ACCT6006 Auditing Theory and Practice Assignment Sample

Question

Task Summary

Students are required to work in the group with maximum of three members. The assessment is designed to assess the subject learning outcomes above including students’ ability to research audit related issues and apply their knowledge to real cases. Students are expected to develop a professional report addressing tasks within following areas: i. Inherent risk identification. ii. Audit procedures in response to inherent risks identified. iii. Analytical review of the financial statements with the purpose of identifying areas of concern or comfort. iv. Substantive audit procedures addressing the identified risks. v. Audit report, its basis, and legal issues. The report should include an Executive summary, Introduction, Body (covering all tasks) and Conclusion.

Instructions:

Review the Financial Year 2021 audited annual reports including financial statements presented to the shareholders for the following organisations:

• Healius limited

• Telstra Ltd

Assume that your audit team is responsible for planning the audits for both companies for the most recent financial year. Discuss your strategies addressing each of the tasks below:

1. Identify at least three inherent risks that you would have to consider for each company in the audit planning phase and justify your answer. Cite the relevant ASAs/ISAs to support your answer. (10 Marks)

2. Which audit procedures and/or tasks would you have planned to carry out in response to the inherent risks identified above? Cite the relevant ASAs/ISAs to support your answer. (12 Marks)

3. Carry out an analytical review on the financial statements of these companies in the planning phase and identify areas of concern (high risk, problem areas) or comfort. Identify at least three areas for each company and justify your answer. (10 Marks)

4. Which audit procedures and/or tasks would you have planned to carry out in response to the high risks or problem areas identified above? Alternatively, in relation to which area would you have minimised your evidence gathering procedure? (10 Marks)

5. Discuss ethical and legal responsibilities/liabilities of the auditors in case they would have given an inappropriate audit opinion. Discuss safeguards available to the auditors. (6 Marks)

Effective communication, Presentation quality and peer review (6 Marks + 3 Marks + 3 Marks) The report should be expertly presented, persuasive, logical communication, coherent and consistency is expected throughout (e.g., formatting, language style, and linkages between the parts). Each group member is required to assess other members based on collaboration and contribution towards the assessment tasks. Please include the peer review commentary at the end of your assessment after the conclusion section. Peer review marks must be allocated in line with the learning rubric placed at the end of the assessment brief.

Solution

Executive summary

ASA 315 on Identifying and Assessing the risks of material misstatement defines those inherent risks as the susceptibility to a class of transactions, or misstatement that might be material whether at an individual level or when it is accumulated with other misstatements before any controls are put by the organization. This report cover the inherent risk related to Telstra and Healius Limited. It provides audit procedure and review of the financial statement of both company.

Introduction

This report provides the financial and audit related concern of the two business organization Telstra and Healius Limited. It also include the financial ratio analyses and ethical factor that can affect the company. Inherent risk analysis has also been included in this report.

Main Body

Identification of Inherent Risks in The Audit Planning Phase:

ASA 200 also states, that every company should assess the threat of inherent risks at the time of inception only i.e. at the assertion level when planning is done to determine the nature, timing, and extent of audit, as it will help to analyze the areas where additional analytical procedures are to be conducted to gather sufficient and appropriate audit evidence (Khelil, et al., 2016).

In this case, the inherent risks have been analyzed for two different businesses i.e. Telstra Ltd, and Healius Limited in the following manner:

Telstra Limited:

1. Telstra Limited is a public limited telecommunication company which provides network services to households and corporates of Australia. However, during the audit planning phase, the following inherent risks need attention. The company is controlling different types of entities. As per the nature of business, ASA 315 states that the risks of material misstatement in the company are increased because of the complex business structure of the company. Hence, the risk might be high in the form of inappropriate account balances, and the disclosure might be inadequate in financial statements.

2. Another inherent risk that the company might be facing is related party transactions. The company has several subsidiary companies as well, due to which it can be said that the company might not be disclosing correct related party transactions or the transparency is less (Cullinan, et al., 2017).

3. ASA 315 also states, that when inherent risks are assessed, it is important to assess the industry in which the company is working. And the industry in which Telstra is working is driven by technology, and the environment is competitive. In the past also, it is seen that the company is driven by competition, and there is a risk that due to increased competition, the company has been unable to meet the changing needs of customers. Hence, it can negatively impact the sales of the company and would increase the obsolete inventory as well.

Healius Limited:

1. One of the major inherent risks that are faced by the company is managing its supply chain. The company has suppliers from all over the world and is trying to reduce the risks but, as the operations of the company are complex, the risks regarding the supply chain are high.

2. The company has also risks regarding mergers and acquisitions. As the balance sheet of the company is strong, it gets involved in various acquisitions. Hence, the inherent risk is high regarding whether the company will be able to gain financial returns from the acquisitions or not. Hence, there are chances that acquisitions might not generate the revenue that the company has expected (Aigul, et al., 2021).

3. The company also operates in the international market, hence, there is a risk of foreign currency exchange, because the market is highly volatile, and the currency rates might fluctuate due to which the currency exchange risk is high, due to which inherent risk of the company is also high.

Audit procedures to be carried out:

Audit procedures are the steps that are to be carried out by the auditor to gather all the information regarding the financial statements of the company i.e. regarding the quality of financial statements to ensure that the stated financial statements are true and correct. It helps the auditors to form an opinion on the truth and fairness of the financial statements. The audit procedures are conducted to gather evidence when any kind of risk is identified. In this case, three different types of risk have been identified for the clients. It is also to be analyzed that there are seven different types of audit procedures that can be applied by the auditor, and in this case, the audit procedures to be carried out are:

Telstra Limited:

1. For account balance inherent risk, the audit assertion to be used is existence, completeness, and valuation. It is very important to ensure that the year-end balances of last year have been carried forward appropriately and there is no misstatement. It is also important to ensure that all the transactions exist, for instance, if an asset is shown on a balance sheet, the company should have the documents regarding that asset. Hence, the audit procedure to be used here is inspection and external confirmation.

2. The audit procedure for related party transactions should include testing how related party transactions are coded and traded in the enterprise resource planning system of the company. It also includes taking an interview with the personnel who is responsible for maintaining accounts of the company in the financial statements(Pankova, 2020).

3. It is important to understand the functioning of products and services sold by competitors. The auditor can use audit procedure, and inspection to analyze the degree of competition and technological advancement that the industry is facing.

Healius Limited:

1. ASA 500 states, that to collect audit evidence, regarding the supply chain the audit procedure of cross-checking the data should be used. The auditor should ensure that company is checking the performance of vendors to ensure that supply chain management is not at risk.

2. For this, the audit procedure of taking external confirmations, inspection, and interviewing can be used by the auditor, to ensure that external help or expert advice was taken by the company before finalizing the acquisition. Because it will ensure that the company is not entering into acquisitions to reduce or adjust their losses, or are not acquiring loss-making companies to reduce their profits.

3. The auditor should ensure that foreign exchange is as per the foreign exchange risk policy formulated by the company. They should also ensure the accounting of foreign exchange risk, and whether the company is creating any provision for the same or not. Here, audit assertion to be used are existence, valuation, occurrence should be checked, to ensure that all foreign exchange gains and losses during the period are reported accurately in the financial statements, and the balance sheet and profit and loss of the company include the impact of foreign exchange gain or loss.

Analytical Review of The Financial Statements:

The analytical review is a technique which is used by the auditor or accountant of the company to analyze the reasonableness of the components of financial statements, and the disclosures, omission of which might make the financial statements materially misstated. Hence, the analytical review is conducted when the auditor is aware of the environment in which the company is working. Hence, in this case, to conduct the analytical review of the financial statements of both companies, a technique known as ratio analysis has been used (O?NDER Tu?rkan. 2020).

Telstra Limited:

Ratio analysis is the technique which helps to evaluate the trend in account balances i.e. whether in the current year liquidity of the company has improved or not.

1. Current asset Ratio:

| 2021 | 2020 | |

| Current asset ratio | 0.68 | 0.65 |

Here, the current asset ratio of the company has improved in comparison to the previous year because the current assets of the company have increased. However, likewise, the current liability of the company has also increased. This makes the current asset and liabilities of the company prone to risks because the current assets of the company are not sufficient to cover its current liability. The area of concern is current liabilities.

2. Gross Profit Ratio:

| 2021 | 2020 | |

| Gross profit ratio | 60.39% | 60.00% |

In the above case, the gross profit of the company has increased slightly, and the account balances that are at risk here are the sales and cost of goods sold by the company. If the sales of the company have increased, but, the related cost of goods sold has been increased by a higher amount, then the gross profit tends to decline. In this case, the sales have declined, but, the cost of goods sold has also declined by a relatively low percentage, due to which only a small percentage increase has been seen in gross profit. The area of concern is the cost of goods sold (Amanzholova, et al., 2019).

3. Non-financial factors:

The analytical review is also important for non-financial factors as well. Here those factors are the climatic change, that the company has to face, and its impact on the financial performance of the company. The company is also taking measures to reduce the climatic impact on the performance of the company because it hinders the operations of the company.

Healius Limited:

1. Current asset ratio:

| 2021 | 2020 | |

| Current asset ratio | 0.48 | 1.36 |

From the above analysis, it can be seen, that the current assets and current liability account balance of the company are at risk. It is because the current asset ratio of the company has declined significantly in 2021 in comparison to 2020, and the current assets of the company are not sufficient to cover its current liabilities. The current assets of the company have declined by more than 300% which exposes the current asset to risk. The area of concern is current assets (Appelbaum, et al., 2018).

2. Gross Profit Ratio:

| 2021 | 2020 | |

| Gross Profit Ratio | 85.76% | 87.17% |

From the above, the account balance that is to be reviewed is sales and cost of goods sold. In comparison to previous, the gross profit ratio of the companyhas changed slightly, despite the fact that sales have increased. This has happened because the increase in sales is lower than the relative increase in the cost of goods sold, due to which there has been only a slight change in the gross profit ratio. The area of concern is the cost of goods sold.

3. Non-financial factors:

Here, the nature of the business of the company is highly exposed to data management risk along with the risk of cyber security. The information stored by the company is regarding the history of patients' clinical treatments as well as the financial data. Hence, if the company has been exposed to cyber risk it will have a negative impact on its reputation of the company (Sheehan, 2017).

Minimization of Gathering of Evidence:

In the above, the audit procedures to be conducted for high risks areas are as follows:

Telstra Limited:

1. The high risks area in Telstra is the current liabilities. It is important to check the existence and occurrence of liabilities to ensure that they are due. Here, external confirmations can be taken from third parties like banks, and also calculations can be done to examine the liability of the company (Dai, et al., 2019).

2. To check the sales and cost of good sold by the company, it is important to check the valuation i.e. whether the sales around the year has been recorded at the correct price, whether the cost of goods sold is accurate or not, and have occurred during the year.

3. Here, for the non-financial factors, the steps that the company is taking to reduce the impact should be checked along with analyzing the investment that the company has done to reduce the uncertain risks.

Healius Limited:

1. Here, the account balance at risk is a current asset. It is important to analyze the existence of current assets, and the reason why current assets have been diluted. The auditors can take confirmation from the bank regarding the dissolution of assets.

2. Here, the company can analyze the sales that they have made and check the price fluctuations throughout the year to check that valuation is carried out at the correct prices.

3. Here, the auditor should check the measures that the company has taken to reduce the impact of cyber risks, and what security measures have been taken to reduce the risks.

Here, the auditor could have found less evidences regarding the current liabilities in Telstra as it was increased due to pandemic, and sales in the case of Healius, because very slight change has come in the sales and cost of goods sold of the company and these areas of the company are not high risks, which needs the auditor to conduct substantive analytical procedures.

Ethical and Legal Responsibilities:

The code of ethics of auditors states that auditors should be independent while forming an opinion on the accuracy of financial statements. It states that the opinion of the auditor on financial statements should not be influenced by the third party because if the opinion formed by the auditor is inappropriate it will make the financial statements incorrect for those who take decisions based on financial statements. The institute has said that when it is found that auditors have given inappropriate opinions, they can be held liable for their actions legally, and the company has the right to remove the auditors and they will be liable for penal provisions as well, in the form of loss suffered by the company and can be sentenced as well(Saha, et al., 2017).

Conclusion

From the above report assessment, it can be conclude that financial analyses can both the companies has been performance well, although management of the Telstra need to improve the liquidity situation by using the appropriate liquidity policy. Ethical compliance should also be consider by both the companies to improve is non financial performance for the longer period. The auditor can attract criminal and as well civil liability in case of offences and can be prosecuted for fraud and being a part of insider trading. Hence, there have been cases where shareholders of the company have initiated proceedings against the auditor because of the inappropriate audit opinion that they have given. It reflects that the auditors have not followed the duty of care and were not diligent while conducting their duties to give an opinion on financial statements which is true and unbiased.

Reference:

Aigul, A., Lyazzat, S., Aleksandr, P., &Aldanysh, N. (2021). Organisation problems and audit of the effectiveness of interbudgetary relations, 20(5). https://doi.org/10.13165/VPA-21-20-5-05

Amanzholova, B., &Karakchieva, V. (2019). Performance audit in construction organisations: relevant criteria and analytical procedures. Journal of Corporate Finance Research / ???????????????????? | Issn: 2073-0438, 13(2), 81–103. https://doi.org/10.17323/j.jcfr.2073-0438.13.2.2019.81-103

Appelbaum, D. A., Kogan, A., &Vasarhelyi, M. A. (2018). Analytical procedures in external auditing: a comprehensive literature survey and framework for external audit analytics. Journal of Accounting Literature, 40(1), 83–101. https://doi.org/10.1016/j.acclit.2018.01.001

Cullinan, C. P., & Zheng, X. (2017). Accounting outsourcing and audit lag. Managerial Auditing Journal, 32(3), 276–294. https://doi.org/10.1108/MAJ-03-2016-1349

Dai, J., Vasarhelyi, M. A., &Medinets, A. F. (2019). Audit analytics in the financial industry (Ser. Rutgers studies in accounting analytics ser). Emerald Publishing Limited. Retrieved April 22, 2022, https://lesa.on.worldcat.org/oclc/1124605784

Khelil, I., Hussainey, K., &Noubbigh, H. (2016). Audit committee – internal audit interaction and moral courage. Managerial Auditing Journal, 31(4-5), 403–433. https://doi.org/10.1108/MAJ-06-2015-1205

O?NDER Tu?rkan. (2020). Analytical procedures in an audit: review and application by cases. O?neriDergisi, 99-106, 99–106. https://doi.org/10.14783/maruoneri.710692

Pankova, S. V., & Popov, V. V. (2020). Applying analytical procedures for performance audit of customs authorities. Economic Analysis: Theory and Practice, 19(6), 1035–1055. https://doi.org/10.24891/ea.19.6.1035

Saha, S. S., & Roy, M. N. (2017). Quality control procedure for statutory financial audit : an empirical study (First). Emerald Publishing Limited. Retrieved April 22, 2022.https://lesa.on.worldcat.org/oclc/993432933

Sheehan, K. (2017). The ongoing audit transformation. Accountancy Ireland, 49(6), 54–55.https://lesa.on.worldcat.org/oclc/7335029058

HI6026 Audit, Assurance and Compliance Assignment Sample

Assignment Brief

Learning Outcomes:

• Evaluate the economic and legal basis for auditing and the applicable auditing standards and reporting requirements

• Analyze and communicate knowledge of the auditor's professional judgement, legal and ethical responsibilities to their clients and third parties

• Assess audit strategies including the evaluation of business risk and internal controls

• Apply audit concepts and processes to gather evidence and formulate judgments with respect to the underlying information

Weight - 40% of the total assessments

Total Marks - 40

Word limit- 3,000 words ± 500 words

Submission Guidelines for assignment help

• All work must be submitted on Blackboard by the due date, along with a completed Assignment Cover Page.

• The assignment must be in MS Word format, single spacing, 12-pt Arial font and 2cm margins on all four sides of your page with appropriate section headings and pagenumbers.

• All reference sources must be provided using Harvard referencing Assignment Specifications

Assignment Specification

Required Task:

Part A: Analytical Procedure (15 marks)

Obtain a copy of a recent annual report (2019) from ASX Top 300 listed companies list (most companies make their annual reports available on their website). Perform analytical procedures of the Statement of Financial Position and of Financial Performance over the two years (2018 and 2019) using appropriate ratios and/or metrics.

Required:

Measure and discuss income statement, balance sheet and cash flow ratios from your selected company and How does this affect your assessment of materiality, detection risk and overall audit Risk? Provide a brief explanation in the report. This should be presented in a table format. (15 marks)

Part B: Audit Committee Effectiveness (20 marks)

1. “Audit committees do not prepare financial reports, nor do they conduct audits. But they have an essential role to play in ensuring the integrity and transparency of corporate reporting”. Explain this statement? Who should be members of the Audit Committee? Is there an association between Audit committee effectiveness and audit quality after IFRS adoption? (10 marks)

2. Explain your selected company’s (same selected company from part A) and prepare the following responses about the application of audit committee effectiveness recommended by ASX Corporate Governance Council (CGC) principles using Corporate Governance Principles and Recommendations (4th Edition) was released on 27 February 2019? (10 marks)

i. Members of the audit committee meet all applicable independence requirements.

ii. The audit committee demonstrates appropriate industry knowledge and includes a diversity of experiences and backgrounds.

iii. Audit committee members have the appropriate qualifications to meet the objectives of the audit

committee ‘s charter, including appropriate financial literacy.

iv. Discuss about audit committee size and members profile.

v. Discuss about meeting arranged by audit committee chairman and whether member participate actively?

vi. The audit committee monitors compliance with corporate governance regulations and guidelines.

The assignment structure must be as follows:

1. Holmes Institute Assignment Cover Sheet – Full Name, Student No., Contribution.

2. Executive Summary

• The Executive summary should be concise and not involve too much detail.

• It should make commentary on the main points only and follow the sequence of the report.

• Write the Executive Summary after the report is completed, and once you have an overview of the

whole text.

• The Executive Summary appears on the first page of the report.

3. Contents Page – This needs to show a logical listing of all the sub-headings of the report’s contents. Note this is excluded from the total word count.

4. Introduction – A short paragraph which includes background, scope and the main points raised in order of importance. There should be a brief conclusion statement at the end of the Introduction.

5. Main Body Paragraphs with numbered sub-headings – Detailed information which elaborates on the main points raised in the Introduction. Each paragraph should begin with a clear topic sentence, then supporting sentences with facts and evidence obtained from research and finish with a concluding sentence at the end.

6. Conclusion – A logical and coherent evaluation based on a thorough and an objective assessment of the research performed.

7. Appendices – Include any additional explanatory information which is supplementary and/ or graphical to help communicate themain ideas made in the report. Refer to the appendices in the main body paragraphs, as and where appropriate. (Note this is excluded from the total word count.

Solution

Introduction

The Wesfarmers Limited is one of the biggest Australian conglomerates currently operating as one of the biggest retails of the chemical as well as fertilizer and other energy related products and services. The company was inaugurated in the year 1914. The company is publicly listed under the Australian Stock Exchange (ASX) (Campbell, 2017). The company deals in the revenue generation from various products and services like the retailing of the departmental stores as well as the processing of the gas and energy production and distribution. The company also manufactures chemicals as well as fertilizers and the distribution of the different products related in safety. The company predominantly operates in the areas of New Zealand as well as United Kingdoms and Australia (Kinsella, 2012). The headquarters of the company is located in the city of Perth of Australia. The financial statement analysis of the company will be done using ratio analysis which will include different types of liquidity and profitability as well as asset and inventory efficiency ratio for the company. The effect of the materiality on the ratios analyzed by the report will be explained in details by the report and the effect of these ratios in the materiality of the company as well as the overall audit risk and the detection risk will be discussed (Sujan and Abeysekera, 2007). The audit committee of the company will be assessed critically and the different members of the audit committee will be discussed to check as per the requirements mentioned in the using Corporate Governance Principles and Recommendations (4th Edition). The preparation of the audit committee will be done with the explanation of the statement regarding the role of the audit committee in ensuring the transparency as well as the integrity of the financial statements reporting using the corporate financial analysis. This will be mentioned in the second part of the report.

Discussion

Part A

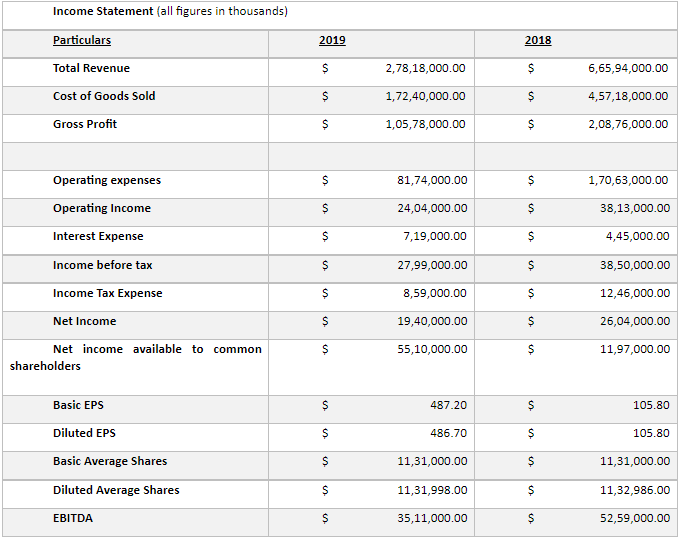

The income statement of Wesfarmers Limited is presented as:

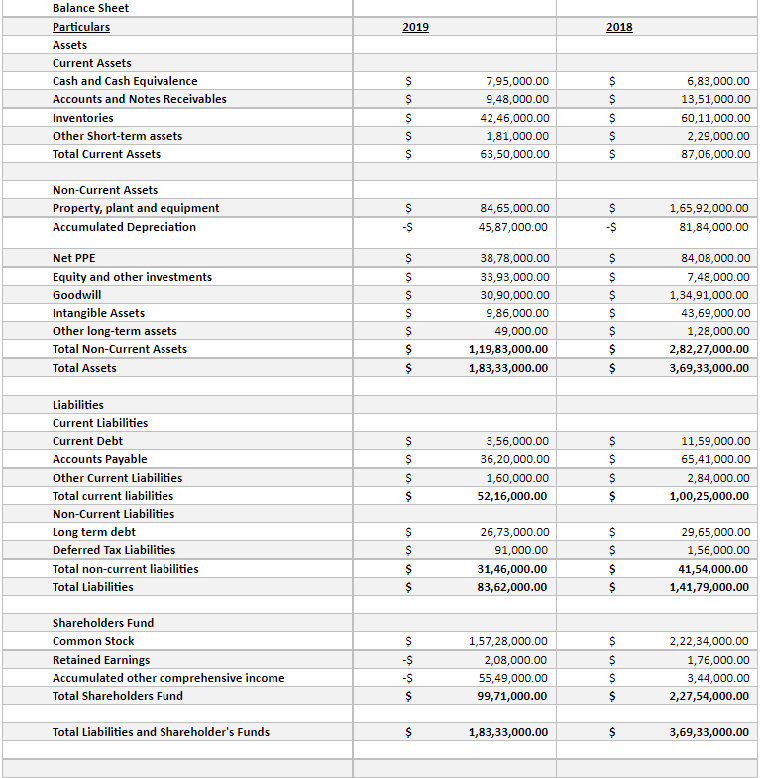

Balance Sheet:

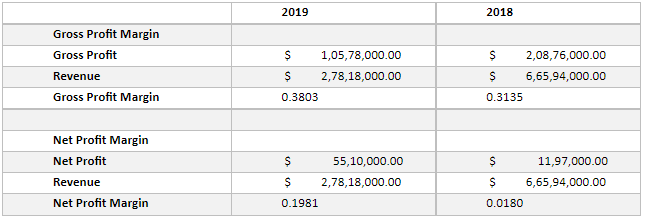

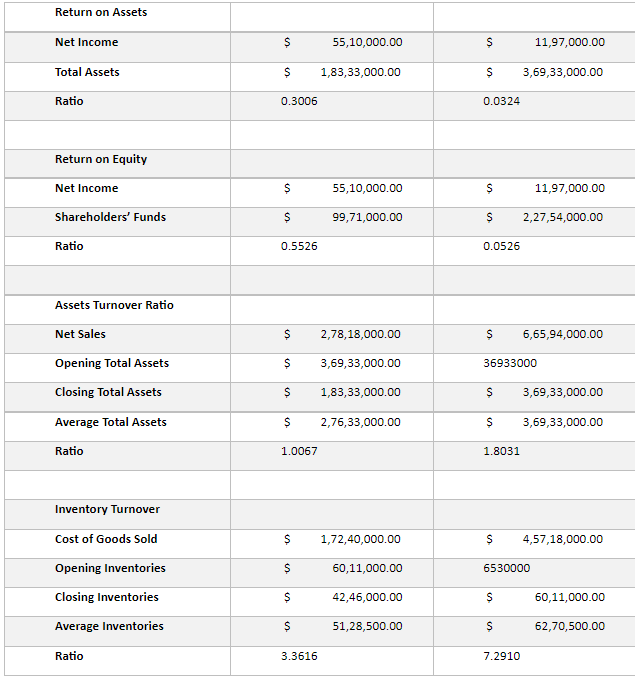

The different profitability ratios that were calculated are:

We can clearly see that net profit margin of the company increased in the financial year 2019 ending 29th June, 2019, as compared to the gross profit margin in the financial year 2018 ending 29th June, 2018. This is because of the increased competition that the company faced in the industry as a reason of which it failed to co-incite with the strategies being implemented for the production of the relevant operations in the business. The effect of the decrease of the profit in Wesfarmers will affect the assessment of the materiality (Curtis and Hayes, 2002). The net profit before tax for the company is calculated to be $ 55,10,000.00, which means that the approximately 1 percent to 2 per cent of the net profit before tax will be used for the assessment of the materiality. This means that approximately $55100 - $115000 will be used as the benchmark which will be assessed for the determination of materiality. At the same time, the benchmark which is set for the materiality of the auditing process of the company is set to be 0.5 percent to 1 percent (Chong and Vinten, 1996). One of the major process that the audit committee needs to follow is the proper documentation of the different figures mentioned in different accounts in the financial statements of the company. The evaluation of the materiality of the company will be determined using proper authentication of the documents present.

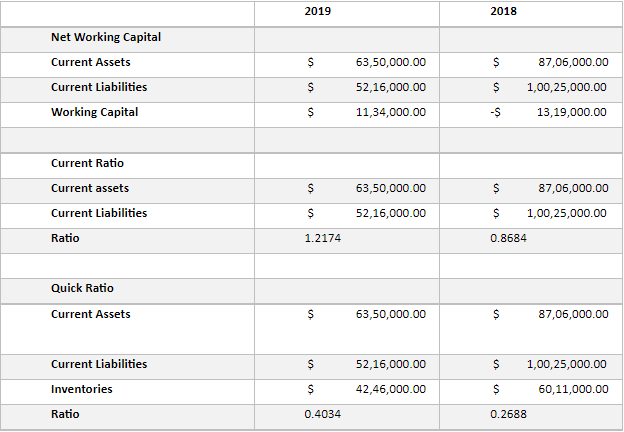

The liquidity ratios of Wesfarmers are calculated to be:

The current ratio as well as the quick ratio has increased significantly in the financial year 2019 as compared to the past financial year 2018. One of the major reasons for the same is the investment of the company heavily in the inventory department of the company. This is because of the fact that the company invested because of the increased demands in chemical and energy-based products prior to the emergence to the COVID-19 (Miah et al., 2020).

The efficiency-based ratios of Wesfarmers are calculated to be:

There is a decrease in the efficiency ratios of the company which means that the company is somewhere incapable of efficiently handling the assets and the inventories in the business organization and this is leading to poor revenue generation from the assets as well as the inventories. This will efficiently affect the materiality as the benchmark threshold for materiality is based on either the net income or the total revenues of the company. The Return on Assets as well as Return on Equity is affected with the changes in the net income of the company and at the same time, the asset turnover ratio will be affected by the net income earned by the company (Houghton, Jubb and Kend, 2011). The changes in the net income by the company can indirectly be affected by the changes in the net revenues of the company.

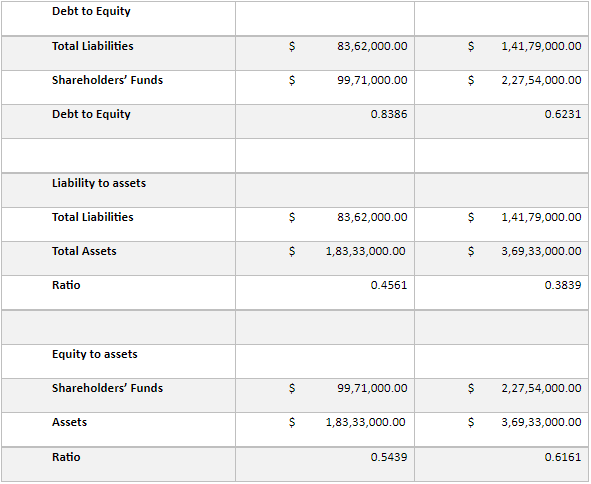

The debt management ratios calculated are:

The debt-to-equity ratio of the company has increased by 1.5 timesg which means that the company is subjected to higher levels of risk as it is majorly financing the operations in the company using the borrowed funds.

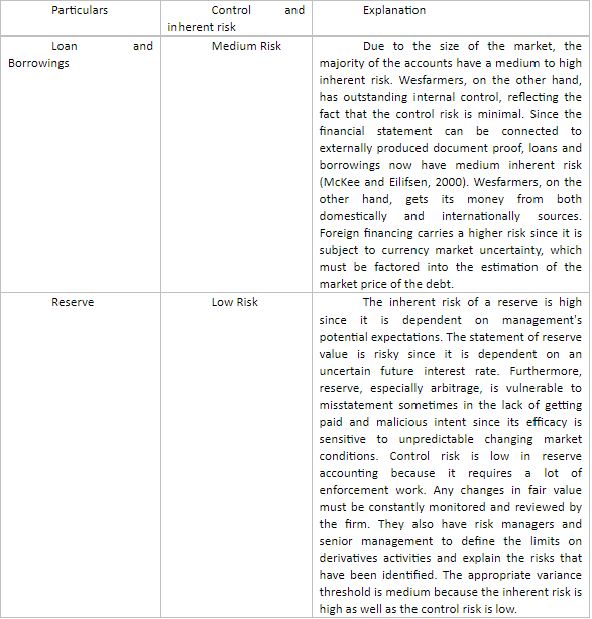

To determine the possibility of material misstatement, two related accounts are subjected to analytical procedures. Loans and borrowings, reserves.

Part B

1. The audit committee's position is critical to business ethics. The internal auditors of board members are responsible for providing successful oversight of the annual audit procedure. Once the rest of the board members are autonomous and impartial, they produce the highest quality work. The audit committee meets with departments and senior auditors to discuss the findings of an audit, particularly matters that must be reported to the panel under widely agreed auditing principles. The committee is responsible for financial statements, information and technology regulation, and organizational concerns. Internal auditors may be aware of the possible effect of financial statements if they have a complete sense of audited accounts (Budescu, Peecher and Solomon, 2012). Both members of the audit committee should be aware of recent legal and functional developments and notifications. The audit committee's biggest duty is to investigate major financial reporting problems. Audit committees engage with executive management and external auditors to discuss the audit's findings, which may include information that managers are expected to reveal mostly with audit committee within general auditing principles. The audit committee authorizes the audit plan, reviews staffing, as well as offers insight into the audit plan's organization for organizations that provide an internal audit function. The Sarbanes-Oxley Act of 2002 should be clear to audit committee members (SOX). In 2003, the Securities and Exchange Commission (SEC) issued a regulation requiring national securities markets and stock exchange associations to refuse listings that do not meet the SOX audit committee criteria (DeZoort, Hermanson and Houston, 2003). In addition, the committee will review potential audit methods as well as coordinates the audit effort through internal audit personnel. Once an internal audit role is established, the committee may check and approve its audit plan, examine the function's personnel and organization, and communicate with internal auditors and administrators on a regular basis to address any issues that may occur.

The members of an audit committee should have enough technical expertise in the fields of auditing as well as financial knowledge (Azzopardi and Baldacchino, 2009). The audit committee should be structured in an independent as well as functional way which will make it easy for the auditors to work in an harmonical environment as well as peaceful cooperation. There should be at least 3 members in the audit committee of the company, all of them should be the non-executive directors of the company as well as the independent directors should comprise the majority of the members of the audit committee (Gist, and Shastri, 2003).

The independent representatives of the audit committee should assist the agents in the process of the monitoring of the actions which will reduce the benefits of withholding the relevant information. There is a negative relationship mentioned under the IFRS between the audit committee independence as well as the audit report lag and the audit committee meetings as well. The committee is made with the ultimate responsibility of looking at the financial reports of the company and checking and authenticating the materiality and the assessment of the risk mentioned (Canning, O’Dwyer, and Georgeakopoulos, 2019). The quality should be at par with the methods used in the process of audit in the company and this should be regularly monitored by the audit committee as per the International Financial Reporting Standards or the IFRS.

2. a. As per the effectiveness which is recommended by the Australian stock exchange (ASX) as well as the corporate governance principles and recommendations, the applicable independence requirements of the members of the audit committee is at par with the audit committee of the Australian conglomerate Wesfarmers Limited. The applicable independent requirements of the members of the audit committee is kept in mind while the framing of the audit and risk committee in the company.

b. The audit and risk committee of Wesfarmers are inclusive of four much knowledgeable members and the chairman as Tony Howarth. All the members of the audit and risk committee possess a great amount of knowledge not only about the economic and business world, but they do have a great knowledge about the financial aspects of the company which will help them in the audit committee (WANG and XU, 2009).

c. The appropriate qualifications of the members of the audit committee should be such that the there should be a minimum of three members in the audit committee and they should be non-executive directors of the company. There should be an adequate knowledge about accounting and financial perspectives of a business. As per the corporate governance report of the company, all the members listed in the audit committee of Wesfarmers possess these types of qualities.

d. The audit committee of Wesfarmers limited has five members out of which the chairman of the audit and risk committee of the business organization is Tony Howarth with other four members in the audit committee being Bill English, Diane Smith-Gander, Sharon Warburton as well as Jennifer Westacott. These five members constitute the audit and risk committee of the Australian conglomerate, Wesfarmers Limited. The chairman of the audit and risk committee is also an independent director who is not a part of the Board of Directors team of the committee to ensure transparency as well as authenticity of the audit committee.

e. There were several meetings that were arranged by the audit committee and these meetings aw an active participation from the members of the audit committee during the course of the financial year. The members actively participated in order to show and represent a fluent and active working of the audit committee in the company which means that the audit committee is working actively and coherently in such a manner which will yield positive and true results at the end of the financial year. The meeting which resulted in the maximum participation from the members was held on the 2nd of October of the financial year.

f. As per the compliances and the rules and regulations set for the purpose of corporate governance, the audit committee is said to have complied very well in terms of the structure of the audit committee, the size of the members of the committee as well as the expertise in the respective accounting and financial fields for the members of the audit committee. The audit committee has a chairman, Tony Howarth which is not chairing the Board of Directors and this is one of the primary and crucial rules which is mentioned in the corporate governance rules and regulations as well as compliances. The audit committee has more than 3 members which are independent directors and non-executive directors of the company.

Conclusion

The financial overview of Wesfarmers Limited, an Australian based corporation and one of the largest Australian conglomerates, will be discussed in this article. Chemical and fertilizer retail, as well as other related items, are dealt with by the company. This corporation is one of Australia's most financially sound corporations. The report discussed about the ratio and financial analysis of the company and effect of them on the materiality of the audit statements. The financial statement analysis of the company has been done using ratio analysis which included different types of liquidity and profitability as well as asset and inventory efficiency ratio for the company. The effect of the materiality on the ratios analyzed by the report has also ben explained in details by taking loans and borrowing as well as reserves and the effect of these ratios in the materiality of the company as well as the overall audit risk and the detection risk were also be discussed. The audit committee of Wesfarmers were critically analyzed and the requirements were assessed with the rules and the regulations as well as the compliances set down for the purpose of corporate governance and financial reporting of the auditing statements by the audit committee and risk committees. The relationship between the compliances of the auditing procedures with the effect of fair and true materiality and the reporting of the financial statements have been scrutiny analyzed. The audit committee and the audit members of the Wesfarmers which is led by EY have been assessed and it seems that performed seemingly well while complying with the rules and regulations.

References

Azzopardi, J. and Baldacchino, P.J., 2009. The concept of audit materiality and attitudes towards materiality threshold disclosure among Maltese audit practitioners.

Budescu, D.V., Peecher, M.E. and Solomon, I., 2012. The joint influence of the extent and nature of audit evidence, materiality thresholds, and misstatement type on achieved audit risk. Auditing: A Journal of Practice & Theory, 31(2), pp.19-41.

Campbell, J., 2017. Insights from the company monitor: Wesfarmers. Equity, 31(8), pp.16-17.

Canning, M., O’Dwyer, B. and Georgakopoulos, G., 2019. Processes of auditability in sustainability assurance–the case of materiality construction. Accounting and Business Research, 49(1), pp.1-27.

Chong, H.G. and Vinten, G., 1996. Materiality and audit risk modelling: financial management perspective. Managerial Finance.

Curtis, M.B. and Hayes, T., 2002. Materiality and audit adjustments. The CPA Journal, 72(4), p.69.

DeZoort, F.T., Hermanson, D.R. and Houston, R.W., 2003. Audit committee support for auditors: The effects of materiality justification and accounting precision. Journal of Accounting and Public Policy, 22(2), pp.175-199.

Gist, W.E. and Shastri, T., 2003. Revisiting materiality. The CPA journal, 73(11), p.60.

Houghton, K.A., Jubb, C. and Kend, M., 2011. Materiality in the context of audit: the real expectations gap. Managerial Auditing Journal.

Kinsella, J., 2012. Luminous World: Contemporary art from the Westfarmer Collection.

McKee, T.E. and Eilifsen, A., 2000. Current materiality guidance for auditors.

Miah, M.S., Jiang, H., Rahman, A. and Stent, W., 2020. Audit effort, materiality and audit fees: evidence from the adoption of IFRS in Australia. Accounting Research Journal.

Sujan, A. and Abeysekera, I., 2007. Intellectual capital reporting practices of the top Australian firms. Australian Accounting Review, 17(42), pp.71-83.

WANG, X. and XU, X.D., 2009. Audit Materiality Level, Accounting Firm Size and Audit Opinion [J]. Journal of Finance and Economics, 1.

MPAA604 Advanced Audit and Assurance Assignment Sample

Instructions:

This assignment is to be submitted in accordance with the assessment information stated in the MPAA604 - Advanced Audit and Assurance Subject Outline.

Students have the responsibility to ensure that the submitted work is in fact their own work.

• Incorporating another source, information or ideas into one's own work without the appropriate acknowledgement through the correct in-text citation protocols is potentially grounds for academic misconduct.

• Students must submit all assignments for plagiarism checking in turn-it-in in Moodle prior to the final submission. For further details, please refer to the MPAA604 Subject Outline and the MPAA604 - Advanced

Audit and Assurance unit information in Moodle.

• Maximum marks available: 15 Marks.

• Refer to the marking rubric for the marking criteria on page 7 of this document for assignment help

• This assignment should be a total of 1,500 words (maximum).

• Please use the "word count" function and include the number of words in the report on the front cover page.

• Due Date: Week 10

Topic: How is Enhanced Auditor Reporting currently being embraced in Australia?

Background and Context:

Since 2016, there has been a strong push to improve the quality of audit reporting. Listed entities now have to report on "key audit matters" and improve the way material information is communicated using "plain English”. As mentioned in the CPA Australia podcast "How is Enhanced Auditor Reporting Being Embraced around the Globe?" (available at CPA Australia website):

“The IAASB's new auditor reporting requirements commenced in December 2016. Standard setters in many jurisdictions, including Australia and New Zealand, have issued the new requirements with the same effective date, whilst others have committed to issue the standards but have not yet done so. The UK have had similar requirements in place since 2013 and some firms in other countries have early adopted the IAASB's requirements. Jim Sylph, Co-chairman of the IAASB's Auditor Reporting Implementation Working Group, and Merran Kensal, IAASB member and AUASB Chairman spoke to CPA Australia about the uptake and impact of enhanced auditor reporting around the globe.”

Research Assessment:

Download an annual report of an Australian Securities Exchange (ASX) listed company that is in the S&P/ASX 300 list. Review all the sections within the selected company's annual report which relate to the Auditor's role in providing reasonable assurance over the entity's financial statements and control environment. Students will need to review and analyses the following key areas included in the selected company's annual report:

• Auditor's Independence Declaration

• Independent Auditor's report

Non-audit services performed by the auditor

• Auditors' remuneration

Role, functions and composition of the Audit Committee

• Independent Auditors' report to the members (shareholders)

• Review all Key Audit Matters noted and the associated audit procedures

Requirements:

Based on your analysis of the auditors' sections and other areas pertaining to the auditor, as included within the annual report, submit a report which summarizes and evaluates the auditor's assurance services performed for the client company.

As part of your review of the assurance services provided, consider the following:

• Has the auditor complied with Independence requirements?

• If there were non-audit services provided, what was the nature of such services?

• Provide an analysis of the auditor's remuneration in a table with prior year comparisons. Include percentage changes and explanations of the remuneration.

Assignment Report Structure:

1. Executive Summary

• The Executive summary should be concise and not involve too much detail.

• It should make commentary on the main points only and follow the sequence of the report.

Write the Executive Summary after the report is completed, and once you have an overview of the whole text. The Executive Summary appears on the first page of the report.

2. Contents Page - This needs to show a logical listing of all the sub-headings of the report’s contents.

3. Introduction - A short paragraph which includes background, scope and the main points raised in order of importance. There should be a brief conclusion statement at the end of the Introduction.

4. Main Body Paragraphs with numbered sub-headings – Detailed information which

elaborates on the main points raised in the Introduction. Each paragraph should begin with a clear topic sentence, then supporting sentences with facts and evidence obtained from research and finish with a concluding sentence at the end.

5. Conclusion – A logical and coherent evaluation based on a thorough and an objective assessment of the facts. Key information has been appraised from an analysis of the company's annual report and supplementary research to support the final evaluation of the Auditor's findings based on the selected company's annual report.

6. Appendices – Include any additional explanatory information which is supplementary and/ or graphical to help communicate the main ideas made in the report. Refer to the appendices in the main body paragraphs, as and where appropriate.

Solution

Introduction

AGL Energy Ltd is one of the oldest and largest business houses that provide essential energy led products and services to households and business houses. It also owns the largest private hydro fleet and power station in Australia. The Board plans to put a demerger to be held in the financial year 2022. The number of customers in Australia is increasing and increasing the industry towards energy businesses (AGL, 2021). It is also engaged in battery development in bulk quantities and energy renewable. The company is engaged in energy products and services that will benefit the customers in the long run. Therefore, the company should make aware of the customers for better results.

Background

The Auditor independent declaration highlights the key audit matter on property, plant and equipment and intangible assets. They also reported on financial instruments acquired by the company during the year. The management of the company has unbilled revenue at the reporting period and the invoice was not raised to the customers. Therefore, the auditors have correctly disclosed in the financial statements of the company.

Scope:

The Independent Auditors have complied with Independence requirements. As per section 307C of the corporation's Act 2001, the auditor has given an opinion on the financial report providing a truthful and fair picture of the company's financial situation as of June 30, 2021and also complying with Australian accounting standards (CPA Australia, 2021). The organization also commenced contracts related to long term arrangements for power purchase agreements.

Main Emphasis

The auditor has pointed out the value of goodwill of $ 2,440 million in the property, plant, and equipment in the financial statements of the organization (AGL Energy Limited, 2021). Auditor has pointed out that the company has invested in derivative financial instruments that have been recorded at a fair value price. Auditor also pointed out unbilled revenue due to collection was not executed during the reporting period. The Audit report also emphasizes environmental rehabilitation.

Analysis

Non-Audit Services

During the financial year 2020-21, the external auditor, Deloitte Touché Tohmatsu Australia (Deloitte), provided non-audit services. The Financial Report 2021 contains information about non-audit services. For audits and related services, the organization maintains a management policy. An external auditor, on the other hand, is prohibited from providing any services that would jeopardize its independence. The Board of Directors has approved the policy of external auditors, which is in line with the general standard of auditor independence. Non-audit services are those that auditors give outside of the scope of the audit.

Auditors Remuneration

The analysis of the auditor’s remuneration is shown below with prior year comparisons. (‘$000)

The table shows that remuneration of the auditor has increased by 7.89% as compared to the previous year (AGL Energy Limited, 2021). However, remuneration of the assurance services, assurance services have increased during the current financial year.

Action taken by auditors on Key Audit Matters

Key Audit matters:

1. The auditor has pointed out the value of goodwill of $ 2,440 million in the property, plant, and equipment in the financial statements of the organization (AGL Energy Limited, 2021). However, management conducted impairment expenses on such tangible and intangible assets.

However, the procedure adopted by the auditor is not only limited to obtaining understanding associated with valuation models and boards approval for impairment charges (AUASB, 2021). The auditor has checked the mathematical accuracy of cash flow models. They have also assessed the historical forecasting accuracy.

2. The Auditor has pointed out that the company has invested in derivative financial instruments that have been recorded at a fair value price. The auditor has sought a significant judgement from the management for the valuation and accounting of those financial instruments.

The auditor has obtained the internal risk management process and controls, and systems adopted by the management for relevant accounting. The auditor has checked for accuracy on a testing basis and assessed for hedging effectiveness, the integrity of the models, contract terms and disclosure of their appropriateness in the financial statements.

3. The Auditor also pointed out unbilled revenue due to collection was not being executed during the reporting period.

The auditor has checked for process flows of the organization and key control management to estimate the unbilled amount. The auditor has also checked for management's challenges for assumption, pricing, and distribution tariff rates. These data have been checked on a sample basis by the auditor. They have also compared the historical data and current data. They have also checked for distribution tariff rates.

4. The Audit report also emphasizes making provisions for environmental rehabilitation.

The auditor has advised the company to restore and rehabilitate the environment disturbed by electricity generation. The auditor has asked for the amount of provision for environmental rehabilitation. They have asked for activities conducted for rehabilitation, the expected timing, and regulatory requirements.

The auditor has assessed the rehabilitation cost estimated with an independent expert. They have compared with historical data and also assess inflation rates and discount rates.

5. The company has recorded contracts relating to long term arrangements for power purchase agreements.

The auditor has checked for onerous contracts and also evaluated methods for completeness of unavoidable costs.

Audit Committee Meetings

The company has audit & risk committee meetings in the financial year ended on 30 June 2021. There are about 5 non-executive directors in the company. The company has an audit committee charter, and it is displayed on the company's website. The main purpose of the audit charter is to assist the Board in fulfilling its responsibilities to provide timely financial reports (IIA, 2021). The audit charter reviews and recommends a risk management framework. Members of the audit committee meetings are chosen by the Board of Directors from among the company's non-executive directors. The committee is required to convene at least four times per year. A quorum of two people is required for such gatherings. Every two years, this charter is reviewed and modified.

Audit Opinion

The auditor has given the unqualified report and stated that financial statements prepared were following the corporation’s act 2001 and given a true and fair view on the financial position prepared by the management as of 30 June 2021. The remuneration report for the year ended 30 June 2021 is in complies with section 300A of the corporation's Act 2001.

Difference between Director’s duties and auditor’s responsibilities

Auditor’s responsibilities are to comment or give emphasis on matters that are seen from the external point of view. However, directors’ duties and management responsibilities are to protect the interest of the company. The director has to implement the policies and take responsibility for any adverse happenings. The auditors are assigned with the responsibility of giving an opinion on the policies and financial viability of the organization. The auditor may give an adverse opinion if the documents asked for are not provided. Therefore, they are not implementers, but they are only entrusted with the task of giving an opinion (IAASB, 2021).

Material Subsequent Events

AGL Energy Ltd has received two penalty notices for releasing emissions beyond the limits. The company enhanced the emission limits with amendment limits that took place on June 1, 2021. However, implementation of such limits has to occur from such dates, but it was not followed.

Third-Party Assessment

Being a third-party stakeholder, the auditor has pointed out effective point’s relation to unbilled revenue and collection cycle. The management should make provisions for environmental rehabilitation. The cost of expenditure towards preserving the environment should be prepared by the company. They should take out effective cost emission costs and rehabilitating the environment for destroying the environment.

Follow-up questions

The auditor would be asked whether they have checked for expenditures and incomes earned during the reporting period. During the current financial period, the expenses have increased and whether they have been checked on a testing basis. The auditor is asked for an increase in liabilities and trade receivables. The auditors have to be asking for checking of dividend pay-out ratio as compared to previous declaration dates. The most important question to be asked to auditors is about the disclosure of financial assets acquired by the company during the reporting period.

Conclusion

Though the company has increased its revenue for unbilled collection, the company has not accounted for the actual amount against the sale of electricity. Therefore, the company should adopt measures to generate the bill within the due date and collect the amount accordingly. The company is also advised to show the financial instruments at fair market value. The company should complete contracts and duly give the information to the board and shareholders. It is also advised that the debt of the company is to be reduced and liabilities are also to be reduced as compared with assets. The company is also advised to increase the customer base for increasing the income. The company should contribute towards society as a whole and should maintain the interest of the customers. The company should adopt transparency policies to enhance its customer base. The company should look out for payment to subsidiaries and businesses before finalization and reduce long term loans.

References:

AGL. (2021). About AGL. Retrieved 13 October 2021, from https://www.agl.com.au/about-agl

AGL Energy Limited. (2021). AGL Energy Limited Annual Report 2021. Retrieved 13 October 2021, from https://www.agl.com.au/-/media/aglmedia/documents/about-agl/asx-and-media-releases/2021/210813_fy21annualreport.pdf

AUASB. (2021). Retrieved 13 October 2021, from https://www.auasb.gov.au/admin/file/content102/c3/ASA_500_Compiled_2019-FRL.pdf

CPA Australia. (2021). Audit and assurance | CPA Australia. Retrieved 13 October 2021, from https://www.cpaaustralia.com.au/tools-and-resources/audit-and-assurance

IAASB. (2021). Retrieved 13 October 2021, from https://www.iaasb.org/system/files/meetings/files/Discussed%20September%2018%20-%20Extract%20of%20ISA%20570%20-%20Wording%20Responsibilities%20of%20management%20and%20auditor.pdf

IIA. (2021). Model audit committee charter | Audit committees | Technical guidance | IIA. Retrieved 13 October 2021, from https://www.iia.org.uk/resources/audit-committees/model-audit-committee-charter/#:~:text=The%20audit%20committee%20charter%20sets,within%20the%20audit%20committee%20charter.&text=The%20audit%20committee%20may%20engage,to%20carry%20out%20its%20duties.

MAA705 Corporate Auditing Assignment Sample

Due date and time: Friday, 8th April 2022, by 8:00 pm (AEST)

Percentage of final grade: 20%

Word count: 1500 words (excluding reference list)

Description for Assignment Help

Probuild is a large commercial construction firm with construction projects across

Australia. On 23 February 2022, Deloitte were appointed as administrators to Probuild’s Australian parent company WBHO Australia Pty Ltd. In the court documents, Deloitte noted that the appointment of the administrators followed the decision of Probuild’s ultimate parent company, Wilson Bayly Holmes-Ovcon Limited’s (a South African-based construction firm) decision to withdraw financial support to the Australian subsidiaries on 22 February 2022.

Among those affected are the 786 employees who are collectively owed more than $14 million (according to the records of the companies). Insolvencies such as this would also leave unsecured creditors at risk of not being paid.

It is important to note that there are usually several factors (both internal and external) that can cause a firm to enter into administration, which are not related to the audit quality. However, in cases where the client company fails, Kadous (2000) finds that the auditor is more likely to be found “guilty” even when they provided higher-quality audits. This points to the expectation gap relating to audits of financial reports.

In April 2020, the International Auditing and Assurance Standards Board (IAASB) ventured on a new project relating to going concern in an audit of financial statements.

According to the IAASB, the “aim of this project is to determine if, and to what extent, the IAASB should take further action on going concern in an audit of financial statements.

Addressing the identified issues and challenges may involve possible future standard-setting, issuance of non-authoritative guidance, or other actions.” They expect the auditing standard relating to going concern (ISA 570) to be updated in December 2023.

The going concern project is important as corporate collapses are often used as a metric of audit quality, especially in the eyes of the public. Research has provided some support for the reasons auditors can fail to issue going concern modified opinions for financially stressed clients. Basioudis et al. (2008) find that financially distressed companies with high non-audit fees are less likely to receive a going-concern modified audit opinion, suggesting that non- audit fees can impair auditor decision making. Second, the concentration of supply by the Big 4 audit firms is documented to reduce audit quality, especially among complex firms despite an increase in audit fees (Gunn et al., 2019).

Given the importance of going concern in an audit of financial statements, the task in this assignment is to envision yourselves submitting a report to provide research-based evidence on the issues surrounding the going concern reporting.

Requirements:

You are to write a professional report in which you:

• Define who the stakeholders of a firm are and define the audit expectation gap.

• Identify Probuild’s stakeholders and discuss the main causes of the expectation gap among the identified stakeholders relating to going concern in the audit of Probuild’s financial reports.

• Consider what can be done to narrow the expectation gap among Probuild’s stakeholders.

• Discuss whether non-audit services impair auditor decision making and elaborate on a

suggestion to mitigate potential issues.

• Discuss whether reduced competition can affect audit quality and elaborate on a suggestion to mitigate potential issues.

Although there is no specific structure for the report, consider the following structure/sections:

1. Introduction [consider providing a general discussion on auditors’ responsibilities relating to going concern. You can provide a definition of stakeholders and the audit expectation gap here.

2. Probuild’s stakeholders and the expectation gap [here you can identify and elaborate on at least 3 stakeholders. Also, consider discussing at least 2 causes of the expectation gap and provide a solution.

3. Non-audit services and auditor decision making [providing research-based evidence and 1 potential solution.

4. Audit market competition and audit quality [providing research-based evidence and potential solution.

5. Conclusion [a summary of the main points of the report and your thoughts about the importance of going concern in an audit of financial statements.

6. List of references

Solution

1. Introduction

Auditor's responsibilities and a quality audit are based on the review of a project along with its quality and effectiveness in this perspective. In order to produce better results and the fact-finding mission of a project, the auditor's responsibilities play a crucial role to maintain all the objectives and aims of this particular project. The study is mainly focused on the case study analysis on the basis of the stakeholders and their performance along with the expectation gap relevant to Probuild's. ISA 570 is an ongoing concern in this case and indicates material uncertainty and auditor’s responsibility in this case of ISA 570 is to obtain betterment of audit evidence along with the appropriate management and financial statements. In this regard, there is an uncertainty of material that must be focused by the stakeholders in Probuild’s construction. Major responsibility of auditors’ is to manage the ability of performance and maintain the financial statements in an appropriate way.

On the basis of auditor's responsibility for a construction industry like Probilud's, several possibilities need to be managed by the auditors, and these are as follows:

Preparing of audit report

Necessity and its exact activity in this regard

Making of inquiries

The lending of assistance in case of branch audit

Reporting of fraud

Complying with auditing standards

Managing of investigations

Focusing on code of professional conduct and code of ethics

Stakeholders are mainly defined as a particular person or organisation that can be helpful to manage all the conditions relevant to the organisation by influencing several kinds of factors. In this case study, it is seen that Deloitte has been appointed as administrators to Probuild's Australian parent company and that it will be represented as WBHO Australia Pty Ltd in 2022. Apart from that, expectation gaps indicate the difference between organisational expectations and providing results by the auditors and this case study, financial report and its statement is considered as an expectation gap for Probuild’s.

2. Probuild’s stakeholders and the expectation gap

In order to identify and illustrate brief management of Probuild's stakeholders, three major stakeholders for the company can be chosen "Deloitte", "Wilson Bayly Holmes-Ovcon Limited", and “International Auditing and Assurance Standards Board” (IAASB). As a commercial large construction company, Probuild has a better reputation over Australia, and in the year 2022, Deloitte has appointed Probuild's Australian parent company as administrators and named "WBHO Australia Pty Ltd". In this particular manner, the major role of IAASB is to determine the proper action and its plans that can manage all financial statements and auditing roles in a promising way for Probuild's.

From analysing the particular case study relevant to this Probuild's construction company, two expectation gaps are observed, such as administrator issues and improper managing of audit in financial statements and its reports. Deloitte has been appointed as the Australian parent company, and that is named WBHO Australia Pty Ltd. Based on this decision, the firm of African construction has taken a decision about withdrawing financial support for the Australian subsidiaries in 2022, and this has very much effect on employees and a big financial loss to the company (Kadous, 2000). For mitigating this issue, it can be undertaken that insolvencies like this can be left unsecured creditors at risk and not to be paid.

Additionally, IAASB ventured is considered as a new project relating to concern, and that is fully based on the audit of financial statements. The overall financial report of Probuild’s is not good, and that is not properly arranged for maintaining the process with good delivery of project and employee management (Mitchell et al., 1997). The main aim of this process is to identify the issue and determine the proper action plan relevant to financial statements. In order to identify the solution for this, an ongoing concern "ISA 570" is to be updated by 2023, and for future development, all challenges and issues need to be addressed by IAASB. This can be fruitful for Probuild’s, and a better concern about financial reports and its audit management can be possible in a significant way.

3. Non-audit services and auditor decision making

Non-audit services are connected with the audit services, whereas the financial statement is not involved. In such correspondence, not-audit services are provided by the auditors. Along with that, as a metric of audit quality, various corporate collapses are used. In such circumstances, various supports can be provided, whereas different modified opinions blended with the stressed clients can be failed to issue (Basioudis et al., 2008). Furthermore, a concerned modified opinion is taken by the non-audit services. Furthermore, the decision making of the auditor can be impaired by the audit fees. Besides, the label of confidence is not impacted through this process.

On the basis of the court documents, it followed the appointment of the administrators, and that was managed by the parent company Wilson Bayly Holmes-Ovcon Limited. It is a South African construction firm and has taken the decision to withdraw financial support from the better subsidiaries in Australia in 2022. On the other hand, IAASB ("International Auditing and Assurance Standards Board") ventured on a new construction project regarding audit financial statements and its ongoing concerns.

For solving different issues, the cost regarding the audit observations has to be communicated. Besides, the regulatory effects blended with the non-confirming protocols have to be explained. Through the statement, the role of the management regarding the audit program has to be explored. Along with that, for the management, an audit report has to be distributed (Gunn et al., 2019). There are multiple kinds of factors, including internal factors and external factors, in order to enter the firm into administration. Public subsidies have to be identified as a decision blended with the case study.

4. Audit market competition and audit quality

WBHO has decided to withdraw the financial support to the Australian subsidiaries in 2022. Additionally, IAASB ("International Auditing and Assurance Standards Board" has started a new project and ongoing concerns corresponding to audits regarding the financial statement. Furthermore, taking different kinds of actions blended with the financial statement is the main target. As per the case study, auditing standards will be concerned in December 2023. Along with that, as a metric of audit quality, various corporate collapses are utilised. Besides, various modified options corresponding to financially stressed clients are not issued by the auditors (Basioudis et al., 2008). According to this case study, an audit market competition helps to track major competitors within particular measurements based on the project like construction Probuild's company, and that can be visible online. After that, the aim is to discover the better working process as well as strategic work within the industry on the management of competitive advantages. It is good to involve Deloitte and IAASB in Probuild's construction company to manage administrative and financial statements by providing quality audits. In this regard, audit expectation gaps also occurred in these particular scenes, like improper management of financial reports and bad quality administration to overcome the employee issues (Xu & Kalelkar, 2020). According to this case analysis of Probuild's construction, an expectation gap such as the users regarding financial statements perceives the audit profession to claim the proper conduction of the audit. For example, it is seen that expectation gaps regarding audit and stakeholders' performance, 786 employees are affected, and those are collectively owed approximately $14 million on the basis of the company's record.

On the other hand, in order to manage the solution and identify exact mitigation to the financial supports and its statements, a concerned modified audit option is less likely to be received by different financially distressed companies along with different non-audit fees. In such circumstances, the decision making of the auditor can be impaired by the non-audit fees. For this company, supply is processed from 4 big audit firms, which has been documented for reducing the quality of audit, whereas the concentration of the supply has been documented. In addition, audit fees are increased for various complex firms. In such accordance, the audit market competition is too high where the financial statement of the company has great importance.

5. Conclusion

From the above discussion of the entire case study regarding audit quality, stakeholders of the construction company and expectation gap, it can be concluded that audit of financial statements management is really important for every construction industry like Probuild's Australia. In this manner, responsibility of stakeholders’ depends on the appropriate financial management and its activity to grow material productivity by mitigating the uncertainty under the ongoing concerns ISA 570. On the basis of this report analysis, a major concern is to take better action plans by IAASB in case of audit financial statements. Moreover, for addressing the identified issues and challenges regarding the ongoing concerns “ISA 570” relevant to financial statements and material uncertainty, a betterment of standard needs to be added in a suitable way. In the case of issuance in non-authoritative guidance and further settings in financial reports, this particular ongoing concern (ISA 570) is to be updated by 2023. Therefore, it can be realised that the construction company of Australia can manage their issues and faults in audit and non-authoritative concerns by including several stakeholders' roles and responsibilities within a certain time period in an adverse way.

Reference List:

Basioudis, I. G., Papakonstantinou, E., & Geiger, M. A. (2008). Audit fees, non?audit fees and auditor going?concern reporting decisions in the United Kingdom. Abacus, 44(3), 284-309.

Gunn, J. L., Kawada, B. S., & Michas, P. N. (2019). Audit market concentration, audit fees, and audit quality: A cross-country analysis of complex audit clients. Journal of Accounting and Public Policy, 38(6), 106-693.

Kadous, K. (2000). The effects of audit quality and consequence severity on juror evaluations of auditor responsibility for plaintiff losses. The Accounting Review, 75(3), 327-341.

Mitchell, R. K., Agle, B. R., & Wood, D. J. (1997). Toward a theory of stakeholder identification and salience: Defining the principle of who and what really counts.

Academy of Management Review, 22(4), 853-886. Xu, Q., & Kalelkar, R. (2020). Consequences of going-concern opinion inaccuracy at the audit office level. Auditing: A Journal of Practice & Theory, 39(3), 185-208.

.png)

~5.png)

.png)

~1.png)

.png)