Order Now

- Home

- About Us

-

Services

-

Assignment Writing

-

Academic Writing Services

- HND Assignment Help

- SPSS Assignment Help

- College Assignment Help

- Writing Assignment for University

- Urgent Assignment Help

- Architecture Assignment Help

- Total Assignment Help

- All Assignment Help

- My Assignment Help

- Student Assignment Help

- Instant Assignment Help

- Cheap Assignment Help

- Global Assignment Help

- Write My Assignment

- Do My Assignment

- Solve My Assignment

- Make My Assignment

- Pay for Assignment Help

-

Management

- Management Assignment Help

- Business Management Assignment Help

- Financial Management Assignment Help

- Project Management Assignment Help

- Supply Chain Management Assignment Help

- Operations Management Assignment Help

- Risk Management Assignment Help

- Strategic Management Assignment Help

- Logistics Management Assignment Help

- Global Business Strategy Assignment Help

- Consumer Behavior Assignment Help

- MBA Assignment Help

- Portfolio Management Assignment Help

- Change Management Assignment Help

- Hospitality Management Assignment Help

- Healthcare Management Assignment Help

- Investment Management Assignment Help

- Market Analysis Assignment Help

- Corporate Strategy Assignment Help

- Conflict Management Assignment Help

- Marketing Management Assignment Help

- Strategic Marketing Assignment Help

- CRM Assignment Help

- Marketing Research Assignment Help

- Human Resource Assignment Help

- Business Assignment Help

- Business Development Assignment Help

- Business Statistics Assignment Help

- Business Ethics Assignment Help

- 4p of Marketing Assignment Help

- Pricing Strategy Assignment Help

- Nursing

-

Finance

- Finance Assignment Help

- Do My Finance Assignment For Me

- Financial Accounting Assignment Help

- Behavioral Finance Assignment Help

- Finance Planning Assignment Help

- Personal Finance Assignment Help

- Financial Services Assignment Help

- Forex Assignment Help

- Financial Statement Analysis Assignment Help

- Capital Budgeting Assignment Help

- Financial Reporting Assignment Help

- International Finance Assignment Help

- Business Finance Assignment Help

- Corporate Finance Assignment Help

-

Accounting

- Accounting Assignment Help

- Managerial Accounting Assignment Help

- Taxation Accounting Assignment Help

- Perdisco Assignment Help

- Solve My Accounting Paper

- Business Accounting Assignment Help

- Cost Accounting Assignment Help

- Taxation Assignment Help

- Activity Based Accounting Assignment Help

- Tax Accounting Assignment Help

- Financial Accounting Theory Assignment Help

-

Computer Science and IT

- Operating System Assignment Help

- Data mining Assignment Help

- Robotics Assignment Help

- Computer Network Assignment Help

- Database Assignment Help

- IT Management Assignment Help

- Network Topology Assignment Help

- Data Structure Assignment Help

- Business Intelligence Assignment Help

- Data Flow Diagram Assignment Help

- UML Diagram Assignment Help

- R Studio Assignment Help

-

Law

- Law Assignment Help

- Business Law Assignment Help

- Contract Law Assignment Help

- Tort Law Assignment Help

- Social Media Law Assignment Help

- Criminal Law Assignment Help

- Employment Law Assignment Help

- Taxation Law Assignment Help

- Commercial Law Assignment Help

- Constitutional Law Assignment Help

- Corporate Governance Law Assignment Help

- Environmental Law Assignment Help

- Criminology Assignment Help

- Company Law Assignment Help

- Human Rights Law Assignment Help

- Evidence Law Assignment Help

- Administrative Law Assignment Help

- Enterprise Law Assignment Help

- Migration Law Assignment Help

- Communication Law Assignment Help

- Law and Ethics Assignment Help

- Consumer Law Assignment Help

- Science

- Biology

- Engineering

-

Humanities

- Humanities Assignment Help

- Sociology Assignment Help

- Philosophy Assignment Help

- English Assignment Help

- Geography Assignment Help

- Agroecology Assignment Help

- Psychology Assignment Help

- Social Science Assignment Help

- Public Relations Assignment Help

- Political Science Assignment Help

- Mass Communication Assignment Help

- History Assignment Help

- Cookery Assignment Help

- Auditing

- Mathematics

-

Economics

- Economics Assignment Help

- Managerial Economics Assignment Help

- Econometrics Assignment Help

- Microeconomics Assignment Help

- Business Economics Assignment Help

- Marketing Plan Assignment Help

- Demand Supply Assignment Help

- Comparative Analysis Assignment Help

- Health Economics Assignment Help

- Macroeconomics Assignment Help

- Political Economics Assignment Help

- International Economics Assignments Help

-

Academic Writing Services

-

Essay Writing

- Essay Help

- Essay Writing Help

- Essay Help Online

- Online Custom Essay Help

- Descriptive Essay Help

- Help With MBA Essays

- Essay Writing Service

- Essay Writer For Australia

- Essay Outline Help

- illustration Essay Help

- Response Essay Writing Help

- Professional Essay Writers

- Custom Essay Help

- English Essay Writing Help

- Essay Homework Help

- Literature Essay Help

- Scholarship Essay Help

- Research Essay Help

- History Essay Help

- MBA Essay Help

- Plagiarism Free Essays

- Writing Essay Papers

- Write My Essay Help

- Need Help Writing Essay

- Help Writing Scholarship Essay

- Help Writing a Narrative Essay

- Best Essay Writing Service Canada

-

Dissertation

- Biology Dissertation Help

- Academic Dissertation Help

- Nursing Dissertation Help

- Dissertation Help Online

- MATLAB Dissertation Help

- Doctoral Dissertation Help

- Geography Dissertation Help

- Architecture Dissertation Help

- Statistics Dissertation Help

- Sociology Dissertation Help

- English Dissertation Help

- Law Dissertation Help

- Dissertation Proofreading Services

- Cheap Dissertation Help

- Dissertation Writing Help

- Marketing Dissertation Help

- Programming

-

Case Study

- Write Case Study For Me

- Business Law Case Study Help

- Civil Law Case Study Help

- Marketing Case Study Help

- Nursing Case Study Help

- Case Study Writing Services

- History Case Study help

- Amazon Case Study Help

- Apple Case Study Help

- Case Study Assignment Help

- ZARA Case Study Assignment Help

- IKEA Case Study Assignment Help

- Zappos Case Study Assignment Help

- Tesla Case Study Assignment Help

- Flipkart Case Study Assignment Help

- Contract Law Case Study Assignments Help

- Business Ethics Case Study Assignment Help

- Nike SWOT Analysis Case Study Assignment Help

- Coursework

- Thesis Writing

- CDR

- Research

-

Assignment Writing

-

Resources

- Referencing Guidelines

-

Universities

-

Australia

- Asia Pacific International College Assignment Help

- Macquarie University Assignment Help

- Rhodes College Assignment Help

- APIC University Assignment Help

- Torrens University Assignment Help

- Kaplan University Assignment Help

- Holmes University Assignment Help

- Griffith University Assignment Help

- VIT University Assignment Help

- CQ University Assignment Help

-

Australia

- Experts

- Free Sample

- Testimonial

HI5020 Corporate Accounting Assignment Sample

Assessment Brief of Accounting for Corporate Income Tax - Theory and Applications

Purpose of the assessment:

This assignment aims at developing an understanding of students on different concepts of Accounting for Income tax and the application of those concepts in the practical financial setting.

In addition to answering theoretical questions on different concepts on accounting for income tax, students will need to analyses the tax related disclosures made by an ASX listed company in its financial statements and the associated notes to the financial statements. (ULO 1, 3, 4, 5).

Weight - 35 % of the total assessments (35 marks)

Total Marks - 35 % in written report

Word limit - 3000 words ±500 words

Due Date - Assignment submission: Final Submission of individual Assignment: Wednesday, Week 10, 11:59 pm Late submission incurs penalties of five (5) % of the assessment value per calendar day unless an extension and/or special consideration has been granted by the lecturer prior to the assessment deadline.

Submission Guidelines and Referencing

• All work must be submitted on Blackboard by the due date along with a completed Assignment Cover Page.

• The assignment must be in MS Word format, no spacing, 12-pt Arial font and 2 cm margins on all four sides of your page with appropriate section headings and page numbers.

• Reference sources must be cited in the text of the report, and listed appropriately at the end in a reference list using Harvard referencing style. The following guidelines apply for assignment help

1. Reference sources in assignments are limited to sources which provide full text access to the source’s content for lecturers and markers.

2. The Reference list should be located on a separate page at the end of the essay and titled: References.

3. It should include the details of all the in-text citations, arranged alphabetically A-Z by author surname. In addition, it MUST include a hyperlink to the full text of the cited reference source.

For example:

P Hawking, B McCarthy, A Stein (2004), Second Wave ERP Education, Journal of Information Systems Education, Fall, http://jise.org/Volume15/n3/JISEv15n3p327.pdf

4. All assignments will require additional in-text reference details which will consist of the surname of the author/authors or name of the authoring body, year of publication, page number of content, paragraph where the content can be found.

For example:

“The company decided to implement an enterprise wide data warehouse business intelligence strategies (Hawking et al, 2004, p3(4)).”

Non Adherence to Referencing Guidelines

Where students do not follow the above guidelines:

1. Students who submit assignments which do not comply with the guidelines will be asked to resubmit their assignments.

2. Late penalties will apply, as per the Student Handbook each day, after the student/s have been notified of the resubmission requirements.

3. Students who comply with guidelines and the citations are “fake” will be reported for academic misconduct.

Assignment Specifications

Purpose:

This assignment aims at developing an understanding of students on different concepts of Accounting for Income tax and the application of those concepts in the practical financial setting. In addition to answering theoretical questions on different concepts on accounting for income tax, students will need to analyses the tax related disclosures made by an ASX listed company in its financial statements and the associated notes to the financial statements.

Assessment task:

Please answer the following questions relating to Accounting for Corporate Income Tax.

Question 1: Why do deferred tax assets or deferred tax liabilities arise? Explain your answer with suitable example.

Question 2: Will the existence of unused tax losses always lead to the recognition of a deferred tax assets? Explain your answer with suitable example.

Question 3: Do the liabilities and assets that are generated by using the 'balance sheet method' of accounting for tax appear to be consistent with the definition and recognition criteria of assets and liabilities promulgated within the Conceptual Framework?

Question 4: Under what condition deferred tax assets can be offset against deferred tax liabilities?

Question 5: Critically examine the disclosures made by an Australian Securities Exchange (ASX) listed company in its latest financial statements and associated notes regarding income tax issues. While every company will have unique tax matters and position, your discussion should highlight the following:

(i) Identify the income tax expense (income) shown in the income statement. On what basis this amount has been calculated?

(ii) Deferred tax assets/liabilities shown in the balance sheet

(iii) A detailed explanation of what has been disclosed for Income tax in the Note associated with the financial statement.

(iv) Under what basis/assumptions deferred tax assets deferred tax liabilities have been recognized?

(v) What portion of the deferred tax assets or deferred tax liabilities have originated in the current year, and what portion relate to prior years?

(vi) Summarize the accounting policies and approaches used by the company in its accounting for Income Tax.

(You can select the company at your discretion. The company must be listed in the ASX)

Assignment Structure should be as the following:

Abstract - One paragraph

List of Content

Introduction

Body of the assignment with detailed answer on each of the required tasks

Summary/Conclusion

List of references

Solution

Introduction

This assignment is all about Deferred Tax Asset and Deferred Tax Liabilities, how they arise, how they are set off and on what basis is the calculation done.

It also, states about the accounting policies basis which an ASX Limited company takes up its Accounting of Income Taxes.

Question 1

An organisation prepares its books of accounts on the basis of various accounting standards (as may be applicable to it). While the same organisation prepares itself for tax computation, the same books of accounts need to be modified in line with the Tax laws applicable i.e. as per Income Tax Assessment Act 1986.

Many a times, situation arises wherein the carrying amount (i.e. amount in the books as per Accounting) of assets or liabilities do not match (i.e. are different) with its tax base (i.e. values appearing as per Taxation Laws), thereby amounting to differences. (Finley, Ribal ,2019, p 2, 86)

These differences may be temporary or other than temporary (also referred as permanent). The temporary differences lead to creation of deferred tax assets and/or liabilities. The difference which are other than temporary do not create any deferred tax asset/liability (DTA/DTL).

When talking about temporary differences, which are responsible for creation of deferred tax assets/liabilities, these differences are further classified into Taxable Temporary Difference and Deductible Temporary Difference.

Taxable temporary differences as the name suggests are the differences which ultimately result in additional taxable amounts in the coming years. These lead to creation of Deferred Tax Liabilities.

Deductible temporary differences are the differences which would result in reduction of taxable amounts in the future years. These lead to creation of Deferred Tax Assets. (Finley, Ribal, 2019, p 2, 86)

The same be explained further with the help of example that follows-

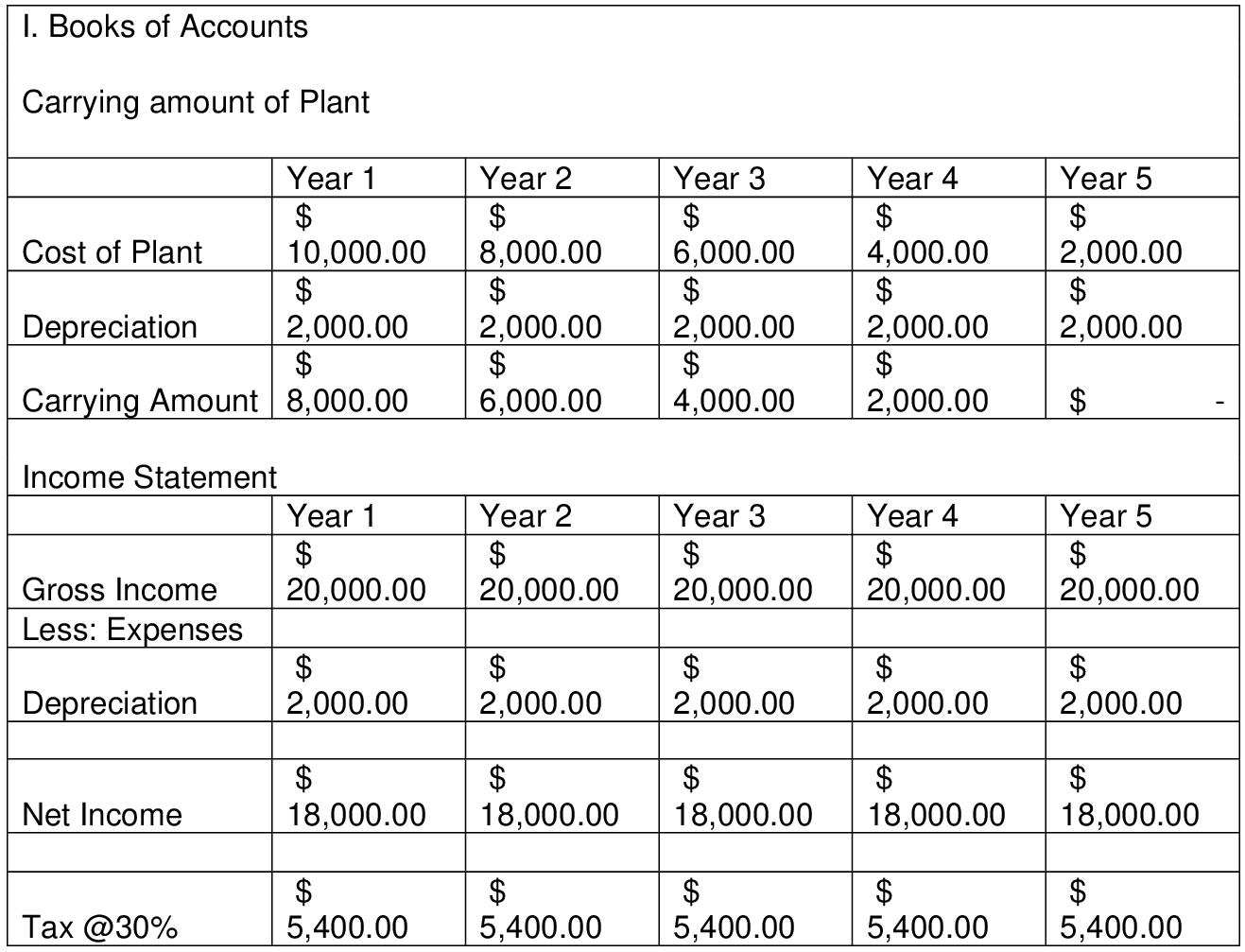

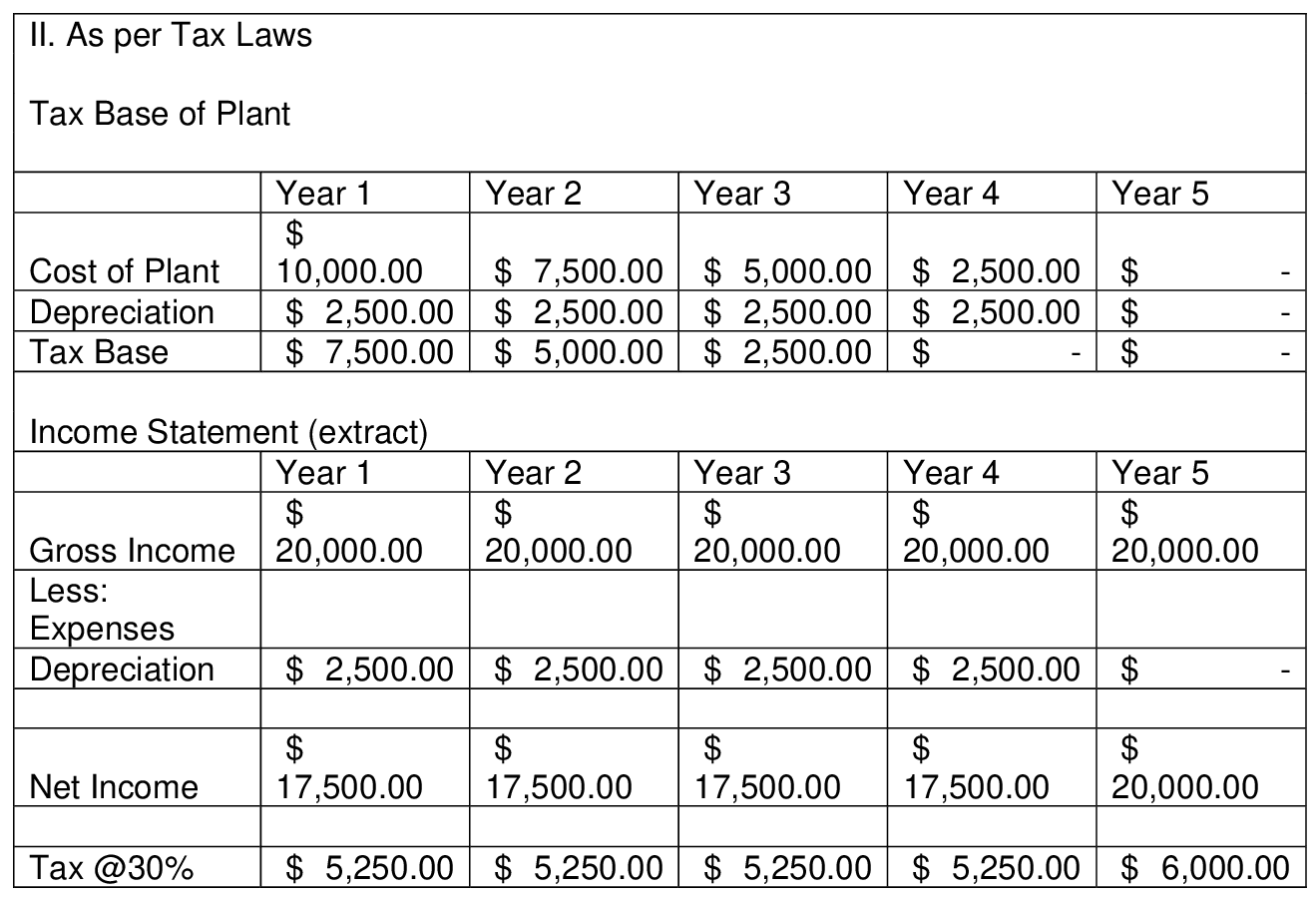

A company XYZ Limited has a plant (fixed asset) which has a cost of $10,000. The company writes off depreciation on the same @20% on SLM and the rate of tax as per Tax Laws is 25% SLM. Now we will see how it leads to creation of DTA/DTL. The applicable tax rate is 30%.

The differences in taxes from Year 1 to Year 4 is $150.00 each which appears to be tax saving bur actually is nothing but tax deferment as in Year 5 an amount of $600.00 is to be paid in excess (as per Tax Laws), that is we have created Deferred Tax Liabilities in the initial years.

As per Income Tax Assessment Act 1986, when we are paying fewer taxes (i.e. taxes as per Tax Laws are lower as compared to taxes as per Books) or we can see that value of an underlying asset has a carrying amount more than its tax base, it will lead to creation of deferred tax liability.

Question 2

The existence of unused tax losses does not necessarily need for recognition of deferred tax assets as per Income Tax Assessment Act 1986,.

DTA can be recognised in the same manner for unused tax losses as is done in DTA being recognised from deductible temporary differences. The main conditions which need to be checked before recognising DTA from unused tax losses are:

1. The entity willing to recognise DTA from some unused tax losses, is convinced

2. Also among other things, the period up to which unused tax losses can be carried forward is to be noted.

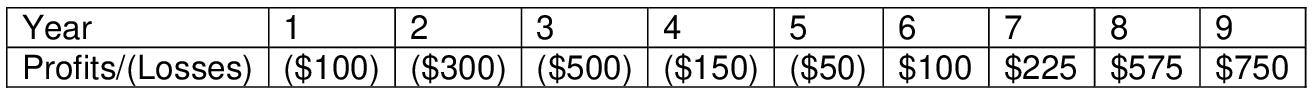

For example, let’s talk about a start-up which is HNL Limited, an organisation willing to penetrate the logistics market. Now, we take up some figures of profit and losses for the organisation

In the initial years i.e. up to Year 5, the company has incurred losses, a cumulative amount of $1100 M.

We will consider the following cases

Case 1: Unused tax losses can be carried forward for 3 years.

In this case, the loss incurred in Year 1 will be carried up to the 4th year, in year 2 up to the 5th Year and so on. Now the loss incurred in Year 1 and Year 2 will not create any DTA as the company does not have sufficient profits. However, for the next year i.e. Year 3 the unused loss of $500 will create DTA up to an extent of $100 as the probable profit in Year 6 is S100.

The balance $400 will lapse.

Case 2: Unused tax losses can be carried forward for 6 years.

In this case, the loss incurred in Year 1 will be carried up to the 7th year, in year 2 up to the 8th Year and so on. Therefore, the loss of $100 will create DTA of full amount as the company has sufficient profit within the time lines available for carrying of the unused losses.

Therefore, we can say that unused tax losses which can be carried forward to the future years and can result in tax saving in the future years will lead to creation of Deferred Tax Assets (DTA). But not all unused tax losses will lead to DTA creation.

Question 3

Conceptual framework is the process in which logical reasons have been taken into consideration for the purpose of detailed and complete understanding with respect to the selected areas. In the current scenario the selected area is deferred tax and the computation of the same. To compute deferred tax is a complex process and hence step by step need to go to arrive at the final payment of deferred tax. This process has been used in almost every field thereby giving a sense of satisfaction. It is necessary that the assets and liabilities which have been generated by using the balance sheet method for the purpose of tax accounting need to be consistent as per the definition and recognition criteria promulgated within the Conceptual framework. Further, deferred tax would be considered as an asset when the same has been paid in advance and deferred tax would be considered as a liability when the same has not been paid at per specified due date thereby creating liability for the organization (Sulistianingsih, 2019, p2, 80).

As per Income Tax Assessment Act 1986, deferred tax arises due to the existence of timing difference which means there is the difference of accounting with respect to taxation purpose and accounting purpose. For example, on the purchase of any asset the tax attracts 50% in the first and second year. However, while computing in the accounting the tax rate is different at the rate of 30% which is less than the above tax leads to which difference arise in the ultimate payment of tax. As per the taxation policy the company has paid 50% tax in the first year and for the same the company would be entitled to receive benefits in future year as a deferred tax asset. Such treatment of tax reduces the burden to pay tax from the company point of view. This process has given the option to the company to set off their tax which has been paid in advance as per the taxation policy. (Sulistianingsih, 2019, p2, 80) As the company has paid extra tax in the initial period the benefit of the same would be delivered in the future period accordingly. The same rule applies for the deferred tax liability also. However, the company has to follow ultimately the tax policy instead of accounting policy as the ultimate payment of tax has been computed as per the taxation norms which has been issued by the government of Australia.

Question 4

Deferred tax assets can be used to set off from the deferred tax liabilities of any particular entity. However, there are certain limitations that have to meet an entity to claim the same exemption. The limitations are as follows:

1. The DTA and DTL are related to taxes which are levied by a single authority of taxation. (Watson, 2018, p 2,83)

2. The DTA and DTL relate to taxes which are levied on the same taxable entity/organisation. The same can be allowed for different entities/organisations if they have an intention to set off their DTA and DTL on a net basis in the coming future period. (Watson, 2018, p 2,83)

For example, an organisation say RTG Limited, has recognised a deferred tax asset of $5000 and also a deferred tax liability is recognised amounting to $4750, both under the same Tax Laws. IN such a case, the company has a right to set off both DTA and DTL, thereby presenting a net amount i.e. $250 as deferred tax assets. “With the issuance of ASU No. 2015-17, the FASB (2015c) by its own admission abandoned the definition of current and noncurrent assets and liabilities in the authoritative literature and changed the proper presentation of those deferred tax items on the classified balance sheet.”(Morris,2017, p3, 2158)

Also, if there is a DTA recognised by RTG Limited under some tax laws amounting to $4500 and a subsidiary of RTG Limited named SUH Limited under the same tax laws has a DTL amounting to $5000. The holding company has the authority to offset DTA and DTL of the current period, as per Income Tax Assessment Act 1986.

Since, the DTA and DTL are related to same tax authority under same tax laws but do not relate to same taxable entity, it is the management which has to think and decide whether the DTA and DTL is to be settles by netting them or by realisation of both DTA and DTL concurrently.

Question 5

The company chosen here is Iluka Resources Limited. It is an international mineral sands company that deal in various activities such as exploration, project development, mining, processing, marketing and rehabilitation. The major focus of this company is to maximize shareholder’s wealth.

(i) The income tax expense of this company in the year 2020 is $95.5 m.

The calculation of current tax for the accounting period is done using the tax rates applicable and tax laws of the land as on the reporting date in the nations where the company operates and generates income that is taxable.

The income tax expense is the tax payable for the current year’s taxable income based on the applicable income tax rate for each jurisdiction which is first adjusted for changes in deferred tax assets and liabilities and to unused tax losses.

(ii) The net deferred tax asset for the year here is $28.4 m.

For the year 2020, Gross DTA is $191.6 m and the Gross DTL correspondingly is $163.2 m. The difference therefore, amounts to $28.4 m that is excess of Gross DTA over DTL.

(iii) In the notes to financial statement (Note 12) Income Tax, it is clearly states as to how the income tax expense has been calculated.IT mentions the rate at which IT has been calculated and also gives a comprehensive list of amounts not deductible while calculating the taxable income thus arriving at the Income tax expense, as per Income Tax Assessment Act 1986. As per the note, current year tax expense is $98.4m and deferred tax is ($3.1m), therefore, IT expense is $98.5 m after adjusting for under providing for $0.2m. The income tax expense can also be bifurcated based on profit from continuing and discontinued operation as $74.8 m and $20.7m totalling to $98.5m.

(iv) As mentioned in the notes, the carrying amount of DTA is reviewed at each balance sheet date and then adjusted by reducing to the extent which is not expected to be allowed to be utilised based on profit availability.

(v) The net deferred tax asset has seen an increase of $6.3 m amounting to $28.4 m in the year 2020 as compared to $22.1 m in the previous year. While we look further, we understand that the gross deferred tax assets have seen a surge of $15.9m due to an increase in temporary differences of employee provisions, other provisions and other factors, whereas lease liabilities and hedge reserve pulled down the DTA (Iluka Resources, p17(1)).

On the other hand, the gross deferred tax liabilities have also witnessed a growth of $9.6 m due to increase in temporary differences of property, plant and equipment, while the differences on account of inventory, receivables and other assets have dragged the growth of DTL.

(vi) The accounting policies and approaches that Iluka Resources Limited have used in preparation of its financial statements include the Australian Accounting Standards and Interpretations issued by Australian Accounting Standards Board. It has also considered International Financial Reporting Standards (IFRS), as and where applicable. The basic preparation has been done as per Historical Cost Convention. However, as required by Law, valuation has been done at fair value for the financial liabilities and assets, wherever applicable.

Conclusion

Here, in this assignment, the taxes, accounting of taxes and practical treatment of the DTA, DTL and income tax is taken up. The ASX company Iluka has all the conditions that were mentioned in the question that helped to check, learn and understand the practical application.

References

A Bakke, T R. Kubick, and M S. Wilkins (2020), Deferred Tax Asset Valuation Allowances and Auditors’ Going Concern Evaluations.https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3622505

A Edwards (2018), The Deferred Tax Asset valuation Allowance and Firm Creditworthiness, Journal of the American Taxation Association (2018) 40 (1): 57–80, https://meridian.allenpress.com/jata/article-abstract/40/1/57/60498/The-Deferred-Tax-Asset-Valuation-Allowance-and

A Finley, A Ribal (2019), The information content from Releases of the Deferred Tax Valuation Allowance, Journal of the American Taxation Association (2019) 41 (2): 83–101, https://meridian.allenpress.com/jata/article-abstract/41/2/83/10464/The-Information-Content-from-Releases-of-the

H Russ (2020), New Evidence on Investors’ Valuation of Deferred Tax Liabilities, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3304846

I A Nwaorgu, M C Abiahu, & J A Iormbagah (2019), Deferred Tax Accounting and Financial Performance: The Listed Agricultural Firms’ Perspective in Nigeria. In Dandago, K.I., Salawu, R.O., Akintoye, R.I. &Oyedokun,

G.E. (Eds.)https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3474769

Iluka Resouces Limited (2020), Annual Report, https://iluka.com/

J L Morris (2017), Classification of deferred tax assets and deferred tax liabilities: An evaluation of FASB’s Attempt at Standard Simplification. Journal of Accounting and Finance.17 (8), 2158-3625, http://www.na-businesspress.com/JAF/JAF17-8/MorrisJL_17_8_.pdf

L Watson, (2018), The Deferred Tax Asset Valuation Allowance and Firm creditworthiness, Journal of the American Taxation Association (2018) 40 (1): 81–85, https://meridian.allenpress.com/jata/article-abstract/40/1/81/60466/The-Deferred-Tax-Asset-Valuation-Allowance-and

R D P. Sulistianingsih (2019), How the effect of deferred tax expenses and tax planning on earning management? International Journal of Scientific and Technology Research, 8(2), 78-83,https://scholar.ui.ac.id/en/publications/how-the-effect-of-deferred-tax-expenses-and-tax-planning-on-earni

Download Samples PDF

Related Sample

- HCCSSD205 Social Justice Research Report 3

- MBA402 Governance Ethics and Sustainability Case Study 2

- BSBRES801 Initiate and Lead Applied Research Assignment

- ISYS1003 Cybersecurity Management

- BUSN20017 Effective Business Communication Assignment

- Describe the Working of a Full Adder Circuit Assignment

- HI5017 Managerial Accounting Assignment

- MGT5IPM International Project Management Case Study 1

- Data4400 Data Driven Decision Making and Forecasting IT Report

- MITS4004 IT Networking and Communication Assignment

- NRSG374 Principles of Nursing Assignment

- MN623 Cyber Security and Analytics Assignment

- CAM528 Introduction To Epidemiology Assignment

- HEAPH6007 Public Health Ethics Assignment

- Model Based Systems Engineering Report Sample

- Healthcare Systems Report

- ACCY962 Auditing and Risk Assurance Assignment

- MBA633 Real world Business Analytics and Management Assignment

- ICT102 Networking Report 3

- Analog Vs Digital Communication Essay Assignment

Assignment Services

-

Assignment Writing

-

Academic Writing Services

- HND Assignment Help

- SPSS Assignment Help

- College Assignment Help

- Writing Assignment for University

- Urgent Assignment Help

- Architecture Assignment Help

- Total Assignment Help

- All Assignment Help

- My Assignment Help

- Student Assignment Help

- Instant Assignment Help

- Cheap Assignment Help

- Global Assignment Help

- Write My Assignment

- Do My Assignment

- Solve My Assignment

- Make My Assignment

- Pay for Assignment Help

-

Management

- Management Assignment Help

- Business Management Assignment Help

- Financial Management Assignment Help

- Project Management Assignment Help

- Supply Chain Management Assignment Help

- Operations Management Assignment Help

- Risk Management Assignment Help

- Strategic Management Assignment Help

- Logistics Management Assignment Help

- Global Business Strategy Assignment Help

- Consumer Behavior Assignment Help

- MBA Assignment Help

- Portfolio Management Assignment Help

- Change Management Assignment Help

- Hospitality Management Assignment Help

- Healthcare Management Assignment Help

- Investment Management Assignment Help

- Market Analysis Assignment Help

- Corporate Strategy Assignment Help

- Conflict Management Assignment Help

- Marketing Management Assignment Help

- Strategic Marketing Assignment Help

- CRM Assignment Help

- Marketing Research Assignment Help

- Human Resource Assignment Help

- Business Assignment Help

- Business Development Assignment Help

- Business Statistics Assignment Help

- Business Ethics Assignment Help

- 4p of Marketing Assignment Help

- Pricing Strategy Assignment Help

- Nursing

-

Finance

- Finance Assignment Help

- Do My Finance Assignment For Me

- Financial Accounting Assignment Help

- Behavioral Finance Assignment Help

- Finance Planning Assignment Help

- Personal Finance Assignment Help

- Financial Services Assignment Help

- Forex Assignment Help

- Financial Statement Analysis Assignment Help

- Capital Budgeting Assignment Help

- Financial Reporting Assignment Help

- International Finance Assignment Help

- Business Finance Assignment Help

- Corporate Finance Assignment Help

-

Accounting

- Accounting Assignment Help

- Managerial Accounting Assignment Help

- Taxation Accounting Assignment Help

- Perdisco Assignment Help

- Solve My Accounting Paper

- Business Accounting Assignment Help

- Cost Accounting Assignment Help

- Taxation Assignment Help

- Activity Based Accounting Assignment Help

- Tax Accounting Assignment Help

- Financial Accounting Theory Assignment Help

-

Computer Science and IT

- Operating System Assignment Help

- Data mining Assignment Help

- Robotics Assignment Help

- Computer Network Assignment Help

- Database Assignment Help

- IT Management Assignment Help

- Network Topology Assignment Help

- Data Structure Assignment Help

- Business Intelligence Assignment Help

- Data Flow Diagram Assignment Help

- UML Diagram Assignment Help

- R Studio Assignment Help

-

Law

- Law Assignment Help

- Business Law Assignment Help

- Contract Law Assignment Help

- Tort Law Assignment Help

- Social Media Law Assignment Help

- Criminal Law Assignment Help

- Employment Law Assignment Help

- Taxation Law Assignment Help

- Commercial Law Assignment Help

- Constitutional Law Assignment Help

- Corporate Governance Law Assignment Help

- Environmental Law Assignment Help

- Criminology Assignment Help

- Company Law Assignment Help

- Human Rights Law Assignment Help

- Evidence Law Assignment Help

- Administrative Law Assignment Help

- Enterprise Law Assignment Help

- Migration Law Assignment Help

- Communication Law Assignment Help

- Law and Ethics Assignment Help

- Consumer Law Assignment Help

- Science

- Biology

- Engineering

-

Humanities

- Humanities Assignment Help

- Sociology Assignment Help

- Philosophy Assignment Help

- English Assignment Help

- Geography Assignment Help

- Agroecology Assignment Help

- Psychology Assignment Help

- Social Science Assignment Help

- Public Relations Assignment Help

- Political Science Assignment Help

- Mass Communication Assignment Help

- History Assignment Help

- Cookery Assignment Help

- Auditing

- Mathematics

-

Economics

- Economics Assignment Help

- Managerial Economics Assignment Help

- Econometrics Assignment Help

- Microeconomics Assignment Help

- Business Economics Assignment Help

- Marketing Plan Assignment Help

- Demand Supply Assignment Help

- Comparative Analysis Assignment Help

- Health Economics Assignment Help

- Macroeconomics Assignment Help

- Political Economics Assignment Help

- International Economics Assignments Help

-

Academic Writing Services

-

Essay Writing

- Essay Help

- Essay Writing Help

- Essay Help Online

- Online Custom Essay Help

- Descriptive Essay Help

- Help With MBA Essays

- Essay Writing Service

- Essay Writer For Australia

- Essay Outline Help

- illustration Essay Help

- Response Essay Writing Help

- Professional Essay Writers

- Custom Essay Help

- English Essay Writing Help

- Essay Homework Help

- Literature Essay Help

- Scholarship Essay Help

- Research Essay Help

- History Essay Help

- MBA Essay Help

- Plagiarism Free Essays

- Writing Essay Papers

- Write My Essay Help

- Need Help Writing Essay

- Help Writing Scholarship Essay

- Help Writing a Narrative Essay

- Best Essay Writing Service Canada

-

Dissertation

- Biology Dissertation Help

- Academic Dissertation Help

- Nursing Dissertation Help

- Dissertation Help Online

- MATLAB Dissertation Help

- Doctoral Dissertation Help

- Geography Dissertation Help

- Architecture Dissertation Help

- Statistics Dissertation Help

- Sociology Dissertation Help

- English Dissertation Help

- Law Dissertation Help

- Dissertation Proofreading Services

- Cheap Dissertation Help

- Dissertation Writing Help

- Marketing Dissertation Help

- Programming

-

Case Study

- Write Case Study For Me

- Business Law Case Study Help

- Civil Law Case Study Help

- Marketing Case Study Help

- Nursing Case Study Help

- Case Study Writing Services

- History Case Study help

- Amazon Case Study Help

- Apple Case Study Help

- Case Study Assignment Help

- ZARA Case Study Assignment Help

- IKEA Case Study Assignment Help

- Zappos Case Study Assignment Help

- Tesla Case Study Assignment Help

- Flipkart Case Study Assignment Help

- Contract Law Case Study Assignments Help

- Business Ethics Case Study Assignment Help

- Nike SWOT Analysis Case Study Assignment Help

- Coursework

- Thesis Writing

- CDR

- Research

.png)

~5.png)

.png)

~1.png)

.png)