LAW6001 Taxation Law Assessment 2 Sample

Task

Summary In response to the issues raised in the case study provided, research and develop a 2000-word tax advice that addresses (a) assessable income (b) allowable deductions (c) calculations of income/deductions and (d) your conclusions and recommendations. Please refer to the Task Instructions for details on how to complete this business law case study help.

Context This assessment assesses your research skills, your ability to synthesise an original piece of work to specific content requirements and your ability to produce a comprehensible piece of advice which addressing the client’s needs. It also assesses your written communication skills. The ability to deliver to a brief is an essential skill in the workplace. Clients may well approach advisors seeking a combination of specific information needs and advice on the tax implications of a particular arrangement in the Australian tax jurisdiction. It is therefore important to be able to identify all the issues presented by an arrangement and to think about the potential consequences of different approaches to addressing the client’s needs.

Task Instructions

• Your case study needs to identify and discuss the tax implications of the various issues raised.

• A report (word document, approx. 2,000 words) must be submitted for the calculations of the assessable income; allowable deductions and taxable income of the taxpayer including identifying and discussing them. E.g., how the amounts of income & deductions have been derived. If any receipts and payments are not assessable or deductible, the reasoning for non-inclusion of these in assessable income or deductions as per relevant legislation or cases.

• Critically analyse the following case study. With respect to each task:

• Review relevant case law and legislation (ITAA1936, ITAA1997)

• Apply the law to the facts of the case study

• Reach a conclusion/ give practical advice to your client.

• You will be assessed in accordance with the Assessment Rubric.

• This case study must be presented as an individual effort. The case study requires individual research. It is expected the student will survey the relevant literature, including decided cases, and select appropriate additional resources.

• Your case study assignment help is not just a list of answers. Your reasons for your conclusions and recommendations must be based on your research into the relevant cases and legislation.

• The format of the report should be a business report and using APA referencing style

Case Study:

Comprehensive Individual Tax Return Advice Question 1 On 17 July 2020, Ken Fong acquired a restaurant as a going concern, paying $850,000 for the land and buildings, plant and equipment and goodwill. Upon taking possession Ken realised that the plumbing and electrical systems required repairing. In August 2020 he spent $27,000 for the repairs so that the restaurant could open for business. Shortly after opening, the tiles in the kitchen cracked and fell off the walls. Ken had them replaced, restoring them to their original condition, costing $6,400. In November 2020 Ken decided to replace all the kitchen cooking equipment in order to reduce the likelihood of having to replace it in the future. The cost was $30,000. At the same time Ken entered into a contract to have the equipment regularly inspected and serviced. The contract fee was $1,500 per year. At that time, he also decided to pay a pest control company $2,000 a year to rid the restaurant of pests and ensure health and safety standards were maintained. In January 2021 a violent summer hail storm caused damage to the roof of the restaurant. Instead of making repairs, Ken decided to replace the entire roof along with the roofing insulation and ducted air conditioning. The roof replacement cost $32,000 and the insulation and air conditioning added another cost of $7,400. At that time Ken contracted builders to construct an additional room to cater for increased patronage. The cost of the addition was $26,800. Required With reference to relevant legislation and cases, advise Ken on the deductibility of the expenditure incurred on repairs and improvements to his restaurant in August 2020, November 2020 and January 2021.

Question 2

Maurice is an individual tax resident of Australia for tax purposes. He has the following assets:

• His home was acquired on 20 February 1989 for $140 000. The home was never used for any income producing purpose. The estimated market value of the house on 1 March 2018 is $310,000

• Shares in FUL Pty Ltd acquired on 10 April 1984 at a cost of $15 000.

• Furniture acquired on 20 May 2010 for $10,500.

• Yacht acquired on 9 July 2020 for $25,000

• Block of vacant land acquired on 20 June 1997 at a cost of $100 000. The estimated market value of the vacant block on 15 May 2021 is $475,000. Maurice subsequently sold the following assets during 2020-2021 (arm’s length transactions):

• His home was sold on 1 March 2021 for $325,000

• The FUL Shares were sold on 15 March 2021 for $19,000

• The furniture was sold on 1 May 2021 for $5,000

• The yacht was sold on 29 June 2021 for $37,000

• The block of vacant land was sold on 30 May 2021 for $465,000. Maurice also has a carry forward capital loss of $12,500 from the sale of an antique drumkit and a carry forward capital loss $5,000 from the sale of underperforming shares in an earlier income year. Maurice is not a share trader. Maurice has also incurred interest expenses on the vacant block of land of $110,000 over the time he owned the vacant block. He never used the vacant block for any income producing purpose. Required With reference to relevant legislation and cases calculate the net capital gain or loss as applicable for Maurice for the 2020/21 income year. You must show all possible methods to calculate capital gains (you must reference each step in the process to the relevant legislation. The numbers in the calculation will not be sufficient) and identify reasons why inclusion/exclusion of all capital gains tax assets

Solution

Question: 1:

Facts and Issues of The Case:

In the current case, the taxpayer has made various repairs and maintenance from time to time to the business organization, the taxpayer has spent some money on pre-starting of the business, during the course of the business, and after the business. Therefore the question in this context arises that whether the expense of the repairs is deductible against the income of the taxpayer or the expense of the repairs is not a deductible expense (Razak, 2020).

Legislation:

In the income tax assessment act, 1997 there are different provisions are there that allow the business expenditure as a general deduction or a special deduction. Any expense that is incurred by a taxpayer for the purpose to meet their repair expense is deductible from the gross income of the taxpayer to get the assessable income of the taxpayer. Tax ruling 97/23 (Mcgregor Lowndes & Crittall) it is clearly established that the tax deduction in case of repairs expense is not admissible if the expense of the repairs is of a capital nature. The assessable income of any person means the income on which the tax is calculated the gross income is income earned by the person (Weltman, & J.K. Lasser Institute 2018).

The different Para of the same ruling provides an explanation and difference between the repairs and improvements. According to the tax, the ruling repair is the expense that incurs by the business for the purpose of restoring the functional efficiency of the organization and on the other side, the improvement in the asset refers to those expenses that incur for the purpose of increasing the functional efficiency of the asset. The expense related to the improvement of the asset is the capital expense and therefore the expenses are called the capital expense and therefore those expenses are not allowed to deduct while calculating the assessable income from the gross income (Property investors benefit from 'repair' year-end deduction. 2017).

If any amount is expenses or incurred as initial repairs of the asset, that is the repair that incurs before bringing such asset into use then such repairs have a nature of the capital repairs and therefore such expense of capital repairs incur as an initial expense is not allowed as a deduction. If any damage, the defect has an existence at the time of acquisition of the asset than in such case the repairs incur for removal of such defect, the damage is considered as the capital nature repairs and therefore such expense is not allowable as a deduction. Any expense on repairs of the organization if incurred for the purpose of complying with the government bodies and government regulations than in such case the expense of repairs is of revenue nature and deduction with respect of such repairs expense is allowable to the organization.

Applicability:

Expenditure for the month of august

During the month of August, the taxpayer incurs two major expenses for the asset as repairs the description and allowability of such expenses are as follows-

(i) The taxpayer incurred $ 27000 On the political and plumbing expense of the asset such damages and defects of the property were in existence when the asset was acquired and also the damages result from the previous owner and not with the actions of the Taxpayer. Since the expense of $ 27000 is an initial repair expense therefore according to the applicable laws such expense should be capitalized as a part of the cost of the asset and depreciation is allowable thereof (Anonymous. 2020).

(ii) Expense of $ 6400 Incurred for wall and kitchen – such expense is a revenue expense because they are damaged with the act of taxpayer and this is a revenue expense and revenue repairs that are associated with the building and therefore such expense is not considered a capital expense and deduction with respect of the same is allowable.

Expenditure incurred for November 2020

During the month of November, the taxpayer has incurred three types of repairs expense those are as follows-

(i) In the current month the taxpayer has incurred the expense of $ 30000 for the replacement of the cooking equipment that will increase the efficiency of the operations of the organization, therefore such expense is not repaired they are called as improvement and therefore such expense is capitalized in the books of accounts and depreciation is allowed on the same.

(ii) $ 1500 has been paid for the equipment inspection, equipment inspection is a revenue nature expense and therefore it can be considered as the revenue expense and charged against the income of the business organization, and deduction si allowed of the same expense.

(iii) For a compilation of health and safety standards the restaurant must conduct a pest control for every year, therefore such expense is a type of revenue expense and deduction in respect of the pest control expense is allowable for the business (Batter, &Biscopink, 2019).

Expenditure in the month of January

In the month of January, two major expenses is incurred, $ 32000 is incurred for the purpose of replacement of the roof, replacement of the roof is a major expense of the organization. The expense is treated as an improvement and such expense is allowed to be added to the cost of the asset and proper depreciation has been charged on such asset.

Expenditure incurred for the purpose of construction of additional rooms are a type of improvement of the building. and therefore such expenses incurred for the purpose of construction of additional rooms are of a capital nature and deduction is not allowed for the same expense incurred for the purpose of construction of additional rooms.

Conclusion:

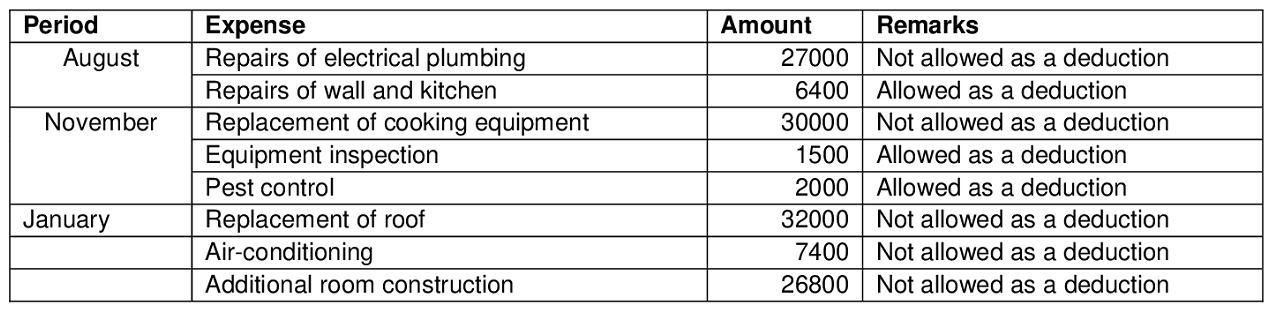

From the above discussion, it can be concluded that the following amount is considered as an allowable deduction or the following amount is not allowed as the allowable deduction

Question: 2:

Legislation related to the case:

Definition of capital Gains – Capital gains and capital losses are gains and losses that are arrived in the capital gain tax event of the capital gain assets, if during the capital gains event if consideration price of the capital asset is higher than the cost of the capital gain asset or the indexed price of the cost of the capital asset, on the other side of the cost of the asset or the index price of the cost of asset if higher than the consideration of the capital asset, than there will be a capital loss of the assets (Healy, 2017).

Any capital asset that is acquired before 20 September 1985 or specified under the exempted assets is not liable to be any Capital gains tax.

Steps to calculate the capital gain or loss- For the purpose of calculation of the capital gains tax, the capital gain or loss should be first calculated, there are different steps that must be followed for the purpose of calculation of the capital gain or loss from the capital asset-

Step 1: the identification of the fair value of consideration is the first step for calculation of the capital gains, in the case of sale the exchange amount is the FVOC, or in the case of an exchange, the fair value is considered as the fair value of the consideration.

Step 2: After identification of the consideration price of the asset, the second step for the purpose of calculation of the capital gain is to calculate the cost base of the asset. The cost base of the asset is derived by including the acquisition cost of the asset along with any indexation if required. For the assets acquired before 20 September 1999 the indexation method is applied for the purpose of increasing the cost base (Pattison-Gordon, 2017).

Step 3: After identifying the proceeds of the capital assets and identification of the cost base of the asset. The cost base of the asset is being deducted from the proceeds of the capital gain event the difference comes positive then it is considered as the capital gains and if in any other case of the difference comes to negative then it will be considered as the capital loss.

Step 4: For every capital gain event, the same process till step 3 is being followed.

Step 5: Combine the capital gains and capital losses of each capital gain asset sold during the tax period.

Step 6: Adjust the previous year's cumulative carried forward losses.

Step 7: The net capital gain is taxable at the applicable rate and if the net capital loss is there then it is forwarded to the future tax period for the purpose of adjustment in the future years.

Calculation:

In the current tax period, the taxpayer has sold various capital gains assets the treatment of the capital gain and the capital loss from the capital gains asset is as follows-

Capital gains / Loss from sale of the home - Home is covered under the exempted list of the assets to be sold therefore in case there is a sale of the home to the other person such sale is not liable for the capital gains tax.

Capital gains / Loss on sale of FUL shares – The taxpayer acquire the shares of the FUL shares before 20 September 1985, therefore such sale of shares are not covered in the capital gains and capital loss, and the capital gains and loss are not liable for such sale of FUL shares.

Capital gain / Loss on the furniture sale – The furniture in the current case is acquired in 2010 at a cost of $ 10500, the said furniture is being sold at $ 5000. As the asset is being used for private purposes and there is no depreciation on such asset, therefore, the capital loss in the current case is $ 10500 - $ 5000 = $ 5500.

Capital gain / Loss on Yacht – In the current case, the taxpayer held the Yacht, for less than 12 months therefore the indexation and 50 % deduction is not allowed, therefore the capital gain on the sale of yatch is as follows-

Proceeds from the Yacht = 37000

Cost base of the assets = 25000

Tax on sale of yacht = 12000

Capital gain/loss on sale of land –

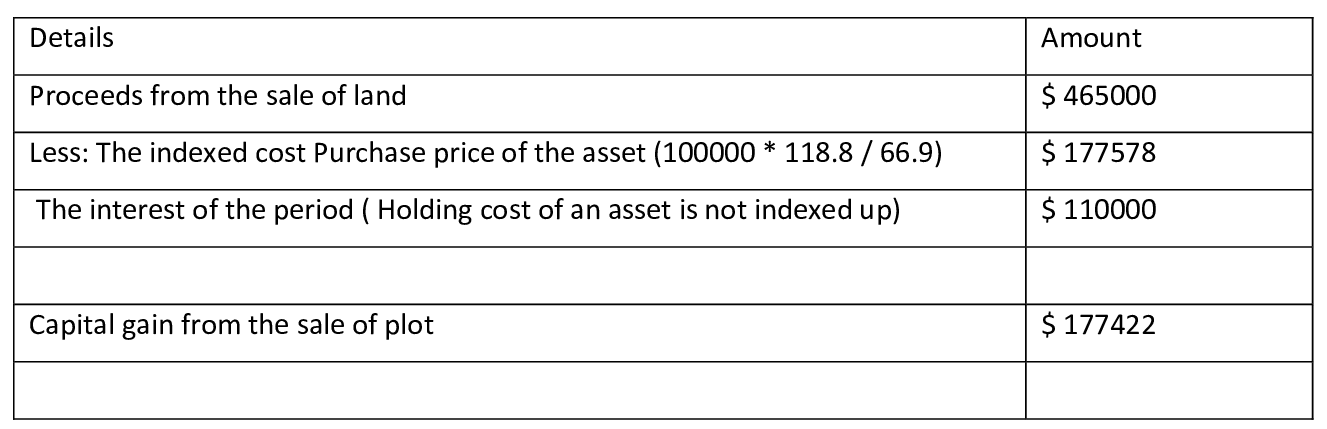

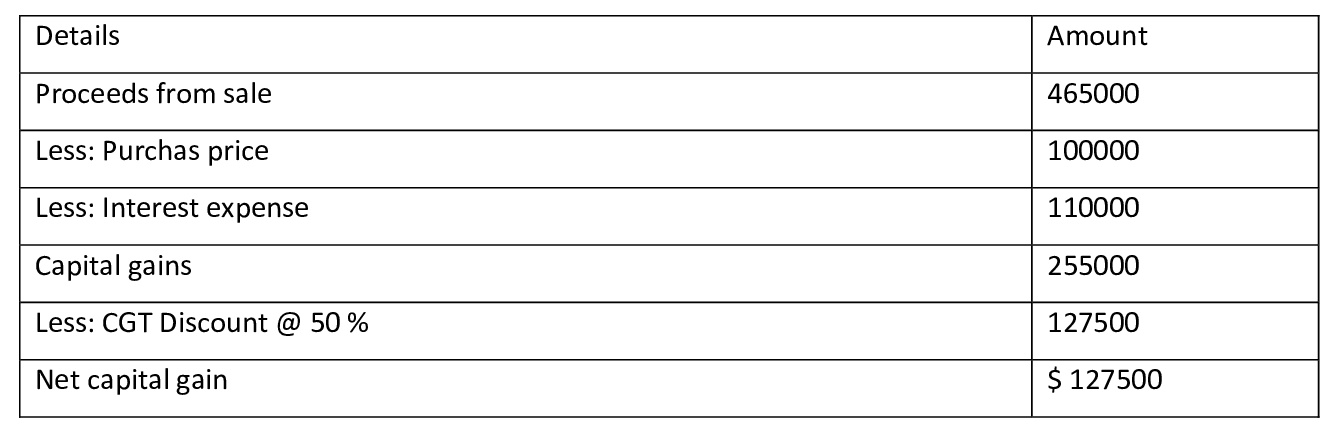

The taxpayer sold the block of land at a proceed of $ 465000, the cost price of the asset is $ 100000 and during the holding period of the asset, the taxpayer has incurred a cost of $ 110000. The capital gain on sale of a plot of land is as follows-

Capital gain as per indexation method

Capital gain as per 50 % CGT discount method

In the current case since the capital gain is less in the 50 % CGT discount scheme, therefore, taxpayer should adopt this scheme (Anonymous. 2019, pg 12(3)).

Capital gain / Loss from collectibles –

Loss of collectible will forward for future years and cannot be adjusted with other capital gains.

Previous year's capital loss of shares will be adjusted in a capital gain of the current year.

Net Taxable capital gains / Loss-

The net taxable capital gains / Loss is as follows- (5500) + 12000 + 127500 + (5000 )

= 129000

References

Anonymous. (2019). Arkansas: income tax: casualty loss deduction denied for failure to establish the pre-casualty fair market value of the real property. State Tax Review, 80(5), 2–3.https://lesa.on.worldcat.org/v2/oclc/7985344152

Anonymous. (2020). A renewed chance to revisit old assets for repairs and maintenance expenses. The Tax Adviser, 51(4), 236–237. https://lesa.on.worldcat.org/v2/oclc/8672699797

Batter, A., &Biscopink, E. (2019). Notice 2018-99 and the deduction disallowance for employer parking: the straw that broke the camel's back. Corporate Taxation, 46(3), 23–26.https://lesa.on.worldcat.org/v2/oclc/8181362429

Healy, B. (2017). Tax incentives for business owners. Businesses, 34(16), 37–57.https://lesa.on.worldcat.org/v2/oclc/7245418371

Pattison-Gordon, J. (2017). Millionaires' tax clears the legislature. The Boston Banner, 52(47), 1–7.https://lesa.on.worldcat.org/v2/oclc/8932426426

Property investors benefit from 'repair' year-end deduction. (2017). Spokesman-Review, E.2, 2.https://lesa.on.worldcat.org/v2/oclc/7250793193

Razak, S. H. A. (2020). Zakat and waqf as instrument of islamic wealth in poverty alleviation and redistribution. International Journal of Sociology and Social Policy, 40(3-4), 249–266. https://doi.org/10.1108/IJSSP-11-2018-0208

Weltman, B., & J.K. Lasser Institute. (2018). J.k. lasser's small business taxes 2018 : your complete guide to a better bottom line. John Wiley & Sons. Retrieved October 20, 2021.https://lesa.on.worldcat.org/v2/oclc/1012132648

LAW6000 Business and Corporate Law Assignment 2 Sample

Assignment Brief

Length: 2000 words +/- 10%

Learning Outcomes

This assessment addresses the following subject learning outcomes:

a) Demonstrate a sound comprehension of the essential elements required to create, manage and discharge a contract and assess the remedies available for breach of a contract;

b) Examine legal principles related to the creation and operation of various forms of business organizations and critically evaluate their effectiveness across a range of business scenarios.

c) Explain the processes for incorporating, managing, and winding up a company, including key director duties, the importance of the Corporations Act 2001, and the role of regulatory bodies.

d) Evaluate the role of agency in contract formation for different business vehicles and identify the associatecd risks such as vicarious liability for negligent acts.

e) Employ legal skills (statute law and case law), critical reasoning, and make informed judgments as to likely legal outcomes of a range of business scenarios.

By 11:55 pm AEST/AEDT Sunday of Week 9 (Module 5.2)

Weighting: 25%

Total Marks: 100 marks

Context:

This assessment allows students to solve practical problems that arise from a fact scenario and to give appropriate advice to clients.

Instructions:

There are five case studies for case study assignment help you are required to critically analyse. With respect to each case study:

? Identify the legal issue(s) arising from the facts of the casestudy

? Identify the appropriate legal rules that requires discussion in the case study

? Apply the law to the facts of the case study

? Reach a conclusion/ give practical advice to your client.

Your analysis should refer to appropriate cases and statutes and be referenced using the APA

Reference system.

Submission is through SafeAssign by 11.55 AEST Sunday of Week 9 of the relevant trimester

Question 1 (20 marks)

James has recently decided to open up a consultancy business near the city. He has identified appropriate premises and immediately gets into negotiation with Bradley, the landlord. He wishes to lease the commercial property for a period of five years. James proposes to demolish some of the interior walls to allow for better lighting and to then fit out the space to suit the modern image that he desires for his business. James and Bradley agree that the work would be completed in one month. It is agreed that once a lease agreement is signed James can commence the work in preparation to move into the premises.

James signs his part of the agreement and sends it to the offices of Bradley’s solicitors. He then commences the work to demolish the walls and fit out the premises. Three weeks later as James was about to complete the fit out of the premises, he learns that Bradley has yet to sign the agreement and has in fact entered into negotiations with Simon with a view to leasing the premises to Simon.

James has completed a substantial amount of work and is preparing to move in. He has in fact printed all his stationery. He approaches Bradley who says that there was in fact no contract and that he is likely to lease the premises to Simon. James is distraught and seeks your advice.

REQUIRED:

With reference to relevant legal principles, use the IRAC legal problem-solving approach to advise James on whether he is able to enforce the agreement with Bradley and the remedies that may be available to him.

Use appropriate case law in support of your answer.

(20 marks)

Question 2 (20 marks)

Elizabeth is a major shareholder in Millennial-Relics Pty Ltd. Elizabeth and has noted that the company maintains the old-fashioned ‘memorandum of association’ which has been prepared for Millennial Relics Pty Ltd.

The objects clause as drafted, limits the objects of the company to the development, manufacture and sale of motor vehicle batteries. Elizabeth believes that the research work that Rahim is doing (and future technology which may be developed as the full implications of Rahim’s work are realized) may have spin- offs into a number of related areas including dynamos for driver-less electric cars.

Elizabeth has spotted an opportunity that may allow the company to enter into a contract with like-minded companies for the development of state of the art dynamos that will be compatible with all types of electric cars. She is however concerned that the narrowness of the ‘memorandum’ may hamper the company’s ability to move into the emerging lucrative area and also the development and commercial exploitation of the dynamos which the company’s ongoing research may uncover may not be pursued lawfully.

Elizabeth has read that there is no legal reason to have a memorandum or articles, even if they are now called a corporate constitution. The company’s research may also expose potentially exploitable products or secret processes in other areas related to artificial intelligence. When Elizabeth raised these concerns with the company’s other shareholders, they told her that they had been advised by the lawyers that this was the standard form for their companies, and that there was no cause for concern. Elizabeth is not convinced.

REQUIRED:

With reference to relevant legal principles use the IRAC legal problem-solving approach to advise Elizabeth of the company’s position regarding any new contracts that it may enter in connection with the development of dynamos for driver-less electric cars and also explain how the replaceable rules may be of use to the company in the future. (20 marks)

Question 3 (20 marks)

In December 2020 Greg Napole was driving along a busy street with his spouse and two children in the car.

As they approached a busier section of the road Greg had to slow down significantly and as he was driving past a nearby park, a southern blue gum tree fell onto the car that he was driving killing wife Marsha and seriously injuring his two children and himself. Greg and his two children were hospitalised for two months with several broken bones. Upon recovery, Greg learnt that the tree had fallen because its root system had been destroyed by underground water leaking from a water channel that had been constructed by the local council, City of Small-town Council, in the year 1998. Greg is keen to have the council compensate him for the injuries he and his children have suffered and for the loss of his wife.

The local council has denied liability. They claim not to have a duty of care to Greg and his family. Greg wishes to pursue his claim and has now come to you for advice.

REQUIRED:

With reference to relevant legal principles use the IRAC legal problem-solving approach to advise Greg as to

whether he would be successful in negligence against City of Small-town Council. Please explain fully, using relevant case law. (20 marks)

Question 4 (20 marks)

Jaswant and his two friends, Davinder and Lachlan have been in a partnership for the last three years. Their business has grown and they now wish to expand into other states and territories. Their other friend Nicholas is a solicitor and he advises them to incorporate their business under the Corporations Act 2001 (Cth) to take advantage of the principle of separate legal entity and to allow them to trade in any state without having to comply with local partnership legislation. Jaswant, Davinder and Lachlan have brought in some of their own assets into the business and their partnership agreement specifically states that the assets will remain their individual property. They are concerned that they may not be able to do this after incorporation. They are also concerned about whether they will be able to contract with the company for the provision of some of the services the national business will be delivering. They each have specialist skills and are hoping to be remunerated by the business for their skills.

The three friends have also agreed to appoint Nicholas as the company solicitor and would be the only solicitor used by the company. This would be set out in the constitution that Nicholas would draw for the company. Lachlan is however concerned that if their relationship with Nicholas becomes strained, it may be difficult to use another solicitor if he chooses to enforce the constitution. Lachlan now approaches you for advice.

REQUIRED:

With reference to relevant sections of the Corporations Act 2001 (Cth) and appropriate case law, use the IRAC legal problem-solving approach to advise Lachlan of the effect and consequences of converting their partnership into a company and further whether Lachlan would be able to enforce the envisaged constitution if they wanted to use a different solicitor. (20 Marks)

Question 5 (20 marks)

Rahab is an executive working for a large pharmaceutical company which has recently transferred her to an overseas branch to manage the roll out of a global vaccine. She decides to leave the apartment Where she lives and to put her household goods in storage. She contacts a company known as KingStore Pty Ltd, Which specialises in the storage of goods. The company agrees to store Rahab’s goods for the period she will be away.

Before signing the contract of storage, Rahab asks about the condition of the building in which her goods will be stored. She has heard about recent floods in the state and just wants to be sure that her be safe. The company manager replies: “Our building is in excellent condition. We built it only two years ago and we used the best building materials. Your goods are safe with us.”

Rahab decides to enter into a written contract with the company and stores her goods with them. The contract which she signs does not, however, say anything about the condition of the building, nor does it make any reference to the other statements made to Rahab by the company manager concerning the quality of the building materials.

Some months later, the company telephones Rahab at her new place of work and advises her that her goods have been badly damaged due to recent heavy rainfall which caused water to enter the building in which Rahab’s goods have been stored, and to damage them. The reason for the entry of the water into the building is that the building was badly built and poor building materials were used. As a result, the building’s foundations sank when the heavy rainfall fell, thereby causing a large gap between the bottom of the doors to the building and the floor of the building where the goods were stored.

Rahab now wants to sue the KingStore Pty Ltd for the loss she has incurred as a result of the damage to her goods.

REQUIRED:

With reference to relevant legal principles use the IRAC legal problem-solving approach to advise Rahab

Of her legal position at common law against the storage company and discuss what remedies would

flow from them. Give full reasons and use any relevant case law. Do not consider any statutory rights.

Solution

Question 1

Issue

Whether James can enforce the agreement entered with Bradley. If yes, then what are the remedies that can be availed by the James?

Rule

In Australia, in order to formulate a legal binding contract there must be presence of all the contract essentials which includes an offer, an acceptance, a consideration, the legal intention of the parties and the legal capacity of the parties. When there is a valid contract, then, the parties must comply with the contractual terms (Wong, 2017).

Now, at times an agreement is established between the parties which is subject to the formation of some formal contract. At times one party to the contract signs the agreement but the other party did not do so and decides to finalise the contract at some future time or date. In Masters v Cameron (1954) it was held that if the intention of the parties portrays that they wish to abide by the terms of the agreement, then, it makes no difference whether a formal contract is prepared or to be prepared at some future date or that the agreement would be signed at some later event. As per Baulkham Hills Private Hospital Pty Ltd v GR Securities Pty Ltd (1986) in such situations, there is a valid contract amid the parties irrespective of the fact whether a final draft is executed by the parties or not. If there is lack of intention, then there is no contract amid the parties. (Tolhurst, 2011)

Application

James wants to take on lease the premises of Bradley for five years. James and Bradley agreed that once the lease is signed amid the two then James is permitted to carry out the repair work within the premises which would take a month to complete and then move into the premises. James signs his part of the agreement and sends the same to the solicitors of Bradley, however, the same was not signed by Bradley. James commences the work and after three weeks he learns that Bradley is not willing to sign the agreement with him, rather, he is in negotiations with Simon.

It is submitted that by applying Masters v Cameron, the intention of both James and Bradley depicts that they intend to enter into a contract immediately as James was permitted to carry out the work at the premises and can then enter the vicinity. Also, James has signed the document and had completed his part of the obligation of the contract. Thus, the head of the agreement is intended to be abide by both the parties and thus Bradley cannot deny the enforceability of the contract amid James and Bradley.

Conclusion

It is thus concluded that there is a binding contract that exists amid James and Bradley and if Bradley did not abide by the agreement, then, it is considered as a breach of contract and James is liable to seek the expenses incurred by him for the repairs and compensation and damages for the stationery.

Question 2

Issue

Whether Elizabeth can enter into contracts which are beyond the object clause of the constitution of the company? How replaceable rules can be used in future?

Rule

Salomon v A Salomon & Co Ltd [1896] when any company is incorporated, then, the same acquires the status of a separate legal entity, that is the acts of the company are considered its own acts and the officers are not held liable for the same. In common law, as per Ashbury Railway Carriage & Iron Co v Riche (1875) the acts which are beyond the objects or powers of the company are held to be ultra-virus and thus not enforceable. However, as per section 125 of the Corporation Act 2001, no act by the company can be termed as ultra-virus even when the same is beyond the powers (object) of the company.Further, if there is no constitution, then, as per section 135 of the Act, the company can be run by the replaceable rules set under section 141 of the Act.

Application

As per the facts, Millennial-Relics Pty Ltd is a company in which Elizabeth is the major shareholder. The company follows its Memorandum of association. The object clause of the company only permits the company to the ‘development, manufacture and sale of motor vehicle batteries’. Elizabeth wants to expand the operations of the business to dynamos of driver less electric cars upon which Rahim is doing research but is restrained by the object clause.

It is submitted that if Elizabeth enters into contracts that are beyond the object clause, then, such contracts are not invalid as per section 125 of the Act 2001 and the company must honour the same.

Elizabeth can rely on the replaceable rules made part of section 141 of the Act to run the company in future.

Conclusion

It is concluded that even if Elizabeth enters into the contract that is beyond the object clause, still such contracts will held to be valid in the eyes of law.

Question 3

Issue

Whether the local council can be held negligent for the losses caused to Greg and his family?

Rule

When any defendant undertakes any acts or omission, then, he must make sure that no loss is caused to the plaintiff provided the plaintiff is his neighbour. To make any defendant negligent the main elements are:

i. The defendant is under duty to provide care to every plaintiff with whom he is sharing proximate relationship and who is reasonably foreseeable. The defendant must make sure that no harm of any kind should be caused to the plaintiff because of his acts and omissions;

ii. That if the duty of care is not comply with by the defendant, then the duty is held to be breached (Palsgraf v. Long Island Railroad Co);

iii. It is necessary that because of the breach, there should be some harm caused to the plaintiff which is not remote and which is caused because of the acts of the defendant (Home Office v Dorset Yacht Co Ltd [1970].

Application

Greg Napole was driving along a busy street along with his spouse and 2 children in December 2020. While he was driving one tree fell on the car killing his wife and causing injuries to him and his children. They took medical aid for 2 months.It is submitted that the local council can be held negligent because:

i. It is the duty of the local council to ensure that any acts that are undertaken by them should not cause any kind of harm to any person who are their neighbours.

It is submitted that Greg was a person who was using the road like any other travellers and the local council is aware of the same. Thus, Greg and local council are neighbours of each other and Greg is reasonably foreseeable. Thus, Local council owns the duty of care towards Greg and any person who was travelling with him;

ii. The duty of care was not complied with by the council as the tree that was fallen on the car of Greg was because of root system of the tree was destroyed because of the water leaking from the Channel that was constructed by the local council. Thus, the level of care that must be taken by the council was met while making the Channel. There was breach of duty of care.

iii. The loss that is caused to Greg was because of the breach on the part of council and the loss is not remote in nature.

It is thus stated that the local council is negligent towards Greg and his family and the council must compensate Greg for the losses so caused to him.

Conclusion

The council is negligent towards Greg and his family and thus must compensate for the losses so caused to him.

Question 4

Issue

Advice Lachlan of the effect and consequences of converting the partnership into a company?Whether Lachlan would be enforcing the constitution if they wish to use a different solicitor?

Rule

As per section 124 of the Corporation Act 2001, upon incorporation, a company has all the powers that of an individual including the power to make contracts.

Application

Jaswant and his friends, Davinder and Lachlan are sharing partnership relationship from past 3 years. If a company is established then:

The main effects of a company

i. The main effect is that the company will become a separate legal entity, that is, the acts of the company will be considered to be its sole acts and no officer will be held personally liable for the same (Shum, 1991).

So, if the three friends operates a company, then the actions taken by them will be on behalf of the company and they will not be held personally liable for the same.

ii. Since the company will be a separate legal entity thus it has the potential to enter into contractual relationships and thus itscan contract for the services of the national business.

iii. Since all the three have special skills, thus, they can be employed by the company and will be reimbursed by way of salary by the company.

iv. Nicholas can be appointed as the solicitor of the company by entering into a contract of employment.

The main consequences of a company

i. If the three friends establish a company, then, the assets that are brought by them in the business will become the property of the company and will be used to settle the liabilities at the time of winding up. Thus, they cannot treat the property as their own.

ii. The company has to pay taxes which will be ultimately borne by the officers;

iii. There are lots of paper work and time consuming in the formation of the company.

Conclusion

It is thus concluded that establishing a company will benefit the friends as the company will be a separate legal entity and has perpetual succession. The company can make contract but it will be lots of money and time that will be invested in its formation. Also, if Nicholas is appointed as lawyer then he will be an employee and he can be removed by terminating the contract of employment.

Question 5

Issue

Whether Rahab will be able to sue the King Store Pty Ltd for the losses so caused to him because of the damage of the goods by rainfall?

Rule

In common law, if any one party to the contract makes a false statement with the intention that the other party enters into a contract with him, then, the contract suffers from misrepresentation and is not enforceable by law. Any aggrieved party has the right to terminate the contract and sue the other party for damages as the contract was based on misrepresentation (Beever, 2007).

Application

Rahab was transferred to an overseas branch to deal with the roll out of a global vaccine. She left her house and put the goods in storage of a company King store Pty Ltd. The company specializes in storage and assured Rahab that their building is excellent and was built 2 years ago and is made with the best building material. That the goods will be safe with them.

Rahab decided to store the goods, however, nothing regarding the promises made by the company was mentioned in the contract. After few months, the company informed Rahab that the goods so stored were damages because of the heavy rain. The reason for the damage was that the building was badly built with poor quality material.

It is submitted that when the contract was made then the company knowingly made a representation that the building wasw made with a good quality material which in fact was not true. The false statement was made with the intention that Rahab enters into a contract with them and thus there was a misrepresentation made on the part of the company towards Rahab (Ciro et al., 2019).

So, Rahab can terminate the contract and seek damages.

Conclusion

It is thus concluded that Rahab can sue the company and seek damages for the losses so caused as the contract that was made amid them was based on misrepresentation.

Bibliography

Books/Articles/Journals

Beever, A. (2007). Rediscovering the law of negligence. Hart. https://lesa.on.worldcat.org/oclc/496273579

Ciro, T., Goldwasser, V., & Verma, R. (2019). Law and business ebook (5th ed.). Oxford University Press Australia. https://ebookcentral-proquest-com.torrens.idm.oclc.org/lib/think/reader.action?docID=5979408&ppg=1

Shum, C. (1991). Business associations : an introduction to agency, partnership and company law (2nd ed., Ser. Hku press law series). Hong Kong University Press. https://lesa.on.worldcat.org/oclc/650877514

Tolhurst, G. J., Carter, J. W., &Peden, E. (2011). 'masters v cameron' - again! Victoria University of Wellington Law Review, 42(1), 49–64.https://lesa.on.worldcat.org/oclc/4822652359

Wong, A. (2017). Company law. (E. Chapple, Ed.) (First). Wiley. https://lesa.on.worldcat.org/oclc/1040039461

Case laws

Ashbury Railway Carriage & Iron Co v Riche (1875) L.R. 7 H.L. 635

Baulkham Hills Private Hospital Pty Ltd v GR Securities Pty Ltd (1986) 40 NSWLR 622 (SC).

Donoghue v Stevenson [1932] UKHL 100;

Home Office v Dorset Yacht Co Ltd [1970] UKHL 2, [1970] AC 1004

Masters v Cameron (1954) 91 CLR 353.

Palsgraf v. Long Island Railroad Co., 248 N.Y. 339, 162 N.E. 99

Salomon v A Salomon & Co Ltd [1896] UKHL 1.

BUS1006 Business Law Assignment Sample

Assignment Brief

Due date: Week 7

Group/individual: Individual

Word count/Time provided: 2500 words

Weighting: 30%

Unit Learning Outcomes: ULO4 & ULO5

Assessment 2

Students must search Australian legal databases and find a court decision that has been decided over the past few years. The court decision must be on legal issues that arise on contract law. Once you have chosen a relevant court decision, you must critically review the decision. In critically reviewing the decisions, you must address the following points:

- Summarise the facts of the case for assignment help

- Identify the legal issues

- Analyse the applicable laws and discuss the relevant aspects of contract law which are applied on the case.

- Critically review the decisions

Apart from critically reviewing the court decisions, students are required to do a literature review on the relevant contract law principles or rules. In that, an in-depth discussion must be included on the meaning, scope, and application of the relevant aspects of contract law.

Solution

Introduction

The criteria of Contract Law are mainly defined as the agreement between two individuals, people and businesses. If someone doesn't follow the agreement, then it is definitely termed as a breach of contract in the negotiation of legal terms legislations. The criteria of contract law also help to exchange major promises between two people in order to manage the affordability of obligations recognised by the enforced laws in a very optimised manner. In this study, a specific Australian court decision will be selected based on the legal issues of contract law. The selected court decision for this study is the High Court of Australia Bulletin [2021] HCAB 5 and it is significantly related to the execution of contract law based on the decision of anti-tendency direction.

Literature review on relevant contract law

Concept and scope of contract law

The idea of contract law is significantly referred to as the passing of unique promises between two or more individuals by following the rules and norms of legal entities in a very reliable and viable manner. The implication of contractual legal entities can easily follow the agreement between new sponsored business partners in a very reliable and viable manner. The major laws used in this specific case study mainly include constitutional law, criminal law and industrial law based on the implication of the High Court of Australia Bulletin (Amigud and Dawson, 2019). The accommodation of industrial law is mainly based on the agreement of enterprises that can be very useful to viably detect serious misconduct of code through the help of certain disciplinary actions in a more meaningful and viable manner. In industrial law, the breach code can be easily identified with the validity of breach of conduct through the help of new business knowledge based on cases of contravened EA in early intervals of time (Awdry and Newton, 2019). In the context of industrial contract law, the respondents are significantly required to append for the proceedings of federal circuits that mainly deals with the valid implication of sources based on the proper conduction of legal codes and authorities in a very suitable manner. According to the actions of Industrial Law in the given case study, almost 56% of casual employees are required to be resituated based on the satisfaction of leave entitlements with the valid negotiations of Fair Work Regulations At of 2009.

Principles of Contract Law

In the country of Australia, the optimum intention for the development of legal relations can be easily confined with the help of valid contract law. Meanwhile, the four major principles of contract law in Australia are Acceptance, Legal Obligation, Meaning and Elements (Bretag, 2019). In contract law, the criteria of acceptance deliberately occur when one party mainly attends the quality of the other party based on the implication of a new research plan and tactics on a reliable basis. The overall optimisation of compliance also helps to generate new amounts of money with the integration of authentic business systems that can be functionally categorised through the growth of new business management systems on a daily basis. The acceptance of a reliable contractual agreement will be done based on the negotiation of agreement papers by following the implications of rules and legal items for future prospects.

The major principle of contract law can also be used to measure the reliability of the concept of return on benefits. On the other hand, the criteria of legal obligations are mainly defined as those duties in which each party is legally contracted with the agreement of sources based on the money of products and exchanges for future activities. On both sides, the implication of legal obligations is required to be disputed through the exchange of productive tools and agreements by following the laws of the Australian government (Crosweller and Tschakert, 2021). The connections of major exchanges can also be easily deliberated by following the mandatory legal actions based on the implications of a lawful basis.

On the contrary, the meaning in contract law is mainly defined as the simplest definition of planning that can be used to functionally result in the requirements of legal access to a person based on the valid execution of mutual assent of disputes in a very predominant and reliable manner. Furthermore, the elements in contract law of Australia are mainly known to be mutual assent and consideration that can be used to viably implicate the authorisation of resources in a very reliable and viable manner with the implication of new business resources and tactics on a formal basis in the future (de Rochefort-Reynolds, 2020). According to this given case study, the major case laws used in terms of the negotiation between two parties in terms of contract mainly include Palmer v the State of Western Australia, Edwards v The Queen, Deputy commissioner of taxation v Shi and Hamilton v The Queen (Draper and Newton, 2017). In this given case study, the implication of industrial law is suitably based on the limited validation of enterprise agreement through which the prosperity of the legal code of conduct can be easily determined in the future. The reliability of new business tools and deliberations can also be judged based on the valid stability of business respondents in order to manage the special working holiday tax rate whose value is up to $3986 AUD.

Applications of Contract Law

The application of contract law is that it viably helps to exchange the authorisation of economic goods and services in the country of Australia. This law also helps to deal with the negotiation of sponsored partners that helps to mitigate the breach of the contract throughout the authorised meetings of minds by elongating the terms of the contract in the future. Meanwhile, the validity of legal documents is another application of contract law that deals with the implication of source based on the capacity as well as the viable legality of systems in a very suitable manner (Feinerman, 2019). According to the given case study, the main application for the perseverance of contract law is Immigration.

The criteria of immigration mainly help to implement the criteria of non-refoulment obligations in which granted refugee and humanitarian can also be negotiated through the execution of Global Special Humanitarian based on the implication of 12 months of imprisonment for the breach of contract in Australian subcontinents. As per the given case study, the other application of Australian contract law is the delegation of plaintiff procedural fairness under the valid assumption of the Mitigation Act (Harpur, 2018). This law is only applied after the decisions made by the constitution of the ministry for the optimum integration of large business resources in the future. Moreover, the valid applications of authorised contractual agreements can be negotiated through the help of non-revocation decisions made with the validity of pursuant to s 501CA (4).

Summarise the facts of the case

The case study named High Court of Australia Bulletins is mainly focussing on the implication of Australian contractual cases that are being decided and reserved for the purpose of judgement. This particular case study also provides valid information about the Court’s Original Jurisdiction by mainly granting a special and predominant leave to appeal based on proceedings and vacated in a very reliable and viable manner (Hemming and Daniel, 2018). In this case study, major laws that are being discussed mainly include constitutional law, immigration law, criminal law and industrial laws of Australia. In the study, the description of hand down cases by the High Court of Australia in June 2021 based on the association of legal terms and laws has also been provided. Moreover, this particular case also summarises the facts of aliens, deportation, duty to remove, vesting of judicial power and false imprisonment. In this case study, the idea of breach of contract in Australian legislation has also been provided that mainly helps to grant visas limited by implications in the future.

This study also provides a brief description of the case law named Commonwealth of Australia v AJL20. This particular case study also summarizes the facts of constitutional laws that are being implied by the freedom of communications on the behalf of foreign principal activities on the provision of a legitimate purpose in order to determine the breach of contract in the future (Hile, 2021). According to Migration Act 1958, the removal of the concerns of non-citizens in Australian residents can be widely deliberated through the removal in accordance with the Act in order to maintain the mortgage that is being extinguished due to the breach of contract.

Identification of legal issues

In this case study of the High Court of Australia Bulletins, the issues related to the Corporations Act of 2001 has been noticed by this limited assurance of leased engines and leaving engines and authentic engine leases for the major implications of third party activities. Meanwhile, the legal issues related to the effective consolidation of new breach of contract can be viably utilised that can be implicated by the formation of the Court of Appeal. This mainly results in the emergence of issues related to the implication of contested credibility within the business. The overall implantation of inadmissible and prejudicial evidence can be viably determined through the substantial miscarriage of justice in the future (Matulionyte, 2019). The implication of justice mainly helps to maintain the overall delegation of resources based on the authentic stability of criminal law and justice.

Moreover, the other legal issue systematically related to this specific case study is the 5 years’ minimum penalty of jurisdiction that is being implied by the magistrate of the district court in suitable intervals of time. On the other hand, the issue of unconscionable conduct of respondent lenders can easily cause the manual implication of breach of contract to appeal the findings of the primary judge within the navigation of future prospects (Schmulow and O’Hara, 2018). The other issue is the major apprehension of biases all around the courts that can be easily justified with the help of a hypothetical observer on a formula basis. On the other hand, the other legal issues of this case study mainly include the trial of the judge made through the implication of the interlocutory interpretation decision that is being punctually exhausted after the judgment made by the Australian Court in the future. Moreover, the issue of jurisdiction under the power of the primary judge can help to measure the affordability of legal contractual exercise between the two parties in the future.

Applicable laws and discuss aspects of contract law

In the case study of the High Court of Australia Bulletins, the major laws used are criminal law, industrial law, constitutional law, tax law and industrial law. In this study, the major implication of constitutional law is mainly to define a certain case law of the Australian Court named Commonwealth of Australia v AJL20 (Sherborne, 2017). In this case, the main judgement was delivered on 23 June 2021 through the execution of false imprisonment of people with the tactical execution of new business growth and technique in a very reliable and viable manner. The execution of new business formats can also be used to maintain the optimum integration of the latest business style and techniques based on the optimum configuration of Chapter III of the constitution in several business concerns with the attribution of contracted features in the future.

The constitutional law can be used to mainly impose the conflicts within the registration obligations that can be used to measure the holding of Conservative Political Action Conference with the negotiation of breach of contract in the future. On the other hand, the implication of constitutional law can be utilised through the methods of state legislative powers based on the implication of alternative sources with the prospects of Federalism (Sherman and Bosse, 2018). According to the Criminal Law of Australia, the foresight of profitability of consequence can be easily measured with the case-law of Aubrey v The Queen (2017) 260 CLR 305. This case law significantly helps to measure recklessness with the indication for the breach of agreement in the future (Steel, 2017). On the other hand, the tax law has also played a significant role in this case study by mainly pursuing the case law named Deputy Commissioner of Taxation v Huang. Moreover, the optimum practice of freeing order helps to determine the persuasion of Australian Foreign Assets that helps to seek judgement among well-renowned respondents for the attribution of Federal Court Rules in 2011.

Furthermore, the relevant aspects of contract law applied in this case study mainly include casual employees, privity of contract, declaratory relief and judicial power of the commonwealth. The implication of contractual matters can help to maintain the delegation of new business resources that results in the practical enforcement of new terms and agreements in the future. The authorisation of privity terms can also be used to respect in the negotiation of third party contracts with the doctrine of enforceable rights and desirable controversies of liability in the future. In this case of contact, the case law used to replicate the breach of contract mainly include the optimum mechanisms of judgements with the implication of Hobart International Airport Pty Ltd v Pacific Airports (Ullah and Al-Turjman, 2021). The attribution of payable amount can also be negotiated between valid appellants that helps to configure the cases of strong contractual business sources in the future. On the other hand, the corporations of insolvency will help to mandate the optimum benefits of contributors that can be obtained with the ASIC authorises of the person in the future. The suitable implications of NSW courts can be easily appealed through the raising of paying purpose among individuals during the effective time frame of the contractual agreement in the future.

Critically review the decisions

In this particular case study, some accurate and some falsified decisions have been made on the basis of behaviour concerns of non-citizens in the country of Australia. In the case-law of Migrant Services v Moorcroft, the huge had made wrong decisions related to the integration of contracts and based on the agreement of Migration Act of 1958. This decision is false as the agreement between two major parties has been cancelled and the third party cannot remove the implication of hard consequences in the future. On the other hand, the case of Chetcuti v commonwealth of Australia has also provided a valid limitation of action based on the exclusion of agreements between users (Whincop et al. 2018). Moreover, the decision of the judge in this case law is accurate due to the implication of the naturalisation of aliens in the country of Australia. The breach of contract was done with the navigation of British Subjects in the major colonies of 1949. Moreover, the formal and authentic justification of this court decision can be effectively managed through the constitution of power management in the future. In the end, the case law of Mineralogy Pty Ltd v The State of Western Australia, the court judge has decided the defendant of agreement relations between two business sources based on the optimisation of Amendment Act of 2020.

Conclusion

Hence, it is concluded that implication of Australian databases has been used to select the case study of High Court of Australia Bulletins that has mainly made the decisions of anti-tendency direction with the specifications of case laws. In the end, valid decisions have been made related to the original jurisdiction of the court based on the implication of constitutional laws and immigration acts from this case study.

References

Amigud, A. and Dawson, P., 2019. The law and the outlaw: is legal prohibition a viable solution to the contract cheating problem?. Assessment & Evaluation in Higher Education.

Awdry, R. and Newton, P.M., 2019. Staff views on commercial contract cheating in higher education: a survey study in Australia and the UK. Higher Education, 78(4), pp.593-610.

Bretag, T., 2019. Contract cheating will erode trust in science. Nature, 574(7780), pp.599-600.

Crosweller, M. and Tschakert, P., 2021. Disaster management and the need for a reinstated social contract of shared responsibility. International Journal of Disaster Risk Reduction, p.102440.

De Rochefort-Reynolds, A.J., 2020. Confused Seas: Identifying the Proper Law of Arbitration Agreements in Maritime Contracts-England, Singapore and Australia. Austl. & NZ Mar. LJ, 34, p.1.

Draper, M.J. and Newton, P.M., 2017. A legal approach to tackling contract cheating?. International Journal for Educational Integrity, 13(1), pp.1-16.

Feinerman, J.V., 2019. Legal institution, administrative device, or foreign import: The roles of contract in the People's Republic of China. In Domestic law reforms in post-Mao China (pp. 225-244). Routledge.

Harpur, P., 2018. Australia-The Licensing of Temporary Agency Work Arrangements: Australian Labour Hire Licensing Acts and the Regulation of On-Hire and Gig Work. American Bar Association, Section of Labor and Employment Law, International Committee Newsletter.

Hemming, A. and Daniel, M., 2018. Halsbury's laws of Australia: contract GC I_II_V. Update of contract GC I, II, and V.

Hile, J., 2021. Dude, Where’s My Data? The Effectiveness of Laws Governing Data Breaches in Australia. Journal of Telecommunications and the Digital Economy, 9(2), pp.47-68.

Matulionyte, R., 2019. Empowering authors via fairer copyright contract law. University of New South Wales Law Journal, The, 42(2), pp.681-718.

Schmulow, A.D. and O’Hara, J., 2018. Protection of Financial Consumers in Australia. In An International Comparison of Financial Consumer Protection (pp. 13-49). Springer, Singapore.

Sherborne, A.K.E., 2017. Restitution in the conflict of laws: characterization and choice-of-law in Australia. Journal of Private International Law, 13(1), pp.1-34.

Sherman, B. and Bosse, J., 2018. Regulating access and benefit-sharing in Australia. International Workshopon Access and Benefit-sharing for Genetic Resources for Food and Agriculture, p.89.

Steel, A., 2017. Contract cheating: Will students pay for serious criminal consequences?. Alternative Law Journal, 42(2), pp.123-129.

Ullah, F. and Al-Turjman, F., 2021. A conceptual framework for blockchain smart contract adoption to manage real estate deals in smart cities. Neural Computing and Applications, pp.1-22.

Whincop, M.J., Keyes, M. and Posner, R., 2018. Policy and Pragmatism in the Conflict of Laws. Routledge.

CLWM4000 Business and Corporations Law Assignment Sample

Assignment Brief

Word Count - 2000 Words (+/- 10%)

Weighting: 30 %

Total Marks: 30

Submission: Via Turnitin

Due Date: Week 9

Your Task

Using the Case Study provided, you will need to undertake an analysis of the various legal issues that are identified, cite relevant rules applicable to the issues, explain the application of the rules to the facts/situation in the case scenario using the IRAC method.

Assessment Description

You are required to answer the following three (3) questions, based on the Case Scenario below

Assessment Instructions

• Your assessment is to be submitted via Turnitin in WORD format. “PDF submissions will not be accepted”

• You must follow the KBS presentation guidelines for assignment help

• Please refer to the assessment marking guide to assist you in completing all the assessment criteria and for information on the use of references and legal citations

CASE SCENARIO

Julia Brennan is an Australian Super Model who had started on an intensive fitness program to prepare for her new TV Commercial that will advertise a new type of gym equipment. She knows that she needs to be super fit. In addition to her fitness program, she decided to consultant dietician about what sort of food she should eat to accelerate her program. The dietician suggested that she have at least one protein smoothie every day. She had done a bit of research to find out what might be the best type of blender for her to buy. When she went to the local electrical store, she found that the only blenders that they had for sale did not meet her needs as they were no powerful enough for smoothies.

So, she decided that she needed to go to a larger store. She had heard good things about, the “Super Big Brand Store” so decided to go there to purchase a blender that met her needs. She was very happy to find that the blender was on sale at the “Super Big Brand Store” The Sale Sign stated “Buy it today and you will get 50% off” it is high quality, superb, safe and durable. You won’t regret it”.

When she went to the counter to pay for it, she was informed by the Sales Assistant that the blender was not on sale for 50% off as the Sale Sign had stated. The Sales Assistant told her “sorry that was yesterday, and I cannot give you 50% discount!

Julia was in a hurry and she just wanted to get started as soon as possible with her protein shakes, so she bought it and kept her receipt. She went back home, she plugged it in and as soon as the blender started the upper lid came straight off as did the sharp blender blades.

Unfortunately, the blades injured her right hand and she needed to go straight to the Hospital Emergency Department. The Doctor told her that she would need stitches in her hand, and she would be unable to use her hand for four weeks unless the cut had healed, and the stitches could be removed. Julia was very upset when she realized that she would not be able to participate in the planned TV Commercial and that another Super Model would have to take the job. She would also lose the $12,000 that was the agreed payment for the commercial.

Three weeks after the accident, Julia went back to the “Super Big Brand Store” to complain about the blender and about the injury to her hand finger! While she was waiting for the Store Manager, she noticed that the same Sales Sign was displayed “Buy it today and you will get 50% off” it is high quality, superb, safe and durable. You won’t regret it”.

She asked the Sales Assistant whether the blender was 50% off as the Sales Sign had stated. The Sales Assistant responded, “Sorry that was Yesterday”. She realized that the displayed Sales Sign did not mentioned the date, so it was difficult to figure out why the Sales Assistants kept saying “Sorry that was Yesterday”. She started to suspect that there was something wrong with the way that the store was operating. Instead of waiting for the Store Manager,

She decided to call a Solicitor from the firm “Injuries at Law” for legal advice.

QUESTION 1 – Contract Law (10 Marks)

• Please advise Julia, if she entered in a contract with the “Super Big Brand Store.”

o In your answer explain the meaning of Contract and which elements need to be satisfied to be in a simple contract and how to identify if this contract can be invalided.

o You will need to address all the “essential elements of a simple contract” including (Offer and acceptance, intention and consideration) as well as “elements of a valid contract” (Capacity, Legality, Genuine Consent, Mistake, Misrepresentation, Durres, Undue Influence and Unconscionability and explain if Julia can invalidate the contract.

o You will also need to address and explain what sort of remedies she will be entitled if she decides to void the contract under the Contract Law in Australia.

QUESTION 2 - TORT LAW (NEGLIGENCE) (10 Marks)

• Please advise Julia, if she has a claim under the tort of negligence.

o You need to address all the “essential elements under the tort of negligence”.

o You also need to address if the “Super Big Brand Store” has any defences under the tort of negligence.

o Explain what sort of remedies she will be entitled to claim under the tort of negligence in Australia.

QUESTION 3 – Australian Consumer Law (10 Marks)

• Please advise Julia, if “Super Big Brand Store” breached her Australian Consumer Law Guarantees under the Competition and Consumer Act 2010 (Cth) Schedule 2.

o You need to justify your view as to whether these guarantees are available. Don’t forget to explain if Julia will be entitled to claim the remedies and

o You also need to explain if the “Super Big Brand Store” will have to pay

SOLUTION

QUESTION 1

Issues in the prevailing case scenario

Present case scenario contained issue related with contract law. It is required to ascertain whether or not Julia has formed contract with the “Super Big Brand Store”?

Rules and regulations

A contract is a set of promises that are legally enforceable. Australian contract law is primarily governed by the ‘common law’. Some of the essential elements need to be satisfied for formations of valid contract are -

1. Offer and acceptance: When one party accepts the offer of another party it leads to the formation of a contract. Offer can be given to any single person or group of person, which can be observed in the case of Carlill v Carbolic Smoke Ball Co.

2. Legal relations: Contract is not just formed by acceptance of offer but there should be intention of parties for creation of legal relations (Tadros 2020).

3. Consideration: It is the price paid by one party to another; price is not just in terms of money but can also be in terms of risk, interest, rights.

4. Legally capable: Not everyone can enter into a valid contract, persons with issues related to legal consent like bankrupt, prisoners, mental issues cannot enter into a valid legal contract (Werbach & Cornell 2017).

5. Consent: These are the elements under the contract on which both the parties agree mutually it must avoid any miscommunication, misinterpretation, mistakes etc.

Apart from above aspects, a contract is invalid if these conditions are there:

1. Fraud has been committed.

2. Consent in the agreements is not understandable or not possible to be fulfilled.

3. Consent has been obtained through undue influence, duress, mistake, unconscionable conduct, and misrepresentation. In the case of Derry v Peek, contract is considered as void because consent is obtained through fraudulent misrepresentation (Clarke 2010).

One must have to convince the second party to agree on the contract if there is misrepresentation under the contract. Misrepresentation is an inaccurate statement which tries to persuade a person or a group to enter in the contract. It has no such effect until and unless the second party was aware of its existence. Further, duress takes place, when individual enter in a contract because of some force or violence their entry is not voluntary (Lamont, Stewart, & Chiarella, 2019). Undue influence occurs when an innocent party is threatened or misbehaved by the other party or even if someone is forced by their elders or any other ascend person for their own benefits is an act of influencing. In fact, a ‘mistake’ is something which exits but it shouldn’t have.

Remedies

Liquidated and damages Claims: Liquidating damages means providing a sum of money under a clause in contract for the breach to other party, further the sum mentioned above is not included in penalty. Damages could be viewed as replacement of the performance from the breached contract, which means a plaintiff is placed in a situation where he would have if the contract was performed correctly (Clarke, 2010).

Equitable Remedies: There are two main equitable remedies for breach of contract.

Specific performance – Under this the breaching party is ordered to perform in the way it was supposed to according to the laws. This order is laid only if the compensation could not be provided.

Injunctions – These are the order or you can say warning by court to not perform such breaches in contract.

Application

By application of above rules, it can be said that, there is valid contract has been formed between Julia and Store as all essential elements such as offer and acceptance, consideration, intention, and legal capacity has been satisfied. It should be noted that, there is violation of terms and conditions of the contract by Store as blender was not as per Sale Sign that states about its quality, safe, durable, and excellence. Based on this, Julia would entitle to claim remedies such as 50% discount on blender, medical expenses, and loss of income as damages under contract law designed in a manner to place plaintiff in a situation if the contract has been executed appropriately.

Overall, it has been concluded that, valid contract has been formed between Julia and Store. However, due to breach of terms and conditions by store, Julia can entitle to claim remedies from store.

QUESTION 2

Issues in the prevailing case scenario

Present case scenario contained issue related with tort law (negligence). In this, it is required to give advice whether or not Julia has a claim by application of tort of negligence?

Rules and regulations

Essential elements as per the tort of negligence are as follows -

Duty of care: It’s a legal responsibility to take reasonable care generally the scope of care not much it depends upon the relationship of the two parties. The duty of care involves the care which is not to harm intentionally or unintentionally to other party. In the legal case of Donoghue v Stevenson, it was held that, even if there is not any contractual relationship, an individual should be capable to sue another who assisted losses to them (Taylor 2020).

Breach: Under this the ‘duty of care ‘is breached that whether the occurred situation is reasonable or not, which means the plaintiff is not entitled to all the risks but if there is an obvious risk involved the plaintiff has to cover (Stoyanova 2020).

Causation: Under this the plaintiff has to prove that the injury which is occurred or the sufferings is the part of breach of duty of care. In the legal case, Amaca Pty Ltd v Ellis, there was inadequate causation to provide negligence.

Damages: The final element of the negligence is the damages. After the plaintiff proves the duty of care, breaching and causation they can receive the compensation for the loss.

The compensation is made on the basis of how the impact of lossinjury is on the plaintiff, like severity of injury, loss in financial terms or the impact of injury on the future of the plaintiff.

Defences

There are two defences a defendant can use where they are found liable for negligence:

Volenti non fit injuria: It means that the claimant has agreed that he had accepted the involvement of risk. Under this if the party successfully proved the acceptance he would not be liable for the loss (Armstrong 2019).

Contributory negligence: Under this the partial liability is taken away if the defendant can prove that there was the contribution of the claimant too in their losses.

Remedies for Negligence Claims

First remedy for negligence claims is the compensation. The claimant will be provided with the sum of compensation he had to suffer from the damages. Damages could be provided for both financial and non-financial losses (Gibbs Wright Litigation Lawyers 2020).

In case of personal injury, the claimant will be provided with additional damages like the loss of his income due to the injury or medical expenses (Eldar 2020).

Application

By application of above rules and regulations in the prevailing case scenario, it can be said that, Julia is eligible to claim as per tort of negligence as sales assistance owned duty of care towards Julia and due to violation of such duty of care, she has suffered from losses, and such losses was also not too remote. Further, there is not any defenses available to store as there is not any voluntary acceptance of risk by defendant and concept of contributory negligence would also not applied. Therefore, Julia would entitle to claim monetary compensation for the losses suffered by her along with loss of $12000 that was agreed payment for commercial performance.

Conclusion

Overall, conclusion can be drawn from above analysis that, Julia would be entitled to claim under tort of negligence and consequently remedies can be claimed by her, which includes loss of income as well as medical expenses.

QUESTION 3

Issues in the prevailing case scenario

Issue in the given case scenario is based on Australian Consumer Law. It is required to provide advice to Julia whether or not provisions of consumer guarantee as given in the schedule 2 of the Competition and Consumer Act 2010 has been violated by the “Super Big Brand Store”. In addition to this, suggestions should also be provided with respect to remedies of Julia and what is required to be paid by “Super Big Brand Store”.

Rules and regulations

Australian Consumer Law is explained in the schedule 2 of the Competition and Consumer Act 2010. As per the cited law, it is required by organizations to offer consumer guarantee for most of the products and services sold by them. It is essential that, organizations that are engaged in selling of goods must provide guarantee as explained in section 51 to 59 of the cited Act that such goods are –

• Goods must be as per the acceptable quality. It suggests that, products should be secure, has no mistake, seems acceptable, and performs all aspects that are expected generally.

• Goods should be appropriate for the purpose that customer made recognized to the company prior to purchasing.

• Goods should be described reliably (Bianchi 2018).

• Goods should be match as per demonstration.

• It should comply with any express warranty.

• They should have a clear title.

• There should not be any hidden charges.

• It should have repairing facility for a rational period of time except the advised is provided to customer otherwise.