Order Now

- Home

- About Us

-

Services

-

Assignment Writing

-

Academic Writing Services

- HND Assignment Help

- SPSS Assignment Help

- College Assignment Help

- Writing Assignment for University

- Urgent Assignment Help

- Architecture Assignment Help

- Total Assignment Help

- All Assignment Help

- My Assignment Help

- Student Assignment Help

- Instant Assignment Help

- Cheap Assignment Help

- Global Assignment Help

- Write My Assignment

- Do My Assignment

- Solve My Assignment

- Make My Assignment

- Pay for Assignment Help

-

Management

- Management Assignment Help

- Business Management Assignment Help

- Financial Management Assignment Help

- Project Management Assignment Help

- Supply Chain Management Assignment Help

- Operations Management Assignment Help

- Risk Management Assignment Help

- Strategic Management Assignment Help

- Logistics Management Assignment Help

- Global Business Strategy Assignment Help

- Consumer Behavior Assignment Help

- MBA Assignment Help

- Portfolio Management Assignment Help

- Change Management Assignment Help

- Hospitality Management Assignment Help

- Healthcare Management Assignment Help

- Investment Management Assignment Help

- Market Analysis Assignment Help

- Corporate Strategy Assignment Help

- Conflict Management Assignment Help

- Marketing Management Assignment Help

- Strategic Marketing Assignment Help

- CRM Assignment Help

- Marketing Research Assignment Help

- Human Resource Assignment Help

- Business Assignment Help

- Business Development Assignment Help

- Business Statistics Assignment Help

- Business Ethics Assignment Help

- 4p of Marketing Assignment Help

- Pricing Strategy Assignment Help

- Nursing

-

Finance

- Finance Assignment Help

- Do My Finance Assignment For Me

- Financial Accounting Assignment Help

- Behavioral Finance Assignment Help

- Finance Planning Assignment Help

- Personal Finance Assignment Help

- Financial Services Assignment Help

- Forex Assignment Help

- Financial Statement Analysis Assignment Help

- Capital Budgeting Assignment Help

- Financial Reporting Assignment Help

- International Finance Assignment Help

- Business Finance Assignment Help

- Corporate Finance Assignment Help

-

Accounting

- Accounting Assignment Help

- Managerial Accounting Assignment Help

- Taxation Accounting Assignment Help

- Perdisco Assignment Help

- Solve My Accounting Paper

- Business Accounting Assignment Help

- Cost Accounting Assignment Help

- Taxation Assignment Help

- Activity Based Accounting Assignment Help

- Tax Accounting Assignment Help

- Financial Accounting Theory Assignment Help

-

Computer Science and IT

- Operating System Assignment Help

- Data mining Assignment Help

- Robotics Assignment Help

- Computer Network Assignment Help

- Database Assignment Help

- IT Management Assignment Help

- Network Topology Assignment Help

- Data Structure Assignment Help

- Business Intelligence Assignment Help

- Data Flow Diagram Assignment Help

- UML Diagram Assignment Help

- R Studio Assignment Help

-

Law

- Law Assignment Help

- Business Law Assignment Help

- Contract Law Assignment Help

- Tort Law Assignment Help

- Social Media Law Assignment Help

- Criminal Law Assignment Help

- Employment Law Assignment Help

- Taxation Law Assignment Help

- Commercial Law Assignment Help

- Constitutional Law Assignment Help

- Corporate Governance Law Assignment Help

- Environmental Law Assignment Help

- Criminology Assignment Help

- Company Law Assignment Help

- Human Rights Law Assignment Help

- Evidence Law Assignment Help

- Administrative Law Assignment Help

- Enterprise Law Assignment Help

- Migration Law Assignment Help

- Communication Law Assignment Help

- Law and Ethics Assignment Help

- Consumer Law Assignment Help

- Science

- Biology

- Engineering

-

Humanities

- Humanities Assignment Help

- Sociology Assignment Help

- Philosophy Assignment Help

- English Assignment Help

- Geography Assignment Help

- Agroecology Assignment Help

- Psychology Assignment Help

- Social Science Assignment Help

- Public Relations Assignment Help

- Political Science Assignment Help

- Mass Communication Assignment Help

- History Assignment Help

- Cookery Assignment Help

- Auditing

- Mathematics

-

Economics

- Economics Assignment Help

- Managerial Economics Assignment Help

- Econometrics Assignment Help

- Microeconomics Assignment Help

- Business Economics Assignment Help

- Marketing Plan Assignment Help

- Demand Supply Assignment Help

- Comparative Analysis Assignment Help

- Health Economics Assignment Help

- Macroeconomics Assignment Help

- Political Economics Assignment Help

- International Economics Assignments Help

-

Academic Writing Services

-

Essay Writing

- Essay Help

- Essay Writing Help

- Essay Help Online

- Online Custom Essay Help

- Descriptive Essay Help

- Help With MBA Essays

- Essay Writing Service

- Essay Writer For Australia

- Essay Outline Help

- illustration Essay Help

- Response Essay Writing Help

- Professional Essay Writers

- Custom Essay Help

- English Essay Writing Help

- Essay Homework Help

- Literature Essay Help

- Scholarship Essay Help

- Research Essay Help

- History Essay Help

- MBA Essay Help

- Plagiarism Free Essays

- Writing Essay Papers

- Write My Essay Help

- Need Help Writing Essay

- Help Writing Scholarship Essay

- Help Writing a Narrative Essay

- Best Essay Writing Service Canada

-

Dissertation

- Biology Dissertation Help

- Academic Dissertation Help

- Nursing Dissertation Help

- Dissertation Help Online

- MATLAB Dissertation Help

- Doctoral Dissertation Help

- Geography Dissertation Help

- Architecture Dissertation Help

- Statistics Dissertation Help

- Sociology Dissertation Help

- English Dissertation Help

- Law Dissertation Help

- Dissertation Proofreading Services

- Cheap Dissertation Help

- Dissertation Writing Help

- Marketing Dissertation Help

- Programming

-

Case Study

- Write Case Study For Me

- Business Law Case Study Help

- Civil Law Case Study Help

- Marketing Case Study Help

- Nursing Case Study Help

- Case Study Writing Services

- History Case Study help

- Amazon Case Study Help

- Apple Case Study Help

- Case Study Assignment Help

- ZARA Case Study Assignment Help

- IKEA Case Study Assignment Help

- Zappos Case Study Assignment Help

- Tesla Case Study Assignment Help

- Flipkart Case Study Assignment Help

- Contract Law Case Study Assignments Help

- Business Ethics Case Study Assignment Help

- Nike SWOT Analysis Case Study Assignment Help

- Coursework

- Thesis Writing

- CDR

- Research

-

Assignment Writing

-

Resources

- Referencing Guidelines

-

Universities

-

Australia

- Asia Pacific International College Assignment Help

- Macquarie University Assignment Help

- Rhodes College Assignment Help

- APIC University Assignment Help

- Torrens University Assignment Help

- Kaplan University Assignment Help

- Holmes University Assignment Help

- Griffith University Assignment Help

- VIT University Assignment Help

- CQ University Assignment Help

-

Australia

- Experts

- Free Sample

- Testimonial

HI6026 Audit, Assurance and Compliance Assignment Sample

Assignment Brief

Learning Outcomes:

• Evaluate the economic and legal basis for auditing and the applicable auditing standards and reporting requirements

• Analyze and communicate knowledge of the auditor's professional judgement, legal and ethical responsibilities to their clients and third parties

• Assess audit strategies including the evaluation of business risk and internal controls

• Apply audit concepts and processes to gather evidence and formulate judgments with respect to the underlying information

Weight - 40% of the total assessments

Total Marks - 40

Word limit- 3,000 words ± 500 words

Submission Guidelines for assignment help

• All work must be submitted on Blackboard by the due date, along with a completed Assignment Cover Page.

• The assignment must be in MS Word format, single spacing, 12-pt Arial font and 2cm margins on all four sides of your page with appropriate section headings and pagenumbers.

• All reference sources must be provided using Harvard referencing Assignment Specifications

Assignment Specification

Required Task:

Part A: Analytical Procedure (15 marks)

Obtain a copy of a recent annual report (2019) from ASX Top 300 listed companies list (most companies make their annual reports available on their website). Perform analytical procedures of the Statement of Financial Position and of Financial Performance over the two years (2018 and 2019) using appropriate ratios and/or metrics.

Required:

Measure and discuss income statement, balance sheet and cash flow ratios from your selected company and How does this affect your assessment of materiality, detection risk and overall audit Risk? Provide a brief explanation in the report. This should be presented in a table format. (15 marks)

Part B: Audit Committee Effectiveness (20 marks)

1. “Audit committees do not prepare financial reports, nor do they conduct audits. But they have an essential role to play in ensuring the integrity and transparency of corporate reporting”. Explain this statement? Who should be members of the Audit Committee? Is there an association between Audit committee effectiveness and audit quality after IFRS adoption? (10 marks)

2. Explain your selected company’s (same selected company from part A) and prepare the following responses about the application of audit committee effectiveness recommended by ASX Corporate Governance Council (CGC) principles using Corporate Governance Principles and Recommendations (4th Edition) was released on 27 February 2019? (10 marks)

i. Members of the audit committee meet all applicable independence requirements.

ii. The audit committee demonstrates appropriate industry knowledge and includes a diversity of experiences and backgrounds.

iii. Audit committee members have the appropriate qualifications to meet the objectives of the audit

committee ‘s charter, including appropriate financial literacy.

iv. Discuss about audit committee size and members profile.

v. Discuss about meeting arranged by audit committee chairman and whether member participate actively?

vi. The audit committee monitors compliance with corporate governance regulations and guidelines.

The assignment structure must be as follows:

1. Holmes Institute Assignment Cover Sheet – Full Name, Student No., Contribution.

2. Executive Summary

• The Executive summary should be concise and not involve too much detail.

• It should make commentary on the main points only and follow the sequence of the report.

• Write the Executive Summary after the report is completed, and once you have an overview of the

whole text.

• The Executive Summary appears on the first page of the report.

3. Contents Page – This needs to show a logical listing of all the sub-headings of the report’s contents. Note this is excluded from the total word count.

4. Introduction – A short paragraph which includes background, scope and the main points raised in order of importance. There should be a brief conclusion statement at the end of the Introduction.

5. Main Body Paragraphs with numbered sub-headings – Detailed information which elaborates on the main points raised in the Introduction. Each paragraph should begin with a clear topic sentence, then supporting sentences with facts and evidence obtained from research and finish with a concluding sentence at the end.

6. Conclusion – A logical and coherent evaluation based on a thorough and an objective assessment of the research performed.

7. Appendices – Include any additional explanatory information which is supplementary and/ or graphical to help communicate themain ideas made in the report. Refer to the appendices in the main body paragraphs, as and where appropriate. (Note this is excluded from the total word count.

Solution

Introduction

The Wesfarmers Limited is one of the biggest Australian conglomerates currently operating as one of the biggest retails of the chemical as well as fertilizer and other energy related products and services. The company was inaugurated in the year 1914. The company is publicly listed under the Australian Stock Exchange (ASX) (Campbell, 2017). The company deals in the revenue generation from various products and services like the retailing of the departmental stores as well as the processing of the gas and energy production and distribution. The company also manufactures chemicals as well as fertilizers and the distribution of the different products related in safety. The company predominantly operates in the areas of New Zealand as well as United Kingdoms and Australia (Kinsella, 2012). The headquarters of the company is located in the city of Perth of Australia. The financial statement analysis of the company will be done using ratio analysis which will include different types of liquidity and profitability as well as asset and inventory efficiency ratio for the company. The effect of the materiality on the ratios analyzed by the report will be explained in details by the report and the effect of these ratios in the materiality of the company as well as the overall audit risk and the detection risk will be discussed (Sujan and Abeysekera, 2007). The audit committee of the company will be assessed critically and the different members of the audit committee will be discussed to check as per the requirements mentioned in the using Corporate Governance Principles and Recommendations (4th Edition). The preparation of the audit committee will be done with the explanation of the statement regarding the role of the audit committee in ensuring the transparency as well as the integrity of the financial statements reporting using the corporate financial analysis. This will be mentioned in the second part of the report.

Discussion

Part A

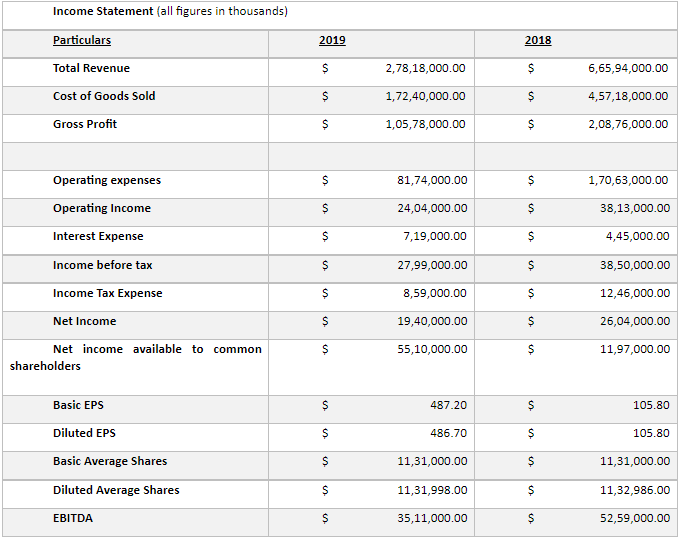

The income statement of Wesfarmers Limited is presented as:

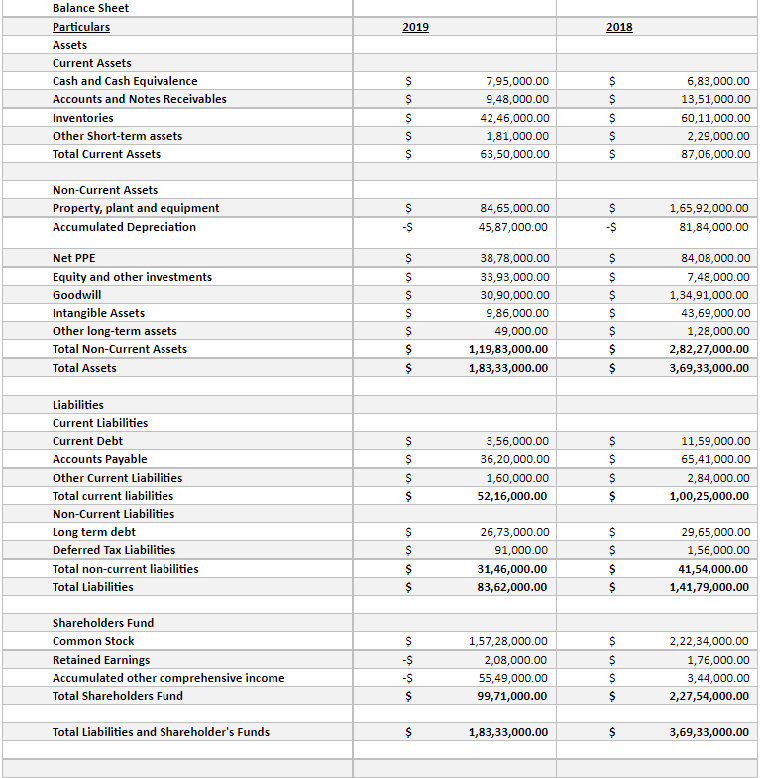

Balance Sheet:

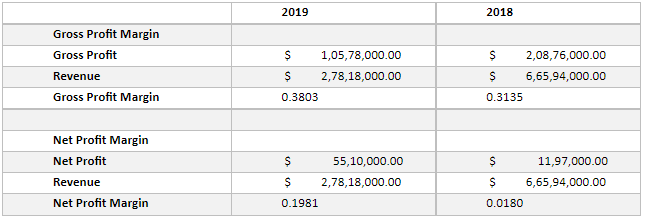

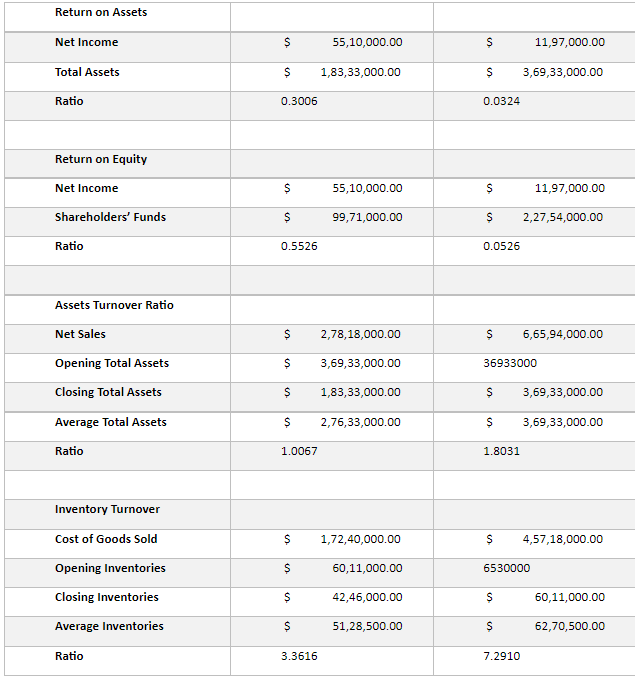

The different profitability ratios that were calculated are:

We can clearly see that net profit margin of the company increased in the financial year 2019 ending 29th June, 2019, as compared to the gross profit margin in the financial year 2018 ending 29th June, 2018. This is because of the increased competition that the company faced in the industry as a reason of which it failed to co-incite with the strategies being implemented for the production of the relevant operations in the business. The effect of the decrease of the profit in Wesfarmers will affect the assessment of the materiality (Curtis and Hayes, 2002). The net profit before tax for the company is calculated to be $ 55,10,000.00, which means that the approximately 1 percent to 2 per cent of the net profit before tax will be used for the assessment of the materiality. This means that approximately $55100 - $115000 will be used as the benchmark which will be assessed for the determination of materiality. At the same time, the benchmark which is set for the materiality of the auditing process of the company is set to be 0.5 percent to 1 percent (Chong and Vinten, 1996). One of the major process that the audit committee needs to follow is the proper documentation of the different figures mentioned in different accounts in the financial statements of the company. The evaluation of the materiality of the company will be determined using proper authentication of the documents present.

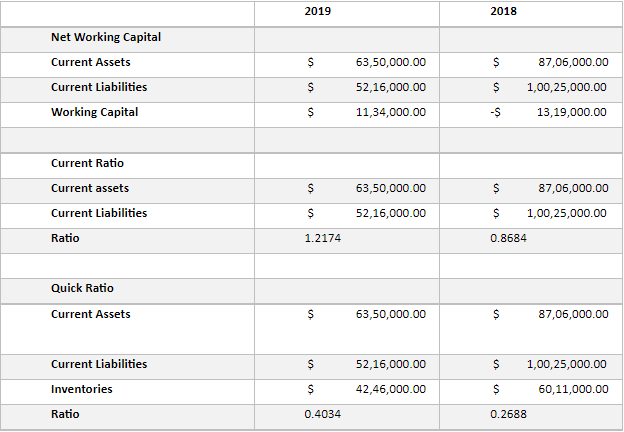

The liquidity ratios of Wesfarmers are calculated to be:

The current ratio as well as the quick ratio has increased significantly in the financial year 2019 as compared to the past financial year 2018. One of the major reasons for the same is the investment of the company heavily in the inventory department of the company. This is because of the fact that the company invested because of the increased demands in chemical and energy-based products prior to the emergence to the COVID-19 (Miah et al., 2020).

The efficiency-based ratios of Wesfarmers are calculated to be:

There is a decrease in the efficiency ratios of the company which means that the company is somewhere incapable of efficiently handling the assets and the inventories in the business organization and this is leading to poor revenue generation from the assets as well as the inventories. This will efficiently affect the materiality as the benchmark threshold for materiality is based on either the net income or the total revenues of the company. The Return on Assets as well as Return on Equity is affected with the changes in the net income of the company and at the same time, the asset turnover ratio will be affected by the net income earned by the company (Houghton, Jubb and Kend, 2011). The changes in the net income by the company can indirectly be affected by the changes in the net revenues of the company.

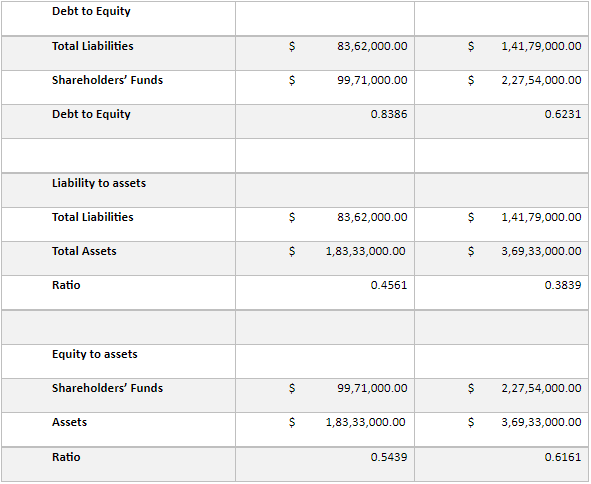

The debt management ratios calculated are:

The debt-to-equity ratio of the company has increased by 1.5 timesg which means that the company is subjected to higher levels of risk as it is majorly financing the operations in the company using the borrowed funds.

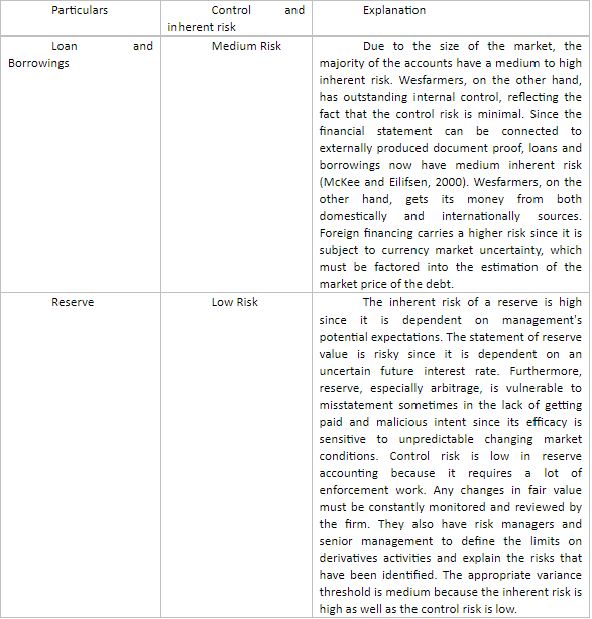

To determine the possibility of material misstatement, two related accounts are subjected to analytical procedures. Loans and borrowings, reserves.

Part B

1. The audit committee's position is critical to business ethics. The internal auditors of board members are responsible for providing successful oversight of the annual audit procedure. Once the rest of the board members are autonomous and impartial, they produce the highest quality work. The audit committee meets with departments and senior auditors to discuss the findings of an audit, particularly matters that must be reported to the panel under widely agreed auditing principles. The committee is responsible for financial statements, information and technology regulation, and organizational concerns. Internal auditors may be aware of the possible effect of financial statements if they have a complete sense of audited accounts (Budescu, Peecher and Solomon, 2012). Both members of the audit committee should be aware of recent legal and functional developments and notifications. The audit committee's biggest duty is to investigate major financial reporting problems. Audit committees engage with executive management and external auditors to discuss the audit's findings, which may include information that managers are expected to reveal mostly with audit committee within general auditing principles. The audit committee authorizes the audit plan, reviews staffing, as well as offers insight into the audit plan's organization for organizations that provide an internal audit function. The Sarbanes-Oxley Act of 2002 should be clear to audit committee members (SOX). In 2003, the Securities and Exchange Commission (SEC) issued a regulation requiring national securities markets and stock exchange associations to refuse listings that do not meet the SOX audit committee criteria (DeZoort, Hermanson and Houston, 2003). In addition, the committee will review potential audit methods as well as coordinates the audit effort through internal audit personnel. Once an internal audit role is established, the committee may check and approve its audit plan, examine the function's personnel and organization, and communicate with internal auditors and administrators on a regular basis to address any issues that may occur.

The members of an audit committee should have enough technical expertise in the fields of auditing as well as financial knowledge (Azzopardi and Baldacchino, 2009). The audit committee should be structured in an independent as well as functional way which will make it easy for the auditors to work in an harmonical environment as well as peaceful cooperation. There should be at least 3 members in the audit committee of the company, all of them should be the non-executive directors of the company as well as the independent directors should comprise the majority of the members of the audit committee (Gist, and Shastri, 2003).

The independent representatives of the audit committee should assist the agents in the process of the monitoring of the actions which will reduce the benefits of withholding the relevant information. There is a negative relationship mentioned under the IFRS between the audit committee independence as well as the audit report lag and the audit committee meetings as well. The committee is made with the ultimate responsibility of looking at the financial reports of the company and checking and authenticating the materiality and the assessment of the risk mentioned (Canning, O’Dwyer, and Georgeakopoulos, 2019). The quality should be at par with the methods used in the process of audit in the company and this should be regularly monitored by the audit committee as per the International Financial Reporting Standards or the IFRS.

2. a. As per the effectiveness which is recommended by the Australian stock exchange (ASX) as well as the corporate governance principles and recommendations, the applicable independence requirements of the members of the audit committee is at par with the audit committee of the Australian conglomerate Wesfarmers Limited. The applicable independent requirements of the members of the audit committee is kept in mind while the framing of the audit and risk committee in the company.

b. The audit and risk committee of Wesfarmers are inclusive of four much knowledgeable members and the chairman as Tony Howarth. All the members of the audit and risk committee possess a great amount of knowledge not only about the economic and business world, but they do have a great knowledge about the financial aspects of the company which will help them in the audit committee (WANG and XU, 2009).

c. The appropriate qualifications of the members of the audit committee should be such that the there should be a minimum of three members in the audit committee and they should be non-executive directors of the company. There should be an adequate knowledge about accounting and financial perspectives of a business. As per the corporate governance report of the company, all the members listed in the audit committee of Wesfarmers possess these types of qualities.

d. The audit committee of Wesfarmers limited has five members out of which the chairman of the audit and risk committee of the business organization is Tony Howarth with other four members in the audit committee being Bill English, Diane Smith-Gander, Sharon Warburton as well as Jennifer Westacott. These five members constitute the audit and risk committee of the Australian conglomerate, Wesfarmers Limited. The chairman of the audit and risk committee is also an independent director who is not a part of the Board of Directors team of the committee to ensure transparency as well as authenticity of the audit committee.

e. There were several meetings that were arranged by the audit committee and these meetings aw an active participation from the members of the audit committee during the course of the financial year. The members actively participated in order to show and represent a fluent and active working of the audit committee in the company which means that the audit committee is working actively and coherently in such a manner which will yield positive and true results at the end of the financial year. The meeting which resulted in the maximum participation from the members was held on the 2nd of October of the financial year.

f. As per the compliances and the rules and regulations set for the purpose of corporate governance, the audit committee is said to have complied very well in terms of the structure of the audit committee, the size of the members of the committee as well as the expertise in the respective accounting and financial fields for the members of the audit committee. The audit committee has a chairman, Tony Howarth which is not chairing the Board of Directors and this is one of the primary and crucial rules which is mentioned in the corporate governance rules and regulations as well as compliances. The audit committee has more than 3 members which are independent directors and non-executive directors of the company.

Conclusion

The financial overview of Wesfarmers Limited, an Australian based corporation and one of the largest Australian conglomerates, will be discussed in this article. Chemical and fertilizer retail, as well as other related items, are dealt with by the company. This corporation is one of Australia's most financially sound corporations. The report discussed about the ratio and financial analysis of the company and effect of them on the materiality of the audit statements. The financial statement analysis of the company has been done using ratio analysis which included different types of liquidity and profitability as well as asset and inventory efficiency ratio for the company. The effect of the materiality on the ratios analyzed by the report has also ben explained in details by taking loans and borrowing as well as reserves and the effect of these ratios in the materiality of the company as well as the overall audit risk and the detection risk were also be discussed. The audit committee of Wesfarmers were critically analyzed and the requirements were assessed with the rules and the regulations as well as the compliances set down for the purpose of corporate governance and financial reporting of the auditing statements by the audit committee and risk committees. The relationship between the compliances of the auditing procedures with the effect of fair and true materiality and the reporting of the financial statements have been scrutiny analyzed. The audit committee and the audit members of the Wesfarmers which is led by EY have been assessed and it seems that performed seemingly well while complying with the rules and regulations.

References

Azzopardi, J. and Baldacchino, P.J., 2009. The concept of audit materiality and attitudes towards materiality threshold disclosure among Maltese audit practitioners.

Budescu, D.V., Peecher, M.E. and Solomon, I., 2012. The joint influence of the extent and nature of audit evidence, materiality thresholds, and misstatement type on achieved audit risk. Auditing: A Journal of Practice & Theory, 31(2), pp.19-41.

Campbell, J., 2017. Insights from the company monitor: Wesfarmers. Equity, 31(8), pp.16-17.

Canning, M., O’Dwyer, B. and Georgakopoulos, G., 2019. Processes of auditability in sustainability assurance–the case of materiality construction. Accounting and Business Research, 49(1), pp.1-27.

Chong, H.G. and Vinten, G., 1996. Materiality and audit risk modelling: financial management perspective. Managerial Finance.

Curtis, M.B. and Hayes, T., 2002. Materiality and audit adjustments. The CPA Journal, 72(4), p.69.

DeZoort, F.T., Hermanson, D.R. and Houston, R.W., 2003. Audit committee support for auditors: The effects of materiality justification and accounting precision. Journal of Accounting and Public Policy, 22(2), pp.175-199.

Gist, W.E. and Shastri, T., 2003. Revisiting materiality. The CPA journal, 73(11), p.60.

Houghton, K.A., Jubb, C. and Kend, M., 2011. Materiality in the context of audit: the real expectations gap. Managerial Auditing Journal.

Kinsella, J., 2012. Luminous World: Contemporary art from the Westfarmer Collection.

McKee, T.E. and Eilifsen, A., 2000. Current materiality guidance for auditors.

Miah, M.S., Jiang, H., Rahman, A. and Stent, W., 2020. Audit effort, materiality and audit fees: evidence from the adoption of IFRS in Australia. Accounting Research Journal.

Sujan, A. and Abeysekera, I., 2007. Intellectual capital reporting practices of the top Australian firms. Australian Accounting Review, 17(42), pp.71-83.

WANG, X. and XU, X.D., 2009. Audit Materiality Level, Accounting Firm Size and Audit Opinion [J]. Journal of Finance and Economics, 1.

Download Samples PDF

Related Sample

- BUSN20016 Research in Business Assignment

- FINC20023 International Financial Management Assignment

- PROJ6003 Project Execution and Control

- CHCMHS006 Facilitate The Recovery Process with The Person, Family and Carers

- LAW6001 Taxation Law Case Study 2

- PROJ6018 Project Portfolio and Program management Assignment

- MEM603 Engineering Strategy Report

- GDECE103 Language and Literacy Assignment

- DASE201 Data Security Assignment

- Research and Data Modelling Assignment

- ISYS1004 Contemporary issue in Information Technology Assignment

- COMP1001 Data Communications and Networks Assignment

- Stock Based Compensation Plans Assignment

- SHS7000 Food Safety in Association with Campylobacter in Chicken Report

- STT500 Statistics for Decision Making Assignment 2

- PROJ6003 Project Execution and Control Report

- LMED28002 Haematopathology Case study 1

- TACC602 Accounting for Business Assignment

- U24035 Customer Relationship Management Assignment

- Business Capstone Project Assignments

Assignment Services

-

Assignment Writing

-

Academic Writing Services

- HND Assignment Help

- SPSS Assignment Help

- College Assignment Help

- Writing Assignment for University

- Urgent Assignment Help

- Architecture Assignment Help

- Total Assignment Help

- All Assignment Help

- My Assignment Help

- Student Assignment Help

- Instant Assignment Help

- Cheap Assignment Help

- Global Assignment Help

- Write My Assignment

- Do My Assignment

- Solve My Assignment

- Make My Assignment

- Pay for Assignment Help

-

Management

- Management Assignment Help

- Business Management Assignment Help

- Financial Management Assignment Help

- Project Management Assignment Help

- Supply Chain Management Assignment Help

- Operations Management Assignment Help

- Risk Management Assignment Help

- Strategic Management Assignment Help

- Logistics Management Assignment Help

- Global Business Strategy Assignment Help

- Consumer Behavior Assignment Help

- MBA Assignment Help

- Portfolio Management Assignment Help

- Change Management Assignment Help

- Hospitality Management Assignment Help

- Healthcare Management Assignment Help

- Investment Management Assignment Help

- Market Analysis Assignment Help

- Corporate Strategy Assignment Help

- Conflict Management Assignment Help

- Marketing Management Assignment Help

- Strategic Marketing Assignment Help

- CRM Assignment Help

- Marketing Research Assignment Help

- Human Resource Assignment Help

- Business Assignment Help

- Business Development Assignment Help

- Business Statistics Assignment Help

- Business Ethics Assignment Help

- 4p of Marketing Assignment Help

- Pricing Strategy Assignment Help

- Nursing

-

Finance

- Finance Assignment Help

- Do My Finance Assignment For Me

- Financial Accounting Assignment Help

- Behavioral Finance Assignment Help

- Finance Planning Assignment Help

- Personal Finance Assignment Help

- Financial Services Assignment Help

- Forex Assignment Help

- Financial Statement Analysis Assignment Help

- Capital Budgeting Assignment Help

- Financial Reporting Assignment Help

- International Finance Assignment Help

- Business Finance Assignment Help

- Corporate Finance Assignment Help

-

Accounting

- Accounting Assignment Help

- Managerial Accounting Assignment Help

- Taxation Accounting Assignment Help

- Perdisco Assignment Help

- Solve My Accounting Paper

- Business Accounting Assignment Help

- Cost Accounting Assignment Help

- Taxation Assignment Help

- Activity Based Accounting Assignment Help

- Tax Accounting Assignment Help

- Financial Accounting Theory Assignment Help

-

Computer Science and IT

- Operating System Assignment Help

- Data mining Assignment Help

- Robotics Assignment Help

- Computer Network Assignment Help

- Database Assignment Help

- IT Management Assignment Help

- Network Topology Assignment Help

- Data Structure Assignment Help

- Business Intelligence Assignment Help

- Data Flow Diagram Assignment Help

- UML Diagram Assignment Help

- R Studio Assignment Help

-

Law

- Law Assignment Help

- Business Law Assignment Help

- Contract Law Assignment Help

- Tort Law Assignment Help

- Social Media Law Assignment Help

- Criminal Law Assignment Help

- Employment Law Assignment Help

- Taxation Law Assignment Help

- Commercial Law Assignment Help

- Constitutional Law Assignment Help

- Corporate Governance Law Assignment Help

- Environmental Law Assignment Help

- Criminology Assignment Help

- Company Law Assignment Help

- Human Rights Law Assignment Help

- Evidence Law Assignment Help

- Administrative Law Assignment Help

- Enterprise Law Assignment Help

- Migration Law Assignment Help

- Communication Law Assignment Help

- Law and Ethics Assignment Help

- Consumer Law Assignment Help

- Science

- Biology

- Engineering

-

Humanities

- Humanities Assignment Help

- Sociology Assignment Help

- Philosophy Assignment Help

- English Assignment Help

- Geography Assignment Help

- Agroecology Assignment Help

- Psychology Assignment Help

- Social Science Assignment Help

- Public Relations Assignment Help

- Political Science Assignment Help

- Mass Communication Assignment Help

- History Assignment Help

- Cookery Assignment Help

- Auditing

- Mathematics

-

Economics

- Economics Assignment Help

- Managerial Economics Assignment Help

- Econometrics Assignment Help

- Microeconomics Assignment Help

- Business Economics Assignment Help

- Marketing Plan Assignment Help

- Demand Supply Assignment Help

- Comparative Analysis Assignment Help

- Health Economics Assignment Help

- Macroeconomics Assignment Help

- Political Economics Assignment Help

- International Economics Assignments Help

-

Academic Writing Services

-

Essay Writing

- Essay Help

- Essay Writing Help

- Essay Help Online

- Online Custom Essay Help

- Descriptive Essay Help

- Help With MBA Essays

- Essay Writing Service

- Essay Writer For Australia

- Essay Outline Help

- illustration Essay Help

- Response Essay Writing Help

- Professional Essay Writers

- Custom Essay Help

- English Essay Writing Help

- Essay Homework Help

- Literature Essay Help

- Scholarship Essay Help

- Research Essay Help

- History Essay Help

- MBA Essay Help

- Plagiarism Free Essays

- Writing Essay Papers

- Write My Essay Help

- Need Help Writing Essay

- Help Writing Scholarship Essay

- Help Writing a Narrative Essay

- Best Essay Writing Service Canada

-

Dissertation

- Biology Dissertation Help

- Academic Dissertation Help

- Nursing Dissertation Help

- Dissertation Help Online

- MATLAB Dissertation Help

- Doctoral Dissertation Help

- Geography Dissertation Help

- Architecture Dissertation Help

- Statistics Dissertation Help

- Sociology Dissertation Help

- English Dissertation Help

- Law Dissertation Help

- Dissertation Proofreading Services

- Cheap Dissertation Help

- Dissertation Writing Help

- Marketing Dissertation Help

- Programming

-

Case Study

- Write Case Study For Me

- Business Law Case Study Help

- Civil Law Case Study Help

- Marketing Case Study Help

- Nursing Case Study Help

- Case Study Writing Services

- History Case Study help

- Amazon Case Study Help

- Apple Case Study Help

- Case Study Assignment Help

- ZARA Case Study Assignment Help

- IKEA Case Study Assignment Help

- Zappos Case Study Assignment Help

- Tesla Case Study Assignment Help

- Flipkart Case Study Assignment Help

- Contract Law Case Study Assignments Help

- Business Ethics Case Study Assignment Help

- Nike SWOT Analysis Case Study Assignment Help

- Coursework

- Thesis Writing

- CDR

- Research

.png)

~5.png)

.png)

~1.png)

.png)