HI5020 Corporate Accounting Assignment Sample

Assessment Brief of Accounting for Corporate Income Tax - Theory and Applications

Purpose of the assessment:

This assignment aims at developing an understanding of students on different concepts of Accounting for Income tax and the application of those concepts in the practical financial setting.

In addition to answering theoretical questions on different concepts on accounting for income tax, students will need to analyses the tax related disclosures made by an ASX listed company in its financial statements and the associated notes to the financial statements. (ULO 1, 3, 4, 5).

Weight - 35 % of the total assessments (35 marks)

Total Marks - 35 % in written report

Word limit - 3000 words ±500 words

Due Date - Assignment submission: Final Submission of individual Assignment: Wednesday, Week 10, 11:59 pm Late submission incurs penalties of five (5) % of the assessment value per calendar day unless an extension and/or special consideration has been granted by the lecturer prior to the assessment deadline.

Submission Guidelines and Referencing

• All work must be submitted on Blackboard by the due date along with a completed Assignment Cover Page.

• The assignment must be in MS Word format, no spacing, 12-pt Arial font and 2 cm margins on all four sides of your page with appropriate section headings and page numbers.

• Reference sources must be cited in the text of the report, and listed appropriately at the end in a reference list using Harvard referencing style. The following guidelines apply for assignment help

1. Reference sources in assignments are limited to sources which provide full text access to the source’s content for lecturers and markers.

2. The Reference list should be located on a separate page at the end of the essay and titled: References.

3. It should include the details of all the in-text citations, arranged alphabetically A-Z by author surname. In addition, it MUST include a hyperlink to the full text of the cited reference source.

For example:

P Hawking, B McCarthy, A Stein (2004), Second Wave ERP Education, Journal of Information Systems Education, Fall, http://jise.org/Volume15/n3/JISEv15n3p327.pdf

4. All assignments will require additional in-text reference details which will consist of the surname of the author/authors or name of the authoring body, year of publication, page number of content, paragraph where the content can be found.

For example:

“The company decided to implement an enterprise wide data warehouse business intelligence strategies (Hawking et al, 2004, p3(4)).”

Non Adherence to Referencing Guidelines

Where students do not follow the above guidelines:

1. Students who submit assignments which do not comply with the guidelines will be asked to resubmit their assignments.

2. Late penalties will apply, as per the Student Handbook each day, after the student/s have been notified of the resubmission requirements.

3. Students who comply with guidelines and the citations are “fake” will be reported for academic misconduct.

Assignment Specifications

Purpose:

This assignment aims at developing an understanding of students on different concepts of Accounting for Income tax and the application of those concepts in the practical financial setting. In addition to answering theoretical questions on different concepts on accounting for income tax, students will need to analyses the tax related disclosures made by an ASX listed company in its financial statements and the associated notes to the financial statements.

Assessment task:

Please answer the following questions relating to Accounting for Corporate Income Tax.

Question 1: Why do deferred tax assets or deferred tax liabilities arise? Explain your answer with suitable example.

Question 2: Will the existence of unused tax losses always lead to the recognition of a deferred tax assets? Explain your answer with suitable example.

Question 3: Do the liabilities and assets that are generated by using the 'balance sheet method' of accounting for tax appear to be consistent with the definition and recognition criteria of assets and liabilities promulgated within the Conceptual Framework?

Question 4: Under what condition deferred tax assets can be offset against deferred tax liabilities?

Question 5: Critically examine the disclosures made by an Australian Securities Exchange (ASX) listed company in its latest financial statements and associated notes regarding income tax issues. While every company will have unique tax matters and position, your discussion should highlight the following:

(i) Identify the income tax expense (income) shown in the income statement. On what basis this amount has been calculated?

(ii) Deferred tax assets/liabilities shown in the balance sheet

(iii) A detailed explanation of what has been disclosed for Income tax in the Note associated with the financial statement.

(iv) Under what basis/assumptions deferred tax assets deferred tax liabilities have been recognized?

(v) What portion of the deferred tax assets or deferred tax liabilities have originated in the current year, and what portion relate to prior years?

(vi) Summarize the accounting policies and approaches used by the company in its accounting for Income Tax.

(You can select the company at your discretion. The company must be listed in the ASX)

Assignment Structure should be as the following:

Abstract - One paragraph

List of Content

Introduction

Body of the assignment with detailed answer on each of the required tasks

Summary/Conclusion

List of references

Solution

Introduction

This assignment is all about Deferred Tax Asset and Deferred Tax Liabilities, how they arise, how they are set off and on what basis is the calculation done.

It also, states about the accounting policies basis which an ASX Limited company takes up its Accounting of Income Taxes.

Question 1

An organisation prepares its books of accounts on the basis of various accounting standards (as may be applicable to it). While the same organisation prepares itself for tax computation, the same books of accounts need to be modified in line with the Tax laws applicable i.e. as per Income Tax Assessment Act 1986.

Many a times, situation arises wherein the carrying amount (i.e. amount in the books as per Accounting) of assets or liabilities do not match (i.e. are different) with its tax base (i.e. values appearing as per Taxation Laws), thereby amounting to differences. (Finley, Ribal ,2019, p 2, 86)

These differences may be temporary or other than temporary (also referred as permanent). The temporary differences lead to creation of deferred tax assets and/or liabilities. The difference which are other than temporary do not create any deferred tax asset/liability (DTA/DTL).

When talking about temporary differences, which are responsible for creation of deferred tax assets/liabilities, these differences are further classified into Taxable Temporary Difference and Deductible Temporary Difference.

Taxable temporary differences as the name suggests are the differences which ultimately result in additional taxable amounts in the coming years. These lead to creation of Deferred Tax Liabilities.

Deductible temporary differences are the differences which would result in reduction of taxable amounts in the future years. These lead to creation of Deferred Tax Assets. (Finley, Ribal, 2019, p 2, 86)

The same be explained further with the help of example that follows-

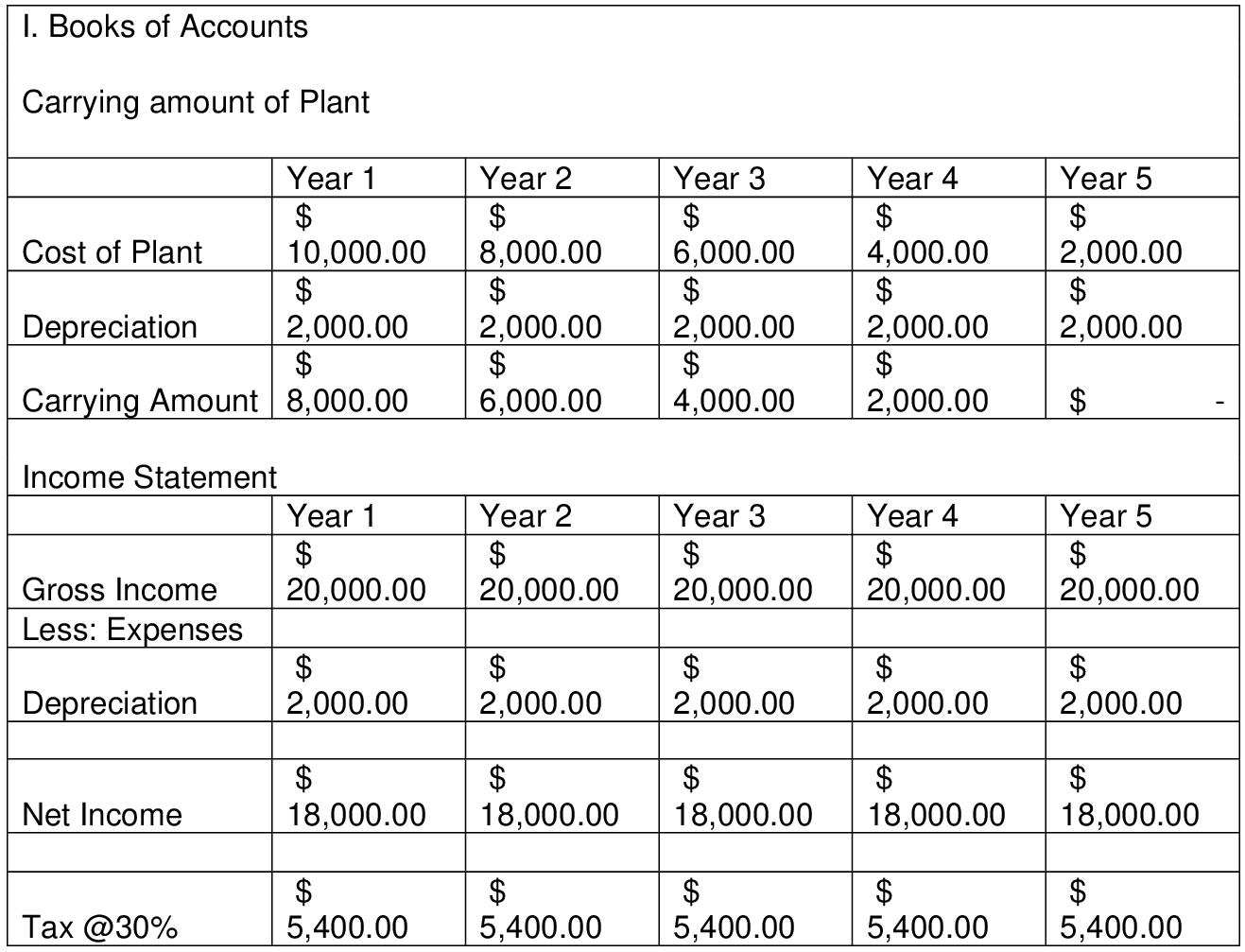

A company XYZ Limited has a plant (fixed asset) which has a cost of $10,000. The company writes off depreciation on the same @20% on SLM and the rate of tax as per Tax Laws is 25% SLM. Now we will see how it leads to creation of DTA/DTL. The applicable tax rate is 30%.

The differences in taxes from Year 1 to Year 4 is $150.00 each which appears to be tax saving bur actually is nothing but tax deferment as in Year 5 an amount of $600.00 is to be paid in excess (as per Tax Laws), that is we have created Deferred Tax Liabilities in the initial years.

As per Income Tax Assessment Act 1986, when we are paying fewer taxes (i.e. taxes as per Tax Laws are lower as compared to taxes as per Books) or we can see that value of an underlying asset has a carrying amount more than its tax base, it will lead to creation of deferred tax liability.

Question 2

The existence of unused tax losses does not necessarily need for recognition of deferred tax assets as per Income Tax Assessment Act 1986,.

DTA can be recognised in the same manner for unused tax losses as is done in DTA being recognised from deductible temporary differences. The main conditions which need to be checked before recognising DTA from unused tax losses are:

1. The entity willing to recognise DTA from some unused tax losses, is convinced

2. Also among other things, the period up to which unused tax losses can be carried forward is to be noted.

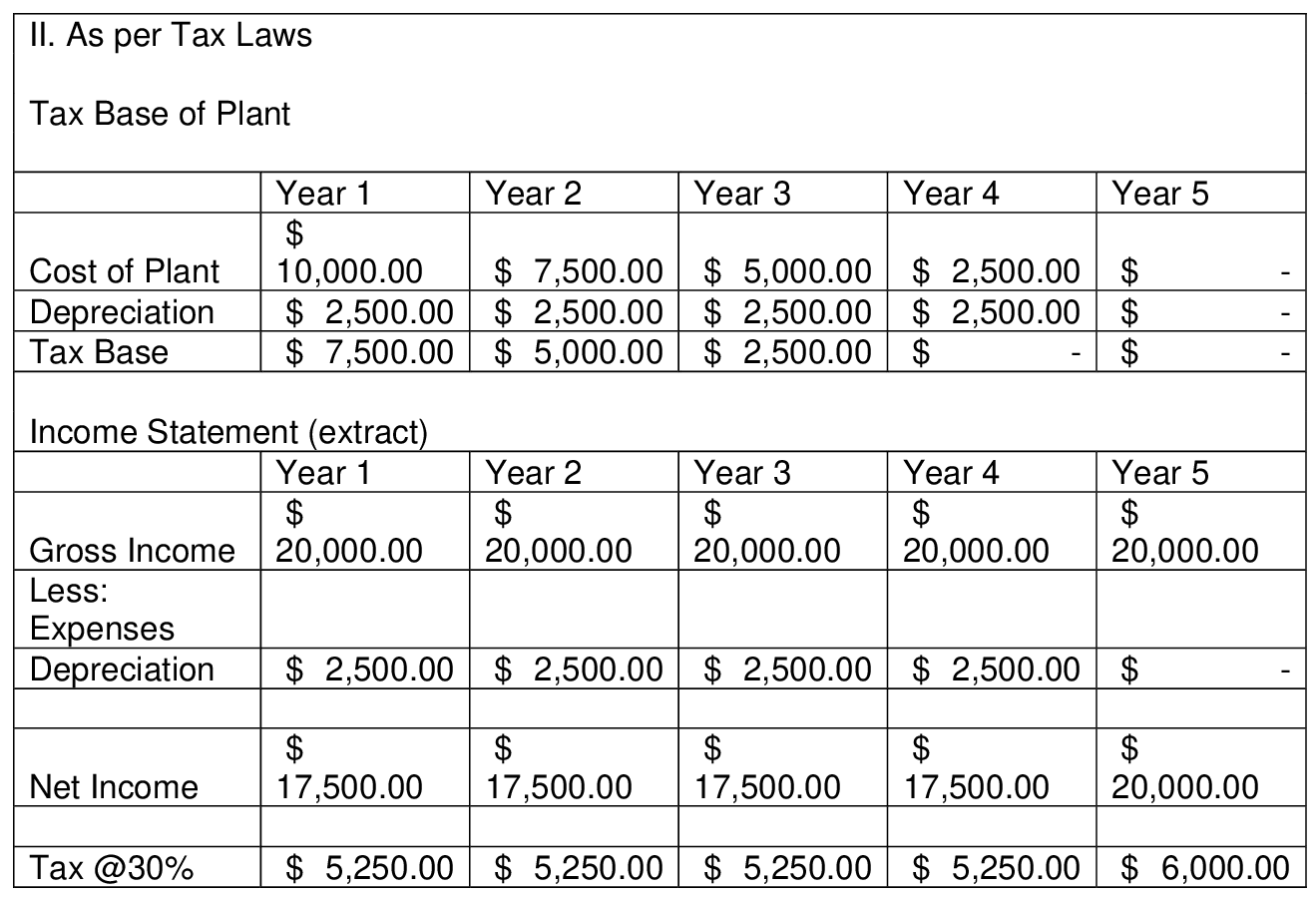

For example, let’s talk about a start-up which is HNL Limited, an organisation willing to penetrate the logistics market. Now, we take up some figures of profit and losses for the organisation

In the initial years i.e. up to Year 5, the company has incurred losses, a cumulative amount of $1100 M.

We will consider the following cases

Case 1: Unused tax losses can be carried forward for 3 years.

In this case, the loss incurred in Year 1 will be carried up to the 4th year, in year 2 up to the 5th Year and so on. Now the loss incurred in Year 1 and Year 2 will not create any DTA as the company does not have sufficient profits. However, for the next year i.e. Year 3 the unused loss of $500 will create DTA up to an extent of $100 as the probable profit in Year 6 is S100.

The balance $400 will lapse.

Case 2: Unused tax losses can be carried forward for 6 years.

In this case, the loss incurred in Year 1 will be carried up to the 7th year, in year 2 up to the 8th Year and so on. Therefore, the loss of $100 will create DTA of full amount as the company has sufficient profit within the time lines available for carrying of the unused losses.

Therefore, we can say that unused tax losses which can be carried forward to the future years and can result in tax saving in the future years will lead to creation of Deferred Tax Assets (DTA). But not all unused tax losses will lead to DTA creation.

Question 3

Conceptual framework is the process in which logical reasons have been taken into consideration for the purpose of detailed and complete understanding with respect to the selected areas. In the current scenario the selected area is deferred tax and the computation of the same. To compute deferred tax is a complex process and hence step by step need to go to arrive at the final payment of deferred tax. This process has been used in almost every field thereby giving a sense of satisfaction. It is necessary that the assets and liabilities which have been generated by using the balance sheet method for the purpose of tax accounting need to be consistent as per the definition and recognition criteria promulgated within the Conceptual framework. Further, deferred tax would be considered as an asset when the same has been paid in advance and deferred tax would be considered as a liability when the same has not been paid at per specified due date thereby creating liability for the organization (Sulistianingsih, 2019, p2, 80).

As per Income Tax Assessment Act 1986, deferred tax arises due to the existence of timing difference which means there is the difference of accounting with respect to taxation purpose and accounting purpose. For example, on the purchase of any asset the tax attracts 50% in the first and second year. However, while computing in the accounting the tax rate is different at the rate of 30% which is less than the above tax leads to which difference arise in the ultimate payment of tax. As per the taxation policy the company has paid 50% tax in the first year and for the same the company would be entitled to receive benefits in future year as a deferred tax asset. Such treatment of tax reduces the burden to pay tax from the company point of view. This process has given the option to the company to set off their tax which has been paid in advance as per the taxation policy. (Sulistianingsih, 2019, p2, 80) As the company has paid extra tax in the initial period the benefit of the same would be delivered in the future period accordingly. The same rule applies for the deferred tax liability also. However, the company has to follow ultimately the tax policy instead of accounting policy as the ultimate payment of tax has been computed as per the taxation norms which has been issued by the government of Australia.

Question 4

Deferred tax assets can be used to set off from the deferred tax liabilities of any particular entity. However, there are certain limitations that have to meet an entity to claim the same exemption. The limitations are as follows:

1. The DTA and DTL are related to taxes which are levied by a single authority of taxation. (Watson, 2018, p 2,83)

2. The DTA and DTL relate to taxes which are levied on the same taxable entity/organisation. The same can be allowed for different entities/organisations if they have an intention to set off their DTA and DTL on a net basis in the coming future period. (Watson, 2018, p 2,83)

For example, an organisation say RTG Limited, has recognised a deferred tax asset of $5000 and also a deferred tax liability is recognised amounting to $4750, both under the same Tax Laws. IN such a case, the company has a right to set off both DTA and DTL, thereby presenting a net amount i.e. $250 as deferred tax assets. “With the issuance of ASU No. 2015-17, the FASB (2015c) by its own admission abandoned the definition of current and noncurrent assets and liabilities in the authoritative literature and changed the proper presentation of those deferred tax items on the classified balance sheet.”(Morris,2017, p3, 2158)

Also, if there is a DTA recognised by RTG Limited under some tax laws amounting to $4500 and a subsidiary of RTG Limited named SUH Limited under the same tax laws has a DTL amounting to $5000. The holding company has the authority to offset DTA and DTL of the current period, as per Income Tax Assessment Act 1986.

Since, the DTA and DTL are related to same tax authority under same tax laws but do not relate to same taxable entity, it is the management which has to think and decide whether the DTA and DTL is to be settles by netting them or by realisation of both DTA and DTL concurrently.

Question 5

The company chosen here is Iluka Resources Limited. It is an international mineral sands company that deal in various activities such as exploration, project development, mining, processing, marketing and rehabilitation. The major focus of this company is to maximize shareholder’s wealth.

(i) The income tax expense of this company in the year 2020 is $95.5 m.

The calculation of current tax for the accounting period is done using the tax rates applicable and tax laws of the land as on the reporting date in the nations where the company operates and generates income that is taxable.

The income tax expense is the tax payable for the current year’s taxable income based on the applicable income tax rate for each jurisdiction which is first adjusted for changes in deferred tax assets and liabilities and to unused tax losses.

(ii) The net deferred tax asset for the year here is $28.4 m.

For the year 2020, Gross DTA is $191.6 m and the Gross DTL correspondingly is $163.2 m. The difference therefore, amounts to $28.4 m that is excess of Gross DTA over DTL.

(iii) In the notes to financial statement (Note 12) Income Tax, it is clearly states as to how the income tax expense has been calculated.IT mentions the rate at which IT has been calculated and also gives a comprehensive list of amounts not deductible while calculating the taxable income thus arriving at the Income tax expense, as per Income Tax Assessment Act 1986. As per the note, current year tax expense is $98.4m and deferred tax is ($3.1m), therefore, IT expense is $98.5 m after adjusting for under providing for $0.2m. The income tax expense can also be bifurcated based on profit from continuing and discontinued operation as $74.8 m and $20.7m totalling to $98.5m.

(iv) As mentioned in the notes, the carrying amount of DTA is reviewed at each balance sheet date and then adjusted by reducing to the extent which is not expected to be allowed to be utilised based on profit availability.

(v) The net deferred tax asset has seen an increase of $6.3 m amounting to $28.4 m in the year 2020 as compared to $22.1 m in the previous year. While we look further, we understand that the gross deferred tax assets have seen a surge of $15.9m due to an increase in temporary differences of employee provisions, other provisions and other factors, whereas lease liabilities and hedge reserve pulled down the DTA (Iluka Resources, p17(1)).

On the other hand, the gross deferred tax liabilities have also witnessed a growth of $9.6 m due to increase in temporary differences of property, plant and equipment, while the differences on account of inventory, receivables and other assets have dragged the growth of DTL.

(vi) The accounting policies and approaches that Iluka Resources Limited have used in preparation of its financial statements include the Australian Accounting Standards and Interpretations issued by Australian Accounting Standards Board. It has also considered International Financial Reporting Standards (IFRS), as and where applicable. The basic preparation has been done as per Historical Cost Convention. However, as required by Law, valuation has been done at fair value for the financial liabilities and assets, wherever applicable.

Conclusion

Here, in this assignment, the taxes, accounting of taxes and practical treatment of the DTA, DTL and income tax is taken up. The ASX company Iluka has all the conditions that were mentioned in the question that helped to check, learn and understand the practical application.

References

A Bakke, T R. Kubick, and M S. Wilkins (2020), Deferred Tax Asset Valuation Allowances and Auditors’ Going Concern Evaluations.https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3622505

A Edwards (2018), The Deferred Tax Asset valuation Allowance and Firm Creditworthiness, Journal of the American Taxation Association (2018) 40 (1): 57–80, https://meridian.allenpress.com/jata/article-abstract/40/1/57/60498/The-Deferred-Tax-Asset-Valuation-Allowance-and

A Finley, A Ribal (2019), The information content from Releases of the Deferred Tax Valuation Allowance, Journal of the American Taxation Association (2019) 41 (2): 83–101, https://meridian.allenpress.com/jata/article-abstract/41/2/83/10464/The-Information-Content-from-Releases-of-the

H Russ (2020), New Evidence on Investors’ Valuation of Deferred Tax Liabilities, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3304846

I A Nwaorgu, M C Abiahu, & J A Iormbagah (2019), Deferred Tax Accounting and Financial Performance: The Listed Agricultural Firms’ Perspective in Nigeria. In Dandago, K.I., Salawu, R.O., Akintoye, R.I. &Oyedokun,

G.E. (Eds.)https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3474769

Iluka Resouces Limited (2020), Annual Report, https://iluka.com/

J L Morris (2017), Classification of deferred tax assets and deferred tax liabilities: An evaluation of FASB’s Attempt at Standard Simplification. Journal of Accounting and Finance.17 (8), 2158-3625, http://www.na-businesspress.com/JAF/JAF17-8/MorrisJL_17_8_.pdf

L Watson, (2018), The Deferred Tax Asset Valuation Allowance and Firm creditworthiness, Journal of the American Taxation Association (2018) 40 (1): 81–85, https://meridian.allenpress.com/jata/article-abstract/40/1/81/60466/The-Deferred-Tax-Asset-Valuation-Allowance-and

R D P. Sulistianingsih (2019), How the effect of deferred tax expenses and tax planning on earning management? International Journal of Scientific and Technology Research, 8(2), 78-83,https://scholar.ui.ac.id/en/publications/how-the-effect-of-deferred-tax-expenses-and-tax-planning-on-earni

HI5017 Managerial Accounting Assignment Sample

Assignment Brief

Purpose of the assessment (with ULO Mapping)

Students are required to develop their understanding of the types of management accounting information that assists managers in organizational planning and control purposes. You are to critically evaluate the literature (using journal articles) to analyses the practical use of management accounting information by contemporary organizations, and their relevance to decision- making by managers and achievement of business goals. (ULO 1 & 4)

Weight - 30% of the total assessments

Total Marks - 30

Word limit Not more than 3,000 words. Please use "word count" and include it in the assignment.

Adapted Harvard Referencing

Submission Guidelines for assignment help

• All work must be submitted on Blackboard by the due date, along with a completed Assignment Cover Page.

• The assignment must be in MS Word format, with no spacing, 12-pt Arial font and 2 cm margins on all four sides of your page with appropriate section headings and page numbers.

• Reference sources must be cited in the assignment's text and listed appropriately at the end in a reference list using Adapted Harvard referencing style.

• It is the student's responsibility to submit the work to ensure that the work is her/his work. Incorporating another's work or ideas into one's work without appropriate acknowledgement is an academic offence. Students should submit all assignments for plagiarism checking on Blackboard before final submission in the subject. For further details, please refer to the Unit Outline and Student Handbook.

Individual Assignment Specifications

Assignment Task: You are required to conduct a literature search for this assignment, cite your source(s) and provide a full reference list (as per the Holmes Adapted Harvard Referencing guidelines on pg. 1-2).

Part A (15 marks)

Management Accountants are seen as the "value-creators" amongst the accountants. They are much more interested in forward looking and taking decisions that will affect the future of the organization, than in the historical recording and compliance (scorekeeping) aspects of the profession (Institute of Certified Management Accountants, 2017).

a) Discuss the pros and cons of the above statement. (4 marks)

b) Explain the relevance of the value chain concept to management accountants today. (3 marks)

c) Assume you are the management accountant of BHP Group, a leading mining company in Australia. Provide examples of how you can create value for the company to support the manager make:

i) strategic decisions (2 examples); and

ii) operational decisions (2 examples). (8 marks)

"Maximum 1500 words."

Part B (12 marks)

a) What distinguishes the successful implementations of ABC costing method from those that have not succeeded? Include real-life examples from the literature to support your answer. (10 marks)

b) Based on your literature findings in (a), state two key lessons that stood out for you, about the ABC costing method as a planning and decision-making tool that would benefit contemporary organizations. (2 marks) "Maximum 1500 words."

Assignment Structure:

The assignment should include the following components:

a. Assignment cover page clearly stating your name and student number

b. Abstract (one paragraph)

c. Table of contents

d. A brief introduction or overview of what the assignment is about.

e. Body of the assignment with appropriate section headings

f. Conclusion

g. List of References (follow the Holmes Adapted Harvard Referencing guidelines.

SOLUTION

INTRODUCTION

Present study is based on management accounting information that helps managers in taking planning and controlling decisions. It contained critical analysis of the practical application of management accounting information by the modern organizations, and their significance in decision making and achievement of business objectives. Apart from this, discussion of the ABC costing method is also given and how it uses as a planning and decision-making technique that provide benefit to the company.

BODY OF ASSIGNMENT

Part A

Answer a)

According to the Institute of Certified Management Accountants, management accountants are considered as value creators amongst the accountant as they are significantly involved in forward looking and taking decision that create impact on the future performance of company as compared to the historical recording and compliance elements of the company. Considering this, pros and cons of above statement are as follows –

Pros of management accountants:

Better decision making: Management accountant provide support in effective decision making for entities. It is because, they help in supplying of all information in the form of tables, forecasting, and charts, which leads towards detailed analysis and better decision making. Additionally, management accountants also apply scientific tools and techniques for evaluation of performance of business and consequently identify deviations and issues. In order to remove such deviations and issues, management accountants take actions accordingly (Mahdavikhou, 2018, p. 245(2)). Therefore, it can be said that, primary aim of management accountants is to mend the overall efficiency of the organization.

Enhancement in performance: Management accountant helps in increasing the profitability of the organization. It is because; they are mainly involved in taking decisions that affects future performance of the organization. They give emphasis on reduction in extra expenses of business activities by application of capital budgeting analysis and budgetary control measures (Ibrahim, El Sibai, and El Din, 2021, p. 53(1)). It enables the organizations to decrease cost of production and generate better returns.

Cons of management accountants:

Lack of specific process: It should be noted that, management accountant does not comply with any particular rules and regulations. Therefore, in the absence of any norms, they may provide inaccurate information.

Dependency: In this aspect, management accountant mainly obtains information from the financial and cost accounting for numerous data. Therefore, the reliability of the information offered by management accountants are primarily depends on the accuracy of records maintained through cost and financial accounting (Omar Fikrat, and Ozyapici, 2019, p. 82(3)). additionally, management accountants provides information and planning for the future activities of the company, as there is no certainty that in the future period activities may take place as per management accountant’s opinion and due to this, they may not provide effective outcomes.

Answer b)

Value chain analysis is a business model that explains the whole extent of activities required to create goods or services. For entities that are engaged in manufacturing of goods, value chain activities are comprised with bringing goods from conception to distribution, as well as each and every element in between like producing raw material, marketing, manufacturing activities. It should be noted that, value chain plays important role for the management accountants as it provides a number of important information like it helps in understanding of points in the value chain and connection between distinct points. By conducting value chain analysis, management accountant could identify elements that build or hinder cost efficiency in the business activities (Brouard et al. 2017, p. 235(1)). In addition to this, in the present environment, there is significant competition in the industries in the context of unbeatable prices, unique goods, and consumer loyalty; therefore it is essential for the management accountant to evaluate the value they build by which competitive advantages can be obtained. In this aspect, value chain analysis provide support to management accountant to discern areas of its organization that are unproductive, and consequently implement strategies and planning that would leads towards optimization of its process for maximum profitability and efficiency as well. The same aspect can be observed in the Nestle Cocoa Plan, in which company has implemented value chain analysis for identification of the areas of significant opportunity for joint value optimization with community, which helps the company to obtain competitive benefits (Value chain analysis, 2013).

On the basis of this, it can be said that, value chain analysis provides significant information to the management accountant and it is highly relevant as it supports in enhancement in business efficiency by which companies could offer the maximum value for the probable cost.

Answer c)

i) Role of management accountant of BHP Group for creation of value for the company to help managers make strategic decision

Management accountants involved in taking management decision, arrangement of plans to performance management system, and offering expertise in financial controlling and reporting for creation and implementation of the organizational strategies. Notably, management accountants observe at a number of aspects that occur within and in relation to business at the time of taking into account the requirements of business (Egan, and Tweedie, 2018, p. 1750(2)). After the completion of data and estimation surface, such estimates and data bring by cost accountant into knowledge that ultimately applied as guidelines of the decision making. In addition to this, in the managerial accounting, collected information is used by the management accountants to obtain better understanding of information prior any decisions are implemented within organization. Subsequent to the formulation of strategies and planning, the main task of management accountant is to confirm that all plans are implemented as per pre-determined strategies and in case of any requirement, such plans should be modified. It is regarded as one of the most critical task of management. It can be said that, managerial accountant engaged in offering essential information to the entities by the manner of offering decision assessment for the near term, application of appropriate combination of product, ascertainment of make or buy decision, termination of products, and many more (Christoph, and Rouven, 2020, p. 322(2)). For example, management accountant could provide support in that five forces analysis model should be related to the strategies of company and does not get out of the track. They could audit the accessibility and use of data within the risk management activities of the company. They could also approve that; there should be involvement of resources of risk mitigation. Furthermore, management accountant by the provision of financial analysis helps in strategies decision making (Mack, and Goretzki, 2017, p. 325(2)). For example, management accountant help is strategies risk management process for identification, assessment, and management of risk and uncertainties that can inhibit the ability of company to reach its strategic objectives. By considering the enhanced expectations of shareholders of BHP, regulators, and other stakeholders, strategic risk management could prove to be one of the essential aspect for creation and protection of value. By all such aspects, it can be said that, management accountant can create value by providing support in strategic decision in effective manner.

ii) Role of management accountant of BHP Group for creation of value for the company to help managers make operational decision

Operational decisions are those which are made for short term process in order to accomplish the task of strategic decisions or long term process. Management accountant of the company helps in directing and controlling the process which results in the transformation of final product. There are various decisions under this operational activity such as decision regarding to the inventory, sales management, employment management, customer engagement and logistic decisions. These all decisions are narrow in nature as they are made weekly or daily basis in order to accomplish the task planned under strategic management process (Dada, 2018). Management accountants are usually engaged in relevant cost analysis for ascertainment of the existing expenses as well as provide advice for the future activities. For example, the motive of the company is to increase its profitability by making increment in the sales, then in such case, management accountant can provide suggestion of 30% of discount in the form of barcodes, promo codes, online coupons which could be used by the customer on shops as well as while online shopping, and the customer could use these coupons several times for a specific period. From this there would be an increase demand the product on sale for that certain period of time, so the purpose of increasing sale for short term period could be fulfilled. Along with this, management accountants use operational information to build sense of the situations rapidly (Pasch, 2019, p. 214(2)). For example, they could apply budgetary techniques to take short term operational decisions. The role of management accountant in this is to evaluate earlier activities and avail opportunities for the further activities.

Overall, it can be said that, data precision as well as accuracy plays significant role in the success of companies. Without any informative data, it becomes very typical to analyse the present state of affairs or planning for future business. In such type of situation, role of management accountant is vital as it helps in taking operational decisions, which is intended to increment in the operational efficiency of company.

Part B

Answer a)

Activity-based-costing method could be used to determine or examine various aspects of the organizational activities such as it explain the profit margins clearly of those activity whose profitability cannot be easily determined, to examine the costing system of unrealistically levels of pricing, low prices offerings from the suppliers etc.

Benefits of the successful implementations of ABC costing method to the entities from those that have not succeeded in its implementation are:

Improvement in performance: ABC method helps for improvement in the productivity, efficiency and the overall performance of the organization by providing them accurate cost information. It helps the firm to eliminate the unnecessary cost from the production and also helps in the implementation of various performance improvement techniques which are to be applied by the organization such as TQM (total quality management), Business process reengineering (BPR), lean methodology. ABC method provide management with the expenditures of each activity and helps to compare it with their value addition, the activity which exceeds its expenditure firm its value that must be eliminated immediately by the firms to reduce their unnecessary cost and increase their efficiency by focusing on the activity which are more profitable instead of the activities whose value addition is less than its expenditure. Other costing methods only believes in following the accounting rules and regulation based on traditional practices, they do not help in the reduction of the unnecessary cost but only ABC methods helps the firm to reduce its cost or eliminate the unnecessary one (Balstad, and Berg, 2020, p. 378(1)).

Downsizing and cost management: ABC method clearly define each and every activity which further helps in making a right decision that which activity is to be eliminated or on which activity one must focus the most or it can be said that it helps management to identify the most profitable and least profitable activity of the firm. If the company is not satisfied with its financial position it must follow this method to clearly identify the weakness and the available opportunities where it could reduce the cost of activity and improve the overall financial position of the firm in the market (Lepistö, and Eeva 2018, p. 108(3)). At last it can be said that, this method provides useful information about the cost of every activity and helps in making a right decision or can say a productive decision. However the traditional costing method or other costing methods focuses more on the volume information that is volume of production instead of identifying the highly productive activity based on its cost which must be focused more (Adams, and Larrinaga, 2019, p. 2385(1)).

Clear allocation of various costs: ABC method helps an organisation with the identification of various cost other than manufacturing cost, as now the non- manufacturing cost cannot be neglected anymore they too play a crucial role in the determination of pricing process of a product such as advertisement cost, marketing cost etc. These costs could be quickly identified by this method, which means through this method management can clearly classify the various costs incurred by the company while performing the activity and through that they can easily determine the cost of final product or service (Tarzibashi, and Ozyapici, 2019, p. 85(1)). But the other costing methods which are volume based does not helps to identify these costs and also could not be applied on the firm which is non-volume based, whereas the ABC method could be applied in any type of the organisation.

Pricing of the product and services: It provides relevant information of the cost of the product furthermore identifies and helps in implementation of effective pricing policy. Additionally, it also helps the organisation to achieve its desired profit goals stated at the planning level by setting an appropriate pricing for the product and services (Jansen, 2018, p. 1505(3)). While the other methods like traditional costing methods does not provide such information in their analyse process they only identifies the cost for the volume of production and rest of the key pointers are ignored which in turn causes difficulty for the firm to identify where they are losing their profit or where they could achieve some more.

Make or buy decision: This is the decision under which the company has to decide whether it will conduct the activity itself or hired some other agency which is subcontractors to perform the activity. The decision of giving the activity to subcontractor depends on the cost incurred; if the cost incurred by the firm is more than that of subcontractor then the company should get the activity done by them and vice versa. But under other costing methods, they do not allow to the company to let the activity done by some outsiders, it performs all of its activity on their own, even if the cost incurred by them is high, which results in the high cost generation by the firm (Jeong, 2016, p. 1638(1)).

Transfer pricing: There are various departments in an organisation so when the activity of department A is completed it transfers it to the department B. As ABC method provide is with the information of the cost incurred by every activity in the organisation, so this helps us to determine the performance of both the departments by providing relevant information of the cost of each activity performed by them individually and collectively (Christoph, and Rouven, 2020, p. 328(1)). While the other costing methods does not provide the deep analysis of each department rather it focuses on the overall cost incurred by the firm to produce the product or service at the end of the process when the finished goods are ready.

Distribution channel: ABC costing is a significant competitive advantage of even analyzing the most appropriate and profitable distribution channel for company which is to be selected. The ABC costing methods determines the cost incurred by each distributing channel, and the performance of these alternative channels. Through this the firm could easily analyse its most profitable channel which incurred the less cost and perform better in the market. While the other methods do not provide you these analyses for the distribution channels (Patten, and Shin, 2019, p. 28(2)).

NESTLE is real life example for the above literature which implemented the ABC costing method. Nestle deals with two types of product that are custom products and standard product. It more focuses on the production of standard product as compare to the custom product. ABC helps nestle to assign its overhead activity cost of the firm to the product it produces or delivers (Smyth, 2019). According to nestle the ABC method is much better than the traditional costing method as it focus more on the relation between the product and its cost and overhead activities. Another example is COCA COLA which uses the ABC method. Coca- Cola deals in various product lines and involves the usage of huge amount of inventory. In order to keep a check on its each and every operation and to determine its speciality or it can be said that the most profitable sector, the company decided to use this method of costing (Real life example for ABC method 2019).

Answer b)

Activity based costing method helps an organisation to reduce its cost, combine various production activities to reduce the time and helps in better decision making process. It is not only used for the purpose of profit maximization or reduce cost, but also for managing proper time and completion of the activity in less time by combining various production activities together.

ABC method is a useful tool for the planning and decision making process as:

1. It is used for making strategic decisions of an organization, by identifying the financial and non – financial activities or which activities are to be reduced in order to reduce the cost of production, which activities are to be combined in order to reduce the time of production of products and services.

2. ABC technique provides us with the accurate information of the expenses and the cost incurred by each and every activity which in turn helps to identify and prioritise the activities which are more beneficial for the company. It also helps management to focus on that activity or product or customer which is more profitable for entity.

CONCLUSION

Above analysis reflects that, although, management accountants are value creator of companies as they help in better decision making and increment in profitability, but there are also some loopholes in their workings such as they are dependent on data of financial and cost accountants and does not comply with any particular rules and guidelines. Activity- based- costing method is an efficient tool for the planning and decision making process of an organisation, as it helps in the planning process by evaluating all the information and analyzing them, at last making a successful decision that what has to be reduced or focused on more.

REFERENCES

Adams, C.A. & Larrinaga, C. (2019), “Progress: engaging with organisations in pursuit of improved sustainability accounting and performance", Accounting, Auditing & Accountability Journal, vol. 32, no. 8, pp. 2367-2394. https://www.proquest.com/docview/2315478099/908B8567623F41B9PQ/1?accountid=30552

Balstad, M.T. & Berg, T. (2020), "A long-term bibliometric analysis of journals influencing management accounting and control research", Journal of Management Control, vol. 30, no. 4, pp. 357-380. https://www.proquest.com/docview/2263761947/C168419DCEDF424EPQ/1?accountid=30552

Brouard, F., Bujaki, M., Durocher, S. & Neilson, L.C. (2017), Professional Accountants' Identity Formation: An Integrative Framework: JBE, Journal of Business Ethics, 142 (2), pp. 225-238. https://www.proquest.com/docview/1899808925/5CF20FBC61D94D44PQ/1?accountid=30552

Christoph, E. & Rouven, T. (2020), "Ethical Implications of Management Accounting and Control: A Systematic Review of the Contributions from the JBE", Journal of Business Ethics, vol. 163, no. 2, pp. 309-328. https://www.proquest.com/docview/2117644502/D80857DDB37C4525PQ/1?accountid=30552

Christoph, E. & Rouven, T. (2020), Ethical Implications of Management Accounting and Control: A Systematic Review of the Contributions, Journal of Business Ethics, 163(2), pp. 309-328. https://www.proquest.com/docview/2117644502/6B619CE79CA54BF6PQ/1?accountid=30552

Dada, G. (2018), Example for operational decision .Available through <https://www.quora.com/What-are-the-examples-of-strategic-operational-and-tactical-decisions> [Accessed on 30th August 2021].

Egan, M. & Tweedie, D. (2018), A “green” accountant is difficult to find: Can accountants contribute to sustainability management initiatives? Accounting, Auditing & Accountability Journal, 31 (6), https://www.proquest.com/docview/2101855822/308768B629D4B80PQ/1?accountid=30552

Ibrahim, S.M., El Sibai, I., M. & El Din, B.B. (2021), "Contextualizing cost system design: A literature review", Accounting and Management Information Systems, vol. 20, no. 1, pp. 28-55. https://www.proquest.com/docview/2547620467/7CAA746D24E1405APQ/1?accountid=30552

Jansen, E.P. (2018), "Bridging the gap between theory and practice in management accounting: Reviewing the literature to shape interventions", Accounting, Auditing & Accountability Journal, vol. 31, no. 5, pp. 1486-1509. https://www.proquest.com/docview/2056772482/7E74FC39D91248C7PQ/1?accountid=30552

Jeong, K. (2016), "The Reaction of Analysts to Management Disclosures and Firm Characteristics: Conservatism and Corporate Governance", Journal of Applied Business Research, vol. 32, no. 6, pp. 1629-1648 https://www.proquest.com/docview/1923981409/AB070520A72A4B45PQ/1?accountid=30552

Lepistö, L. & Eeva-M. (2018), Understanding the recruitment and selection processes of management accountants: An explorative study, Qualitative Research in Accounting and Management, 15 (1), pp. 104-123. https://www.proquest.com/docview/2042229348/45D19D3C42AC4342PQ/1?accountid=30552

Mack, S. & Goretzki, L. (2017), How management accountants exert influence on managers - a micro-level analysis of management accountants' influence tactics in budgetary control meetings, Qualitative Research in Accounting and Management, 14 (3), pp. 328-362. https://www.proquest.com/docview/1929000888/404C42DD978459CPQ/1?accountid=30552

Mahdavikhou, M. (2018), "Exploring Accounting Research in "Emerald's Accounting Journals" Using Content Analysis Approach", Journal of Accounting, Finance and Auditing Studies, vol. 4, no. 4, pp. 243-259. https://www.proquest.com/docview/2118758626/79B6FD882FB345FAPQ/1?accountid=30552

Omar Fikrat, F.T. & Ozyapici, H. (2019), The Impact of the Magnitude of Overhead Costs on the Difference Between ABC and TDABC Systems, Foundations of Management, 11(1), pp. 81-92. https://www.proquest.com/docview/2230172954/8FDD91FF3B484AD1PQ/1?accountid=30552

Pasch, T. (2019), Strategy and innovation: the mediating role of management accountants and management accounting systems’ use, Journal of Management Control, 30 (2), pp. 213-246. https://www.proquest.com/docview/2258055552/36A47A23A6E146D3PQ/1?accountid=30552

Patten, D.M. & Shin, H. (2019), Sustainability Accounting, Management and Policy Journal’s contributions to corporate social responsibility disclosure research: A review and assessment, Sustainability Accounting, Management and Policy Journal,10 (1), pp. 26-40. https://www.proquest.com/docview/2188872963/D4A9A9B49F46446APQ/1?accountid=30552

Real life example for ABC method (2019), Available through <https://embapro.com/frontpage/abccostingco/20280-nestle> [Accessed on 30th August 2021].

Smyth, D. (2019), Real life Example for ABC method. Available through<https://bizfluent.com/info-12105073-types-businesses-activitybased-costing.html> [Accessed on 30th August 2021].

Tarzibashi, O. F. F., and Ozyapici, H. (2019), The Impact of the Magnitude of Overhead Costs on the Difference Between ABC and TDABC Systems. Foundations of Management, 11(1), pp. 81–92. https://www.proquest.com/docview/2230172954/288E15F621D143B5PQ/1?accountid=30552

Value chain analysis, (2013), (Online). Available through <https://www.cgma.org/resources/tools/essential-tools/value-chain-analysis.html>[Accessed on 30th August 2021]

ACCT6003 Financial Accounting Processes Assignment Sample

Learning Outcomes

Apply accounting principles and standards when accounting for non-current assets, revenue and liabilities and recognize the judgements required in a range of diverse business contexts.

Differentiate between shares and debentures and apply appropriate accounting procedures.

Submission - By 11:55pm AEST/AEDT Sunday of week 8

Weighting - 25%

Total Marks - 100 marks

Learning Outcomes

Context:

This assessment will cover the learning objectives from the topics covered in weeks 3, 4, 5 and 6 and applying them to real cases. These include accounting for shares and debentures and accounting for non-current assets, including impairment and asset revaluation.

Part A: This assessment is designed to demonstrate your understanding of the accounting process to account for the above topics.

Please use the supplied templates for assignment help to design your answer in the correct General Journal format and combine all answers into one assessment document covering all tasks. Please follow the submission instructions on Blackboard. Submit the assessment file in a word or PDF format including cover sheet. JPEG files cannot be opened and will not be marked.

Instructions:

Part A:

• Using the templates provided. Design your own General Journal templates.

• Type your answers into the General journal, remembering to leave a blank line after each entry and include a narration and date for every entry.

• Where required, please provide clear workings of your calculations in your answers.

• Do not rewrite the question in your assignment.

Round all amounts to the nearest dollar.

Part A: Written report (40 marks)

Question 1: Impairment of assets (9 Marks)

Flights Ltd has determined that its aviation division is a cash–generating unit (CGU). Information as at 30th June 2020 is as follows:

Additional information:

• Buildings - Accumulated depreciation as at 30 June 2020: $100,000

• Equipment - Accumulated depreciation as at 30 June 2020: $200,000

• Flights Ltd calculated the value in use for the division to be $600,000

Required:

a) Calculate the impairment loss as at 30 June 2020: (2 Marks)

b) Prepare a table as provided below to allocate the above impairment loss: (2 Marks)

c) Prepare a general journal (as per template below) to record the above impairment loss for the year ended 30 June 2020. Include a narration. (5 Marks)

General Journal template:

Question 2: Revaluation of Non-current assets (13 Marks)

The Balance sheet for Saturn Ltd disclosed the following information:

Saturn Ltd

Balance Sheet (extract) 30th June 2019

Additional information:

• The company has adopted fair value for the valuation of non-current assets. This has resulted in the recognition in previous periods of an asset revaluation surplus/reserve for the plant of $120,000.

• The plant has a useful life of 10 years and a zero-residual value.

• On 31st December 2019, it was decided to revalue this amount to its fair value of $400,000.

Required:

a) Record the journal entries (as per template below) as at 31 December 2019, relating to the revaluation of this plant. Include narrations. (7 Marks)

b) Record the closing journal entries (as per the template below) for any gain or loss on revaluation only, as at 30th June 2020. Include narrations. (6 Marks)

Ignore any tax effects.

General Journal template:

.png)

Question 3: Share issue (18 Marks)

Cobra Ltd was incorporated on 1 July 2019 and issued a prospectus inviting applications for 100,000 ordinary shares at an issue price of $10.

The shares are payable as follows:

• $5 payable on application

• $2 payable on allotment

• $3 payable on call to be made 30th September 2019

• Share issue costs were $1,500 and legal costs were $500

The transactions for the period were as follows:

Additional information:

The company’s constitution states that any forfeited shares must be refunded to the shareholders.

Required:

Prepare the general journal entries (as per template below) in the books of Cobra Ltd to record the above transactions. Provide narrations for all your entries.

General Journal template:

.png)

Solution

Question 1:

Part A:

The Impairment loss of the cash generating unit is amounting to be $900000 (Hassine and Jilani, 2017)

Part b:

As per the procedure of impairment loss allocation the losses are to be adjusted with each asset based on its proportionate share on the carrying value.

Part c:

Question 2:

Part a:

Workings:

Part b:

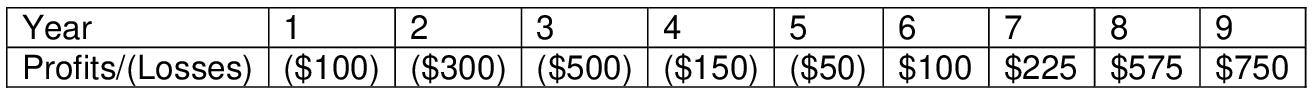

Question 3: Journal Entries

The Journal Entries in the books of Cobra is as follows

Journal entries

Reference:

Hassine, N.M. and Jilani, F., 2017. Earnings management behavior with respect to goodwill impairment losses under IAS 36: The French Case. International Journal of Academic Research in Accounting, Finance and Management Sciences, 7(2), pp.177-196.

ACC2CRE Financial Accounting and Reporting Assignment Sample

1. This assignment is compulsory and is worth 20% of the marks of the subject. There are two questions in the assignment worth 40 marks and students acquired marks will be converted into 20%.

2. The assignment must be submitted via Turnitin.

3. Students must provide their names and ID numbers in cover page of the assignment.

4. You must keep a copy of your assignment until you receive the marked original back.

5. The assignment must be in MS word format, double-spacing and 12-pt Times New Roman font.

6. Submissions must be properly referenced and students are required to use either an APA or Harvard referencing style

7. Word limit: 700 words excluding references. The total word number for Question 1 is 200. The number of words can be 10% more or less without penalty.

8. Plagiarism is a serious academic misconduct. Students involved in plagiarism will be referred to the University’s appropriate authority.

Questions for Assignment Help

Question 1

A newly appointed accountant, Mr Max of Bulla Ltd told to his team members that financial

statements will be more comparable when our entity will use AASB/IFRS standards to

prepare a set of financial statements consistent with other reporting entities.

Required:

(a) Do you agree with this statement or otherwise? Explain the above statement with four examples (Hint: AASB 116 requires that PPE must be valued at historical cost or fair value).

(b) If Bulla Ltd changes its accounting policies in the current year explain whether such changes need to be disclosed in the financial statement. If so, how?

Question 2

On 1 July 2020, Rina Ltd acquired all the share capital of Tina Ltd for $944,000. At that date, Tina Ltd’s equity consisted of: Share capital $300,000, General Reserve $192,000 and Retained earnings $112,000.

At 1 July 2020, all the identifiable assets and liabilities of Tina Ltd were recorded at fair value. Both companies employ the perpetual inventory system.

Financial information for Rina and Tina Ltd for the year ended 30 June 2021 is presented below:

Additional information:

(a) On 1 January 2021, Tina Ltd sold inventory costing $60,000 to Rina Ltd for $100,000. Half of this inventory was still on hand with Rina Ltd at 30 June 2021.

(b) On 31 March 2021, Rina Ltd sold equipment to Tina Ltd for $12,000 which was $2,000 below its carrying amount to Rina Ltd at that date. Tina Ltd charged deprecation at the rate of 10% p.a. on this time.

(c) In the 2021 period, Rina Ltd sold a block of land to Tina Ltd at $40,000 above cost. The land is still held by Tina Ltd.

(d) There was a profit in the beginning inventory of Rina Ltd of $12,000 on goods acquired from Tina Ltd in the previous period.

(e) The tax is 30 per cent.

Required:

(a) Calculate goodwill on the date of acquisition;

(b) Prepare journal entries for consolidation worksheet;

(c) Using excel spreadsheet prepare consolidation worksheet for Rina Ltd for the year ended 30 June 2021.

(d) Using excel spreadsheet prepare consolidated financial statements for the year ended 30 June 2021.

Solution

Answer to question 1

(a) Agreement with the statement

The above statement suggested by the newly appointed accountant regarding the applicability of financial standards such as IFRS and AASB holds true. The primary purpose of the accounting standard is to provide common accounting policies and regulations to be managed and followed by the organisation to prepare the financial statements. The management is only responsible for selecting accounting policy; however, it should be Limited with the appropriate accounting standards (Commenced, 2018). For a better understanding of the applicability of various accounting standards, the following examples can be considered:

(b) Disclosure of the changes

As per AASB 8, the accounting policies and the principles can only be changed by the management if there are reliable indications that it will improve the overall financial reporting of the organization, change in statute, or change in relevant accounting standards. According to paragraph 5 of AASB 8, the company will be required to present the current accounting policies followed by the management and any changes in the accounting policies made in the current financial year. According to pa para 5 of the said accounting standard, retrospective change because of the change in accounting policy will also be included, and it will be required to present in detail (Aasb.gov.au. 2022).

Answer to Question 2:

(a) Goodwill

(b) Consolidation of journal Entries

(c) Consolidation worksheet

.png)

(d) Consolidated financial statement

Reference:

Aasb.gov.au. 2022. [online] Available at: <https://aasb.gov.au/pronouncements/accounting-standards/> [Accessed 27 April 2022]. https://aasb.gov.au/pronouncements/accounting-standards

Aasb.gov.au. 2022. [online] Available at: <https://www.aasb.gov.au/admin/file/content105/c9/AASB108_08-15.pdf> [Accessed 27 April 2022]. https://www.aasb.gov.au/admin/file/content105/c9/AASB108_08-15.pdf

Commenced, D., 2018. 2.5 STATEMENT OF SIGNIFICANT ACCOUNTING POLICIES. Policy. https://www.coomalie.nt.gov.au/images/Documents/All/2.5%20Statement%20of%20Significant%20Accounting%20Policies%202017.pdf

ACCT1081 Ethics and Accountability Assignment Sample

Requirements:

This is worth 10% of your marks and should not exceed 1000 words excluding appendices. You are required to work in groups of two students to search existing databases of: newspapers, periodicals, YouTube, academic articles, etc. to find a current business event that involves either ethical or unethical practice and behaviour. The business event should have occurred within the last two years.

NOTE WELL: Your choice of ethical issue has to be approved by your lecturer/instructor as we wish to avoid the same issue being presented more than once in the seminar.

You are then required to discuss the following issues:

1. What are the relevant facts of the case?

2. Who are the primary stakeholders, and why are they considered such?

3. What are the ethical issues? (This includes identifying the ethical issues associated with each of the relevant facts and ranking these or commenting on the severity of each. You should include the different perspectives of: utilitarianism, deontological ethics, and justice and fairness.

Solution

Introduction:

The emergence of coronavirus disease (COVID-19) and its subsequent pandemic spread has resulted in a global public health crisis with devastating health, social and economic consequences. The initial response of the different states was to impose restrictive measures and social barriers, such as the use of face masks or social distancing or mobility restrictions. In this context of pandemic chaos and after the rapid and celebrated development of several effective vaccines against COVID-19

Relevant Facts

There is no doubt that the prevention of infectious diseases through vaccination has been one of the most important advances in public health. However, it seems that scepticism towards such vaccines Thus, reluctance to the vaccine, defined as refusal, delay or acceptance with doubts about the usefulness and safety of the vaccine, can affect a significant number of the population, which may be reluctant to vaccinate for COVID- 19, despite the clear public perception of the high health risks associated with the pandemic. In such a situation, different medico-legal and ethical debates emerge, In the reluctance to COVID-19 vaccination in health professionals, we would find different values and principles in conflict. On the one hand, as mentioned above, a group of values and principles related to the protection of health, both collective and individual, are identified.

Primary Stakeholders

Given the realities of ordering coronavirus vaccinations in the working environment of stakeholders and employees, businesses must provide a stable environment to receive vaccinations, providing reassurance and support. This assignment writing for assignment help is necessary because the work environment must provide stakeholders with a credible, open and educational conversation about vaccine use. Web and other strong administrative portals to support delegates with booking arrangements and other motivational schemes. The convenience of adaptability to go to delegates and get antibody certification is important for all our critical partners to help prevent the spread of coronavirus from person to person. The report proposed by Berlinger et al. (2020), is if a state or county's overall prosperity requirements require employees to be vaccinated, the course for delegates to be vaccinated against Covid is one of the obligations companies have under occupational safety guidelines. It is a truly actionable step to consider as a department. Anyway, in conditions where there is no sensible government need to order vaccination, various organizations are logically engaging to change their work prosperity and security responsibilities against their assurance, and various responsibilities toward staff.

Fundamentally, administrators ought to continue to have regard for truth be told practicable advances they can take to deliver their responsibilities under work prosperity and security guidelines and whether that consolidates necessary vaccination will depend upon the states of every business. General prosperity should attempt to execute the most un-restrictive intercession at whatever point what is going on permits, yet inoculation orders are the most restrictive, nosy sort of counteracting agent technique (Sinclair et al. 2021). Moral conversation on vaccination orders dependably suggests that except for assuming any leftover reasonable means have failed (or are most likely going to forget) to augment immune response take-up as well as lessening disorder transmission by various means to an all-right level, orders should not be done. This anticipates that foundations should consider whether they have sought after each possible intervention and sponsorship instruments for preventing sickness even without a vaccination mediation.

Utilitarianism Approach to COVID-19 Vaccination

Utilitarianism is the laws are chosen because they bring about the best consequences. If the utilitarian course of action is not adopted, someone (often many) people will suffer or die avoidably. There may be good reasons to sacrifice well-being or lives. But such choices need to be made transparently and in full awareness of their ethical cost. Therefore, the requirement to get the jab wasn’t only in the best interest for individual but also for the countries and states Australia wide. Therefore, people of power saw this as way to adopt this to ensure that well-being of our lives was completed for good reasons to ensure the jab was mandatory. This was a major issue worldwide country wide and state-wide with the severity of this high.

Deontological Approach to COVID-19 Vaccination

Vaccine reluctance in health professionals must also be addressed from a deontological perspective. However, at present, it is important to note that studies show high efficacy figures for different types of vaccines in preventing infection in the vaccinated person, but it is not yet known whether COVID-19 vaccination prevents transmission. That is, at present, we know that a vaccinated person is more protected from the disease, but it is unknown whether a vaccinated person can transmit the disease. Therefore, at present, it is not yet established that vaccination prevents a direct risk of transmission to patients.

From a deontological point of view, a health professional's decision not to vaccinate would affect his or her own health, herd immunity and exemplarity, and is therefore highly recommended, but it is not clear that it would cause direct harm to the patient.

On the other hand, it is a deontological responsibility of the doctor, in relation to vaccination, to generate confidence in it, using evidence-based knowledge when available, avoiding the dissemination and promotion of misinformation.

This was a major issue worldwide country wide and state-wide with the severity of this high.

Justice & Fairness Approach To COVID-19 Vaccination

The COVID-19 pandemic has resulted in lockdowns, the restriction of liberties, debate about the right to refuse medical treatment and many other changes to the everyday behaviour of persons. The justice issues it raises are diverse, profound and will demand our attention for some time. The need to make the vaccine mandatory was one of the major talking points, as many saw this as a major factor of their rights as a individual being non-existent. People didn’t see this fair to them as some were not certain on getting the vaccine due to the untested vaccines and their right not to get vaccinated due to this issue. The COVID-19 pandemic is pushing ethical deliberation in new directions and many of them turn on approaching medical ethics with a greater emphasis on justice and related ethical concepts.

This was a major issue worldwide country wide and state-wide with the severity of this high.

References

.png)

BUACC5930 Accounting and Finance Assignment Sample

All questions must be completed.

Question 1.

Woolworths Group Limited, a major Australian company, has extensive retail interests throughout Australia and New Zealand. It is the largest company in Australia by revenue and the second-largest in New Zealand.

The most recent financial report for the Company are found at the following site:

https://www.woolworthsgroup.com.au/page/investors/our- performance/Financial_Results

Here you will find the latest annual report (to 30 June 2021) and quarter and half yearly reports.

a. Using the 2021 annual report only, compare the financial results for assignment help of the Company between 2020 and 2021. You should use any financial information provided in the 2021 report (including ratios, and narratives) to conclude on the improvements or not in financial position and profitability. Your discussion should focus on reasons for this, and should include any impact due to the COVID- 19 pandemic.

b. Using the other financial information provided (quarter and half yearly reports for FY2022), comment on any financial changes between the annual report (ended 30 June 2021) and the FY2022 reports.

c. What other information would you need to assess the financial performance and financial position of Woolworths Group Limited?

Question 2.

The 2021 Sustainability Report for the Woolworths Group Limited is available at

https://www.woolworthsgroup.com.au/page/community-and-responsibility/group- responsibility/

This report outlines Woolworths approach to People, Planet and the Product.

Summarise the goals of the Woolworths Group Limited in relation to People, Planet and the Product.

What is your opinion of the measures that Woolworths has to achieve these goals?

Question 3: Cash Flows Question

.png)

Melbourne Ltd Income Statement for the year ended 30 June 2021

.png)

Solution

Solution 1

Financial performance analysis of Woolworths

Woolworth Group limited has been incorporated in 1924. It has its headquarter in Bella Vista Australia. It is operating in the grocery stores industry and belong to consumer defense sector. It operates as a retail store through Australia food, new Zealand food, and BIG W.

.png)

From the above, it can be observed that the Net profit of the business has been higher by 43% in 2021 which has increased the NP ratio in the current year. Gross profit has been lower by 13% while sales have also been reduced in the same context which lead to maintaining the GP ratio same in the current year. Operating profit has also been higher by 105% which has increased the ROCE of the company. Such Operating profit has also been the reason for such higher trend in the ROC ratio. Overall profitability performance of the entity has been higher and improved in the current year (Ginting, 2021).

.png)

From the above Current assets ratio of entity has been higher due to the increasing trend in the current assets by 48% while CL has just improved by 42%. QA have higher by 42%. The liquidity position of the company is strong (Rao, 2021).

.png)

Gearing ratio help to understand the capital risk and capital utilization by the company. In the above case, the company has a higher debt capital risk for the company due to a higher trend in the debt capital by 30% in the current year. It also increases the financial cost for the business. It is the reason for the higher debt-equity ratio for the business. Debt to assets has also been higher because assets have just increased by 2% while debt capital is higher by 30%. It shows that the entity has not used the debt capital for the investment of the assets in an optimum way (Nugroho, & Halik, 2021).

COVID -19 Impact on the company

Due to COVID -19 company has faced a reduction in the sale because the government has imposed the lockdown policy. It has to lead to an increase in the reduction in the net profit in 2020. Consumers were not allowed to visit the stores and due to this company was facing a reduction in sales. The cost of the business operation has been increasing as employees were not working efficiently. To improve from such a situation company has decided to provide the home delivery of the product and generate the sales through the online portal. It has given a hike in the sales of the company. The company also allows the work from home to the employees so that efficiency can be increased and the cost of operation can be reduced for the business. The liquidity position has also been compromised due to COVID but the company has managed it in 2021 (Fridson, & Alvarez, 2022).

Therefore after observation of ratio compliance it can be seen that Woolworth company has done well as compared to the previous year and successfully generated the higher profitability in the current year. It has generated value for its shareholders.

Comparing the financial data for 2022 with 2021

Woolworths Group Limited's financial performance and changes in the past years as compared to the current half-yearly statements are assessed and discussed. The company has generated revenue in the half-year 2022 of 31,894,000 US dollars and in 2021 full year the company was able to generate total revenue of 55,694,000 US dollars which means that the company has been performing better than in the past year. Expenses of the company have also been less in this quarter as compared to the year 2021 (Pizzi,& Venturelli, 2022). This means that the company can generate more sales and revenue by reducing its overheads. Earnings per share of the company have increased a lot from the previous year of the company for this quarter. It has jumped from 1.65 to 6.31 and this means that the shareholders of the company are generating returns on their investments.

The net profit ratio of the company in 2021 was 3.72% which has increased to almost 12% in the half-year ended 2022. This shows that the company is performing very well and is increasing its revenues and ultimately the ratios. However gross profit of the company has decreased this year from the year 2021 of 29.32%. The company needs to focus on improving its gross profit and generating higher margins. The current assets of the company have also improved and the company has a good liquidity position this year which shows that the company is easily able to pay off its short-term debts. However, the company has improved its sales and has shown good performance in terms of the profits in the half-year ended. This means that the company is regularly taking measures to improve its performance and implement it effectively and efficiently.

Other factors to assess financial performance

To assess the financial performance of a company only evaluating the balance sheet and related financial information would not give a complete analysis of the company's financial performance. Many non-financial factors affect the business of the company and these are also necessary to be looked at for assessing the complete financial performance of the company. These non-financial metrics are qualitative and it is difficult to express them in financial terms (ABDELRAHEEM, & HUSSIEN,2022).

Woolworths Limited should carry out a PESTEL analysis that will look at the macroeconomic factors of the company. It consists of assessing different factors naming Political, Economic, Social, Technological, Environmental, and Legal matters. This analysis will give insight into some non-financial factors that affect the company. Another method that the company can opt for is the SWOT analysis. In this analysis, the company focuses on analyzing its Strengths, Weaknesses, Opportunities, and Threats. These are all non-financial factors that the company has to assess for monitoring its performance. This helps the company in taking advantage of the available opportunities by focusing on its strengths and assessing its weaknesses by minimizing the threats that can occur. Both of these analyses are a great way of assessing the performance of the company other than using the company's financial information. This gives a different perspective to the business by looking at other non-financial segments.

The company can also consider applying the balanced scorecard for the business. This model takes into consideration both financial and non-financial indicators of the business. It considers the company's financial perspective, Learning perspective, Customer Perspective, and Internal business perspective. It also helps in gathering the data for the company's business related to the qualitative information by assessing customer and learning and innovation perspective.

Hence all these methods will provide some information for Woolworths Limited to assess the company's financial performance and financial position.

Solution 2

Sustainability Retorting

How is Woolworths Group Limited achieving its aims in the Sustainability Report?

Woolworths is the largest business organization in Australia with many operations throughout Australia and New Zealand. It is one of the second largest businesses in New Zealand with the highest income (Adams, 2019). This business organization brings new resources for sustainability. The main target of this business is people, the planet, and their prosperity or product to cover all the engagement related to the suppliers, clients, team members, and societies as well as a corporate social responsibility that directly impacts its operations. The main aim is to achieve a sustainability report of the Woolworths group limited business organization as well as deliver the best convenience, value, and quality to their customers. This firm maintains its employees with over 2 lakh team members who serve 29 billion clients across the entire world.

Woolworth’s group limited mainly focuses on sustainable clothing businesses across the entire supply chain, raw materials, and resources to make a new product and disposal of end goods or services. The sustainability framework is to focus on farming practices in the various supply chains through programs and the main aim is to reduce imports such as fertilizer, pesticides, water use, and biodiversity. It can also promote sustainability to reduce the amount of waste recycling, recyclable and materials where they can.

Woolworths business organization achieves its aim in this sustainability report through people because this business organization maintains its core values, and purpose in partnership with 10,000 team members to create a better experience for teams and customers. It is also helpful to promote gender equality only to create a culture and workplace which provides for all the team members. Some benefits, opportunities, and resources are should be identified or regularly reviewed in our systems (Nishant, Kennedy, and Corbett, 2020). This business organization is helpful for the people because the firm can provide parental leave, policies, superannuation payments, flexibility policy, family violence support policy, and impress their diversity. It can make better efforts to reflect their society, and maintain diversity as well as an inclusive workforce.