84 of 2019. For both the years the debt-to-equity ratio was lower than one which means that company gives more importance to equity to fund most of its operations (Trenca, Petria & Corovei, 2015).

Debt ratio on the other hand provides insight into the number of total debts used to fund the total assets that the company currently owns. The debt ratio of 2020 and 2019 amounted to 0.43 and 0.46 respectively. This means for every $1 spent on asset, 0.43 is funding from debts and rest from other sources of funding. Preference over s specific funding source is a matter of choice. Generally, businesses avoid being highly dependent on debts to fund most of its operation as the chances of becoming highly leveraged increases (Lang & Schmidt, 2016).

On the other hand, it can be noted that equity ratio of the business has an increasing trend which means that preference towards equity to fund the acquisition of assets is high. Also. Equity ratio of 0.57 means that for every $1 dollar spent on asset, 0.57 is sourced from the equity capital. Businesses gives high preference to equity ratio has it does not have the company leveraged and the company is not obligated to return back the capital gathered unlike the debt funding. However, the cost of maintaining equity capital is significantly higher than debt which needs to be keep in mind (Yapa Abeywardhana, 2017).

Debt coverage ratio indicates the ability of company to cover for long term debts using the cash from operating activities. As can be seen from the table above, the debt coverage ratio for both the years have been higher than one, even though having declining trend. This means that the cash from operating activities is significantly lower and can effectively cover for the long-term debts.

Lastly, the interest coverage ratio is a capital structure ratio which indicates the ability of business to cover for interest expense using the EBIT. As can be seen from the table above, the Interest coverage has significantly positive and increasing trend. This means that EBIT of company has increased at a faster pace than interest expense and hence Bega Cheese has become significantly capable of cover for its interest expense without needing funds from external sources (Öztekin, 2015).

• Recommendations and overall assessment

Has the reporting year been better than the prior reporting year for the company?

The reporting year of 2020 has not been better than the previous year, primarily due to the onset of Covid 19 pandemic is reduced prices of its dairy products. Further, the profitability ratios for both the years have not been very impressive given the competitive environment of dairy industry in Australia. Apart from the ROE, ROA and net margin ratios, with a marginal increasing trend all other profitability ratio had a declining trend (begacheese.com.au 2021).

This indicates, that even though the company has gain market leadership in the industry, it is still failing to generate significant income for itself, due to increase competition in the market and inability of investing in new innovative products. Further, the ROE and ROE of the company is not very impressive as well standing at 1.31% and 0.73% respectively which is an area of concern and indicates that the company is failing to generate value from its resources.

Will the company succeed in the future?

Based on the assessment of gearing and efficiency ratio, the chances of business succeeding in future is relatively high, as the business has survived an unfortunate event like the Covid 19 pandemic and was still able to improve its revenue significantly. Also, the current ratios of the business are more than 1 for both the years which means that the company is capable enough to cover for its short-term debts without raising external source of funding.

However, based on the efficiency ratio, the growth and success of business seems doubtful as the company does not have effective strategy in place to collect receivables from debtors and neither has a high receivable turnover ratio which increases the chances of incurring bad debts. As far as the gearing ratio is concerned, Bega Cheese is dependent on the equity share capital for funding most of its capital which means that the company would not get heavily leveraged in the future.

The likelihood of a merger or acquisition of the company?

In the upcoming years, the company is likely to acquire a business rather than getting acquired as it has significant hold over the market place and is a renowned dairy business located in Australia. It is also very likely to increase to create huge synergy through acquisition. However, the company has been lagging behind is significantly improving its profitability which is an area of concern,

Even if the company successfully acquires a business, the chances of becoming highly leverage would also increase. This is due to the fact that the company inclination towards debt money would steadily increase with increased requirement of capital. Further based on its interest coverage ratio, Bega Cheese would be able to cover for its long-term debts without needing external funding.

Suggest what should the company be doing help it succeeds

• There are several things that the business can do to improve its performance. Firstly, it can expand its line of products to attract higher customer base. It can expand its operation to international market which would help gaining traction from all around the world. It can also offer special discounts to its loyal customer to retain their loyalty.

Bega Cheese needs to improve their profitability and efficiency ratio which are considerably lagging behind in the market. The profitability can be increased by increasing revenue while the efficiency can be improved by increasing the returns from invested assets.

External impacts that need to be taken into consideration

The impact of government on the business

The external factors such as economy of country, political factors, technological factors, environmental and social factors are some of the aspects which the business needs to consider while taking any decision. Economic factors such as GDP growth can help boost the revenue of business while political factors can limit the chances of success.

Government can impose higher tax on businesses making significantly high revenue which posses’ immense threat to the income of company. Further, it regulates the performance of businesses in the market which is another reason why it is necessary to abide by the rules and regulation set by the administration of country.

Would you invest in this company?

Based on the performance and evaluation of ratios, I would not invest in the stakes of business and rather look for better alternatives which has higher chances of geniting revenue. The major concern for me is declining EPS and ROE which are two critical areas depending on which a company can the performance is assessed. Also, the shares are trading lower than market value which is another red signal for the company.

• References/Bibliography

Alipour, M., Mohammadi, M.F.S. & Derakhshan, H., (2015). Determinants of capital structure: an empirical study of firms in Iran. International Journal of Law and Management.

AREAS, B., (2018). Financial analysis. growth, 30, p.10.

Arkan, T., (2016). The importance of financial ratios in predicting stock price trends: A case study in emerging markets. Finanse, Rynki Finansowe, Ubezpieczenia, (79), pp.13-26.

Ball, R., Gerakos, J., Linnainmaa, J.T. & Nikolaev, V.V., (2015). Deflating profitability. Journal of Financial Economics, 117(2), pp.225-248.

Begacheese.com.au 2021. Home - Bega Cheese. [online] Retrieved from: https://www.begacheese.com.au/

Bunker, R.B., Cagle, C. & Harris, D., (2019). A Liquidity Ratio Analysis of Lean vs. Not-Lean Operations. Management Accounting Quarterly, 20(2), pp.10-16.

Garanina, T.A. & Belova, O.A., (2015). Liquidity, cash conversion cycle and financial performance: case of Russian companies.

Ichsani, S. & Suhardi, A.R., (2015). The effect of return on equity (ROE) and return on investment (ROI) on trading volume. Procedia-Social and Behavioral Sciences, 211, pp.896-902.

Kanapickien?, R. & Grundien?, Ž., (2015). The model of fraud detection in financial statements by means of financial ratios. Procedia-Social and Behavioral Sciences, 213, pp.321-327.

Kourtis, E., Kourtis, G. & Curtis, P., (2019). Αn Integrated Financial Ratio Analysis as a Navigation Compass through the Fraudulent Reporting Conundrum: Α Case Study. International Journal of Finance, Insurance and Risk Management, 9(1-2), pp.3-20.

Lang, M. & Schmidt, P.G., (2016). The early warnings of banking crises: Interaction of broad liquidity and demand deposits. Journal of International Money and Finance, 61, pp.1-29.

Mitrovi?, A., Kneževi?, S. & Veli?kovi?, M., (2015). RATIO ANALYSIS SPECIFICS OF THE FAMILY DAIRIES’FINANCIAL STATEMENTS. ????????? ????????????, 62(4).

Nofiana, L. & Sunarsi, D., (2020). The Influence of Inventory Round Ratio and Activities Round Ratio of Profitability (ROI). JASa (Jurnal Akuntansi, Audit dan Sistem Informasi Akuntansi), 4(1), pp.95-103.

Olariu, D.B., (2016). Profitability ratio as a tool for bankruptcy prediction. SEA–Practical Application of Science, 4(11), pp.369-372.

Olesen, O.B., Petersen, N.C. & Podinovski, V.V., (2015). Efficiency analysis with ratio measures. European Journal of Operational Research, 245(2), pp.446-462.

Öztekin, Ö., (2015). Capital structure decisions around the world: which factors are reliably important?. Journal of Financial and Quantitative Analysis, 50(3), pp.301-323.

Saputra, A.J., (2019). The Effect Of Liquidity Ratio Leverage Ratio And Activity Ratio In Predicting Financial Distress. Management and Economic Journal, pp.581-592.

Setiawan, H. & Amboningtyas, D., (2018). Financial Ratio Analysis for Predicting Financial Distress Conditions (Study on Telecommunication Companies Listed In Indonesia Stock Exchange Period 2010-2016). Journal of Management, 4(4).

Trenca, I., Petria, N. & Corovei, E.A., (2015). Impact of macroeconomic variables upon the banking system liquidity. Procedia Economics and Finance, 32, pp.1170-1177.

Yapa Abeywardhana, D., (2017). Capital structure theory: An overview. Accounting and finance research, 6(1).

MBM BST 713 Analysing Financial Performance Assignment Sample

Assignment Brief

• You are required to produce a 2,000 word individual report containing:

An analysis of the financial performance and position of Marks and Spencer. Your analysis should be based on your calculation of basic accounting and financial ratios for 2021, and 2020 for comparative purposes; and an evaluation of the results of those calculations. In addition, your analysis should be supplemented by key data contained in the narrative sections of the 2021 annual report and other sources; (40 marks)

• a consideration of Marks and Spencer’s prospects for the foreseeable future, taking into account the challenges facing the group and its responses thereto;(30 marks) and,

• drawing on appropriate literature, an assessment of the extent to which Marks and Spencer could justifiably claim to have a diverse board of Directors. (20 marks)

The remaining 10 marks will be awarded for the presentation and structure of your report and appropriate referencing.

The report can be found here:

https://corporate.marksandspencer.com/msar2021/m-and- s_ar21_full_210602.pdf

Report Guidance:

As a guide, for the report, you should aim to devote:

• 900 words on Marks and Spencer’s past financial performance;

• 600 words on the future prospects of the group; and

• 500 words on the corporate governance aspect.

In addition, you should present the accounting ratios as a table in an appendix to your report for https://www.theassignmenthelpline.com/ (see proforma on final page); the appendix will not be included in the overall word count for the assignment. You MUST show the figures you use in the calculation of the ratios AND, if they do not come from the face of the Consolidated Statement of Comprehensive Income or the Consolidated Statement of Financial Position, you must show the exact source of the figure(s). Failure to do so will result in no marks being awarded for that calculation.

Your report should also be:

1. Word-processed;

2. Professionally presented with page numbers and having undergone a Grammar/spell-check;

3. Properly referenced (where you use words taken from a source, you must give a proper citation to that source).

Academic Misconduct

You need to be aware that this is an individual assignment. Academic misconduct will not be tolerated. Do not be tempted to copy another’s work or use another person to do the work that you should do yourself. Academic misconduct will result in an award of a zero mark, at best; at worst, the consequences could be more serious.

Submission Details:

Deadline for submission is: 11.00 AM BST, March 18, 2022. The report must be submitted via the Learning Central portal. If you have any queries or difficulties with submitting your work, please address those to the PG Hub, NOT to academic staff.

Solution

Introduction

The business environment is uncertain and dynamic that is faced by the business organization. This report provides the business performance analyses of Marks and Spencer by implementing the ratio analyses tool. It also contained the recommendation to improve the business performance of the company. It considers the foreseeable future of the company and the challenges faced by the company. Diversify board of directors has been assessed in this report.

Company outlook(MKS.L)

Marks and Spencer Group plc engaged in the industry of department stores in the sector of consumer cyclical with the total number of employees of 69577. It operates as a retail store in 5 segments. These five segments are UK Clothing & Home, UK Food, International, OCADO, and all others. It offers protein daily, ambient, dairy produce, meals dessert, and food on move products. It also provides women's wear, menswear, and clothing for kids. Apart from that company invest in real estate property. It has been founded in 1884 and headquarter in London, The United Kingdom (MKS.L 2021).

Financial review of MKS.L

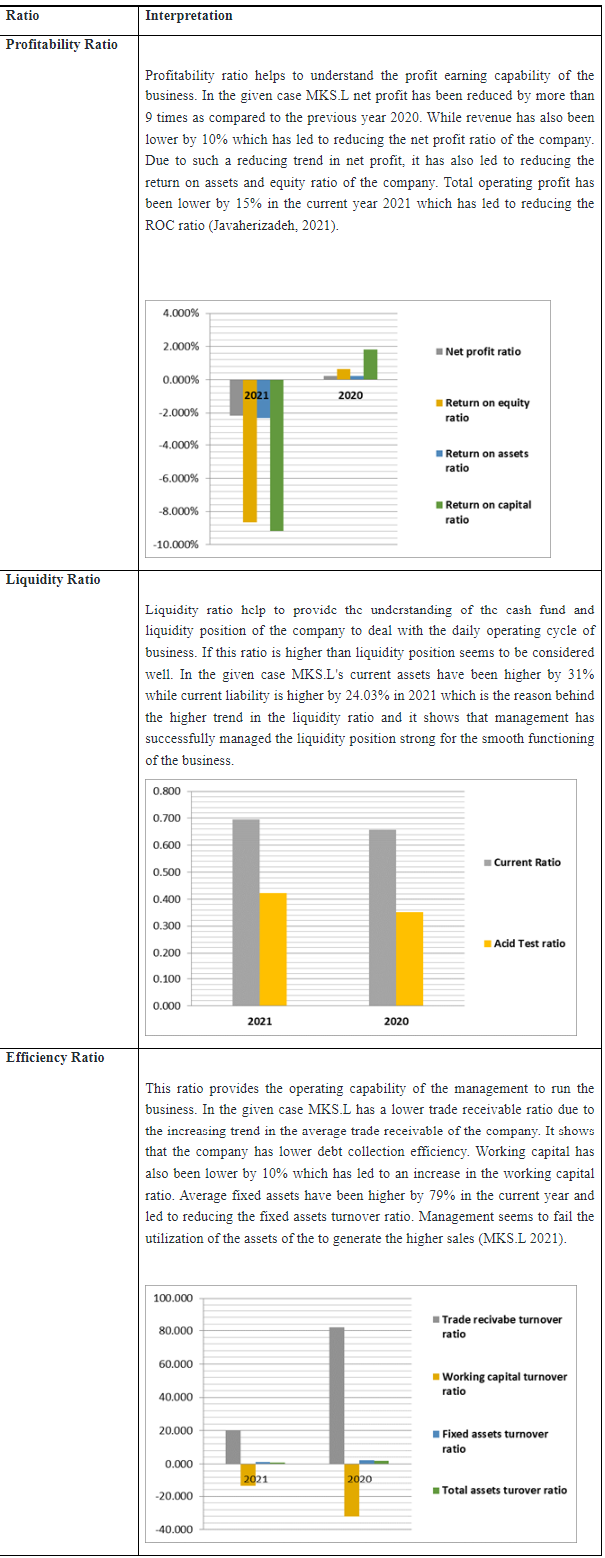

To assess the financial performance of the business organization, the ratio analyses tool is the best option. It helps to assess the financial data of the company in comparative form so that trends in each financial item can be understood easily. It considers the financial data of more than 1 year. Following are the computational ratio analyses of the Marks and Spencer Group plc:-

Core ( Financial Ratio computation)

Additional ( Interpretation , Notes to accounts)

Narratives

Hence it can be observed that MKS.L company has not performed well in the current year 2021. It needs to improve the performance by considering the cost control factor so that profitability gets positive in next upcoming years. The company needs to improve the efficiency ratio too so that operating capability can be increased and businesses will get benefit from it. The company should focus on the long-term goal and cost control should also be done by incorporating the new policy (Easton,& Zhang, 2018).

Future Prospectus

Marks and Spencer Group Plc. is a British based multinational company that runs its business in the retail sector and the headquarters of the company is located in London. The company has different lines of business which includes retail stores of clothes, food stores, and home products. The company had its presence in the industry for a long. But, in 2018 a radical plan was issued by the company where it stated that the company will be closing its 100 stores worldwide by 2022 (MKS.L 2021).

During the pandemic, the company has cut down more than 7,000 jobs, because the stores were closed and the expenses of the company were exceeding the income that the company was earning from running the stores. Moreover, again in 2021, the company has announced that other than 100, it will be closing 30 more stores, in the next 10 years, as a part of its turnaround plan. Based on the financial analysis conducted above, it can be said, that in some areas the company has been able to maintain its stance, such as the liquidity of the company is strong in 2021 in comparison to 2020. On the other hand, the efficiency ratios of the company have declined which states that the company has not been utilizing its assets to earn income for the shareholders (MKS.L 2021).

Core Analysis

In the past few years, the company is facing several issues, due to which the company had to come up with different turnaround plans, where they are deciding to close the stores. The policy of the company has always been clear, where they want to satisfy the customers by providing them valuable products. As a part of its future, the company has decided that they want to come up with stores that fit the future and will help the company to achieve its transformation goals. The strategy that a company can use is to open the right stores, at the right locations. This can be done by conducting market analysis, which will help the company to identify the central locations, where the company should open its stores. It will also help the company to close the stores in the location which is not yielding results for the company (Joshi, et al., 2021).

To achieve the future that the management has seen the company will require to indulge in some investing and renewing the new stores to target the new markets that the company is viewing. This can be done by redeveloping the existing space that is available with the company. There are several risks and issues that the company is facing, which is stopping the company from moving forward.

One such issue has been exiting of UK from EU. This has initiated the Brexit contract among, which the trade between UK and EU countries have been limited. Hence, the company has to work on its importance and make strong its third-party relationships. The company plans to do this, by focusing on customer loyalty and improving the brand experience provided to customers.

External fact analysis

Apart from this, there are several regulatory changes in SOX that are impacting the business of the company. As the regulations are changing, the risks of the company coming under scrutiny have increased and the future reporting requirements of the company has also increased. However, in the past two years, the performance of the company has declined in several aspects because of the emergence of the pandemic but, it has also helped the company to learn new things. Such as it has helped the company to understand how it can respond to the customers quickly and how important it is to maintain touch with the customers. As a result, the company immediately decided to improve their website, so that customers who cannot go to retail stores can order goods online. This involved refocusing the strategy of the company, and instead of maintaining retail stores, the company should try to shift its focus to online stores (Schleper, et al., 2021).

In the future, the company wishes to accelerate its stores, and improve the experience of customers. Also, the main issue or challenge that the company is facing is regarding its property portfolio which is aged, due to which the company is not able to focus on its earning from investment in property. Hence, the company plans to upgrade its property portfolio, which has been negatively impacted due to pandemic.

Hence, if the company implements what they have decided while keeping the sustainability aspect in mind, the company will have a bright future.

Governance practice:

The responsibilities that are borne by the board of directors of the company are very important. They are basically the agents of shareholders, who are the owners of the company. The duty of the board of directors is to manage the business effectively and formulate operating and financial strategies to ensure that the practices of the company are helping the business to grow (Zopounidis, and Passas, 2020).

Over the years, the focus has been put on the board of directors, whereas part of the regulation, it is compulsory for every company to have non-executive directors on their board. Along, with this, it is important that at least one of the non-executive directors is a person with skills and competence in accounting, finance, etc. Hence, here the importance of board diversity is dictated. When there is diversification in board, it leads to effective decision-making, it helps in better utilization of talent, and it increases the level of relationship that company has with the shareholders of the company (Dicuonzo and Dell’Atti, 2022).

Diverse board of directors

The governance of Marks and Spencer is also diversified. Over the years, there are several changes that the company has made in its board of directors, were not long back company has introduced two more non-executive directors, and the same was done by the company to ensure that their board of directors are balanced. This is done because of the uncertainties that are prevailing in the market amid pandemic and Brexit (Yukhno, 2022).

The board of directors of the company is diversified and it helps them to enhance their decision making. Some directors of the company are proficient in law and help the company to ensure that they are abiding by the legal laws. Other directors of the company are proficient in finance and help the company to take decisions amid pandemic, and how the situation can be controlled.

Recommendation

Hence, for every company in the business, it is advisable that the board of directors of the company are diversified, as it will help them to improve their choices, and will lead to better decision making. When the board of directors of the company are not diversified it leads to bad decision making, because the choices are limited, and there are no educated people who will question a decision, or who will put their opinion in front.

Conclusion:

From the above, it can be concluded that Marks and Spencer have been in the retail business for a long now, as the company had been able to make its name in the industry. However, for the past few years, the company is facing issues, due to which they have taken the decision of closing some of the stores. As a result, the company is thinking of renovating the strategies that they have currently employed, which included new stores, and diversifying the board of directors of the company.

Reference:

Aigbedo, H. 2021. An empirical analysis of the effect of financial performance on environmental performance of companies in global supply chains. Journal of Cleaner Production, 278, 121741.https://www.sciencedirect.com/science/article/pii/S0959652620317881

Annual report of the Marks and Spencer has been retrieved from https://corporate.marksandspencer.com/annualreport

Dicuonzo, G., Donofrio, F., Iannuzzi, A.P. and Dell’Atti, V., 2022. The integration of sustainability in corporate governance systems: an innovative framework applied to the European systematically important banks. International Journal of Disclosure and Governance, pp.1-15. https://link.springer.com/article/10.1057/s41310-021-00140-2

Easton, P.D., McAnally, M.L., Sommers, G.A. and Zhang, X.J., 2018. Financial statement analysis & valuation. Boston, MA: Cambridge Business Publishers. https://www.fau.edu/graduate/faculty-and-staff/programs-committee/docs/02202019/NCP-ACG5176.pdf

Javaherizadeh, E. 2021. An empirical study on the impact of female leaders and intellectual capital on the financial performance of FTSE 350 companies (Doctoral dissertation, University of West London).http://repository.uwl.ac.uk/id/eprint/8511/

Joshi, N., Gabhane, D., Devi, B. P., & Somashekhar, I. C. 2021. How social media marketing is helping in customer retention and customer engagement: A case of Marks and Spencer. SPAST Abstracts, 1(01).https://spast.org/techrep/article/view/3561

Ramzan, M., Amin, M., & Abbas, M. 2021. How does corporate social responsibility affect financial performance, financial stability, and financial inclusion in the banking sector? Evidence from Pakistan. Research in International Business and Finance, 55, 101314.https://www.sciencedirect.com/science/article/pii/S0275531919301199

Schleper, M. C., Gold, S., Trautrims, A., & Baldock, D. 2021. Pandemic-induced knowledge gaps in operations and supply chain management: COVID-19’s impacts on retailing. International Journal of Operations & Production Management.https://www.emerald.com/insight/content/doi/10.1108/IJOPM-12-2020-0837/full/html?utm_source=rss&utm_medium=feed&utm_campaign=rss_journalLatest

Zopounidis, C., Garefalakis, A., Lemonakis, C. and Passas, I., 2020. Environmental, social and corporate governance framework for corporate disclosure: a multicriteria dimension analysis approach. Management Decision. https://www.researchgate.net/profile/Alexandros-Garefalakis/publication/346060596_Environmental_social_and_corporate_governance_framework_for_corporate_disclosure_a_multicriteria_dimension_analysis_approach/links/5fbb452d299bf104cf6cf32e/Environmental-social-and-corporate-governance-framework-for-corporate-disclosure-a-multicriteria-dimension-analysis-approach.pdf

MCR006 Financial Management Assignment Sample

Assignment Brief

Due date - Friday Week 10 11.59 pm

Weight - 15%

Marks for assignment - 50

The Research Report should contain no more than 2,000 words, excluding references.

Submission via Turn-it-in on Moodle and strict adherence to submission and uploading rules to be followed. All parts should be answered.

All references and examples must be within an Australian context.

Scope of the research can include Academic articles and journals, and relevant Books. Students are encouraged to use the e-library resources.

Assignment Topics

Complete all questions for assignment help

Part A 400 words each 10 marks each

a. Explain how the general dividend valuation model values a share.

b. Explain, compare and contrast the various capital budgeting methods such as the Net

Present Value Method, the Payback Period, the Accounting Rate of Return and the Internal Rate of Return.

c. Discuss the two Modigliani and Miller propositions and the key assumptions underlying them and their relevance to capital structure decisions.

Part B 800 words 20 marks

Your Board of Directors is considering acquiring a business in the same industry. The Board has not undertaken such a venture before. The CEO has come to you to ask you to prepare a Board report

which clearly explains the 3 main methods of valuing a business. Include in your report the specific valuation methods the board should consider when making their decision on the company they should acquire. Assume this is a listed company and the company Being acquired is a listed company.

In the report identify and explain some other areas than valuation methods that should be considered by the directors when undertaking the acquisition of another organisation.

Solution

Abstract

This report provides the acquisition analyses of the two business corporate belong to Australia in the industry of gold mines. Saracen Mineral Holdings has acquired Kalgoorlie Consolidated Gold Mine. It also includes the various financial appraisal technique and model. Saracen Mineral Holdings company engaged in the mineral development and exploration while KCGM has also been engaged in the same business filed.

Part A

a. Dividend Valuation Model

The dividend is referred to as a part of a business's profit that is distributed by an entity to its shareholders (Sahoo 2020). Whenever a business entity earns profits, it has the option to either reinvest the earned profits in its business or payout such profits to its shareholders in the form of a dividend. Different patterns or models may be followed by the business entities for the payment of dividends. These dividend valuation methods help in determining the value of an entity's share. These patterns may include the following:

? Zero Growth Model

When the payment of dividends by any business entity is expected to remain the same in the future, then it may be said that the business entity applies a zero growth dividend model. The following formula may be used to determine the value of share when the entity is using a zero growth model for the dividend payment:

Stock’s Value = Dividend / Required (RoR) Rate of Return

The above formula is also used to determine the present value (PV) of perpetuity. Also, the formula may be used to calculate the price of the preferred stock of the entity that pays the dividend at a particular rate. The price of the stock may change in the zero-growth model when there is a change in the required rate (RoR) of a return due to the change in risk factors (d'Amico & De Blasis, (2020)).

? Constant Growth Model

When the payment of dividends by any business entity is estimated to grow or increase at the same rate in the future, then it may be said that the business entity applies a constant growth dividend model. It is also known as Gordon (GGM) Growth Model. Valuation of matured companies may be performed based on this dividend model. The dividends of matured companies using this model increase on a steady basis. The formula in the below-provided image is used to determine the value of the entity's share who is applying constant growth model for dividend:

? Variable Growth Model

The variable growth model is the most commonly used dividend model in a real-life scenario. As the business entity goes through different phases, it becomes difficult for the entity to pay the same dividend every year. The growth in the variable model may be divided into 2 or 3 phases. The growth rate in the initial phase may be high, then it may get low in the transition phase and finally, it may end with a lower dividend rate. The formula in the below-provided image may be used to calculate the stock value as per the variable model:

b. Capital Budgeting

Capital Budgeting is a method used in finance to evaluate the potential of a major investment proposal or project (Siziba & Hall, (2021)). It helps the investors to ascertain the value that a potential project may provide to them. Capital Budgeting helps to make an important investment decision that may increase its profitability and ultimately the wealth of its shareholders (Cloyne & Surico, (2018)). Different methods may be used by the business entity in the process of capital budgeting that has been discussed hereunder:

? Net Present (NPV) Value

Net Present (NPV) Value helps to assess the profitability aspect of an investment proposal in the process of capital budgeting (Kadim & Husain, (2020)). The present value (PV) of all the cash inflows that are expected to be generated through the tenure of the project is subtracted from the present value (PV) of all the cash outflows to arrive at the Net Present (NPV) Value. If the difference between the cash flows is positive that the investment project may be considered viable. The discount rate is used to ascertain the expected cash flows of the future period. Assessing the profitability of a project from NPV may have several errors as it is based on various assumptions & estimates.

? Payback Period

The payback period is the period by which the investment cost in any investment project is recovered. It is the period by which the project reaches its break-even. A short payback period is considered favorable by the investors. This method has some limitations as it ignores the time value (TVM) of money. Overall profitability of an investment proposal may not be ascertained through the payback period as it will only tell the time by which cost will be recovered and it will not tell what will happen after such period.

? Internal Rate (IRR) of Return

Internal Rate (IRR) of Return is referred to as a rate of discount that will make the NPV of future cash (FCF) flows to zero. A higher IRR is always considered good by the investors. It is calculated similarly as the NPV is calculated. The only difference in the calculation is that IRR makes the NPV zero.

? Accounting Rate (ARR) of Return

Accounting Rate (ARR) of Return is referred to a rate (RoR) of return that may be expected from an investment in comparison to the cost of the initial investment. ARR is calculated by dividing the average revenue of an asset by the entity's initial investment. ARR is useful when determining the profitability of investment quickly but it ignores the time value (TVM) of money.

c. Modigliani & (MM) Miller Approach

The theory of Modigliani & (MM) Miller Approach states that the overall value of a business entity is not affected by its capital structure. In Modigliani & (MM) Miller Approach's first version there were a lot of limitations as such version was developed with the assumption that a business entity operating in the perfectly efficient industry wherein it need not pay taxes. Later on, Modigliani along with Miller developed the next version of the theory wherein they included bankruptcy costs, asymmetric data, and taxes.

MM Approach in Perfect Market

Modigliani & Miller's first version of the theory assumed that businesses always operate in the perfectly efficient market. This means that the business entities are not required to pay tax, no transaction costs are incurred on the trading of the entity's shares. Also, it had the assumption that no bankruptcy costs are incurred in case of bankruptcy.

Proposition 1 (First Version)

Value of (Vl) Levered Entity = Value of (Vu) Unlevered Entity

According to the first proposition, the value of an entity is not affected by its capital structure whether it is funded by only equity or by a combination of debt & equity as its value is determined by the present value (PV) of future (FCF) cash flows. Additionally, entities need not pay taxes in a perfect market, the entity does not get a benefit tax deduction for the interest on the debt.

Proposition 2 (First Version)

Cost of (Re) levered equity = Cost of (Ra) unlevered equity + Debt to (D/E) Equity (Ra – Cost of (Rd) Debt)

According to the 2nd Proposition of the theory, the Cost of (Ke) Equity and leverage level of entity is directly proportional. When leverage level increases, the entity's profitability of entity also increases.

MM Approach in Real Life

Proposition I

Value of (Vl) Levered Entity = Value of (Vu) Unlevered Entity + Tax Rate x Debt

According to the 1st Proposition, the value of (Vl) levered entity is higher than the unlevered entity's value because of the tax benefit shield on the interest payment.

Proposition II

Cost of (Re) levered equity = Cost of (Ra) unlevered equity + Debt to (D/E) Equity x (1 – Tax Rate) x (Ra – Cost of (Rd) Debt)

According to the 2nd proposition, the cost of (Ke) equity and leverage level of the entity is directly proportional. The effect of tax shield makes the cost of (Ke) equity& entity’s leverage level less sensitive to each other.

Part B

Board Report

Introduction

At Saracen Mineral Holdings, all of our operations are controlled and managed by the Board of Directors on shareholders' behalf. This report has an agenda for the acquisition of the business of one of the listed companies known as Kalgoorlie Consolidated Gold Mines (KCGM) which is also engaged in the business of gold mining.

Reason for Acquisition

The main reason for the acquisition is to become the source player in the gold industry and to remain in the field of basic material . As our company is competing with Saracen Mineral in the Gold industry, its acquisition will help our company in gaining competitive advantages and both the company will merge to create the AUS 16 billion global gold producer (Saracen Mineral Holdings 2019)

Capital Expenditure

On considering the business of Saracen Mineral and its market value, Board is willing to expand a budget of AUD 1099.31million (Saracen Mineral Holdings 2019) Various business valuation methods have been applied to assess the most realistic value for the business of Saracen Mineral .

Business Valuation Methods

? Net Asset Method

Net Asset Method is one of the business valuation methods that derive the value of an entity's business by deducting all the liabilities of the entity from its total assets. The following formula may be used to derive the net asset of the business.

Net Assets = (Assets in Total – Total Liabilities – Preferred Stock) / Outstanding Equity Shares

Net Asset (NAV) Valuation helps to understand the real worth of the business. The acquirer firm always wants to assess the value of the acquired firm to offer the best bid price. SARACEN MINERAL HOLDINGS is getting the value of 50% by paying a sum of $ 750 million which is a very great deal for the entity. This will add value to the wealth of the shareholders in the coming future (Saracen Mineral Holdings 2019)

? Price-Earnings (P/E) Ratio

Price-Earnings (P/E) ratio is used to determine the value of the business by comparing the share price of an entity's share with its earnings (EPS) per share (Anwar, (2019)). PE ratio helps to understand whether the share price of an entity is undervalued or overvalued. This ratio helps to know the value that an investor may pay for an entity's share on the earnings of the entity (Wibowo & Radianto, (2019)). The P/E ratio of KCGM is 24.14 and the P/E ratio of the industry in which Kalgoorlie Consolidated Gold Mines Operates is 18.6. This means that the share price of KCGM is undervalued and it is a great opportunity for us to make our investment in KCGM 's Business.

? Discounted Cash (DCF) Flow

Discounted Cash (DCF) Flow is one of the business valuation methods that consider the present value (PV) of all the cash flows that are expected from the investment proposal. The present value (PV) of future cash (FCF) flows are added with the present value (PV) of Terminal value (TV) to arrive at the total value of the business (Fernandez, (2019)). The following images are presented to show the business value of Kalgoorlie Consolidated Gold Mineson the basis of the DCF method:

According to the above calculation, the value of each share of KCGM is lower than market price of its share. This means that the share of the company is undervalued and the company has the potential to grow shortly that making it a great investment opportunity that will surely bring value addition to SARACEN MINERAL HOLDINGS and will help in increasing the wealth of its shareholders in near future.

Compliances

? Appropriate standards for corporate governance along with legal compliance are required to be established by the management to proceed with the acquisition.

? Statement on Corporate Governance along with ASX Appendix is required to be approved

? Charter of Board committee is required to be approved

Risk Management

? Framework for managing the overall risk of the company is to be approved.

? Policies regarding risk management, taxes, and financials are required to be approved.

? Due Diligence shall be exercised to make sure that the company is complying with all the required obligations.

Human resources

? Selection, Remuneration, cessation, and termination terms for the Managing director along with the CEO are required to be approved.

? Performance objectives for every person shall be set.

? Incentive plans for the employees shall be considered by the board.

Health & Safety

? Board is required to consider the reports on health & safety along with the environment.

? It shall be made sure that the health & safety of the entity's people is not compromised at any cost and the entity complies with all the environmental obligations.

? Policies related to health & Safety shall be approved.

? Policies related to Environment shall be approved.

References

Anwar, Y. (2019). The effect of return on equity, earning per share, and price earning ratio on stock prices. The Accounting Journal of Binaniaga, 4(01), 57-66.https://stiebinaniaga.ac.id/e-journal/index.php/Accounting/article/download/314/264

Cloyne, J., Ferreira, C., Froemel, M., & Surico, P. (2018). Monetary policy, corporate finance, and investment (No. w25366). National Bureau of Economic Research.https://www.nber.org/system/files/working_papers/w25366/w25366.pdf

D'Amico, G., & De Blasis, R. (2020). A review of the Dividend Discount Model: from deterministic to stochastic models. Statistical Topics and Stochastic Models for Dependent Data with Applications, 47-67.https://arxiv.org/pdf/2001.00465

Fernandez, P. (2019). Three residual income valuation methods and discounted cash flow valuation.http://pruss.narod.ru/ThreeIncome_OneDCF.pdf

Kadim, A., Sunardi, N., & Husain, T. (2020). The modeling firm's value is based on financial ratios, intellectual capital, and dividend policy. Accounting, 6(5), 859-870.http://m.growingscience.com/ac/Vol6/ac_2020_48.pdf

Sahoo, V. D. Investors perception on Dividend Policy and Valuation Models (2020) .https://www.academia.edu/download/79810078/13635.pdf.pdf

Siziba, S., & Hall, J. H. (2021). The evolution of the application of capital budgeting techniques in enterprises. Global Finance Journal, 47, 100504.https://repository.up.ac.za/bitstream/handle/2263/74586/Siziba_Evolution_2020.pdf?sequence=1

Wibowo, A. I. L., Putra, A. D., Dewi, M. S., & Radianto, D. O. (2019). Differences In Intrinsic Value With Stock Market Prices Using The Price Earning Ratio (Per) Approach As An Investment Decision Making Indicator (Case Study Of Manufacturing Companies In Indonesia Period 2016-2017). Aptisi Transactions On Technopreneurship (ATT), 1(1), 82-92.https://att.aptisi.or.id/index.php/att/article/download/23/6

BEAFGE Business Economics and Finance in a Global Environment Assignment Sample

A. Project question

You have received an email from the Chief Executive Officer of Clark Casc Logistics plc, where you are employed as manager of the refrigerated goods division, inviting you to the first in a series of budget-setting meetings and asking you to submit a brief report in advance for assignment help.

You are only permitted to submit your report once. Trial runs are not permitted and no spare, draft or test drop boxes will be provided. It is your responsibility to submit your own work and to ensure that your report is finalised, complete and properly edited before, not after, you submit it.

This is an individual assignment. The sharing of files or copying of work between students is not permitted.

You are only allowed to submit one document, which must contain your full report, including your reference list. Do not attempt to submit additional documents.

Your submission must be either a Word document in .doc or .docx format or a .pdf document.

Appendices are not permitted.

Dear “Laser”,

For the last financial year Clark Casc Logistics plc made a profit of £32 million – with profits of £18 million in the first six months of this year and the Board believes that there is scope for continuing expansion. We are therefore reaching out to all managers to provide realistic budgets for the income and costs for which they are responsible, so that we can plan ahead with confidence.

We will be holding a first round of budget-setting meetings on Thursday next week. As the manager of the refrigerated goods division, the income and expenditure for which you were responsible for the last financial year were as follows.

Your expenditure for the first six months of the present financial year is as follows, with a comparison with the budget which, I would remind you, you agreed to this time last year.

Year Ended April 30th 2022

Six Months to October 31st 2021

Refrigerated Goods

Next Year: Year Ending April 30th 2023

The purpose of next week’s meeting is not to congratulate ourselves on past profits but to plan for the future.

We already have a budget for the rest of this year and monitoring progress against this is an entirely separate exercise and not the purpose of this report, so do not include any budget monitoring information, as we already have that.

We need a realistic budget for income and expenditure, to tell us how much sales income we intend to make and how much we are going to have to spend to earn it. This year is already underway and what we need is a budget for next year. We need this budget to be agreed well in advance, so that we can make the necessary commitments and contractual arrangements for all our planned expenditure.

Please provide a report in advance of the meeting detailing your budget for the year ending April 30th 2023.

The format of the proposed budget is up to you, as is the method by which you arrive at the budget. However, please include the following sections in your report. We do not require an executive summary:

1. Introduction

2. Approach to evaluation of the proposed investment in a new depot

3. Evaluation of the proposed investment in the new depot

4. Approach to drawing up the refrigerated goods department budget

5. Relevant calculations to show that your budget for the year ending April 30th 2023 is realistic

6. Your proposed budget for the year ending April 30th 2023 with complete income and expenditure figures

7. A conclusion on the levels of income and expenditure in your department and on the likely result of building the new depot

8. Recommendations on the new depot proposal, including a recommendation on whether or not to proceed with it, and on the next steps in managing resources in the refrigerated goods department

Please make sure you provide a list of references to any published external material you refer to in your report.

Make sure your report is at least 2,250 words to prove you’ve done some work but I’m not reading it if it’s more than 2,750 words apart from the references. I will not waste time reading appendices. If you have something to say, say it in your report.

Our growing sales income has already enabled the Board to give employment to the Chief Executive’s son and I was frankly astonished to find that he has been assigned to the Finance department. As I am struggling to find any real use for his talents, I will be reading your report carefully for signs that you “need help” with financial matters, in which case I will have no hesitation in sending young Tony to “help” you on a daily basis.

Best Wishes,

Iain

“Until a man dies, wait and until then never call him happy but only fortunate.”

Herodotus

This email contains confidential information relating to Clark Casc Logistics plc. If you are not the intended recipient delete this email immediately.

Further information

As manager of the refrigerated goods division you are responsible for sales income from the transport of refrigerated goods.

Note that the figures above are for six months. You are required to provide a budget for a full year and not for six months only.

You are responsible for pricing and negotiating each contract. You have complete discretion over pricing and all refrigerated goods contracts must be signed by you or somebody authorised by you. You usually start by offering a price based on £0.22 per tonne per kilometre. However, if a prospective client has asked for sealed bids in a competitive bidding process you submit a bid priced at £0.19 per tonne per kilometre, which is approximately the average price you are able to negotiate with customers.

The sales income generated by your department over the past six months has been as

As manager of the refrigerated goods division, you are responsible for the following costs:

Salaries and Associated Payroll Costs

In addition to the salaries below, Clark Casc is required to pay Employer’s National Insurance Contributions. Employer’s National Insurance Contributions are presently assessed as 13.8% of each employee’s salary, including bonuses but excluding the first £8,840 of the employee’s annual salary.

Clark Casc is also required to pay an additional 0.5% of total salaries, including bonuses, as an apprenticeship levy.

Clark Casc also contributes to an employees’ superannuation scheme. Clark Casc’s contribution is 8.5% of all staff salaries, including bonuses.

All of these costs are part of your budget.

Heavy Goods Vehicle Drivers:

You have 202 drivers earning an average base salary of £35,000 per year. Each driver can presently cover about 125,000 miles per year. Last year, all drivers also qualified for a bonus of 10% of base salary for accident-free driving and there have been no vehicle accidents this year.

Employer’s insurance is handled centrally and is not part of your department’s budget.

Refrigerated Goods Depot Operatives

You have 97 operatives working at you refrigerated goods depot, earning an average salary of £19,000 per year.

Administrative Staff

You have 11 administrative staff in the refrigerated goods department, earning an average salary of £27,000 per year.

Property Plant and Equipment

Vehicles

Your department uses 151 heavy goods vehicles and 16 other vehicles, all of which are owned by Clark Casc. Each vehicle has an estimated useful life of 12 years in the company after which it can be resold for an estimated 10% of its original cost. The average replacement cost of a heavy goods vehicle is presently £120,000 and the average replacement cost of other vehicles is £24,000 per vehicle. You are responsible for the cost of depreciation on these vehicles. Depreciation is to be charged at current replacement cost.

Vehicle Excise Duty

Vehicle Excise Duty varies from vehicle to vehicle but is an average of £560 per vehicle per year for heavy goods vehicles and an average of £220 per vehicle per year for other vehicles.

Vehicle Insurance

Your vehicle insurance costs average £2,400 per vehicle per year for heavy goods vehicles and £400 per vehicle per year for other vehicles.

Other Equipment

You have just completed a major exercise with the finance department to establish what equipment you are using at the refrigerated goods depot and in the office. The annual depreciation cost at current replacement cost for this equipment is £228,000.

Equipment insurance other than vehicle insurance is handled by another department and is not part of your budget responsibilities.

Buildings Depreciation

The depot and office which you occupy have a current replacement cost of £3,500,000 and a useful life of 50 years. The land which they occupy has a current resale value of £600,000 and the scrap value of the building materials is estimated at £100,000 at current prices. You are required to budget for depreciation on the buildings on a straight-line basis.

Buildings Maintenance

Buildings maintenance, including cleaning, is carried out by the in-house Buildings Maintenance Department and recharged to your department. It is a fixed cost and averages £7,000 per month.

Equipment Maintenance

Vehicle Maintenance

Clark Casc’s vehicle maintenance department is under separate management. You are responsible for booking the vehicles in your department in for repairs, routine maintenance and annual testing. You are also responsible for ordering the recovery of any vehicles which have broken down or been involved in accidents. All of these

services are managed by the vehicle maintenance department. There have been no motor vehicle accidents in your department in the last 18 months.

Vehicle maintenance is a semi-variable cost.

The vehicle maintenance costs charged to your department over the last six months have been as follows:

The sales income generated by your department over the past six months has been as follows:

Other Equipment Maintenance

Depot and office equipment maintenance is a fixed cost and averages £12,000 per month.

Fuel and Power Costs

Vehicle Fuel

Vehicle fuel is a semi-variable cost.

Total vehicle fuel costs for the last six months have been as follows:

Other Power Supplies

Gas and electricity supplies to the depot and office are a fixed cost and average £15,000 per month.

Staff Training

The cost of drivers’ training averages £1,225 per driver per year, including fees for Certificates of Professional Competence.

Depot operatives’ training costs average £225 per operative per year. Administrative staff training costs average £275 per person per year.

Other Costs

There are no other costs in your budget. All other costs, including legal costs, employer’s insurance, public liability insurance and insurance of buildings and non-vehicle equipment, are handled by other departments and you are not responsible for managing them.

Step Fixed Costs

You presently have enough drivers and vehicles to meet demand up to 140 million tonne kilometres per year (£26,600,000 sales income per year at £0.19 per tonne kilometre). To fulfil orders above this level you will need 2 extra drivers and 1 extra heavy goods vehicle for every 1.4 million extra tonne kilometres per year (£266,000 sales income per year at £0.19 per tonne kilometre).

Proposed New Depot

If sales exceed 150 million tonne kilometres per year (£28,500,000 sales income per year at £0.19 per tonne kilometre), your department will need a new depot of the same size and with the same number of depot operatives as the existing depot and you will also need 3 additional administrative staff with salaries of £27,000 per year each. It will take 12 months to build a new depot and bring it into use and Clark Casc will have to pay the builders before it is complete.

You are responsible for deciding whether to make this extra investment in a new depot or not. You are not responsible for deciding on how to finance it. However, you have been told that further investments are required to make a return of at least 9% per annum and that this is to be used as the discount rate in any discounted cash flow calculations.

Additional Information

You are the manager of the refrigerated goods department and you have full access to any additional information required. If more information is required from a published, broadcast or webcast source, you must present that information with a proper reference in the normal referencing format required in the business school. If further information would be required from internal sources at Clark Casc, you must create that information yourself for use in drawing up your report and provide your own indication of internal sources.

You must not present a report which concludes that information is incomplete, or that further information is required or which recommends that further information is obtained. This would be a clear indication that you have not completed your report as required.

Required:

Write your report, addressed to the Managing Director of Clark Casc and containing the following sections, as directed in the Managing Director’s email. Submit your report in the Turnitin dropbox.

1. Introduction

2. Budgeting Approach

3. Relevant Calculations, including any investment appraisal

4. Proposed Income and Expenditure Budget

5. Conclusion

6. Recommendations

7. References

Your report must be between 2,250 and 2,750 words in length excluding references.

Do not include an executive summary.

Appendices are not permitted.

Solution

Introduction

The term forecasting is associated with the aspect of predicting the future expected outcome by analysing the present situation. As we are all know, that being human, it is difficult to watch the future, but on can make an predication about the possibility. The corporate leaders or business leaders, use their skill and the methods, along with the past data for projection of future projected outcome. Forecasting is the systematic approach of examining the future. Forecasting sales in this context refers to the act of producing a prediction about future sales, followed by a careful investigation of data linked to future events and factors that may effect the entire firm. This budget report is drafted based on the past experience, the prevailing situation of business and the expectation of top management. (Ogun Bayo, B. F., Alibaba, C. O., Thala, W. D., & Akinradewo, O. I. (2022).

As a head of the refrigerator department, I believer, that every corporate operates under the Isolated business environment and they are open to influence by the factors associated in the business environment. the smart business tried to take an advantage through continues scanning, reviewing and analysing the operation and non-operation activities surrounding the business. All these activities are essential for continues growth and development of business. Further scanning, analysing, reviewing, planning, controlling and formulating the action plans are some key elements which are widely associated with business. After associating myself with Clark Cask Logistics plc, and after reviewing the work culture in the corporation. I feel that the planning and budgeting is the primary requirement for continues growth of business. Any decision with logical reason, required detail research, as well as this decision required continues observation of business environment. this budget report is drafted based on the experience gain in last year, as well as observing the overall strength of my department and considering that this budget report shall be realistic one. We have seen numbers of opportunities in the competitive business environment, but we sometime wait to check the actual reaction of change in the market.

Approach To Evaluate The Proposal To Invest in New Department

The growth and expansion of any business is the outcome of hardworking, delegation and continues commitment from the all the people associated with the company and the various department. projection about the future inflows and flows are made based on the overall demand for customer as the company market share in the competitive environment. further business is also required to update and up-grade them self, with the change in the business environment and level of competition. The expansion strategy of business can be carried out either by acquiring control over the competitor or by reinvesting the in exiting business by adding funds in exiting operation. Either of the selected option will result into growth of business and which will enhance the capacity of company to serve more and more customers. However, this decision of expansion of operation or the decision to enhance the operating capacity, again suffers from the numbers of drawback, hence it is essential to make proper research, before adding new capital either in exiting operating capacity or to expand the business operation. Here in current case, our management are on the option that we are in position to grow our business, considering these facts we have plan out to adopt some strategic action plan, at each division. It is totally true that we are in position to growth. But as the responsible person of the refrigerator goods department. I personally feel that before finally taking an decision for further, expansion or investment of funds in to the existing operation, we need to wait for another one year. (Nikodijevi?, M. (2021). the proposal of new investment is totally correct, but before finally deciding, or taking a finical conclusive decision. We are supposing consider the growth rate in sales of industry as whole as well as the growth of sales of our department from one year or another year. based on the growth in sales of during first 6 months, it can be projected that the refrigerator department will continues to grow at the stable rate, however as the industry is growing and our top executive also feel that we have a opportunities to expand, then in such a situation we can project that refrigerator department can grow at the rate of 10 % in total sales, this growth rate Is seem realistic, and if we consider this growth rate, then the budged sales will be nearly to £27000000, this situation does not permit use to make an further investment in new plan, rather we can go with the option of adding some more resources, which can help our operation to work smoothly and deliver the product and services with high quality standard. Here we can adopt the approach of being aggressive but with suitable Calculation. Here we will adopt the approach of adding new resources and expanding the operation in next one or two years. Further even if we take a decision for further investment in this department, it will start operating after a year.

This decision shall not be limited with the final conclusion to avoid investment in department in order to expand the operation strategy. As we are in middle of year, we are can wait for next 6 month in order to oversee the actual performance of industry as whole, the competitor position and the reaction of our customers. The new investment decision will result into the high outflow of cash. this decision required to consider the opportunity cost with this investment planning. Hence it is best suitable for wait for some time let say 6 months, and then after again the meeting shall be called to take a decision to start new operation division.

Evaluation of Proposed Investment in New Department