Order Now

- Home

- About Us

-

Services

-

Assignment Writing

-

Academic Writing Services

- HND Assignment Help

- SPSS Assignment Help

- College Assignment Help

- Writing Assignment for University

- Urgent Assignment Help

- Architecture Assignment Help

- Total Assignment Help

- All Assignment Help

- My Assignment Help

- Student Assignment Help

- Instant Assignment Help

- Cheap Assignment Help

- Global Assignment Help

- Write My Assignment

- Do My Assignment

- Solve My Assignment

- Make My Assignment

- Pay for Assignment Help

-

Management

- Management Assignment Help

- Business Management Assignment Help

- Financial Management Assignment Help

- Project Management Assignment Help

- Supply Chain Management Assignment Help

- Operations Management Assignment Help

- Risk Management Assignment Help

- Strategic Management Assignment Help

- Logistics Management Assignment Help

- Global Business Strategy Assignment Help

- Consumer Behavior Assignment Help

- MBA Assignment Help

- Portfolio Management Assignment Help

- Change Management Assignment Help

- Hospitality Management Assignment Help

- Healthcare Management Assignment Help

- Investment Management Assignment Help

- Market Analysis Assignment Help

- Corporate Strategy Assignment Help

- Conflict Management Assignment Help

- Marketing Management Assignment Help

- Strategic Marketing Assignment Help

- CRM Assignment Help

- Marketing Research Assignment Help

- Human Resource Assignment Help

- Business Assignment Help

- Business Development Assignment Help

- Business Statistics Assignment Help

- Business Ethics Assignment Help

- 4p of Marketing Assignment Help

- Pricing Strategy Assignment Help

- Nursing

-

Finance

- Finance Assignment Help

- Do My Finance Assignment For Me

- Financial Accounting Assignment Help

- Behavioral Finance Assignment Help

- Finance Planning Assignment Help

- Personal Finance Assignment Help

- Financial Services Assignment Help

- Forex Assignment Help

- Financial Statement Analysis Assignment Help

- Capital Budgeting Assignment Help

- Financial Reporting Assignment Help

- International Finance Assignment Help

- Business Finance Assignment Help

- Corporate Finance Assignment Help

-

Accounting

- Accounting Assignment Help

- Managerial Accounting Assignment Help

- Taxation Accounting Assignment Help

- Perdisco Assignment Help

- Solve My Accounting Paper

- Business Accounting Assignment Help

- Cost Accounting Assignment Help

- Taxation Assignment Help

- Activity Based Accounting Assignment Help

- Tax Accounting Assignment Help

- Financial Accounting Theory Assignment Help

-

Computer Science and IT

- Operating System Assignment Help

- Data mining Assignment Help

- Robotics Assignment Help

- Computer Network Assignment Help

- Database Assignment Help

- IT Management Assignment Help

- Network Topology Assignment Help

- Data Structure Assignment Help

- Business Intelligence Assignment Help

- Data Flow Diagram Assignment Help

- UML Diagram Assignment Help

- R Studio Assignment Help

-

Law

- Law Assignment Help

- Business Law Assignment Help

- Contract Law Assignment Help

- Tort Law Assignment Help

- Social Media Law Assignment Help

- Criminal Law Assignment Help

- Employment Law Assignment Help

- Taxation Law Assignment Help

- Commercial Law Assignment Help

- Constitutional Law Assignment Help

- Corporate Governance Law Assignment Help

- Environmental Law Assignment Help

- Criminology Assignment Help

- Company Law Assignment Help

- Human Rights Law Assignment Help

- Evidence Law Assignment Help

- Administrative Law Assignment Help

- Enterprise Law Assignment Help

- Migration Law Assignment Help

- Communication Law Assignment Help

- Law and Ethics Assignment Help

- Consumer Law Assignment Help

- Science

- Biology

- Engineering

-

Humanities

- Humanities Assignment Help

- Sociology Assignment Help

- Philosophy Assignment Help

- English Assignment Help

- Geography Assignment Help

- Agroecology Assignment Help

- Psychology Assignment Help

- Social Science Assignment Help

- Public Relations Assignment Help

- Political Science Assignment Help

- Mass Communication Assignment Help

- History Assignment Help

- Cookery Assignment Help

- Auditing

- Mathematics

-

Economics

- Economics Assignment Help

- Managerial Economics Assignment Help

- Econometrics Assignment Help

- Microeconomics Assignment Help

- Business Economics Assignment Help

- Marketing Plan Assignment Help

- Demand Supply Assignment Help

- Comparative Analysis Assignment Help

- Health Economics Assignment Help

- Macroeconomics Assignment Help

- Political Economics Assignment Help

- International Economics Assignments Help

-

Academic Writing Services

-

Essay Writing

- Essay Help

- Essay Writing Help

- Essay Help Online

- Online Custom Essay Help

- Descriptive Essay Help

- Help With MBA Essays

- Essay Writing Service

- Essay Writer For Australia

- Essay Outline Help

- illustration Essay Help

- Response Essay Writing Help

- Professional Essay Writers

- Custom Essay Help

- English Essay Writing Help

- Essay Homework Help

- Literature Essay Help

- Scholarship Essay Help

- Research Essay Help

- History Essay Help

- MBA Essay Help

- Plagiarism Free Essays

- Writing Essay Papers

- Write My Essay Help

- Need Help Writing Essay

- Help Writing Scholarship Essay

- Help Writing a Narrative Essay

- Best Essay Writing Service Canada

-

Dissertation

- Biology Dissertation Help

- Academic Dissertation Help

- Nursing Dissertation Help

- Dissertation Help Online

- MATLAB Dissertation Help

- Doctoral Dissertation Help

- Geography Dissertation Help

- Architecture Dissertation Help

- Statistics Dissertation Help

- Sociology Dissertation Help

- English Dissertation Help

- Law Dissertation Help

- Dissertation Proofreading Services

- Cheap Dissertation Help

- Dissertation Writing Help

- Marketing Dissertation Help

- Programming

-

Case Study

- Write Case Study For Me

- Business Law Case Study Help

- Civil Law Case Study Help

- Marketing Case Study Help

- Nursing Case Study Help

- Case Study Writing Services

- History Case Study help

- Amazon Case Study Help

- Apple Case Study Help

- Case Study Assignment Help

- ZARA Case Study Assignment Help

- IKEA Case Study Assignment Help

- Zappos Case Study Assignment Help

- Tesla Case Study Assignment Help

- Flipkart Case Study Assignment Help

- Contract Law Case Study Assignments Help

- Business Ethics Case Study Assignment Help

- Nike SWOT Analysis Case Study Assignment Help

- Coursework

- Thesis Writing

- CDR

- Research

-

Assignment Writing

-

Resources

- Referencing Guidelines

-

Universities

-

Australia

- Asia Pacific International College Assignment Help

- Macquarie University Assignment Help

- Rhodes College Assignment Help

- APIC University Assignment Help

- Torrens University Assignment Help

- Kaplan University Assignment Help

- Holmes University Assignment Help

- Griffith University Assignment Help

- VIT University Assignment Help

- CQ University Assignment Help

-

Australia

- Experts

- Free Sample

- Testimonial

LAW6001 Taxation Law Assessment 2 Sample

Task

Summary In response to the issues raised in the case study provided, research and develop a 2000-word tax advice that addresses (a) assessable income (b) allowable deductions (c) calculations of income/deductions and (d) your conclusions and recommendations. Please refer to the Task Instructions for details on how to complete this business law case study help.

Context This assessment assesses your research skills, your ability to synthesise an original piece of work to specific content requirements and your ability to produce a comprehensible piece of advice which addressing the client’s needs. It also assesses your written communication skills. The ability to deliver to a brief is an essential skill in the workplace. Clients may well approach advisors seeking a combination of specific information needs and advice on the tax implications of a particular arrangement in the Australian tax jurisdiction. It is therefore important to be able to identify all the issues presented by an arrangement and to think about the potential consequences of different approaches to addressing the client’s needs.

Task Instructions

• Your case study needs to identify and discuss the tax implications of the various issues raised.

• A report (word document, approx. 2,000 words) must be submitted for the calculations of the assessable income; allowable deductions and taxable income of the taxpayer including identifying and discussing them. E.g., how the amounts of income & deductions have been derived. If any receipts and payments are not assessable or deductible, the reasoning for non-inclusion of these in assessable income or deductions as per relevant legislation or cases.

• Critically analyse the following case study. With respect to each task:

• Review relevant case law and legislation (ITAA1936, ITAA1997)

• Apply the law to the facts of the case study

• Reach a conclusion/ give practical advice to your client.

• You will be assessed in accordance with the Assessment Rubric.

• This case study must be presented as an individual effort. The case study requires individual research. It is expected the student will survey the relevant literature, including decided cases, and select appropriate additional resources.

• Your case study assignment help is not just a list of answers. Your reasons for your conclusions and recommendations must be based on your research into the relevant cases and legislation.

• The format of the report should be a business report and using APA referencing style

Case Study:

Comprehensive Individual Tax Return Advice Question 1 On 17 July 2020, Ken Fong acquired a restaurant as a going concern, paying $850,000 for the land and buildings, plant and equipment and goodwill. Upon taking possession Ken realised that the plumbing and electrical systems required repairing. In August 2020 he spent $27,000 for the repairs so that the restaurant could open for business. Shortly after opening, the tiles in the kitchen cracked and fell off the walls. Ken had them replaced, restoring them to their original condition, costing $6,400. In November 2020 Ken decided to replace all the kitchen cooking equipment in order to reduce the likelihood of having to replace it in the future. The cost was $30,000. At the same time Ken entered into a contract to have the equipment regularly inspected and serviced. The contract fee was $1,500 per year. At that time, he also decided to pay a pest control company $2,000 a year to rid the restaurant of pests and ensure health and safety standards were maintained. In January 2021 a violent summer hail storm caused damage to the roof of the restaurant. Instead of making repairs, Ken decided to replace the entire roof along with the roofing insulation and ducted air conditioning. The roof replacement cost $32,000 and the insulation and air conditioning added another cost of $7,400. At that time Ken contracted builders to construct an additional room to cater for increased patronage. The cost of the addition was $26,800. Required With reference to relevant legislation and cases, advise Ken on the deductibility of the expenditure incurred on repairs and improvements to his restaurant in August 2020, November 2020 and January 2021.

Question 2

Maurice is an individual tax resident of Australia for tax purposes. He has the following assets:

• His home was acquired on 20 February 1989 for $140 000. The home was never used for any income producing purpose. The estimated market value of the house on 1 March 2018 is $310,000

• Shares in FUL Pty Ltd acquired on 10 April 1984 at a cost of $15 000.

• Furniture acquired on 20 May 2010 for $10,500.

• Yacht acquired on 9 July 2020 for $25,000

• Block of vacant land acquired on 20 June 1997 at a cost of $100 000. The estimated market value of the vacant block on 15 May 2021 is $475,000. Maurice subsequently sold the following assets during 2020-2021 (arm’s length transactions):

• His home was sold on 1 March 2021 for $325,000

• The FUL Shares were sold on 15 March 2021 for $19,000

• The furniture was sold on 1 May 2021 for $5,000

• The yacht was sold on 29 June 2021 for $37,000

• The block of vacant land was sold on 30 May 2021 for $465,000. Maurice also has a carry forward capital loss of $12,500 from the sale of an antique drumkit and a carry forward capital loss $5,000 from the sale of underperforming shares in an earlier income year. Maurice is not a share trader. Maurice has also incurred interest expenses on the vacant block of land of $110,000 over the time he owned the vacant block. He never used the vacant block for any income producing purpose. Required With reference to relevant legislation and cases calculate the net capital gain or loss as applicable for Maurice for the 2020/21 income year. You must show all possible methods to calculate capital gains (you must reference each step in the process to the relevant legislation. The numbers in the calculation will not be sufficient) and identify reasons why inclusion/exclusion of all capital gains tax assets

Solution

Question: 1:

Facts and Issues of The Case:

In the current case, the taxpayer has made various repairs and maintenance from time to time to the business organization, the taxpayer has spent some money on pre-starting of the business, during the course of the business, and after the business. Therefore the question in this context arises that whether the expense of the repairs is deductible against the income of the taxpayer or the expense of the repairs is not a deductible expense (Razak, 2020).

Legislation:

In the income tax assessment act, 1997 there are different provisions are there that allow the business expenditure as a general deduction or a special deduction. Any expense that is incurred by a taxpayer for the purpose to meet their repair expense is deductible from the gross income of the taxpayer to get the assessable income of the taxpayer. Tax ruling 97/23 (Mcgregor Lowndes & Crittall) it is clearly established that the tax deduction in case of repairs expense is not admissible if the expense of the repairs is of a capital nature. The assessable income of any person means the income on which the tax is calculated the gross income is income earned by the person (Weltman, & J.K. Lasser Institute 2018).

The different Para of the same ruling provides an explanation and difference between the repairs and improvements. According to the tax, the ruling repair is the expense that incurs by the business for the purpose of restoring the functional efficiency of the organization and on the other side, the improvement in the asset refers to those expenses that incur for the purpose of increasing the functional efficiency of the asset. The expense related to the improvement of the asset is the capital expense and therefore the expenses are called the capital expense and therefore those expenses are not allowed to deduct while calculating the assessable income from the gross income (Property investors benefit from 'repair' year-end deduction. 2017).

If any amount is expenses or incurred as initial repairs of the asset, that is the repair that incurs before bringing such asset into use then such repairs have a nature of the capital repairs and therefore such expense of capital repairs incur as an initial expense is not allowed as a deduction. If any damage, the defect has an existence at the time of acquisition of the asset than in such case the repairs incur for removal of such defect, the damage is considered as the capital nature repairs and therefore such expense is not allowable as a deduction. Any expense on repairs of the organization if incurred for the purpose of complying with the government bodies and government regulations than in such case the expense of repairs is of revenue nature and deduction with respect of such repairs expense is allowable to the organization.

Applicability:

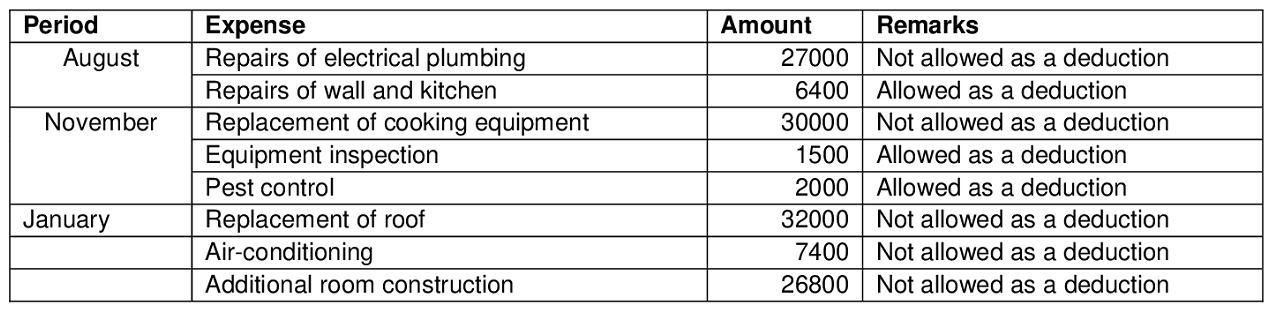

Expenditure for the month of august

During the month of August, the taxpayer incurs two major expenses for the asset as repairs the description and allowability of such expenses are as follows-

(i) The taxpayer incurred $ 27000 On the political and plumbing expense of the asset such damages and defects of the property were in existence when the asset was acquired and also the damages result from the previous owner and not with the actions of the Taxpayer. Since the expense of $ 27000 is an initial repair expense therefore according to the applicable laws such expense should be capitalized as a part of the cost of the asset and depreciation is allowable thereof (Anonymous. 2020).

(ii) Expense of $ 6400 Incurred for wall and kitchen – such expense is a revenue expense because they are damaged with the act of taxpayer and this is a revenue expense and revenue repairs that are associated with the building and therefore such expense is not considered a capital expense and deduction with respect of the same is allowable.

Expenditure incurred for November 2020

During the month of November, the taxpayer has incurred three types of repairs expense those are as follows-

(i) In the current month the taxpayer has incurred the expense of $ 30000 for the replacement of the cooking equipment that will increase the efficiency of the operations of the organization, therefore such expense is not repaired they are called as improvement and therefore such expense is capitalized in the books of accounts and depreciation is allowed on the same.

(ii) $ 1500 has been paid for the equipment inspection, equipment inspection is a revenue nature expense and therefore it can be considered as the revenue expense and charged against the income of the business organization, and deduction si allowed of the same expense.

(iii) For a compilation of health and safety standards the restaurant must conduct a pest control for every year, therefore such expense is a type of revenue expense and deduction in respect of the pest control expense is allowable for the business (Batter, &Biscopink, 2019).

Expenditure in the month of January

In the month of January, two major expenses is incurred, $ 32000 is incurred for the purpose of replacement of the roof, replacement of the roof is a major expense of the organization. The expense is treated as an improvement and such expense is allowed to be added to the cost of the asset and proper depreciation has been charged on such asset.

Expenditure incurred for the purpose of construction of additional rooms are a type of improvement of the building. and therefore such expenses incurred for the purpose of construction of additional rooms are of a capital nature and deduction is not allowed for the same expense incurred for the purpose of construction of additional rooms.

Conclusion:

From the above discussion, it can be concluded that the following amount is considered as an allowable deduction or the following amount is not allowed as the allowable deduction

Question: 2:

Legislation related to the case:

Definition of capital Gains – Capital gains and capital losses are gains and losses that are arrived in the capital gain tax event of the capital gain assets, if during the capital gains event if consideration price of the capital asset is higher than the cost of the capital gain asset or the indexed price of the cost of the capital asset, on the other side of the cost of the asset or the index price of the cost of asset if higher than the consideration of the capital asset, than there will be a capital loss of the assets (Healy, 2017).

Any capital asset that is acquired before 20 September 1985 or specified under the exempted assets is not liable to be any Capital gains tax.

Steps to calculate the capital gain or loss- For the purpose of calculation of the capital gains tax, the capital gain or loss should be first calculated, there are different steps that must be followed for the purpose of calculation of the capital gain or loss from the capital asset-

Step 1: the identification of the fair value of consideration is the first step for calculation of the capital gains, in the case of sale the exchange amount is the FVOC, or in the case of an exchange, the fair value is considered as the fair value of the consideration.

Step 2: After identification of the consideration price of the asset, the second step for the purpose of calculation of the capital gain is to calculate the cost base of the asset. The cost base of the asset is derived by including the acquisition cost of the asset along with any indexation if required. For the assets acquired before 20 September 1999 the indexation method is applied for the purpose of increasing the cost base (Pattison-Gordon, 2017).

Step 3: After identifying the proceeds of the capital assets and identification of the cost base of the asset. The cost base of the asset is being deducted from the proceeds of the capital gain event the difference comes positive then it is considered as the capital gains and if in any other case of the difference comes to negative then it will be considered as the capital loss.

Step 4: For every capital gain event, the same process till step 3 is being followed.

Step 5: Combine the capital gains and capital losses of each capital gain asset sold during the tax period.

Step 6: Adjust the previous year's cumulative carried forward losses.

Step 7: The net capital gain is taxable at the applicable rate and if the net capital loss is there then it is forwarded to the future tax period for the purpose of adjustment in the future years.

Calculation:

In the current tax period, the taxpayer has sold various capital gains assets the treatment of the capital gain and the capital loss from the capital gains asset is as follows-

Capital gains / Loss from sale of the home - Home is covered under the exempted list of the assets to be sold therefore in case there is a sale of the home to the other person such sale is not liable for the capital gains tax.

Capital gains / Loss on sale of FUL shares – The taxpayer acquire the shares of the FUL shares before 20 September 1985, therefore such sale of shares are not covered in the capital gains and capital loss, and the capital gains and loss are not liable for such sale of FUL shares.

Capital gain / Loss on the furniture sale – The furniture in the current case is acquired in 2010 at a cost of $ 10500, the said furniture is being sold at $ 5000. As the asset is being used for private purposes and there is no depreciation on such asset, therefore, the capital loss in the current case is $ 10500 - $ 5000 = $ 5500.

Capital gain / Loss on Yacht – In the current case, the taxpayer held the Yacht, for less than 12 months therefore the indexation and 50 % deduction is not allowed, therefore the capital gain on the sale of yatch is as follows-

Proceeds from the Yacht = 37000

Cost base of the assets = 25000

Tax on sale of yacht = 12000

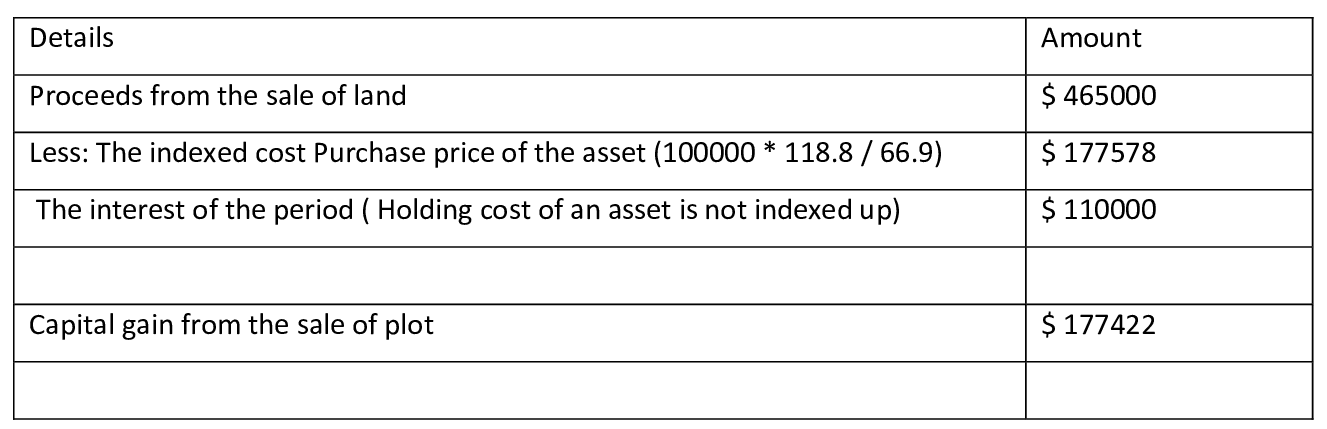

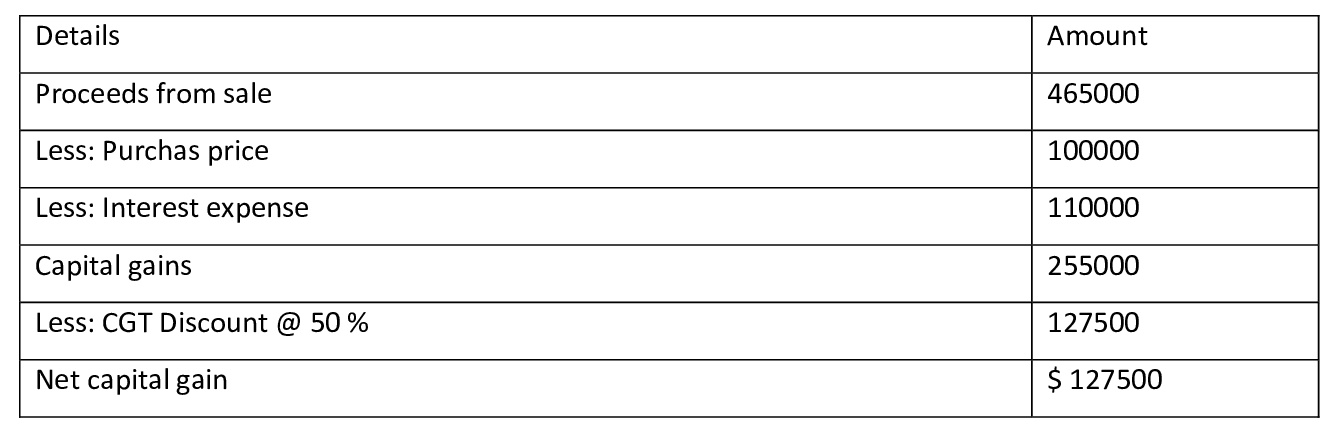

Capital gain/loss on sale of land –

The taxpayer sold the block of land at a proceed of $ 465000, the cost price of the asset is $ 100000 and during the holding period of the asset, the taxpayer has incurred a cost of $ 110000. The capital gain on sale of a plot of land is as follows-

Capital gain as per indexation method

Capital gain as per 50 % CGT discount method

In the current case since the capital gain is less in the 50 % CGT discount scheme, therefore, taxpayer should adopt this scheme (Anonymous. 2019, pg 12(3)).

Capital gain / Loss from collectibles –

Loss of collectible will forward for future years and cannot be adjusted with other capital gains.

Previous year's capital loss of shares will be adjusted in a capital gain of the current year.

Net Taxable capital gains / Loss-

The net taxable capital gains / Loss is as follows- (5500) + 12000 + 127500 + (5000 )

= 129000

References

Anonymous. (2019). Arkansas: income tax: casualty loss deduction denied for failure to establish the pre-casualty fair market value of the real property. State Tax Review, 80(5), 2–3.https://lesa.on.worldcat.org/v2/oclc/7985344152

Anonymous. (2020). A renewed chance to revisit old assets for repairs and maintenance expenses. The Tax Adviser, 51(4), 236–237. https://lesa.on.worldcat.org/v2/oclc/8672699797

Batter, A., &Biscopink, E. (2019). Notice 2018-99 and the deduction disallowance for employer parking: the straw that broke the camel's back. Corporate Taxation, 46(3), 23–26.https://lesa.on.worldcat.org/v2/oclc/8181362429

Healy, B. (2017). Tax incentives for business owners. Businesses, 34(16), 37–57.https://lesa.on.worldcat.org/v2/oclc/7245418371

Pattison-Gordon, J. (2017). Millionaires' tax clears the legislature. The Boston Banner, 52(47), 1–7.https://lesa.on.worldcat.org/v2/oclc/8932426426

Property investors benefit from 'repair' year-end deduction. (2017). Spokesman-Review, E.2, 2.https://lesa.on.worldcat.org/v2/oclc/7250793193

Razak, S. H. A. (2020). Zakat and waqf as instrument of islamic wealth in poverty alleviation and redistribution. International Journal of Sociology and Social Policy, 40(3-4), 249–266. https://doi.org/10.1108/IJSSP-11-2018-0208

Weltman, B., & J.K. Lasser Institute. (2018). J.k. lasser's small business taxes 2018 : your complete guide to a better bottom line. John Wiley & Sons. Retrieved October 20, 2021.https://lesa.on.worldcat.org/v2/oclc/1012132648

Download Samples PDF

Related Sample

- MBA632 Knowledge Management Assignment

- MIS605 Systems Analysis and Design Report

- Character Embedded Based Deep Learning Approach For Malicious URL Detection

- MBA504 Data Analytics for Business Assignment

- NUR133 Professional Nursing Practices Report 3

- Data Science and Analytics Assignment

- PUBH6005 Epidemiology Report

- EDUC8731 Motivation Cognition and Metacognition Assignment

- PRJ5108 Project Delivery and Procurement Report

- MBA5008 Business Research Methods Report 3

- ENGR9742 Systems Engineering Assignment

- MSc Computer Science Project Proposal

- RSK80006 Risk Management

- SBU716 Corporate Financial Management Report

- TITP105 The IT Professional Report

- Financial Decision Making Behaviour Assignment

- HRMT20024 Human Resource Management Assignment

- MBA621 Healthcare Systems

- MGT610 Organisational Best Practice Assignment

- PHCA9521 Global Health and Development Assignment

Assignment Services

-

Assignment Writing

-

Academic Writing Services

- HND Assignment Help

- SPSS Assignment Help

- College Assignment Help

- Writing Assignment for University

- Urgent Assignment Help

- Architecture Assignment Help

- Total Assignment Help

- All Assignment Help

- My Assignment Help

- Student Assignment Help

- Instant Assignment Help

- Cheap Assignment Help

- Global Assignment Help

- Write My Assignment

- Do My Assignment

- Solve My Assignment

- Make My Assignment

- Pay for Assignment Help

-

Management

- Management Assignment Help

- Business Management Assignment Help

- Financial Management Assignment Help

- Project Management Assignment Help

- Supply Chain Management Assignment Help

- Operations Management Assignment Help

- Risk Management Assignment Help

- Strategic Management Assignment Help

- Logistics Management Assignment Help

- Global Business Strategy Assignment Help

- Consumer Behavior Assignment Help

- MBA Assignment Help

- Portfolio Management Assignment Help

- Change Management Assignment Help

- Hospitality Management Assignment Help

- Healthcare Management Assignment Help

- Investment Management Assignment Help

- Market Analysis Assignment Help

- Corporate Strategy Assignment Help

- Conflict Management Assignment Help

- Marketing Management Assignment Help

- Strategic Marketing Assignment Help

- CRM Assignment Help

- Marketing Research Assignment Help

- Human Resource Assignment Help

- Business Assignment Help

- Business Development Assignment Help

- Business Statistics Assignment Help

- Business Ethics Assignment Help

- 4p of Marketing Assignment Help

- Pricing Strategy Assignment Help

- Nursing

-

Finance

- Finance Assignment Help

- Do My Finance Assignment For Me

- Financial Accounting Assignment Help

- Behavioral Finance Assignment Help

- Finance Planning Assignment Help

- Personal Finance Assignment Help

- Financial Services Assignment Help

- Forex Assignment Help

- Financial Statement Analysis Assignment Help

- Capital Budgeting Assignment Help

- Financial Reporting Assignment Help

- International Finance Assignment Help

- Business Finance Assignment Help

- Corporate Finance Assignment Help

-

Accounting

- Accounting Assignment Help

- Managerial Accounting Assignment Help

- Taxation Accounting Assignment Help

- Perdisco Assignment Help

- Solve My Accounting Paper

- Business Accounting Assignment Help

- Cost Accounting Assignment Help

- Taxation Assignment Help

- Activity Based Accounting Assignment Help

- Tax Accounting Assignment Help

- Financial Accounting Theory Assignment Help

-

Computer Science and IT

- Operating System Assignment Help

- Data mining Assignment Help

- Robotics Assignment Help

- Computer Network Assignment Help

- Database Assignment Help

- IT Management Assignment Help

- Network Topology Assignment Help

- Data Structure Assignment Help

- Business Intelligence Assignment Help

- Data Flow Diagram Assignment Help

- UML Diagram Assignment Help

- R Studio Assignment Help

-

Law

- Law Assignment Help

- Business Law Assignment Help

- Contract Law Assignment Help

- Tort Law Assignment Help

- Social Media Law Assignment Help

- Criminal Law Assignment Help

- Employment Law Assignment Help

- Taxation Law Assignment Help

- Commercial Law Assignment Help

- Constitutional Law Assignment Help

- Corporate Governance Law Assignment Help

- Environmental Law Assignment Help

- Criminology Assignment Help

- Company Law Assignment Help

- Human Rights Law Assignment Help

- Evidence Law Assignment Help

- Administrative Law Assignment Help

- Enterprise Law Assignment Help

- Migration Law Assignment Help

- Communication Law Assignment Help

- Law and Ethics Assignment Help

- Consumer Law Assignment Help

- Science

- Biology

- Engineering

-

Humanities

- Humanities Assignment Help

- Sociology Assignment Help

- Philosophy Assignment Help

- English Assignment Help

- Geography Assignment Help

- Agroecology Assignment Help

- Psychology Assignment Help

- Social Science Assignment Help

- Public Relations Assignment Help

- Political Science Assignment Help

- Mass Communication Assignment Help

- History Assignment Help

- Cookery Assignment Help

- Auditing

- Mathematics

-

Economics

- Economics Assignment Help

- Managerial Economics Assignment Help

- Econometrics Assignment Help

- Microeconomics Assignment Help

- Business Economics Assignment Help

- Marketing Plan Assignment Help

- Demand Supply Assignment Help

- Comparative Analysis Assignment Help

- Health Economics Assignment Help

- Macroeconomics Assignment Help

- Political Economics Assignment Help

- International Economics Assignments Help

-

Academic Writing Services

-

Essay Writing

- Essay Help

- Essay Writing Help

- Essay Help Online

- Online Custom Essay Help

- Descriptive Essay Help

- Help With MBA Essays

- Essay Writing Service

- Essay Writer For Australia

- Essay Outline Help

- illustration Essay Help

- Response Essay Writing Help

- Professional Essay Writers

- Custom Essay Help

- English Essay Writing Help

- Essay Homework Help

- Literature Essay Help

- Scholarship Essay Help

- Research Essay Help

- History Essay Help

- MBA Essay Help

- Plagiarism Free Essays

- Writing Essay Papers

- Write My Essay Help

- Need Help Writing Essay

- Help Writing Scholarship Essay

- Help Writing a Narrative Essay

- Best Essay Writing Service Canada

-

Dissertation

- Biology Dissertation Help

- Academic Dissertation Help

- Nursing Dissertation Help

- Dissertation Help Online

- MATLAB Dissertation Help

- Doctoral Dissertation Help

- Geography Dissertation Help

- Architecture Dissertation Help

- Statistics Dissertation Help

- Sociology Dissertation Help

- English Dissertation Help

- Law Dissertation Help

- Dissertation Proofreading Services

- Cheap Dissertation Help

- Dissertation Writing Help

- Marketing Dissertation Help

- Programming

-

Case Study

- Write Case Study For Me

- Business Law Case Study Help

- Civil Law Case Study Help

- Marketing Case Study Help

- Nursing Case Study Help

- Case Study Writing Services

- History Case Study help

- Amazon Case Study Help

- Apple Case Study Help

- Case Study Assignment Help

- ZARA Case Study Assignment Help

- IKEA Case Study Assignment Help

- Zappos Case Study Assignment Help

- Tesla Case Study Assignment Help

- Flipkart Case Study Assignment Help

- Contract Law Case Study Assignments Help

- Business Ethics Case Study Assignment Help

- Nike SWOT Analysis Case Study Assignment Help

- Coursework

- Thesis Writing

- CDR

- Research

.png)

~5.png)

.png)

~1.png)

.png)