Reports

BUA4003 Principles of Economics Report 2 Sample

Assessment Brief

This assignment consists of two separate tasks that must be submitted at the same time. Your response to each task should be no more than 500-600 words plus diagrams. Use headings for Task 1 and Task 2. Your responses can draw on real world examples and sources and must include appropriate diagrams.

Task 1: The Impact of Elasticity on Strategic Choices for Electric Vehicle Producers

You are an industry analyst investigating the global EV market. In your research, you came across the following:

“In 2023, Tesla implemented multiple price adjustments across its model range”

“China's growing middle class and rising incomes have led to a surge in EV sales”

“The recent fluctuations in global oil prices have significantly impacted the adoption rates of EVs”

As an industry analyst, you have been tasked with providing a comprehensive report to help electric vehicle producers understand the importance of elasticity in their strategic decision-making. Prepare a short report (400-500 words plus diagrams) that addresses the following:

1. Price Elasticity of Demand:

- Explain the concept of price elasticity of demand (PED) and its significance for an electric vehicle producer. Illustrate how sensitive the demand for electric vehicles can be to price changes. [Hint: how would Tesla implementing multiple price adjustments across its model range affect the PED?]

2. Income Elasticity of Demand:

- Explain income elasticity of demand (YED) and how changes in consumer income levels can affect the demand for electric vehicles. Illustrate how rising incomes influence demand.

3. Cross-Price Elasticity of Demand:

- Explain the cross-price elasticity of demand (XED) in the context of electric vehicles and their substitutes and complements. Illustrate how prices of related goods can affect the demand for electric vehicles.

Task 2: The implementation of tax policy on petrol cars

Consider yourself as an economist working for the Australian Federal government. In your role, you evaluate issues relating to economic policy proposals. Your task here is to evaluate a proposal for Australia to reduce its air pollution by reducing its use of petrol cars and thus implementing a tax on for each litre of petrol sold. The aim of this policy is to reduce uptake of petrol-powered vehicles. You should focus on the importance of elasticity on the achievement of the objectives of the tax and discuss any potential unintended impacts of the tax (400-500 words plus diagrams).

Intended Learning Outcomes:

1. Apply economic frameworks for policy and business decision-making.

2. Research and apply economic concepts to predict how changes in economic conditions may impact individuals, businesses and industries within market structures.

3. Critically analyse economic data to explain relationships between economic variables and their impacts on policy, business and individuals.

4. Construct and present logical and persuasive economic arguments and communicate concepts professionally.

Referencing

- It is expected that you will reference a range of resources (e.g. the textbook, news media, journal articles, industry reports, the ABS and other sources).

- Attributing authorship correctly helps us all be better scholars. The referencing style for this subject is APA7.

- The Academic Referencing Tool provides detailed referencing examples for the prescribed La Trobe University referencing styles. Select the link if you would like to learn more.

Solution

Task 1: The Impact of Elasticity on Strategic Choices for Electric Vehicle Producers

Introduction

Elasticity therefore defines how sensitive the value of market parameters is to forces of value of economy. Essentially, elasticity is important for any strategic planning among EV producers. This report explores three key types of elasticity. This section focuses on the analysis of the Price Elasticity of Demand (PED), Income Elasticity of Demand (YED), and Cross-Price Elasticity of Demand (XED) to understand the market dynamics of the electric vehicle (EV) market.

1. Price Elasticity of Demand

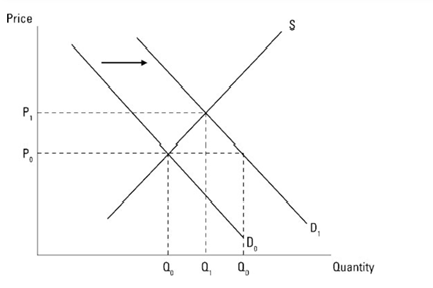

.png)

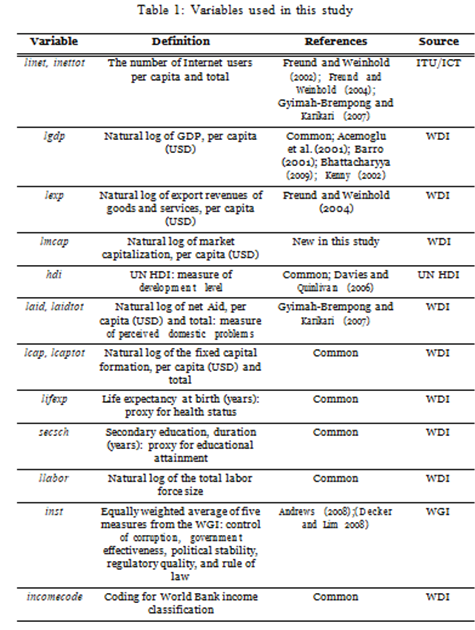

Figure 1: Price Elasticity of Demand

(Source; Self-made)

Definition and Significance: The Price Elasticity of Demand (PED) is the coefficient to changes in price and is calculated as the ratio of the percentage change in quantity demanded to percentage change in price (Lecocq & Muehlegger, 2019). In the case of EV producers, PED is used to understand how changes in price impact sales volume, revenue, and the direction taken in the market.

Application to Tesla's Price Adjustments: One of the best examples of PED is the regular price changes that Tesla has employed in respect to its physical products. For example, a decrease in price of 10% for Model 3 and a subsequent change of sales of 15% leads to the determination of a PED of -1.5, indicating elastic demand. On the diagram, it is reflected in the decrease of the elasticity of demand, indicated by a flatter curve for the assignment helpline.

Sensitivity Analysis: Elastic demand means small changes in price can cause big changes in the quantity demanded and thereby affect market share. Knowledge about PED assists Tesla to adjust the prices in the right way to maximize its profits while at the same time maintaining competitiveness in the market.

2. Income Elasticity of Demand

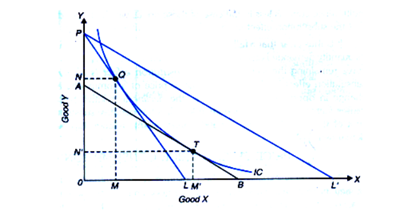

.png)

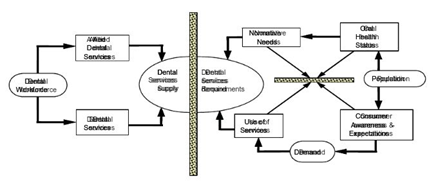

(Source; Self-made)

Definition and Significance: Income elasticity of demand (YED), on the other hand, tends to point out a change in quantity demanded of a particular good when income moves around (Springel, 2021). The necessity of it is to divide the percentage change in quantity demanded by the corresponding change in income. Thus, for EV producers, YED is an effective tool that reveals how shifts in income affect demand for their products and determines the further course of action.

Impact of Rising Incomes: The improvement in income levels especially in China have greatly enhanced the demand for EV. For instance, the average income increases by 10% although to 20% the consumption of EV rises the corresponding is +2.0. This is depicted by a shift of the EV demand curve rightwards.

2. Cross-Price Elasticity of Demand

.png)

(Source; Self-made)

Definition and Significance: Cross-Price Elasticity of Demand (XED) defined as the influence of the relative price of one good on the quantity demanded of another good (Kalthaus & Sun, 2021). It is expressed as the percentage change in quantity demanded of Good A divided by the percentage change in the price of Good B.XED can be used by EV producers to determine on how shifts in the price of related goods like petrol influences the demand of EVs or electric cars.

Effect of Oil Price Fluctuations: Rising oil prices often increase EV demand. For example, a 10% increase in oil prices leading to a 5% rise in EV demand results in an XED of -0.5, indicating that petrol and EVs are substitutes. Diagrammatically, this is shown as a rightward shift in the EV demand curve.

Conclusion

It is, therefore, important for EV producers to understand elasticity such as PED, YED, and XED to enable better strategic decisions. PED demonstrates how to improve the right pricing schemes, YED identifies how shifts in incomes affect demand, XED describes how related products’ prices affect EV sales.

Task 2: The Implementation of Tax Policy on Petrol Cars

Introduction

Levying on petrol has the ambition of mitigating the emission of gases into the atmosphere since the utilization of vehicles that use petrol is unpopular. The policy targets are to reduce the usage of petrol and the resultant emissions (Wangsness & Halse, 2021). Another important concept that should be used to evaluate the policy is elasticity, which captures the impact of price changes on petrol consumption and consumers’ responses.

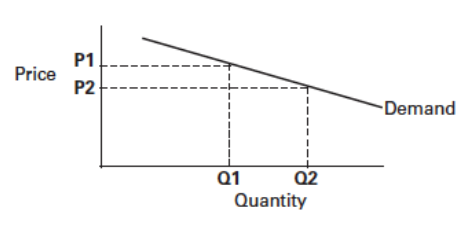

1. Importance of Elasticity for Policy Objectives

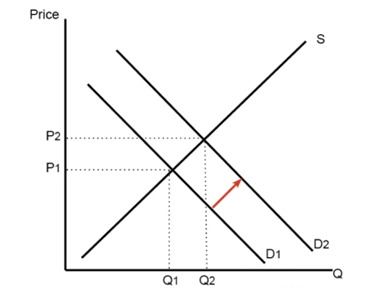

Price Elasticity of Demand (PED): Price Elasticity of Demand (PED) is the degree of responsiveness of quantity demanded of petrol to a change in price of petrol. If the demand for petrol is elastic (PED > 1), an increase in price because of a tax will result in a proportionate reduction in quantity demanded. For example, if a tax increases petrol prices by 20% and the PED is -1.5, the quantity demanded could decrease up to 30%. This significant saving in petrol use is beneficial in the fight against pollution and is useful in achieving environmental goals.

Illustration: An upward shift in the demand curve in an elastic demand scenario indicates that a petrol tax will reduce the quantity demanded in the market. On the same diagram, an increase in price leads to a shift of the initial demand curve (D1) to a steeper curve (D2) that reduced quantity demanded from Q1 to Q2 of petrol. This shift to the left demonstrates that an increase in the price of gasoline reduces its use and consequently minimizes emissions (Bitencourt et al., 2021). In terms of the policy objectives outlined in the diagram, the tax successfully reduces the use of petrol and, as a result, minimizes air pollution, a key environmental and public health concern.

2. Potential Unintended Impacts

Consumer Behavior Changes: One disadvantageous impact of adopting the petrol tax might be the saturated shifting of consumers towards other fuels or higher fuel economy vehicles. With the upsurge in petrol prices, consumers are inclined to buy either EVs or hybrids, trends that may partially neutralize the effect of reduction in petrol consumption. This shift may also help increase the demand for these alternative technologies and may do more than just reduce the usage of petrol.

Economic Impact: The tourists may be affected by the petrol tax since the less fortunate or those who consume significantly higher quantities of petrol are the worst hit as compared to the upper classes. This additional cost could further widen the inequality gap and decrease the funds available for these households (Valogianni et al., 2020). This might lead to low sales of petrol vehicles within the automotive industry thus affecting the manufacturers as well as the dealers in the sale of those models. Although the function is to decrease the use of petrol or is associated with emission reduction the tax would increase government revenue. Having this extra revenue, one can use it for environmental issues, infrastructure developments or to pay other taxes which might counterbalance some of the effects. However, whether these measures will help in eradicating the tax’s adverse effects will depend on the responses and amendments that the government will make on the policy level.

Conclusion

Elasticity crucially affects the petrol tax policy's success in reducing consumption and pollution. While PED helps predict the tax's impact on petrol demand, policymakers must consider unintended consequences, such as shifts to alternative fuels and economic strain on low-income households. If these facets are addressed, the policy stands to benefit by having increased optimality and fairness added to it.

Reference List

.png)

Reports

EC501 International Economic Development Report 2 Sample

Assignment Details

Students will complete an issue report which addresses one major issue that impacts upon international economic development. Each student will choose an issue from weeks (topics) 3, 4, 5 or 6 and will address theory, empirical evidence and recommendations for government and business responses.

Purpose

The purpose of this assessment item is for each student to develop and demonstrate a deeper knowledge and understanding of an issue in international economic development than is possible during the class session on the issue. Each student will become the class expert on their chosen issue.

The Task

Students should chose an issue from topics 3, 4, 5 or 6 that interests them. There is considerable scope provided in these topics and a number relate directly to agribusiness. Students should choose their issue as early as possible and read widely. Special attention should be paid to all the material used or referred to in the relevant class session (presentation). Issues that could potentially be addressed include:

- Trade in primary commodities as a barrier to economic growth in developing economies

- Economic enclaves as an impediment to economic growth in developing economies

- Application of dependency theory to economic development in the Global South

- Costs and benefits of international migration flows among nations

- The role of international aid in relieving foreign currency shortages

- Costs and benefits of industrialisation as a growth strategy

The written report should outline the chosen issue and state why it is of interest in the context of international economic development. Contributions to analysis of the issue from both theoretical and empirical perspectives should be presented, noting areas of agreement and disagreement and identifying any gaps in the literature that could be addressed by future research. Lessons or implications for government and business should be discussed. Students will then each present their report.

Format

The format required for the report is set out here. This format contains eight sections.

Cover Page (not included in word count)

List of contents (not included in word count)

Executive Summary (around 200 words) (this is the last section to be written)

Introduction (around 500 words)

- Identify the chosen issue

- Describe briefly the nature of the issue

- Summarise briefly the analysis to follow

Analysis (around 1,500 words)

- Provide a review of the theoretical and empirical literature relevant to the issue

- Use algebraic or geometric models to demonstrate mastery of the issue (use of such models is not compulsory but a model can sometimes convey an idea succinctly without using too many words)

- Carefully identify areas of agreement and disagreement among various contributors to the literature

- Identify any area(s) that should be the focus of future research

Conclusion (around 300 words)

References (not included in word count)

Appendices (if any) (not included in word count)

Solution

1. Introduction

Common problems the host countries experience include pressure on the economy because of rising demand in areas such as health, education, and accommodations. Sometimes the social problems are due to interaction with strangers for a certain time and change of the population, manifesting in conflict between groups. The industry often influences employment prospects, and job markets have limited positions for newcomers, as with locals and immigrants (Safarian, 2024). Furthermore, capacity is also strained where infrastructure reaches its optimum and the services offered dilute.

The nature of the issues is mostly related to the economic and cultural factors of the host countries. As follows the economy, this report highlighted the problems of unskilled employment. In addition, it highlighted the issues of immigration and the cultural burden issues in host countries for the assignment helpline.

This report highlighted major problems associated with the structures of host countries. In addition, it served the thoughts of literature and revealed a model of capital mobility to highlight the problems associated with the host countries. Some of the economic developments are additionally revealed, which can help to develop the capacity of the host countries' business effectiveness.

2. Analysis

2.1 Review of the theoretical and empirical literature

One of the relevant reasons for wishing the host countries suffered the most is their unskilled wages. According to Demireva and Zwysen (2020), an oversupply of employment in the sectors of low skills leads to the suppression of wages. As for that, the levels of employment benefits are getting lower by 4.9%. Disappointment, the earning capabilities of the skilled employees have fallen in those host countries. As per Livermore and Revesz (2020), the cost-benefit analysis theory helps to analyse the relationships between business costs against the benefits they receive. Using this theory and the thoughts of Wahba (2021) revealed differences in economic cost effects on the host countries. The rising demands for different public services like education and healthcare facilities have raised their economic stain. In addition, infrastructural pressures like the development of public transportation additionally affected their budgetary works.

From the viewpoint of Bilir et al. (2019), multinational companies play a huge role in the parts of trade developments as well as technological developments in host countries. For the lower employment costs, the multinational companies receive more benefited employability environments. It helps them to raise their structures of productivity with a minimum of employment costs. According to Lyailya and Zagida (2020), the host countries are additionally suffering from migration problems. The political influence of these countries influenced most of the young people. It is the cause of cultural shifts and concerns about job security environments.

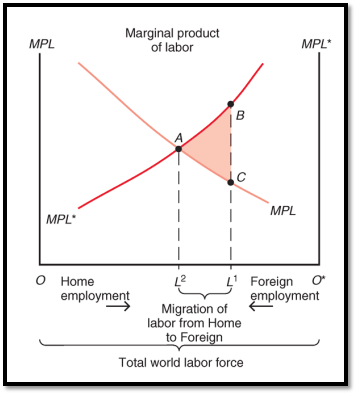

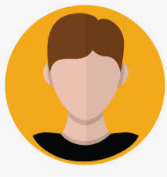

2.2 Model of Capital Mobility

As follows the model of capital mobility, the effects of reward factors as well as international migations are analysed between two countries. As follows the model, the poor structures of labour mobilities of host countries affected their levels of employee effectiveness. As for the unskilled employees of those host countries, their capital can be moved faster in the international markets (Gerking and Mutti, 1983). However, it can bring lower returns on their international capital as well as employees' capital.

As for this model utilisation, two host countries are taken into consideration, which are the United States and Mexico. To understand the problems of this host country, two basic elements, their labour and capital, are taken into consideration. For that, the US contained an unskilled labour range of 5.7 million between the session of 2024 (International Labour Office, 2024). At this time, the country contained a growth rate of 37% on their capital infrastructures (International Labour Office, 2024). This shortage of labour in the US is greater than the shortage of unskilled labourers in Mexico. However, the country contained capital growth of 27% which is lower than the US (Deloitte, 2024). As follows the capital-labour ratios of these host countries, they both suffered from the issue of labour shortage and rising unfilled demands of skillful employment.

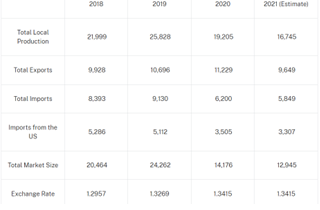

Table 1: Labour shortage

(source: International Labour Office, 2024)

2.3 Areas of Agreement and Disagreement

The main area of agreement is the employment issues in the host countries. In the global international market, there are 13 countries that face similar issues, where Israel is in the top position for the matters of unskilled employment (Yahoo, 2024). As for that, there was a rise in migrant employment visualised in the global job market, which reached 169 million last year. Additionally, from the global economy, the imigations lecvels of the unskilled employees are visaulised from 20% to 60% (Yahoo, 2024). It effected the efficiency rates and productional capabilities of the countries.

The disagreement factor of the literature is the attraction of multinational companies for the host countries. In host countries, the multinational business can receive employment benefits. However, it can affect their cost structures most (Hunter, 2024). It can raise the risks of exchange rates within the business. The differences in exchange rates between the countries can lead the multinational business financial consequences (Hunter, 2024). As like the poor exchange rate of Iran, the relationship with its multinationals is being affected (VoA, 2024). Additionally, the cultural risks can additionally reduce the production capacity of the company.

As for that, the gap in the thought literature is visualised for the analysis of output levels of unskilled employees. The capacity of unskilled employees for effective production, as well as the factors of capital-labour ratio, is not utilised by the thought of literature.

2.4 Area of Further Research

The area which will be considered for further research is the return on investment rates. It will analyse the levels of returns the international business can receive from their operational procedures in the host countries. Multinational companies face differences in internal and external issues during the time of their operational work in host countries. In addition, it will additionally serve to research the factors or challenges the multinational companies can face during the session of operations in these countries.

2.5 Current Developments

AI and Automation- One of the effective developments in the international economy is automation technologies. By using AI and automation technologies, international businesses utilise their digital services as well as productivity facilities (Cugurullo, 2020). As per the world's economic theory, the AI foundation model can help to serve dynamic market control (World Economic Forum, 2024). For that, it can bring equitable benefits of market distributions.

Global Supply Chain- For reasons of the COVID-19 pandemic, different countries faced geopolitical issues. As for that, the countries utilised their supply chain management procedures and served their focus for the diversity of supply chain management (Guan et al. 2020). Fort the COVID, the transportation costs for supplements are raised by 1.5%, whereas the costs of consumer purchases are raised by 7.5% (UNCTAD, 2024). By these moves, the business can manage its supply chain from international countries and reduce its supply costs (UNCTAD, 2024). It can additionally help to reduce their productivity price in features.

2.6 Evaluation

In the host countries, businesses face illegal migration issues. As for that, the US faced the highest number of migration issues during the time of 2018 as it contained a migration level of 23%, which is the highest level of migration (Immigration Council, 2021). In the current session, the country contained levels of immigrant population of 13.8%, which affected the economic levels deeply (Immigration Council, 2021). As for the reasons for migration, thousands of people travelled from north to southern countries. It deeply affected the levels of populations of different countries. In addition, of the rising levels of illegal migrants in economically developed countries, the employment levels of those areas are affected the most (Wihtol de Wenden, 2023). It additionally impacted the levels of their economic structures and raised the demand for public transportation as well as the public services offered by the governments.

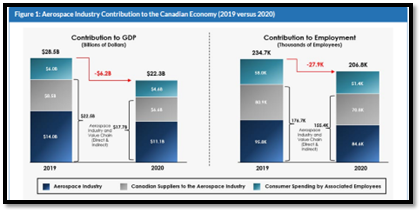

Figure 1: Immigrant population in the US

(Source: Immigration Council, 2021)

3. Conclusion

This report served as a detailed analysis of the problems associated with the host countries. As the major problem, this report served unskilled employees at different levels of the country. In addition, it analysed the difficulties faced by the host countries during the time of their economic management. By using the capital mobility model, this report highlighted the differences in capital modalities between the US and Mexico. It additionally revealed some of the effective agreement thoughts as well as disagreement thoughts of literature. As follows the theory of cost benefits analysis, the major difficulties are revealed in the portions of cost structures of host countries.

As follows, the host countries suffer from economic burdens as well as cultural difficulties during the time of their operational process. Additionally, highlighted the difficulties of analysing the involvement of multinational companies in creating better economic and employment structures for the host countries. As for the significance, these lessons highlighted the developments of the economy and technologies. It highlighted international economic developments by using authoritative tools as well as the utilisation of the global supply chains. It additionally described the shifts of business needs for new technological skills that can help support the development of host countries.

References

Reports

HM5003 Economics for Business Report Sample

Detailed Requirements of The Assignment

You are a group of advisors to the Management Board in your company with Headquarters in Australia. As advisors you are first, required to conduct research on your selected sector/industry covering the previous 5- 10 years. Second, you are required to present a company strategy to your Management Board and to the Federal Government of Australia covering the next 5 years. Your Management Board requires that you submit a 3000-word market report containing your findings and strategies. Finally, your Management Board requires that your research should predominantly be based on microeconomic and macroeconomic theory and application of Holmes Institute syllabus.

Company Selection Guidelines

Note:

(i) Choose a company/firm of your choice.

(ii) The company/firm must be an enterprise based in Australia either as a national enterprise or a multinational subsidiary in Australia with headquarters abroad

Note:

i. if your company has many products and/or services, you can select a representative product/service to be the basis for your research.

ii. This report should provide useful information for your company’s Management Board. It should use a variety of resources, including the textbook, newspapers, industry reports, the ABS website, and other sources.

iii. Furthermore, your report should include headings and sub-headings. It needs to be properly referenced using the Harvard style and at least 5 references.

Solution

Introduction

It is the retail sector where one may find a few of Australia's strong economic pillars; and in that retail sector, there is the paramount position of the Woolworths Group. Formed in 1924, Woolworths has grown to become Australia's only largest supermarket chain, having gained a strong force of customers from metropolitan and regional areas. A broad portfolio comprising groceries, clothes, and other household goods or items really pinned this company to the leading spot in the retail industry. This report will deeply analyse the Woolworths Group's positioning in the market through discussions of both microeconomic and macroeconomic variables that shape its operations, from consumer preference and cost structures to regulatory environments, each influencing overall demand and supply. Furthermore, this essay discusses two recent important macro events that have affected Woolworths and the retail sector: the COVID-19 pandemic. Precisely, through an understanding of such variables, the report is supposed to render strategic proposals that would allow Woolworths to sustain its competitive advantage and adjust to the constant economic changes occurring within the Australian market.

Company Background

The group of Woolworths was established in 1924 and grew steadily as the largest supermarket chain in Australia, holding an outstanding share in the retail market. The company Woolworths was able to secure about 37% shares in the concerned market by the year 2024 and indicates its leading position in the business sector (Woolworths Group 2024). Major group operates via a host of brands and among them, Woolworths Supermarkets is the most famous. In Australia, there are the Woolworths Supermarkets, which serve millions of customers with extensive varieties of fresh produce and groceries, bakery foods, and household items.

Apart from Woolworths Supermarkets, the company owns a chain of discount department stores, Big W, which offers everything from clothing and electronics to homeware. This way, Woolworths Diversity can enable its company to infiltrate various sectors of the retail market and make sure customers enjoy one-stop shopping. With more than 1,000 store locations across the country, in both urban and regional settings, Woolworths' immense network ensures outreach to all types of customers, from metropolitan centers down to the most remote rural communities (Woolworths 2024). The company has now embraced digital transformation, expanding its online shopping platform and home delivery services to meet growing demand for convenience.

The commitment to sustainability by Woolworths has also seen the company embark on plastic use reduction strategy, energy efficiency, and supports the local community. With its solid supply for The Assignment Helpline complemented with a focus on customer service and innovation, the company has sealed a position among the leaders in the Australian retailing industry. While Woolworths continues to adapt to the changing market conditions and consumer preference, the company is positioned to maintain its leadership in the market in coming years.

Industry/Sector Background

The Australian retail industry is dynamic and highly competitive. Among the many it plays one of the important roles in the nation's economy. It perceives tough competition from all major companies like Woolworths, Coles, and Aldi, fighting for more shares of the market. This has made conditions such that there is a moderately low profit margin in the marketplace and for companies to make money based on high turnover rates.

Over the past decade, the retail industry has changed a lot, and it still does, for reasons that are very important. Among such causes of change are technological advances, which brought a full change in consumers' ways of shopping (KMPG 2024). This grudgingly forced companies like Woolworths to extend their online shelf space to a greater degree and integrate more technology into their operations to make the customer experience great and to make supply chains efficient.

Consumer preferences have also changed dramatically. Convenience, price on value, and sustainability are absolutely demanded. Providing the same information as before, consumers are more knowledgeable and price-sensitive, and they usually reach for digital means when comparing prices or searching for the best value. That trend has forward-shifted the retailer's price competition; therefore, companies run promotions very frequently, discounts, and loyalty programs to win and retain customers (KMPG 2024).

Besides that, economic cycles of recession and recovery have also taken their turn to hit the retail industry. Some major factors that determine retail sales include inflation, unemployment rates, and consumer confidence (Chen et al., 2024, p. 1678(2)). However, the most unparalleled attack on the industry has come from the unseen enemy known as the COVID-19 pandemic, which disrupted supply chains, altered the way people shop, and accelerated the switch to online shopping.

Despite these, the Australian retail industry is equally resilient, with companies in the industry working constantly to innovate, especially at times when the demand from consumers shifts. The resilience of the sector strongly depends on how it will adapt to changing economic conditions and technological advancement.

Market Structure of the Industry

Woolworths falls into the oligopolistic market structure in that of the Australian supermarket sector, wherein there are a limited number of large-scale firms put together in one market (Woolworths Group 2024). This market structure is highly manifested through the duopoly between Woolworths and the other major competitor, Coles. Aggregated, these two giants share more than 70% of the supermarket market share in Australia. Significant economies of scale, for instance, are few of the reasons that maintain this dominance, besides the fact that the extensive supply chains and brand loyalty exhibited by their products make it very difficult to effectively compete with new entrants.

Markets are oligopolistic in nature, and hence entry barriers for the market are high. Some of these impediments include the huge capital amount required to enter into a supermarket chain, huge distribution networks required, and it is difficult to earn consumer trust and loyalty (Devine & Bertsch 2023, p. 559(2)). Moreover, woolworths and Coles representing players of this category have existing relations with all suppliers in addition to having the best logistics system and hence are in strong positions.

Here, product differentiation plays an important role. Indeed, varied products are not absent in Woolworths and Coles as both sell private label brands, organic produce, and locally produced goods, which enable them to cater to the various preferences of their customers (Yuki & Kubo 2023, p. 95(3)). In turn, this would allow companies to retain brand loyalty and impede the entry of competition by small players and discounters such as Aldi.

Another defining characteristic of oligopoly in the Australian supermarket industry is price leadership. In this respect, both Woolworths and Coles have the predisposition to often lead any changes to prices, while through their market power, they have been able to lay down the law on overall pricing across the sector. These situations tend to build into minor price wars where aggressive discounting by both companies is used to lure customers away and hurts profitability throughout the industry.

Microeconomic and Macroeconomic Factors Influencing Demand

Microeconomic Factors:

1. Consumer Preferences:

Consumer preferences: These are vital and, therefore, have the effect of changing demand for products offered by Woolworths. Of late, consumers have been demanding organic and locally sourced products. This reflects an increased awareness by Australian consumers of health sustainability and environmental problems. Woolworths has responded by expanding its organic and locally produced products to position itself as the retailer of these emerging consumer needs. In doing so, it finds itself in a better position to meet the consumer requirements for such values in the products and also enhances its brand image among consumers for being responsible and customer-centric (Forest et al., 2023, p. 148(2)).

2. Price Elasticity:

Woolworths has highly elastic demand in many of its products. This means that with minor price increases or decreases, the level of demand changes significantly. Where this aspect is most striking among products for non-essential and luxury categories, consumers in this regard tend to be rather sensitive regarding price. For instance, when on sale, they consume more and more consumers are found when on sale. Still, any increase in price brings down the level of sales considerably (Chen & Lim 2023, p. 236(3)). Price elasticity empowers Woolworths with the necessary insights to either raise or lower prices in order to optimize product revenues within the realm of competitiveness.

Macroeconomic Factors:

1. Economic Growth:

The general economic conditions, such as the growth in Australia's GDP, have an impact on the spending capacity of consumers, influencing the demand at Woolworths. In good economic times, when the consumer has a sense of financial security, there is usually gains in discretionary spend, improving sales of higher-margin items for Woolworths in premium groceries and household goods. Due to this, consumers are sometimes very conscious of their prices during the downtrends in the economy, shifting demand to basic and cheaper varieties. Woolworths would have to be agile in its product offering and pricing strategies based on these economic cycles (Kaye & Nair 2023).

2. Inflation Rates:

Inflation: it is one of the most vital macro-economic factors that can occur, and it will directly affect the consumers' purchasing power. Increased inflation diminishes disposable income (Kozlov 2023, p. 23(3)). Therefore, consumers will become very conscious about spending. It can dampen demand for non-essential, high-value products of Woolworths, since they prefer to spend money on plain, basic merchandise only. Probably, Woolworths will also need to pass on some of the inflationary pressures that are related to an upsurge in the cost of goods sold. However, this is not always easy in a highly competitive market without having any adverse impact on demand. Therefore, Woolworths has to make a fine balance in pricing strategy to retain demand amidst cost pressures.

Microeconomic and Macroeconomic Factors Influencing Supply

• Microeconomic Factors:

1. Cost of Goods Sold:

The cost of goods sold or COGS is a major microeconomic factor that influences the supply of Woolworths. Any sort of change in the input cost from suppliers mainly in agriculture has a great effect on the supply chain. In such a scenario, the ensuing changes in fresh produce, dairy, and meat price are brought about by conditions of weather, crop yield, and feed prices and it influences the cost structure for Woolworths. If the cost to the supplier goes up, it will be hard for Woolworths to maintain their usual price without giving up some of the profit margin, which could affect how much is supplied or the pricing approach.

2. Labour Costs:

Other than that, one of the basic microeconomic factors which could affect the supply of Woolworths is labour costs. An increase in minimum wage or any other employee-related cost such as cost of training and development and employee benefits may affect the overall operational cost for the company (Woolworths Group 2024). For example, an increased cost of labour increases the operational cost for maintaining stores and logistics; hence, such increased cost might force Woolworths to change the supply of its merchandise with a view to optimizing cost. The shortage or surplus of labor could also impact the efficiency of supply chain functions, ensuring that the store shelves are always stocked or empty.

• Macroeconomic factors

1. Global Supply Chains:

Global supply chains significantly affect the sourcing and supplying of products to Woolworths. Disruptions in global trade have started to take their toll in regard to the availability and cost of imported goods. Shipping delays, along with increased costs for freight and bottlenecks in supply chains, have caused shortages with some products; thus, higher costs that have, in turn, been one factor making Woolworths reconsider strategies on sourcing. This dependence on global supply chains means international disruptions have a cascading effect on Woolworths' domestic supply capabilities.

2. Government Regulations:

Government regulations, particularly governmental laws about food safety and environment-friendly practices are still one of the major macroeconomic determinants that can affect Woolworths supplies. Compliance with strict regulations typically requires investment in improving technology, processes, and training (Nouhaila, M. & Younes 2023, p. 77(4)). These usually sum up to operational costs. Similarly, environmental-related regulations directed at reduction of carbon footprints or waste methods influence packaging, sourcing, and distribution channels. While they are regulatory requirements that ensure this product is safe and sustainable, they add complexity and cost to the Woolworths supply chain, which impacts the availability of goods and price of some of those goods..

Elasticity

Different products offered by Woolworths have different elasticities of their respective prices. For example, the demand for most of the essential goods, such as bread, milk, and eggs, is usually inelastic. In other words, for inelastic demand, a change in price would relatively have a small effect on the quantity demanded (Kolay & Tyagi 2018, p. 92(3)). For instance, even if the price of milk increases, consumers would still buy the product since it is considered an essential commodity. This inelasticity allows Woolworths some flexibility in transferring price increases without significantly impacting sales volumes for these staple commodities.

On the other hand, goods of luxury or non-essentials, like high-end chocolates, gourmet foods, and seasonal goods, operate under elastic demand. This means consumers are always sensitive to price changes, and even with a slight increase in price, there can be a reasonable fall in the quantity demanded (Kolay & Tyagi 2018, p. 95(2)) As an example, if the price of a particular luxury chocolate increases at Woolworths, then their consumers may opt for a more economic version of the same brand or may not buy it altogether. This elasticity means that for such products, pricing strategies should be carefully worked out by Woolworths to ensure competitiveness at an optimum revenue level.

Knowing the elasticity of said various products will also enable Woolworths to adapt its pricing strategies to ensure that it is able to maximize revenues without hurting consumer sensitivity over the prices of various group products. By balancing the pricing of inelastic and elastic products, Woolworths can maintain overall profitability and customer satisfaction.

Recent Macroeconomic Event Affecting Woolworths and Australia

The COVID-19 pandemic is, without doubt, one of the most pivotal macroeconomic events of the modern era. It has hit hard on the retail industry worldwide, including Woolworths, an Australian retail company. Surprisingly, as the pandemic started to take shape, it brought in changes in customer purchase patterns that were fundamental in nature. The demand the Company witnessed for basic items such as groceries, households, and hygiene was arguably unprecedented. Since Woolworths has always been one of the biggest supermarket chains in Australia, it found itself at the receiving end of such a demand and thus had to effect immediate alterations in their operations with all due haste.

The sudden rise in the demand for essential products led to a situation where stock was out and disrupted supply chains. Due to the closure of international borders, slowed production, and delayed shipping, the global supply chains were highly disrupted. Woolworths had to take on this challenge by optimizing its supply chain, cleaning up its inventory levels, and ensuring that the key products were available in the stores. Furthermore, they attached importance to the health and safety of its employees and customers by following strict hygiene practices and social distancing in its stores.

Another major change which the pandemic brought in its wake was the rapid acceleration of online shopping. Consuming populations were fast depending on online services for their grocery needs with lockdowns and social distancing norms in force. Woolworths scaled up its digital infrastructure and expanded its online shopping to reach home deliveries to meet the demand surge (Vohra & Mehta 2021, p. 19(2)). Contactless delivery is one of the innovative solutions proposed by Woolworths for customer convenience along with click-and-collect services to make customers and staff safer.

Recommendations

Other key strategic recommendations that would help Woolworths remain competitive and resilient in the changing retail landscape will include:

1. Invest in Digital Transformation:

o Woolworths should continue its integration and development of the online shopping platform, and ensure a wider delivery network to meet the consumer expectation for convenience. Further, this would be cemented by investing in technology-enabled solutions in forms of AI, whether for inventory management or personalising the shopping experiences.

2. Supply Chain Diversification:

o To reduce the risk of disruption within international supplies, Woolworths should decrease reliance on international suppliers by buying more products locally. Building stronger relationships with local producers and investing in domestic supply chains will reduce supply chain vulnerability stemming from external shocks.

3. Sustainability Initiatives:

It is recommended that Woolworths further invest in sustainable practices such as reduction of plastic use, enhancing energy efficiency, and support for local communities. Such initiatives are likely to find resonance among environmentally sensitive consumers and also ensure compliance with regulatory demands, which indeed are getting tough. This will be positioning Woolworths as one of the leaders in sustainable retailing.

Conclusion

In such a situation, Woolworths Group should be well placed to maintain a competitive edge in the Australian retail market. However, it is equally true that this industry faces stiff volatility, at the same time suffering at the hands of economic fluctuations and consumer changes. For example, Woolworths would need to pursue digital transformation continuously to sustain the growth of its online platforms and reach consumers with more convenient options for increased delivery services. Besides, the supply chains must be spread out to minimize risks of global disruption and ensure supplies of goods smoothly. Lastly, full-scale commitment to environmental sustainability will attract customers who are green-aware and thus help the supermarket comply with increasing demands by regulators. With such strategic focuses, Woolworths is bound to continue surging into the future, capitalize on any forthcoming opportunities, and stay viable through unforgiving retail competition. These efforts ensure that Woolworths will continue to be a powerhouse that leads the Australian market with trusted and innovative leadership.

References

.png)

.png)

Assignment

BUECO5903 Business Economics Assignment Part A Sample

Instructions:

This assignment contains five questions. You are required to answer all five questions. This is an individual piece of assessment. Make sure your submission is an original submission; this means it must be the creation of the person submitting it. You are required to explain your reasoning and use diagrams where appropriate.

Due date: Your instructor will advise you of the submission date of this assessment task. Assignment to be submitted electronically in the drop box in your Moodle shell.

Question 1

Using a production possibilities frontier (PPF) diagram, determine how does the PPF change in response to the events describe below. Make sure to explicitly indicate what sectors you are representing, and what sort of assumptions each event implies (i.e., a neutral effect vs a sector-biased effect). The latter follows from your assumptions on the factor intensity of the sector you are representing.

a) A relaxation of policies allowing more foreign direct investment into the country.

b) Increasing the minimum wage level.

c) A decrease in expenditure on research and development.

d) An increase in the retirement age.

e) Government policies supporting the provision of services, without affecting manufacturing.

Question 2

For each of the events describe below, you are required to explain:

1. The market you are evaluating (e.g., labour market, automotive market, etc).

2. Does the event act on the demand side, supply side, or both sides of the market?

3. Does the event lead to a quantity or price change? Or does the event lead to a shift in demand, supply, or both?

Make sure to explain what sort of assumptions you are making on the elasticities of demand and supply (when plotting your demand and supply, describe whether you are assuming an elastic or inelastic demand/supply).

a) A concerted reduction in the total production level in oil markets.

b) The implementation of a minimum wage.

c) The implementation of subsidies to agricultural production in Australia

d) The implementation of a Carbon tax in the resources exploitation sector. A Carbon tax is charged according to the level of emissions of greenhouse gases in an economy.

e) The implementation of a new loan program to university students in the education sector

Question 3

Compare the impact of a recession that reduces consumer income by 10 percent on the consumption of durable goods and house rentals. Suppose that the income elasticity of demand for durable goods is 1.5 and the income elasticity of demand for house rentals is 0.3. Based on your response, make a policy argument to support through government funding either businesses or house rentals.

Question 4

Using a supply and demand analysis show first the labour market in equilibrium, and then show

a) the effect of a reduction in the demand for labour as a consequence of a pandemic.

b) The effect of a government subsidy to producers to restore the employment of labour.

Provide a diagram with clear axis details. Make sure to explain what sort of assumptions you are making on the elasticities of demand and supply.

Solution

Answer 1:

a.

Here, agricultural and service sectors are represented. Assume the economy produces good X which is capital-intensive in service sector and good Y which is labor-intensive in agricultural sector. Hence, more foreign direct investment will create sector-biased effect as the production of good X will increase keeping the production of good Y unchanged. This situation is drawn in the figure below:

.png)

Figure 1: Production Possibility Frontier: Sector-Biased Effect

b.

Again consider good X in the agricultural and good Y in the manufacturing industry. Good X is capital intensive and Good Y is labour intensive. For Assignment Help, Increasing the minimum wage level will help the industry to get more labourers for producing good Y while the production of good X will also increase but by a smaller rate (Arnold, Arnold and Arnold 2022). Hence, the situation implies sector-biased effect.

.png)

Figure 2: Production Possibility Frontier: Sector-Biased Effect

C.

Consider two industries, service and manufacturing industries are operating in the economy. As expenditure on research and development (R&D) declines, the service sector can increase its total production by conducting more research work. Furthermore, manufacturing sector can also increase its total production due to increasing R&D. Hence, the economy will experience a neutral effect on the PPF.

.png)

Figure 3: Production Possibility Frontier: Neutral Effect

d.

Suppose the economy has manufacturing sector and service sector. An increase in the retirement age will help both sectors to get a large number of skilled and experienced labour force. Hence, production in both sectors will increase and a neutral effect can be seen on the PPF.

.png)

Figure 4: Production Possibility Frontier: Neutral Effect

e.

The economy has both service sector and manufacturing sector. Government policies are implemented to support the provision of services though these do not influence manufacturing process. Hence, production in the service sector will increase keeping total production in manufacturing sector unchanged. Thus, a sector-biased effect can be seen on the PPF.

.png)

Figure 5: Production Possibility Frontier: Sector-Biased Effect

Answer 2:

A.

.png)

Figure 6: Change in supply in the oil market

The condition is based on the oil market. The concerted reduction in total production of oil will affect the supply side. Oil market has inelastic demand and supply. This is because, supply of oil cannot be increased suddenly and demand for oil does not change significantly with its price change. Figure 6 depicts the situation from where it is observed that equilibrium price will increase to P1 and equilibrium quantity will decrease to Q1.

b.

.png)

Figure 7: Change in supply in the labour market

The condition is based on the labour market. The implementation of a minimum wage will affect the supply side of labour if the wage rate will impose above the market wage rate. Labour market has elastic demand and supply. This is because, demand and supply of labour can be changed significantly by a small change in its wage. The condition of implementing minimum wage is shown in Figure 7. Here Wm is the minimum wage which is higher than market wage W0. Hence, an increase in labour supply by N1N2 are can be seen in the economy.

c.

.png)

Figure 8: Change in supply in the agricultural market

The condition is based on the agricultural market. The implementation of subsidies on Australian agricultural product will affect supply side. Agricultural market has elastic demand and supply. The implementation of subsidy will encourage farmers to produce more amount of agricultural products. Figure 8 depicts the situation where supply curve increases from S0 to S1. Thus, equilibrium price declines to P1 and equilibrium quantity increases to Q1.

d.

.png)

Figure 9: Change in supply in the Energy market

The condition is based on the energy producing market. The implementation of a carbon tax as per the level of greenhouse gas emission will affect the supply side of energy production. Energy market has inelastic supply due to the limited resource. The condition of decreasing supply of energy resource is shown in Figure 9. Here market price of energy increase to P1 from P0 and energy supply will decline to Q1 from Q0 due to imposition of carbon tax.

e.

.png)

Figure 10: Change in supply in the Energy market

The condition is based on the energy education market. The implementation of a new loan program will increase demand for education among university students. Education has inelastic demand as it is necessary for everyone. The condition of increasing demand for education is shown in Figure 10. Here market price of education increases to P1 from P0 and equilibrium quantity declines to Q1 from Q0.

Answer 3:

When income elasticity of demand becomes greater than 1 then it implies that the good is luxury item. On the other hand, income elasticity of demand less than 1 implies that the good is necessary item. For durable goods, the income elasticity of demand is 1.5 and income elasticity of house rental is 0.3. Hence, as per the given condition, durable goods are luxury items and house rentals are necessary items (El Shagi, Sawyer and Tochkov 2022). Thus, government needs to implement funding policy on house rents so that people can afford it easily.

Answer 4:

Labour demand curve has a negative slope showing an inverse relationship between real wage of workers and amount of labour. Labour supply curve is upward rising as it shows a positive relationship between real wage and amount of labour. The supply curve expresses a tradeoff between labour and leisure and hence it bends slightly at the upper portion.

.png)

Figure 11: Labour Market Equilibrium

a.

The impact of decreasing labour demand due to pandemic is shown in figure below:

.png)

Figure 12: Decrease in Demand for labour

Due to decrease in demand for labour, the real wage will also fall to W1 from We while amount of labour in the market will also fall to N1 from Ne.

b.

Impact of a government subsidy to producers for restoring the labour employment:

.png)

Figure 13: Increase in labour supply

Due to increase in labour, the real wage will also fall to W1 from We while amount of labour in the market will increase to N1 from Ne.

Answer 5:

a.

.png)

b.

Figure 13: MC, AVC and ATC Curves

References:

.png)

Case Study

ECON6001 Economic Principles Case Study Sample

Context:

COVID-19 continues to adversely affect economies and is burdening the fiscus of many economies globally. It has implications not only on national budgets but on macroeconomic management.

This assessment aims at:

• Assessing the students’ ability to critically analyse the impact of COVID-19 on key sectors of the pair of countries given, one from the ASEAN nations and another from Asia Pacific nations.

• Testing the students’ ability to perform a comparative analysis of the impact of COVID-19 on the forecast macroeconomic performance in 2021 and 2022

• Testing students’ evaluation of the efficacy of fiscal policy in dealing with the COVID-19 induced recessions

• Evaluating the students’ understanding of the concept of quantitative easing and how it has been used, if any, to assist in combating the COVID-19 induced recessions.

Instructions:

(a) On the basis of that information and other sources of data, compare the countries’ projected macroeconomic performance in 2021 and 2022, your discussion should focus on real GDP, unemployment and inflation. Sources of useful data could be government websites, think tanks, IMF, OECD, Asian Development Bank and the World Bank.

(b) Discuss how these two countries have used fiscal policy in combating the COVID-19

recession.

(c) Critically evaluate the following statement, “Fiscal policy should lead and monetary policy follows in dealing with the recession as a result of COVID-19”. Discuss this in the context of the two allocated countries and any third country from the table of countries given above.

(d) Quantitative easing (QE) is one of the untraditional monetary policy approaches that can be used by central banks. Discuss how it can be used to deal with severe economic crises suchas the recession caused by COVID-19. To what extent have these countries (the three in part (d)) used this unconventional monetary policy tool to contain the recession emanating from the advent of COVID-19? (10 marks).

Solution

Introduction

Overview of the Report

Every country across the world can be seen to have different growth patterns and trends in economic development and much of the same can be seen to be related to the primary industries and their contribution to the growth of the concerned economies as well as on the economic policies that are taken by the governments of the concerned countries. For Assignment Help However, the growth and performance of the economies and the industries operating in the same, can be seen to be considerably affected by different internal as well as external fluctuations taking place across the globe and in the country itself (Deb et al., 2020). One such fluctuation or phenomenon of immense importance is that of the ongoing crisis of the COVID-19 pandemic across the globe, that has not only led to deaths of millions of people, but can also be seen to be causing immensely negative implications on the businesses, industries and economies of almost all the nations across the globe.

Purpose of the Report

Keeping this into consideration, the concerned document emphasizes on the impacts of this pandemic on the economy and industries of India and Philippines, with the purpose of discussing the policy frameworks of the concerned nations and their implications in this aspect.

Comparison of five main sectors and their performance in COVID-19

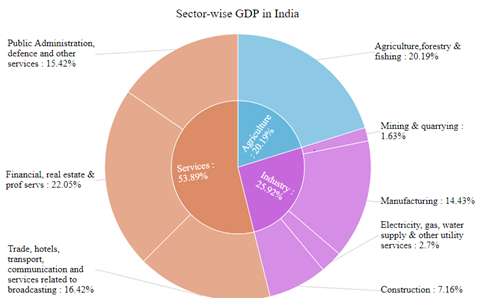

India has been performing impressively in the global economic framework over the years and is considered to be one of the most prominent developing nations across the globe. The primary industries or sectors of the concerned country, that can be seen to be contributing impressively in the GDP of the concerned country, can be shown with the help of the following figure:

.png)

Figure 1: Primary sectors and their contribution to the GDP of India

(Source: Statisticstimes.com, 2021)

The textile sector, the real estate sector, the agricultural sector, the manufacturing sector and the tourism sector can be seen to be the top five and prominent sectors in India, contributing substantially to the growth and the GDP of the concerned country over the years. However, the ongoing crisis of the COVID-19 pandemic situation can be seen to have affected these major industries and their profitability and revenue generation, much of which can be attributed to the lockdowns and the restrictive measures that are being taken by the government of India to contain the spread of the COVID-19 pandemic situation (Mckinsey.com, 2021). The effects of the concerned pandemic situation on these industries can be shown with the help of the following figure:

.png)

Figure 2: Impacts of the COVID-19 pandemic situation on the outputs of the different sectors

(Source: Mckinsey.com, 2021)

The construction sector, tourism sector and the textile sector can be seen to have been majorly affected and the effects can also be seen to be severe in the different manufacturing operations and in the agricultural sector (Pib.gov.in, 2021).

On the other hand, the contributions of different sectors to the GDP of Philippines, over the years, can be shown as below:

.png)

Figure 3: Contributions of different sectors to the GDP of Philippines

(Source: Statista.com, 2021)

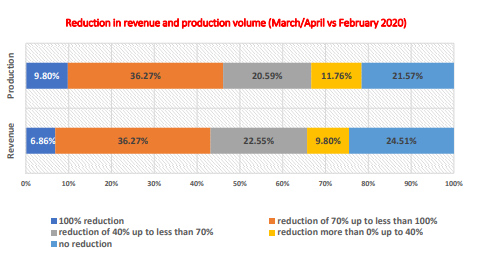

The tourism sector, the agricultural sector, the real estate sector, outsourcing, retailing and the construction sector can be seen to be the top five industries or sectors contributing massively to the economic growth of the concerned country (Unido.org, 2021). There has been nearly 80% decline in the tourism demand in the concerned country due to the ongoing COVID-19 pandemic situation, while there has also been considerable reduction in the production volumes of the general manufacturing sector of Philippines as shown below:

.png)

Figure 4: Reduction in production volumes of the manufacturing industries in Philippines due to the COVID-19 pandemic situation

(Source: Unido.org, 2021)

The agricultural sector has been comparatively less affected while there have been substantial implications of the pandemic situation on the retail and the outsources sectors of the concerned country, much of which can be attributed to the changing demands and preference patterns for the products and services of the concerned sectors of Philippines.

Comparison of the projected macroeconomic performance of India and Philippines in 2021-2022

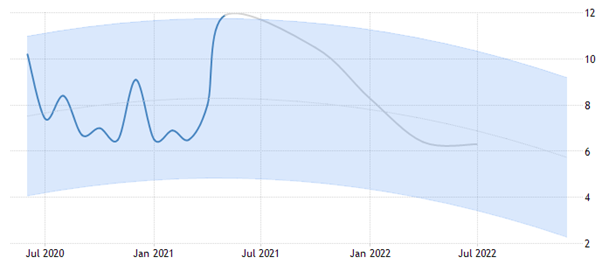

The two countries considered in this report are expected to have differences in their projected macroeconomic performances, based on the ways in which they are trying to mitigate the adverse impacts of the COVID-19 pandemic crisis situation on their economies. India, is expected to have an increase in the GDP in 2021, with the expected GDP being 2850 billion USD in 2021 and the same is expected to grow further to around 3000 billion USD in 2022. However, the growth of Philippines is expected to be slower in the coming years, with the expected GDP to be 373.00 USD billion in 2021 and 379.00 USD billion in 2022 and this may be due to the slower recovery of the concerned nation from the impacts of the ongoing pandemic crisis (Data.worldbank.org, 2021). The unemployment in Philippines is expected to have the following trends with the slow recovery of the economy:

.png)

Figure 5: Predicted unemployment in Philippines in 2021-2022

(Source: Tradingeconomics.com, 2021)

However, although India also experienced a considerable spike in the unemployment due to the pandemic situation and the consequent lockdowns and restrictive measures, it is expected to experience a more impressive fall in the unemployment rate in both 2021 and 2022:

.png)

Figure 6: Projected unemployment rate in India in 2021-2022

(Source: Tradingeconomics.com, 2021)

The projected evidences highlight that while Philippines will be having a stagnated fall in unemployment in 2021 without much changes in 2022, India is expected to experience a continuous fall in unemployment in both 2021 and 2022 with the recovery of the concerned economy (Statisticstimes.com, 2021).

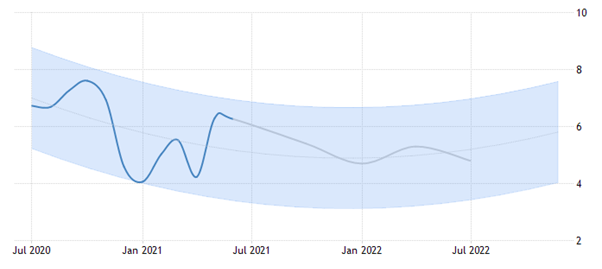

There will also be a fall in the inflation, as expected for India, and this may be due to the fall in prices of products and services for boosting the demand in the concerned economy in the COVID-19 aftermaths, as shown below:

.png)

Figure 7: Expected inflation rate in India in 2021-2022

(Source: Tradingeconomics.com, 2021)

However, the inflation rate for Philippines is expected to experience a constant decline in 2021 and 2022 and this can be shown as below:

.png)

Figure 8: Expected inflation rate of Philippines in 2021-2022

(Source: Tradingeconomics.com, 2021)

This can be due to the fact that due to the slow recovery of the economy of Philippines from the pandemic situation, the recessionary phase is expected to be prolonged in case of Philippines as compared to India.

Usage of fiscal policies for combating the COVID-19 recession

Both the concerned countries can be seen to have used fiscal policies extensively to boost their economies out of the recessionary situation caused by the ongoing COVID-19 pandemic crisis. In case of India, the government had launched a fiscal package of 22 billion USD for supporting the businesses, investments and also to strengthen the “Make in India” program, thereby supporting the small and medium industries in the concerned country. There are also different employee support programs and unemployment support as well as health care packages that have been incorporated under the fiscal policies of the concerned country to combat the COVID-19 recession (Home.kpmg, 2021). There have also been tax cuts incorporated by the government of India and similar fiscal policies can also be seen to have been implemented by Philippines to combat the recessionary effects of the ongoing pandemic crisis. However, unlike that of India, Philippines could not incorporate a huge relief package under its fiscal policy frameworks for the COVID-19 pandemic situation and this is mostly due to the lack of such resources for the small and developing nation like Philippines. However, there has been special risk allowances for health workers that have been launched by the concerned country, which is similar to the health insurances that have been implemented for the health workers of India, by the government of the concerned country.

Evaluation of The Statement in Terms of India, Philippines and Australia

There is a notion that in case of a recessionary situation, the fiscal policies are more effective and should be prioritized and the monetary policies should accompany the same. This has been the case for both India and Philippines as well as for the developed nations like that of Australia in combatting the recessionary effects caused by the ongoing COVID-19 pandemic situation. In case of India as well as Philippines, extensive tax cuts and exemptions are evident. On the other hand, Australia can be seen to have launched an elaborate fiscal relief package as well as programs like that of the Job-Keeper program to support the businesses to retain their workforces during the pandemic situation. These can be seen to be similar to that of India, which has also prioritized in providing direct support to the businesses and the general population of the concerned country (Imf.org, 2021). However, the policies taken by India can be seen to be a mixture of the fiscal as well as the monetary policies, and the monetary policies include more relaxed borrowing and lower interests which can also be seen to be similar in case of Australia. Philippines, on the other hand, can be seen to have mostly emphasized on fiscal policies than that of the monetary policies although there have been changes in the rate of interests in the concerned country, which has been done to boost the borrowing and the investment operations in the country to mitigate the recessionary situation caused by the ongoing pandemic crisis (Home.kpmg, 2021). Thus, it can be asserted that in case of the concerned three countries, fiscal policies have been prioritized and monetary policies have been supportive policies to combat the negative impacts of the COVID-19 pandemic situation on the respective economies of the concerned three countries.

Quantitative Easing and Its Usage To Contain The COVID-19 Recession By The Three Countries

The quantitative easing is an unconventional monetary policy, which is taken to increase the money supply, investment and lending activities in an economy and this is done by the central bank of an economy, by purchasing longer-term securities in the open market and is especially incorporated in recessionary situations. India, in the present period, can be seen to be incorporating this quantitative easing policy, to combat the stagnant economic situation created by the COVID-19 pandemic situation. To stimulate the economy, in 2020-2021, the Reserve Bank of India has bought bonds worth more than 14 billion USD to increase the money supply in the economy, which in turn is expected to help in boosting the investments and the lending activities in the economy, thereby contributing potentially in the expansion of businesses and the production activities in the concerned country (Bloomberg.com, 2021).

The Reserve Bank of Australia, can also be seen to have started with the quantitative easing policy, with an amount of more than 80 billion dollars being spend on the QE program, where Australian government bonds are being purchased and 20 billion dollars is being spent on purchasing the state and territory government bonds by the concerned nation. This has been helping the government to stimulate the economy by increasing the money supply and it is working as evident from the impressive recovery of the Australian economy, the business activities and the investments in the business operations in the aftermath of the COVID-19 pandemic situation (Imf.org, 2021). Like that of Australia and India, Philippines can also be seen to be taking the quantitative easing measures by buying up the government securities and this is being done directly to avoid the deflationary situation created by the COVID-19 pandemic situation. However, in case of Philippines the level of bond buying and quantitative easing can be seen to be lower than expected. Nevertheless, all the nations considered in this case, can be seen to be incorporating the unorthodox monetary policy of quantitative easing at different extents to mitigate the recessionary impacts of the ongoing COVID-19 pandemic situation (Pib.gov.in, 2021).

Conclusion

The above discussion makes it evident that the COVID-19 pandemic situation has been affecting the economies of different nations adversely and this is evident in case of both India and Philippines, as can be seen from the effects of the same on the top five industries of both the concerned countries. There is different fiscal as well as monetary policies that can be seen to be incorporated by the governments of these two countries as well as by the government of developed nation like that of Australia to mitigate the adverse effects of the ongoing COVID-19 pandemic situation and there are also evidences those fiscal policies are gaining more emphasis and prioritization in case of these countries to take their respective economies out of the recessionary situations. However, different extents of quantitative easing can also be seen to be taking place in these countries and these are being done to increase money supply, lending and investments and to decrease the recessionary situations in the economies of these concerned countries in the COVID-19 pandemic situation.

References

.png)

Assignment

ECO600 Economics and Finance for Business Assignment Sample

Instructions

1. Answer ALL four (4) sections. They contain short-answer questions. There are NO multiple-choice questions.

2. Keep your answers WITHIN 500 words per section.

Weighting 40%

Word Count Maximum 2,000 words

Section 1: Ethical enterprises in the modern economic system: the circular economy (10 marks; length: max. 500 words)

Background

You are hired as the sustainability manager of Manly Golf Club. It is in Sydney, not too far away from ICMS’s main campus.

Learn about the golf club, its facilities, and the services it provides here, in this website.

To distinguish itself from rival golf clubs in the area, this club is under pressure to demonstrate its circular economy credentials.

It has hired you to propose strategies that apply the circular economy principles to all aspects of its operations.

Question

1. Propose four (4) circular economy strategies, two for each of this golf club’s two services:

(i) Golfing

(ii) Weddings and functions

Where possible, demonstrate how each strategy could be good/profitable for the business.

Section 2: International trade and development (10 marks; length: max. 500 words)

Background

Papua New Guinea is a large island country north of Australia. It has a largely underdeveloped economy: it mostly exports raw materials such as timber and copper.

It does not have a large manufacturing base, relying instead on importing manufactured goods from abroad.

To learn about the country, go here. To learn about its economy, go here.

To see its low and high complexity exports, use Harvard University’s Atlas of Economic Complexity (click here):

- Enter the country’s name and click ‘start exploring’

- Find the section called ‘Export basket’ (the products it exports).

- Lastly, click on ‘Export complexity’ near the bottom.

Question

1. Select one (1) export item from this country whose complexity is low.

Then, follow these three steps:

First: propose how this item’s complexity could be improved using creativity, innovation or value-adding. Provide interesting detail. Argue why your proposals might be beneficial for this country’s economy.

Second: which country or region would be good target markets for this export, and why?

Third: suggest any trade-related policy that could help this country in this project.

Section 3: Macroeconomic fundamentals (10 marks; length: max. 500 words)

Background

Maldives is an archipelagic country made up 1,200 islands of which only around 200 are inhabited. It has a population of 540,000 people. It is located to the south of India, in the Arabian Sea.

The economy is heavily reliant on tourism, which is its largest ‘export’ industry by far, followed by seafood exports (fish, prawns etc.)

Macroeconomic situation

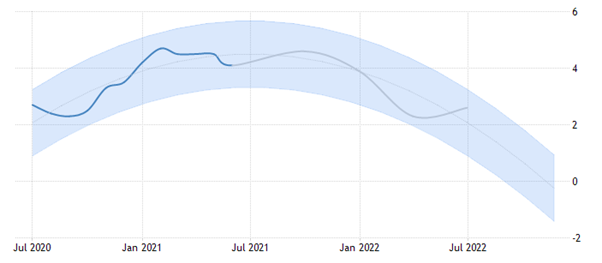

Since 2012, Australia’s inflation rate was around 2% and falling, before rising sharply in 2022 to almost 4% as COVID-19 restrictions were largely removed (go here, click on ‘10Y’ button to see the last 10 years’ trend).

In contrast, Maldives inflation in 2012 was almost 20%, fell to 5% in 2018, and was mostly negative (between 0% and -5%) since then. Analyse Maldives inflation rate since 2018, by going here and clicking on the ‘10Y’ button. See how it looks like, in contrast to Australia’s.

Analyse Maldives unemployment rate, here (click on the ‘50Y’ button for a long historical perspective. Analyse its balance of trade, here (click on the ‘25Y’ button).

Contrast that to Australia’s unemployment and balances of trade (see here and here, click the ‘25Y’ button). You may investigate these and other macroeconomic measures more on the Internet.

Question

1. By contrasting Maldives and Australia’s macroeconomic measures up to today in 2022, assess which phase of the business cycle Maldives is likely to be in (see here to learn about the business cycle). Justify your answer.

2. You are the general manager of the Four Seasons hotel chain in the Maldives. Given your analysis of the business cycle above:

(i) assess whether it might be a good idea for Four Seasons to invest in expanding its hotel operations in the Maldives

(ii) assess issues involved in hiring new hospitality managers and other workers for its hotels.

Section 4: Fiscal, monetary and supply-side policy (10 marks; max. 500 words)

Background

Country X is a developing country with a large government bureaucracy that is quite inefficient. The processing of applications to start new businesses are slow.

This country also has generous unemployment benefits: its unemployed citizens receive a generous payment that allows them to pay for rent and food such that there is little motivation for some of the unemployed to look for jobs.

The key macroeconomic measures of Country X over time– from two years ago to the present– are shown below. Examine them carefully. They are expressed in quarters (quarters means in chunks of three months):

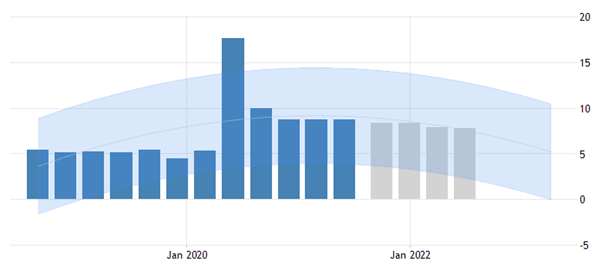

(a) GDP growth: -2%, -1%, -2%, 14%, 5%, 3%, 2%, -1%

(b) Unemployment rate: 8%, 9%, 10%, 6%, 6%, 5%, 5%, 8%

(c) Inflation rate: 2%, 2%, 1%, 3%, 3%, 1%, 0.5%, 0.5%

(d) The purchasing managers’ index, PMI, in the manufacturing sector: 47, 48, 49, 49, 45, 48, 46, 45

The current official interest rate is 4%.

Question

Monetary policy

Given the macroeconomic information above about this country’s economy:

1. Would this country’s central bank be likely to increase or decrease its official interest rate or maintain it at the same level? Why do you say that?

Next, based on your answer above, assess how that action might affect or transmit to each of these, with sufficient detail and discussion:

(a) consumer spending (C) and business investment (I)

(b) the unemployment rate

(c) the inflation rate

(d) the currency’s exchange rate, assuming all other things being equal (will the currency’s value tend to appreciate or depreciate, and why?)

(e) the exchange rate’s effect on the country’s exports, assuming all other things being equal (could the trade balance move towards a surplus or a deficit?)

Solution

Section 1

Question 1

(i) Golfing