HI5016 International Trade and Enterprise Assignment Sample

Students are expected to demonstrate their knowledge and understanding of a chosen topic by applying international trade theories and concepts learnt during Week 1 to Week 9. The in-depth analysis of the chosen topic, should be supported by data/statistics, figures, tables and relevant literature.

In this assignment,students are required to do betterthan recycle the lecture materials. Students are to research the chosen topic in more depth providing evidence of independent research.

Detailed Requirements of the Assignment

You are a group of advisors working in the Department of Trade and Foreign Affairs in Australia. As advisors you are required to write a report covering the following topics, based on the past 5 years, in which you compare two countries. Each group must choose two countries (not including Australia). This report should provide useful information for the Department of Trade and Foreign Affairs for appropriate strategic decision making for Australia and multinational enterprises in the country. The report should use a variety of

resources, including the textbook, newspapers, industry reports, the ABS website, and other sources.

Solutions

International trade is the economic transaction made between different countries. Items that are common in trading are clothing items, electronics items, capital goods, raw materials, food items, etc. another type of transaction involves services, like travel service, payment for patents in foreign relationships. International trade is facilitated by foreign trading payments, where central banks and private banking sectors play vital roles. There is a rapid growth in the international trading goods and in the last few decades trading is known as the most important driver of globalization.

Each characteristic of international trading of foreign countries is different and this is the key element to maintain international enterprise relationships across the globe. The statistics show different movements of goods between different countries provide exceptional characteristics of enterprise behind the flow of trading. This paper contains different characteristics of trading and iteration trade policies to understand how all the countries are interconnected with each other through the economical overview. This paper will cover comparative advantage, terms of trade, export subsidies, the pattern of trade of different countries, and how they affect the trading of Australia.

Comparative Advantage (Canada and UK)

Comparative Advantage theory was developed in the year 1817 by economist David Ricardo to explain international trade in more than two economies. David Ricardo emphasized that resource distribution and other factors can create an advantage for a nation or might create a disadvantage, although despite the factor's countries could indulge in international trade (WATSON, 2017). The comparative advantage theory criticized theoretical framework identified that Adam Smith who was of the view that economies produce one product (which is in abundance) and import the other (in which resources are constraint).

Building on initial theories by Adam Smith, Ricardo explained the comparative international trade theory through concepts of relative opportunity costs. In real-time, theories have relevance as countries have established different trade agreements which helps to maintain opportunity costs for producing goods or services(Conversable Economist: Ricardo's Comparative Advantage After Two Centuries, 2017). In addition, many countries have established trade agreements for importing and exporting different ingredients or intermediary products which reduces the cost of production.

The comparison will be made amongst UK and Canada on the aerospace industry, which is one of the largest industries in the world. Both the countries have comparative advantages owing to history, technological development, population skill, and others.

Identification of Industries That Have a Comparative Advantage

UK- Description of Aerospace Industry

The UK is considered to be the second-largest globally attributing to turnover rates of $34.8 billion which is more than 16% market share globally. Aerospace is the highest growth market even if large airlines are not produced domestically. Domestic production exports more than 97% to other countries which includes engines, helicopters, space, structures, unmanned aircraft systems like drones (ITA, 2022). The country’s aerospace industry is involved in designing, manufacturing, and repairing thus providing services to domestic and international military and defense systems. the company named UK Airbus is engaged in the assembly of wings for civil aircraft. From the year 2020, it was reported that the aerospace industry was worth $22 billion in the year 2020 while commercial and government efforts aimed at increasing its share by 10% in the global market by the year 2030 (ITA, 2022). The market growth for the aerospace industry within the UK can be attributed to four segments like Space Applications, manufacturing, operations, and auxiliary services.

Canada Aerospace Industry

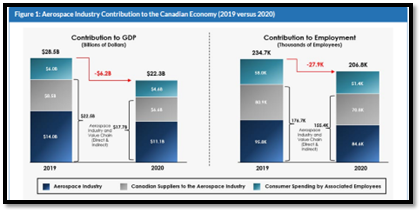

It ranks in the fifth position for exports for aerospace products and services of the US. In 2019, Canada's export market for aerospace was worth US$9. 1 billion, thus, it was identified that more than 60 % of production within Canada aerospace was exported. Manufacturing and Repair Organizations (MRO) has reported growth of more than 26% in the last few decades while 20 % of manufacturing units are located in Quebec and 30% within 30% while the majority of MRO that is 41% are done within Western Canada (Government of Canada, 2021). The leading subsectors for the aerospace industry in Canada include parts, systems, and sub-systems of aircraft, engine and other components of aircraft, maintenance, repair, and overhaul parts of aircraft, and space commerce.

(Source: Government of Canada, 2021)

There is a profound difference like production and manufacturing of the aerospace industry which owes to differences in factor availability, trade agreement, transportation, and other comparative advantage elements.

Sources of Comparative Advantage

One of the comparative advantagesfor Canada is that former and US have integrated supply chains due to which the former earns high export earnings. Since the majority of exports are directed to the US, MRO sectors have witnessed high growth in the last few decades. In addition, agreements between US and Canada(US- Canada Bilateral Aviation Safety Agreement (BASA)) have made it easier for conducting business. Canada is also a signatory under Civil Aircraft Agreement (WTO) which ensures fair play amongst the nations. The mature market of the Canadian aerospace industry owes to its establishment from the year 1945- 1980 which was initially established for meeting the growing needs of the national military for which Avro Canada was created with efficient engine design for defense (ITA, 2020).

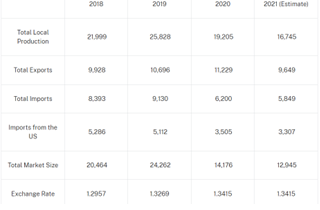

1:Total production

(Source: ITA, 2020).

On the contrary, the UK aerospace industry is different from that of Canada. It not only repairs and manufacturers defence aircraft but also designs commercial units. Thus, the technological development within the UK supports the designing and production of engines, wings, helicopters, aircraft systems, and others. Its excellence in engineering has made it a leader in nano and small satellites which are coupled with soaring investments in space technologies (International Aviation, 2019).

Considering both the countries, it can be said that the geographical location of Canada and the UK has provided comparative advantages. For instance, the US is closer to Canada while pre- Brexit period free entry in the UK from the EU helped the nations for conducting the business. In addition, technologies are more advanced in the UK than in Canada, hence the comparative advantage for the UK is higher.

Economies of Scale

In addition, the sources of comparative advantage could be explained with theories of economies of scale. In the works of Moon (2018), two types of economies of scale were explained which included external and internal. In this view, internal economies of scale refer to the reduction of costs per output relying on firm size while external economies are dependent on industry of size.

External Economies of Scale

The aerospace industry in both UK and Canada owes external economies of scale due to growth in passenger air flights owing to increasing demand and changing regulations. From the past few decades, the airline industry has witnessed high growth owing to changes in flier destinations, deregulations, uniform standards, and agreement networks amongst the nations (PHAM et al., 2021). US witness’s high passenger growth in domestic and international travel which impacts trade in the aerospace industry of Canada as it is under a bilateral trade agreement with the United States. Another factor of external economies of the scale includes an increase in military demands for which Canada provides the majority of aerospace products (ITA, 2020). Similarly, in European nations air travel has increased from past decades during a surging number of immigrants, visitors, and laborers traveling for personal and professional motives. After the United States, Europe is considered to be the largest air travel market for Asin countries.

Internal Economies of Scale

Both Canada and UK encompass the internal economies of scale, although the sectors are different. For instance, economies of scale in the commercial aerospace industry are low which positions the country in comparative disadvantage condition.Similarly for the UK, internal economies of scale are comparatively less in civil and military aerospace products which results in comparative disadvantage. In the UK, 3000 firms in the aerospace industry operate owing to small-medium size intermediaries in European regions. Before Brexit, the UK was in an advantageous position in the context of economies of scale as intermediary products could be easily procured from the European nation as goods and services were allowed a free pass across the borders (ITA, 2022). This is further supported by government initiatives like Aerospace Growth Partnership that has encouraged firms for cooperating their operations to detect issues and problems which boost UK exports. Space-related progress has been improving due to which UK commercial space industry was worth $22. 8 billion in the year 2020.

Technological enhancements and connectivity within the UK are higher than that of Canada which provides a higher comparative advantage for the former. On the contrary, the internal economies of scale can be only owed to effective collaboration of governments and industry which can provide a growth worth $7 billion, that will create more than 55, 000 jobs. The existing aerospace industry is largely impacted by pandemics, thus impetus from internal and external factors would increase its comparative advantage in civil aerospace products.

Improving Comparative Advantage

Concept of International Factor Mobility for improving trade

In addition to this, international factor movements are also important for improving labor mobility. International factor movement includes labor migration, transferring financial assets, and transactions amongst multinational corporations involving direct owners (Podrecca&Rossini, 2015). Labour is considered one of most factors on which output is dependent. Competitive markets like Canada and UK are capable of paying salaries of which purchasing power is equivalent to marginal productivity. Canada and UK both require a skilled workforce, although the population is density in such countries is less than compared to Asian economies. Also, countries experience high immigrants from varied economies of which India, China, Japan are common.

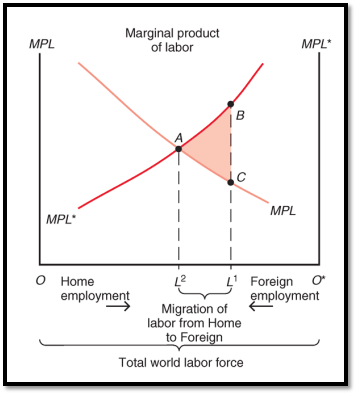

In the Asian economies, labor is cheaply available as the resources for education, job, and skill advancement, hence, many talented and skilled labor force work for more hours with less pay. In this view, labor productivity is highly dependent on the work amount and number of workforces working within the aerospace industry (Chaudhuri& Gupta, 2014). The marginal labor productivity of any individual workforce is equivalent output value produced (Hiscox, 2020). In the domestic country, if labor is abundant within the domestic country and other foreign countries have other resources, then the incentive for moving to that economy is higher (Navaretti&Venables, 2020).Also, the MPL that is the marginal productivity of labor forces is relatively less, due to which they would earn comparatively less owing to the technology and related factors of production. There is always an impetus for moving to labor deficit countries, this would only decline only with the differences in purchasing powers (Pi&Zhou, 2015). The figure given below states the differences in home and foreign employment, depicting the change inlabor productivity.

2: Marginal Productivity of Labour

(Source: Week 8 lecture notes)

The figure states that foreign output has increased from OL1 to OL2, while the domestic output has reduced within the MPL curve (OL2 to OL1 ). The theory suggests that an increase in world output can be maximized only if marginal labor productivity holds an equivalent position in all countries (that is home and a foreign country). Additionally, during post Brexit period, labor movement across EU borders was free, which enabled many manufacturers for hiring temporary or long-term employees at relatively lower costs. The marginal product labor productivity has provided evidence for governments of both countries are required to create trade agreements and collaboration with governments for supporting labor migration on work visas.

Although, post-Brexit labor laws have changed that restricts immigrants from the European region thereby putting pressure on economies of scale and comparative advantage. A similar situation is prevalent in Canada as pandemic has restricted international flying, hence immigration from varied countries is at a halt. In addition, immigration laws need to be relaxed from labor-abundant countries like Asian economies to ones with a deficit for improving trading relations and comparative advantage (Chaney, 2014). To this, Hecksher- Ohlin Model predicted trading in goods could provide the best alternatives for ensuring factor mobilities. It is considered that services as a factor of production are embedded with goods which ultimately reflects good value or productivity (Di Giovanni&Levchenko, 2012). This cannot hold with equalization with labor mobility due to varied assumptions made by Hecksher- Ohlin model.

• It assumes the same products are produced by the countries. In this case, both countries are operating in different segments of the aerospace industry. Europe is an indirect trading partner of Canada as (trading activities are generally connected with the United States).

• The model also assumes that trading economies are operating on the same technologies. In this view, the state of technologies of Canada and the UK varies.

• The model has assumed that barriers to immigration and transportation exist.

In both countries, bilateral trade agreements will help to improve comparative advantages. Canada conducts the majority of its business with the US owing to its trade agreements under WTO, thus, such agreement with other foreign nations for improving trading-related activities which positively influences the GDP rates (Baker, 2021). In addition, Brexit will severally impact trading relations of the UK with EU nations, hence, mutual- beneficial bilateral trade agreements with the EU need to be settled for reducing comparative disadvantage. It is to be remembered that the UK had been in a comparative advantage position when entry and to exist across the borders prevailed accompanied by low or no taxes on imports and exports of aerospace products. Although, Brexit was settled with no deal due to which has exposed its comparative disadvantage position.

The Flow of Trade and Investment

The flow of trade and investment can be related to demand and supply factors. It is assumed that the import demand curve refers to the difference in quantity demanded from home suppliers and producers. As the price for the product would increase, the demand for the same would decline. Considering the Brexitconditions in the UK, the price of aerospace products can be expected to rise due to changing political conditions, which might impact the demand (investment) for the product. On the contrary, the export supply curve would be differences in quantity demanded by suppliers and producers in the foreign market. Both the countries that are Canada and UK are export-oriented aerospace sectors, thereby any changes in prices would directly earn from abroad. Unlike, the import demand curve increase in price would result in a rise in export supplies. Thus, the flow of trade and investment is positive for both nations who are the epicentre of manufacture and design in the aerospace industry (Mansfield&Milner, 2012). Since both Canada and UK are engaged in the manufacturing and designing of defence sectors, thus it receives government aid. In the UK, trade, and investment are also received through foreign spaces due to its engagement in commercial repairs and manufacturing of aircraft.

Also, the investments in the UK are higher due to its advanced technologies which have resulted in the development of satellites, drones, and other advanced aero craft products.

Benefits to Australia

The gravity model depicts that economic size has a direct relation with import and export volumes. Thereby larger economies are engaged in the production and service in huge quantities, which improves its opportunity for selling in the market (Yabuuchi, 2015). Considering this theory trade with Canada and UK will have beneficial impacts owing to the size and nature of trading activities. This further strengthened from the free trade agreement with Canada in 2018 which provides Australia with huge trading opportunities. Also, Australia is a prominent member of the EU, hence trade relations and profound investment in the aerospace industry of the UK would enable the nation in procuring advanced aircraft and related products (International Aviation, 2019). Also, the UK is the nearest manufacturing unit through which transportation costs of aerospace products could be reduced. Some benefits for the flow of trade and investments are provided below.

• It reduces tariff barriers and leads to trade creation

• It increases export and imports and maintains a durable international relation

• It is effective to maintain the scale of positive economies

• It increases international competition

In addition, investments of £90 million in the aerospace industry by the UK would profoundly benefit Australia owing to the focus on lightweight parts that would help both nations reduce the use of fuel within the aircraft.

The aerospace industry of Canada is embarked on promising factors that could benefit Australia in the long run which are mentioned below.

• Aerospace is the main manufacturing unit employing 50, 000 workforce with additional laborers who have working maintenance and services.

• The aerospace industry of Canada enjoys a trade surplus that owes technology and machinery use coupled with high labor productivity.

• Innovation is high as 20 % of GDP is invested in research and development.

Conclusion

The aerospace industries have supported the world in witnessing growth and development. Both the UK and Canada have attributed to growth and development which owes to factors like collaboration, investment, rich culture, and history. Different factors of comparative advantages have been explained with economic theories like economies of scale, factor mobility, and gravity model. The benefits of trade relations of Canada and the UK are high for Australia owing to development, innovation, and investments encountered by the nations. Both UK and Canada are recommended for forming trade policies with labour-abundant countries to reap benefits of high productivity which will also improve economies of scale.Trade relations amongst Canada andUK are still in establishing stage as UK is no longer part of EU, hence countries are recommended to reconsider international factor mobility for creating trade relationships. In addition, both the countries are operating on different sector that is commercial and civil, hence trading can be conducted on the basis of comparative advantage theories. Since, Canada has efficient trade relation relations with EU, it should consider developing relations with UK for mobility like technology, skilled labour force, innovation to expand its aerospace industry. Both the parties will benefit from trade, owing to the prevalence of comparative disadvantage.

Reference List

Baker, N., 2021. Canadian Aerospace Industry. [online] Available at: <https://www.thecanadianencyclopedia.ca/en/article/aerospace-industry> [Accessed 11 Jan 2022].

Chaney, T., 2014. The network structure of international trade. American Economic Review, 104(11), pp.3600-3634.https://mpra.ub.uni-muenchen.de/32682/1/MPRA_paper_32682.pdf

Chaudhuri, S. and Gupta, M.R., 2014. International factor mobility, informal interest rate, and capital market imperfection: a general equilibrium analysis. Economic Modelling, 37, pp.184-192.

Conversable Economist: Ricardo's Comparative Advantage After Two Centuries. 2017. Chatham: Newstex. https://www.proquest.com/docview/1977077407/8167A5CE10E549A0PQ/2?accountid=30552

Destatis, 2020. Foreign trade. [online] Available at: <https://www.destatis.de/EN/Themes/Economy/Foreign-Trade/_node.html> [Accessed 11 Jan 2022].

Di Giovanni, J. and Levchenko, A.A., 2012. Country size, international trade, and aggregate fluctuations in granular economies. Journal of Political Economy, 120(6), pp.1083-1132.

Government of Canada, 2021. State of Canada's Aerospace Industry. [online] Available at: <https://www.ic.gc.ca/eic/site/ad-ad.nsf/eng/h_ad03964.html> [Accessed 11 Jan 2022].

Hiscox, M.J., 2020. International trade and political conflict. Princeton University Press.https://www.google.co.in/books/edition/International_Trade_and_Political_Confli/XdPgDwAAQBAJ?hl=en&gbpv=1&dq=international+Trade+and+Political+Conflict&printsec=frontcover

International Aviation, 2019. Why were there so many aircraft manufacturers in the UK in the 1950s? [online] Available at: <https://internationalaviationhq.com/2019/09/07/aircraft-manufacturers-in-the-uk/> [Accessed 11 Jan 2022].

ITA, 2020. Canada - Country Commercial Guide. [online] Available at: <https://www.trade.gov/country-commercial-guides/canada-aerospace-and-defense> [Accessed 11 Jan 2022].

ITA, 2022. United Kingdom - Country Commercial Guide. [online] Available at: <https://www.trade.gov/country-commercial-guides/united-kingdom-aerospace-and-defense> [Accessed 11 Jan 2022].

Mansfield, E.D., and Milner, H.V., 2012. Votes, vetoes, and the political economy of international trade agreements. Princeton University Press.https://www.google.co.in/books/edition/Votes_Vetoes_and_the_Political_Economy_o/FnZh_iCZDs0C?hl=en&gbpv=1&dq=Mansfield,+E.D.,+and+Milner,+H.V.,+2012.+Votes,+vetoes,+and+the+political+economy+of+international+trade+agreements.+Princeton+University+Press.&printsec=frontcover

Moon, B.E., 2018. Dilemmas of international trade. Routledge.https://www.google.co.in/books/edition/Dilemmas_Of_International_Trade/WVJPDwAAQBAJ?hl=en&gbpv=1&dq=Moon,+B.E.,+2018.+Dilemmas+of+international+trade.+Routledge.&pg=PT12&printsec=frontcover

Navaretti, G.B. and Venables, A.J., 2020. Multinational firms in the world economy. Princeton University Press.https://www.google.co.in/books/edition/Multinational_Firms_in_the_World_Economy/q27dDwAAQBAJ?hl=en&gbpv=1&dq=.+Multinational+firms+in+the+world+economy.&printsec=frontcover

Pham, V., Woodland, A. and Caselli, M., 2021. Exceptional performance of multinational suppliers: theory and evidence. Review of World Economics, 157(2), pp. 221-269.https://doi.org/10.1007/s10290-020-00399-7

Pi, J. and Zhou, Y., 2015. International factor mobility, production cost components, and wage inequality. The BE Journal of Economic Analysis & Policy, 15(2), pp.503-522.https://doi.org/10.1515/bejeap-2014-0006

PODRECCA, E. and ROSSINI, G., 2015. International Factor Mobility, Wages and Prices. Review of Development Economics, 19(3), pp. 683-694. https://www.proquest.com/docview/1696144708/1BBAB2C138824558PQ/1?accountid=30552

Watson, M., 2017. Historicising Ricardo's comparative advantage theory, challenging the normative foundations of liberal International Political Economy. New Political Economy, 22(3), pp. 257-272. https://www.proquest.com/docview/1883144812/8167A5CE10E549A0PQ/1?accountid=30552

Yabuuchi, S., 2015. Globalization, International Factor Mobility, and Wage Inequality. Journal of Economic Integration, 30(3), pp. 577-590.https://www.proquest.com/docview/1898683750/1BBAB2C138824558PQ/2?accountid=30552

.png)

~5.png)

.png)

~1.png)

.png)