Taxation Law Assignment Help

As a student pursuing a degree in law, you know that taxation law is a complex and ever-changing subject. With the constant amendments and updates to tax laws, it can be challenging to keep up with all the changes, let alone complete all your assignments on time.

That's where our Taxation law assignment help service comes in. We understand the difficulties that students face when it comes to taxation law, and we're here to provide you with the assistance you need to excel in your studies.

Whether you're struggling to understand a particular tax law concept, or you're short on time and need help completing an assignment, our Taxation law assignment help service has got you covered.

What Is Taxation Law?

Taxation law is a field of law that deals with the legal rules and regulations that regulate the government's collection of taxes. This legislation oversees the taxation process, which includes levying, calculating, and collecting taxes from people and corporations. Taxation law is a difficult subject that necessitates a thorough grasp of legal concepts as well as their practical application in a variety of tax-related situations.

Our Taxation law assignment help service provides students with the resources they need to excel in their studies. We offer personalized assistance to students, helping them gain a better understanding of complex tax concepts and providing them with the support they need to complete their assignments on time. Whether you need help with a specific assignment or you're struggling with the subject in general, our experts are here to help.

Have A Look To Our Assignment Samples

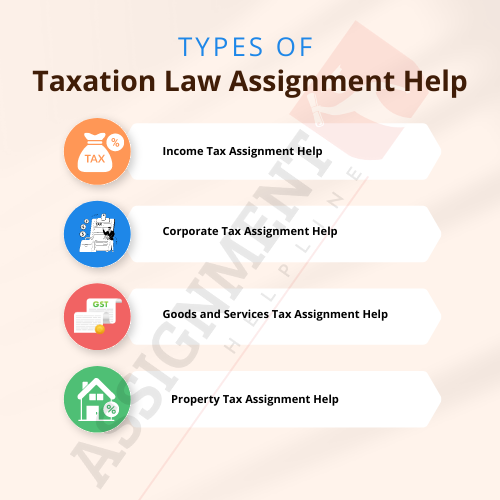

Types of Taxation Law Assignment Help

At TheAssignmentHelpline.com, we offer various types of Taxation law assignment help to meet the needs of students pursuing a degree in law. Our experts are experienced in handling various taxation law assignments, including:

1. Income Tax Assignment Help: This type of assignment requires a thorough understanding of income tax laws and the calculations involved. Our experts provide accurate and comprehensive solutions to income tax assignments.

2. Corporate Tax Assignment Help: This type of assignment involves the application of tax laws to corporate entities. Our experts provide comprehensive assistance to students struggling with corporate tax assignments.

3. Goods and Services Tax Assignment Help: This type of assignment deals with the application of GST laws and regulations. Our experts have a deep understanding of GST laws and provide accurate and timely solutions to GST assignments.

4. Property Tax Assignment Help: This type of assignment requires a thorough understanding of property tax laws and their practical application. Our experts provide personalized assistance to students struggling with property tax assignments.

We strive to provide the best taxation law assignment help to students. Our experts are committed to providing accurate and timely solutions to assignments, ensuring that students achieve academic success. So, if you're struggling with a taxation law assignment, don't hesitate to contact us for the best law assignment help.

Kinds of Taxes

Our Taxation law assignment help experts can offer students a thorough grasp of the many forms of taxes. Among the most popular forms of taxes are:

1. Income Tax: This is a tax imposed on the earnings of people, corporations, and other entities. It is often computed as a percentage of overall earnings.

2. Sales Tax: This is a sales tax levied on the purchase of goods and services. The tax is often determined as an amount of the sale price & is collected at the moment of sale by the seller.

3. Property Tax: This is a tax on the value of real estate owned by people, corporations, or other entities. The local government collects the tax, which is normally based on the assessed worth of the property.

4. Excise Tax: This is a tax levied on the sale or use of certain products and services, such as cigarettes, alcoholic beverages, petrol, and luxury items.

5. Estate Tax: This is a tax payable on the sale of property following the death of a person. It is often computed as a percentage of the estate's overall worth.

6. Gift Tax: This is a tax charged on the gifting of property between one person to another. The tax is normally computed as an amount of the gift's value.

7. Payroll Tax: This is a tax levied on employee earnings and salaries. The tax is normally divided equally between the employer and the employee and is used to pay social security, Medicaid, and various other social welfare programs.

In conclusion, Taxation law assignment help professionals can give students a thorough grasp of the many sorts of taxes, such as income tax, sales tax, property tax, excise tax, inheritance tax, gift tax, and payroll tax.

What Topics Do We Cover In Our Taxation Law Assignment Help Services?

Taxation law assignment help services cover a wide range of topics related to taxation and can provide students with comprehensive assistance on various aspects of taxation law. Some of the topics covered in our Taxation law assignment help services include:

1. Taxation Laws and Regulations: Our professionals can help students grasp the numerous tax rules and regulations, such as the Income Tax Act, Sales Tax Act, and others.

2. Tax Planning and Management: Our experts can assist students in developing effective tax planning and management strategies, which can help individuals and businesses minimize their tax liabilities.

3. International Taxation: Our Taxation law assignment help also includes international taxation topics such as transfer pricing, tax treaties, and cross-border taxes.

4. Corporate Taxation: Corporate taxation refers to the system of taxing profits earned by corporations or businesses. Governments impose corporate taxes to generate revenue and fund public services and programs.

5. Goods and Services Tax (GST): Our Taxation law assignment help services also cover the GST, including the GST Act, GST compliance, and GST returns.

6. Property Taxation: Our experts can assist students in understanding property taxation, including the assessment of property values and the calculation of property taxes.

Our Taxation law assignment help services cover a wide range of topics related to taxation, including taxation laws and regulations, tax planning and management, international taxation, corporate taxation, GST, and property taxation. By availing of our Taxation law assignment help services, students can get comprehensive assistance on various aspects of taxation law.

Why May Students Opt For Taxation Law Assignment Help?

Students pursuing a degree in law may face various challenges when it comes to completing taxation law assignments. Some of the reasons why students may opt for

Taxation law assignment help include:

Complex Subject Matter:

Taxation law is a complicated subject that necessitates a thorough grasp of legal concepts as well as their practical implementation. Students may find it difficult to comprehend the complex concepts and calculations involved.

Time Constraints:

With the busy schedules that law students have, it can be challenging to complete taxation law assignments on time. Many students may have other commitments, such as part-time jobs or internships, which can take up a significant amount of time.

Lack of Resources:

Students may lack access to the resources needed to complete taxation law coursework, such as current textbooks or research materials.

Need for High-Quality Assignments:

Students may need to achieve high grades in their taxation law assignments to excel in their studies. This may require them to seek help from taxation law assignment helpers who can provide accurate and high-quality assignments.

By opting for taxation law assignment help online, students can overcome these challenges and achieve academic success. We provide personalized assistance to students struggling with taxation law assignments, ensuring that they achieve their academic goals. Our experts have years of experience and a deep understanding of taxation law, providing students with accurate and timely solutions to their assignments.

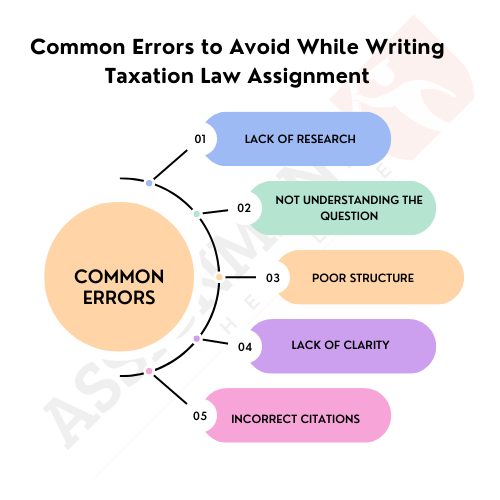

Common Errors to Avoid While Writing Taxation Law Assignment

When it comes to writing Taxation law assignments, students may make common errors that can impact their grades. To ensure that students achieve academic success, it is essential to avoid these errors. Some of the common errors to avoid while writing Taxation law assignments include the following:

1. Lack of Research: One of the biggest mistakes students make is not conducting enough research on the topic they are writing about. It is crucial to conduct thorough research and gather relevant information to support the arguments presented in the assignment.

2. Not Understanding the Question: Many students make the mistake of not understanding the question they are required to answer. It is essential to read the question carefully and understand what is being asked before starting to write the assignment.

3. Poor Structure: Poorly structured assignments can be confusing to read and may not effectively communicate the intended message. It is essential to use a logical and coherent structure when writing Taxation law assignments to ensure that the content is easy to understand.

4. Lack of Clarity: Assignments that are unclear might be hard to read and comprehend. It is critical to utilize simple and succinct language, eliminate jargon, and explain complicated topics.

5. Incorrect Citations: Incorrect or insufficient citations might result in plagiarism charges, which can have significant implications. All sources utilized for the assignment must be correctly cited, and the citation style provided by the lecturer must be followed.

By avoiding these common errors, students can improve the quality of their taxation law assignments and achieve better grades. We are offering top-notch and tailored taxation law assignment help for students by understanding and completing their taxation law assignments effectively.

Process of Availing Taxation Law Assignment Help Online

The process of availing Taxation law assignment help online is simple and hassle-free. Here are the steps to follow:

Step 1: Submit Your Requirements

Visit our website and fill in the assignment submission form with all the necessary details, including the topic, word count, deadline, and any additional requirements.

Step 2: Get a Quote

Once you submit your requirements, our team will provide you with a quote for the assignment. The quote will be based on the complexity of the assignment, the word count, and the deadline.

Step 3: Make the Payment

If you are satisfied with the quote, you can make the payment through our secure payment gateway using your preferred payment method.

Step 4: Get the Assignment Delivered

After the payment is processed, our team will assign the assignment to a qualified Taxation law assignment help expert who will work on your assignment and deliver it to you within the specified deadline.

Step 5: Review and Revisions

Once you receive the assignment, review it carefully. If you need any revisions or modifications, you can request them from our team within the stipulated timeframe. We provide free revisions to ensure that you are completely satisfied with the assignment.

Step 6: Submit the Assignment

Once you are satisfied with the assignment, submit it to your professor and earn top grades.

Availing our Taxation law assignment help online is a straightforward process that involves submitting your requirements, getting a quote, making the payment, receiving the assignment, reviewing and requesting revisions if necessary, and submitting the final assignment. Our team of experts is available 24/7 to provide you with the best Taxation law assignment help services and ensure your academic success.

Benefits of Online Taxation Law Assignment Writing Help Services

Online Taxation Law Assignment Writing Help Services have become increasingly popular among students pursuing a degree in law. This is because these services offer a range of benefits that help students overcome the challenges they face when completing taxation law assignments. Some of the benefits of online taxation law assignment help services include:

Access to Expert Assistance:

Our Taxation law assignment help services provide students with access to our assignment help experts who have years of experience in the field. These specialists have a thorough grasp of taxation law and can supply students with precise and high-quality assignments.

Timely Completion of Assignments:

With the help of taxation law assignment writing services, students can complete their assignments on time. These services offer quick turnaround times, ensuring that students can submit their assignments before the deadline.

Affordable Pricing:

Our taxation law assignment help services are easily accessible to students on a tight budget. Many services offer discounts and promotions, making their services even more affordable for students.

Personalized Assistance:

We offer personalized assistance to students, ensuring that they receive the help they need to excel in their studies. These services provide one-on-one assistance to students, helping them to understand complex concepts and complete their assignments with ease.

Overall, Our Taxation law assignment help services provide students with the assistance they require to excel in their studies. These services offer a range of benefits, including access to expert assistance, timely completion of assignments, affordable pricing, and personalized assistance.

.png)

~5.png)

.png)

~1.png)

.png)