Order Now

- Home

- About Us

-

Services

-

Assignment Writing

-

Academic Writing Services

- HND Assignment Help

- SPSS Assignment Help

- College Assignment Help

- Writing Assignment for University

- Urgent Assignment Help

- Architecture Assignment Help

- Total Assignment Help

- All Assignment Help

- My Assignment Help

- Student Assignment Help

- Instant Assignment Help

- Cheap Assignment Help

- Global Assignment Help

- Write My Assignment

- Do My Assignment

- Solve My Assignment

- Make My Assignment

- Pay for Assignment Help

-

Management

- Management Assignment Help

- Business Management Assignment Help

- Financial Management Assignment Help

- Project Management Assignment Help

- Supply Chain Management Assignment Help

- Operations Management Assignment Help

- Risk Management Assignment Help

- Strategic Management Assignment Help

- Logistics Management Assignment Help

- Global Business Strategy Assignment Help

- Consumer Behavior Assignment Help

- MBA Assignment Help

- Portfolio Management Assignment Help

- Change Management Assignment Help

- Hospitality Management Assignment Help

- Healthcare Management Assignment Help

- Investment Management Assignment Help

- Market Analysis Assignment Help

- Corporate Strategy Assignment Help

- Conflict Management Assignment Help

- Marketing Management Assignment Help

- Strategic Marketing Assignment Help

- CRM Assignment Help

- Marketing Research Assignment Help

- Human Resource Assignment Help

- Business Assignment Help

- Business Development Assignment Help

- Business Statistics Assignment Help

- Business Ethics Assignment Help

- 4p of Marketing Assignment Help

- Pricing Strategy Assignment Help

- Nursing

-

Finance

- Finance Assignment Help

- Do My Finance Assignment For Me

- Financial Accounting Assignment Help

- Behavioral Finance Assignment Help

- Finance Planning Assignment Help

- Personal Finance Assignment Help

- Financial Services Assignment Help

- Forex Assignment Help

- Financial Statement Analysis Assignment Help

- Capital Budgeting Assignment Help

- Financial Reporting Assignment Help

- International Finance Assignment Help

- Business Finance Assignment Help

- Corporate Finance Assignment Help

-

Accounting

- Accounting Assignment Help

- Managerial Accounting Assignment Help

- Taxation Accounting Assignment Help

- Perdisco Assignment Help

- Solve My Accounting Paper

- Business Accounting Assignment Help

- Cost Accounting Assignment Help

- Taxation Assignment Help

- Activity Based Accounting Assignment Help

- Tax Accounting Assignment Help

- Financial Accounting Theory Assignment Help

-

Computer Science and IT

- Operating System Assignment Help

- Data mining Assignment Help

- Robotics Assignment Help

- Computer Network Assignment Help

- Database Assignment Help

- IT Management Assignment Help

- Network Topology Assignment Help

- Data Structure Assignment Help

- Business Intelligence Assignment Help

- Data Flow Diagram Assignment Help

- UML Diagram Assignment Help

- R Studio Assignment Help

-

Law

- Law Assignment Help

- Business Law Assignment Help

- Contract Law Assignment Help

- Tort Law Assignment Help

- Social Media Law Assignment Help

- Criminal Law Assignment Help

- Employment Law Assignment Help

- Taxation Law Assignment Help

- Commercial Law Assignment Help

- Constitutional Law Assignment Help

- Corporate Governance Law Assignment Help

- Environmental Law Assignment Help

- Criminology Assignment Help

- Company Law Assignment Help

- Human Rights Law Assignment Help

- Evidence Law Assignment Help

- Administrative Law Assignment Help

- Enterprise Law Assignment Help

- Migration Law Assignment Help

- Communication Law Assignment Help

- Law and Ethics Assignment Help

- Consumer Law Assignment Help

- Science

- Biology

- Engineering

-

Humanities

- Humanities Assignment Help

- Sociology Assignment Help

- Philosophy Assignment Help

- English Assignment Help

- Geography Assignment Help

- Agroecology Assignment Help

- Psychology Assignment Help

- Social Science Assignment Help

- Public Relations Assignment Help

- Political Science Assignment Help

- Mass Communication Assignment Help

- History Assignment Help

- Cookery Assignment Help

- Auditing

- Mathematics

-

Economics

- Economics Assignment Help

- Managerial Economics Assignment Help

- Econometrics Assignment Help

- Microeconomics Assignment Help

- Business Economics Assignment Help

- Marketing Plan Assignment Help

- Demand Supply Assignment Help

- Comparative Analysis Assignment Help

- Health Economics Assignment Help

- Macroeconomics Assignment Help

- Political Economics Assignment Help

- International Economics Assignments Help

-

Academic Writing Services

-

Essay Writing

- Essay Help

- Essay Writing Help

- Essay Help Online

- Online Custom Essay Help

- Descriptive Essay Help

- Help With MBA Essays

- Essay Writing Service

- Essay Writer For Australia

- Essay Outline Help

- illustration Essay Help

- Response Essay Writing Help

- Professional Essay Writers

- Custom Essay Help

- English Essay Writing Help

- Essay Homework Help

- Literature Essay Help

- Scholarship Essay Help

- Research Essay Help

- History Essay Help

- MBA Essay Help

- Plagiarism Free Essays

- Writing Essay Papers

- Write My Essay Help

- Need Help Writing Essay

- Help Writing Scholarship Essay

- Help Writing a Narrative Essay

- Best Essay Writing Service Canada

-

Dissertation

- Biology Dissertation Help

- Academic Dissertation Help

- Nursing Dissertation Help

- Dissertation Help Online

- MATLAB Dissertation Help

- Doctoral Dissertation Help

- Geography Dissertation Help

- Architecture Dissertation Help

- Statistics Dissertation Help

- Sociology Dissertation Help

- English Dissertation Help

- Law Dissertation Help

- Dissertation Proofreading Services

- Cheap Dissertation Help

- Dissertation Writing Help

- Marketing Dissertation Help

- Programming

-

Case Study

- Write Case Study For Me

- Business Law Case Study Help

- Civil Law Case Study Help

- Marketing Case Study Help

- Nursing Case Study Help

- Case Study Writing Services

- History Case Study help

- Amazon Case Study Help

- Apple Case Study Help

- Case Study Assignment Help

- ZARA Case Study Assignment Help

- IKEA Case Study Assignment Help

- Zappos Case Study Assignment Help

- Tesla Case Study Assignment Help

- Flipkart Case Study Assignment Help

- Contract Law Case Study Assignments Help

- Business Ethics Case Study Assignment Help

- Nike SWOT Analysis Case Study Assignment Help

- Coursework

- Thesis Writing

- CDR

- Research

-

Assignment Writing

-

Resources

- Referencing Guidelines

-

Universities

-

Australia

- Asia Pacific International College Assignment Help

- Macquarie University Assignment Help

- Rhodes College Assignment Help

- APIC University Assignment Help

- Torrens University Assignment Help

- Kaplan University Assignment Help

- Holmes University Assignment Help

- Griffith University Assignment Help

- VIT University Assignment Help

- CQ University Assignment Help

-

Australia

- Experts

- Free Sample

- Testimonial

ACCT6004 Management Accounting Assessment 2 Sample

Assignment Brief

Length - (1,800 words +/- 10%)

Learning Outcomes

a) Identify and analyses ethical and organizational issues confronting contemporary management accountants.

b) Categories and identify the nature of various types of costs, cost objects and cost behaviours and use cost estimation techniques to develop cost functions.

c) Apply cost accounting techniques to calculate the cost of a range of cost objects, as well as analyse costs.

d) Apply cost information to planning, control and decision-making.

e) Critically evaluate the relevance of both quantitative and qualitative costing information to management decision making.

Submission - by 11:55pm AEST/AEDT Sunday of Module 5.1 (week 9)

Weighting - 30%

Total Marks -100 marks

Context:

The purpose of this assessment is to establish the skills needed in the workplace for costing products and services using the appropriate processes and tools and applying analytical processes to construct accounting systems and models using workplace tools. Each question uses realistic data and the professional practices

similar to that found in workplaces.

Submission Instruction

Due Date/Time: 11:55pm Sydney time (AEST/AEDT) on Sunday 18th April 2021 Please aim to complete this assignment a few days prior to the due date to allow for any unforeseen circumstances such as illness, holidays, family issues, work commitments etc. You may submit the assignment early if you have other commitments around the due date.

All times listed are local (Sydney) times. For assignment help Please ensure you factor in any time difference between Sydney and your location when submitting your assignment, to avoid incurring any late submission penalties.

Please note the following important instructions relating to the assignment format and Submission:

• Note that this is an individual piece of assessment. You will need to work individually to prepare a response to ALL of the questions listed in the assessment.

• You must submit your assessment in one Excel file. Any submissions in any other file formats will not be accepted.

• Each question (including all sub-questions) should be presented in a single worksheet. As there are 5 questions in this assessment, your Excel file should contain 5 worksheets in total.

• You cannot scan handwritten responses and submit. All answers must be typed in Excel.

• Your assessment needs to be submitted though the submission links available on the Blackboard. Assignments submitted via e-mail (or any other method) will NOT be accepted.

• Make sure that you upload the correct file. If you discover (after the due date) that you have uploaded a draft version or the wrong file completely, you will not be allowed to submit a second file.

- The typo in Question 2-part C has been rectified in this version.

Question 1: Support Department cost allocation

Diamond Trust Bank has two support departments: The Human Resources Department and the Computing Department. The bank also has two operation departments that service customers directly: The Deposits Department and the Loan Department. The usage of the two support departments' output is provided below:

|

|

Providerofservice

|

|

|

Usersofservice

|

HumanResources

|

Computing

|

|

HumanResources

|

-

|

20%

|

|

Computing

|

20%

|

-

|

|

Deposits

|

50%

|

60%

|

|

Loans

|

30%

|

20%

|

The costs in the support departments and operation departments for the is presented below:

|

Departments

|

BudgetedCosts

|

|

HumanResources

|

$72,000

|

|

Computing

|

$120,000

|

|

Deposits

|

$300,000

|

|

Loans

|

$500,000

|

Required

a) Report the total costs of operation departments (the Deposits Department and the Loan Department) after the support departments' (the Human Resources Department and the Computing Departments) costs have been allocated using each of the following methods:

i) Direct Method

ii) Step Down Method (The bank allocates the costs of the Human Resources Department first.)

iii) Reciprocal Method

b) Diamond Trust Bank evaluates the performance of the operation department managers on the basis of how well they manage their total costs, including allocated costs. As the manager of the Loan Department, which allocation method would you prefer? Why?

Question 2: Job Costing

ACT Manufacturing Ltd. is highly automated company that uses computers to control manufacturing operations. The company uses a job-order costing system and applies manufacturing overhead cost to products on the basis of computer-hours. The following estimates were used in preparing the predetermined overhead rate at the beginning of the year:

|

Computer-hours

|

85,000

|

|

Manufacturingoverheadcost

|

$1,530,000

|

The company’s cost records revealed the following actual cost and operating data for the year:

|

Computer-hours

|

60,000

|

|

Manufacturingoverheadcost

|

$1,350,000

|

|

Inventoriesatyear-end:

|

|

|

Rawmaterials

|

$600,000

|

|

Workinprocess

|

$230,000

|

|

Finishedgoods

|

$1,756,000

|

|

Costofgoodssold

|

$2,800,000

|

Required

a) What is ACT Manufacturing Ltd.’s predetermined overhead rate for the year?

b) Calculate the company’s under applied or over applied overhead for the year.

c) Assume that overapplied or underapplied overhead allocated on a pro rata basis to the ending balances in work in process, finished goods and cost of sales. The ending balance of these accounts are reported below. Prepare journal entries to show the allocation.

|

Workinprocess

|

$43,200

|

|

Finishedgoods

|

$280,000

|

|

CostofGoodsSold

|

$756,000

|

d) How much higher or lower will net operating income be for the year if the underapplied or overapplied overhead is allocated on a pro rata basis rather than closed directly to Cost of Goods Sold? Explain the reason for this difference.

Question 3: Process Costing System

Techsafe Company manufactures car seats. Each car seat passes through the assembly department and testing department. When the assembly department finishes work on each car seat, it is immediately transferred to testing department. The process-costing system at Techsafe Company has a single direct-cost category (direct materials) and a single indirect-cost category (conversion costs). Direct materials are added at the beginning of the process. Conversion costs are added evenly during the process.

The table below shows the relevant data for the assembly department for July 2020.

|

|

Physical Units

(Car Seats)

|

Direct Material Costs

|

Conversion Costs

|

|

Work in process, 1July2020(*)

|

5,000

|

$1,250,000

|

$402,750

|

|

StartedduringJuly

|

20,000

|

|

|

|

2020

|

|

|

|

|

Completedduring

|

22,500

|

|

|

|

July2020

|

|

|

|

|

Workinprocess,31

|

2,500

|

|

|

|

July2020(**)

|

|

|

|

|

Costsaddedduring

|

|

$4,500,000

|

$2,337,500

|

|

July2020

|

|

|

|

Note:

(*) Degree of completion: 100% for direct materials and 60% for conversion cost (**) Degree of completion: 100% for direct materials and 70% for conversion cost

Required

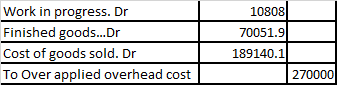

a) Determine the cost per equivalent unit for the Techsafe Company’s direct materials and conversion costs, and the total unit cost for the current period, under the FIFO method. Show all workings.

Determine the cost per equivalent unit for the Techsafe Company’s direct materials and conversion costs, and the total unit cost for the current period, under the Weighted Average method. Show all workings

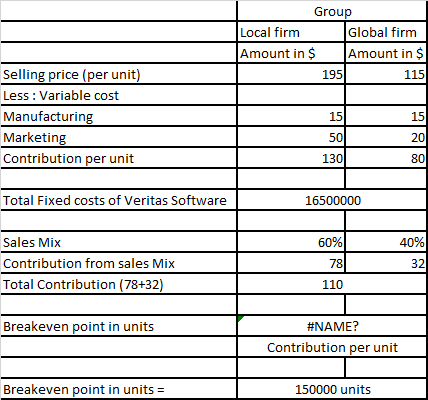

Question 4: Cost Volume and Profit (CVP) analysis

Veritas Software is a leading Australian based accounting software manufacturer. It develops software packages for accounting firms located in Australia and overseas. Veritas is planning to release an upgraded version of their software soon. The company divides its clients into two groups: Local firms (those firms that operate in Australia) and Global firms (those firms that operate in overseas). Although the same physical product is provided to each client group, significant differences exist in selling prices and variable marketing costs:

|

|

Localfirms

|

Globalfirms

|

|

Sellingprice(perunit)

|

$195

|

$115

|

|

Variablecosts(perunit)

ManufacturingMarketing

|

$15

$50

|

$15

$20

|

The fixed costs of Veritas Software are $16,500,000. The planned sales mix for the upgraded software in units is 60% Local firms and 40% Global firms.

Required

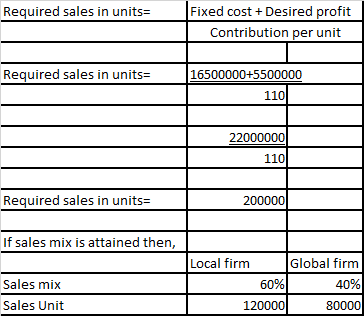

a) What is the break-even point in units for Veritas Software’s upgraded software if the planned sales mix is attained?

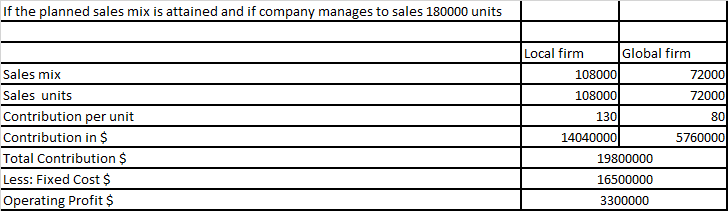

b) If the planned sales mix is attained, what will be the operating income when 180,000 units are sold?

c) If Veritas Software wants to generate operating income of 5,500,000, how many units do they need to sell to Local and Global firms each? Assume that the planned sales mix is attained.

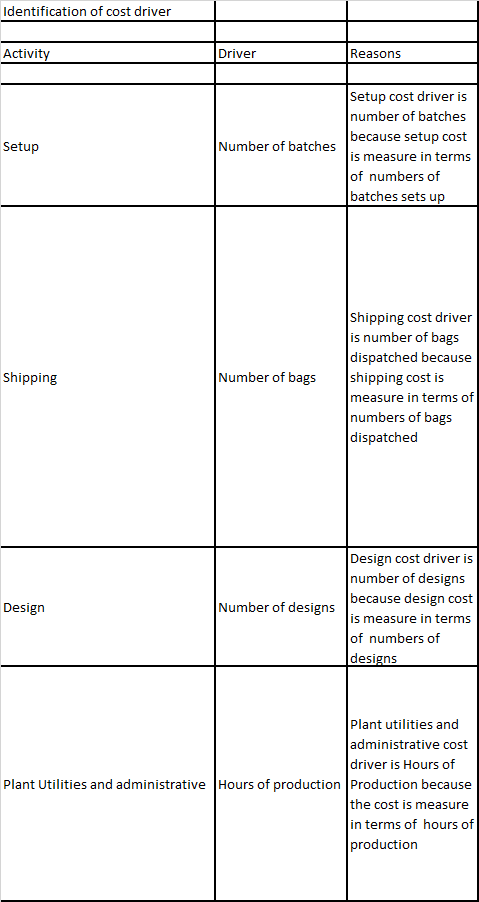

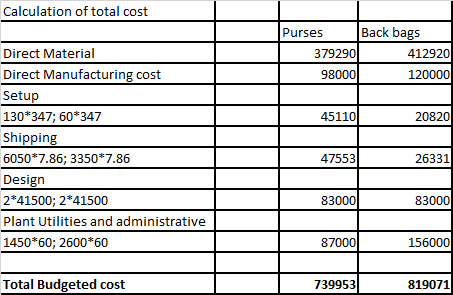

Question 5 Activity Based Costing

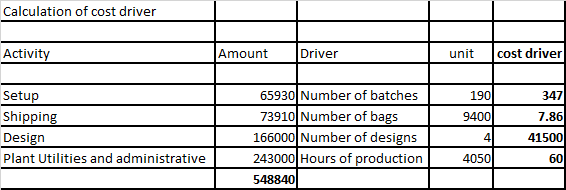

MaxPak is a designer of high-quality backpacks and purses. Each design is made in small batches. Each summer, MaxPak comes out with new designs for the backpack and for the purse. The company uses these designs for a year, and then moves on to the next trend. The bags are all made on the same fabrication equipment that is expected to operate at capacity. The equipment must be switched over to a new design and set up to prepare for the production of each new batch of products. When completed, each batch of products is immediately shipped to a wholesaler. Shipping costs vary with the number of shipments. Budgeted information for the year is as follows:

|

MaxPak

|

|

|

Budget forcostsandActivities

|

|

|

For theYearEnded30June2020

|

|

|

Directmaterials—purses

|

$379,290

|

|

Directmaterials—backpacks

|

412,920

|

|

Directmanufacturinglabour—purses

|

98,000

|

|

Directmanufacturinglabour—backpacks

|

120,000

|

|

Setup

|

65,930

|

|

Shipping

|

73,910

|

|

Design

|

166,000

|

|

Plantutilitiesandadministration

|

243,000

|

|

Total

|

$1,559,050

|

Other Budget information follows:

|

|

Backpacks

|

Purses

|

|

Numberofbags

|

6,050

|

3,350

|

|

Hoursofproduction

|

1,450

|

2,600

|

|

Numberofbatches

|

130

|

60

|

|

Numberofdesigns

|

2

|

2

|

Required:

a) Identify the cost hierarchy level for each cost category.

b) Identify the most appropriate cost driver for each cost category. Explain briefly your choice of cost driver.

c) Calculate the budgeted cost per unit of cost driver for each cost category.

d) Calculate the budgeted total costs and cost per unit for each product line.

e) Explain how you could use the information in requirement 4 to reduce costs.

Solution

Answer 1

Part a

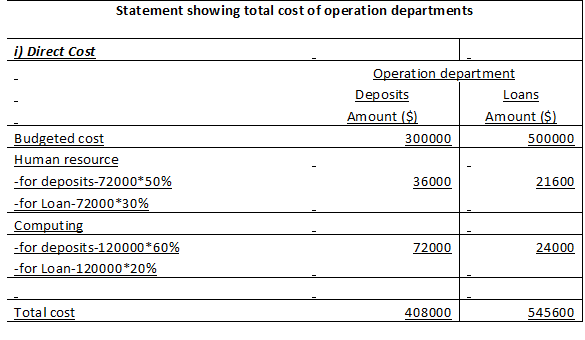

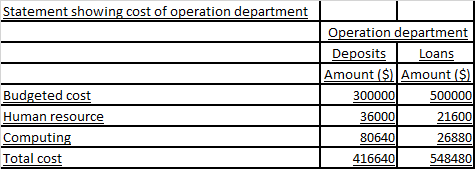

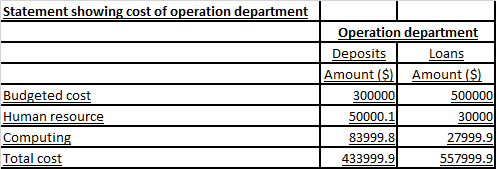

ii) Step down method

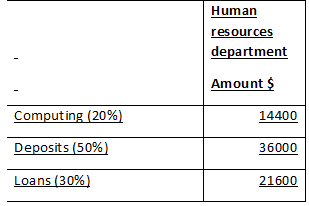

In step down method the cost of Human resource department shall be allocated first to

Cost of Human resource department is $ 72000

After allocation of Human resource then the second will be computing department

Cost of Computing department= 120000+14400 = $ 1,34,400.00

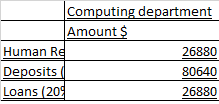

Part iii

In Reciprocal method the cost of computing allocated to Human resource shall be distribute again So, in this case $26880 allocated to Human resource from computing will be distributed again till it reduces to zero.

Part B

As a Manager we would always choose that method which provides most accurate measure of cost. Thus by evaluating all the three methods above it can be seen that Reciprocal method gives the most accurate evaluation of cost and thus will provide the most accurate performance evaluation

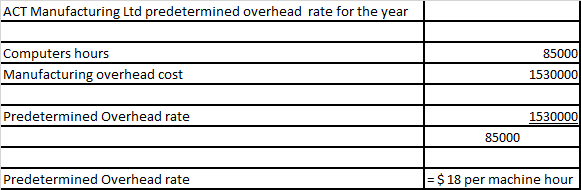

Answer 2

Part a

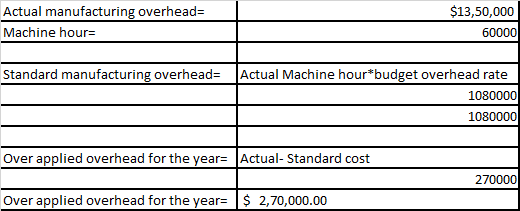

Part b

Part c

Part d

The company profit has got reduced due to over applied overhead. The cost of goods sold will increase and thus the profit margin will get reduce, thus the company should ignore over application of overhead cost

Answer 3

Answer 4

Part a

Part b

Part c

Answer 5

Part a

Direct Material

Direct Manufacturing cost

Plant Utilities and administrative

Design

Shipping

Setup

Part b

Part c

Part d

Part e

Use of ABC activity based costing gives the true view of cost allocation on the basis of cost driver and thus it eliminated traditional approach of cost allocation

Download Samples PDF

Related Sample

- ACCM6000 Capstone Accounting and Governance Case Study 2

- PROJ6003 Project Execution and Control

- MIS605 Systems Analysis and Design Report

- HI5033 Database Design Report

- ECO500 Economics for Business Assignment

- Microservices Architecture Assignment

- Information Security Assignment

- MGT601 Dynamic Leadership Report Part A

- DATA4000 Introduction to Business Analytics Report 3A

- ICT102 Networking Report 3

- MKG102 Consumer Behaviour Assignment

- BUSN20017 Effective Business Communication Assignment

- MRKT20057 Global Marketing Assignment

- MIS611 Information Systems Capstone Report

- PUBH6006 Community Health and Disease Prevention

- MGT60040 Management Analyses and Problem Solving Assignment

- The Australian Solicitors Conduct Rules

- ISYS6008 IT Entrepreneurship And Innovation Assignment

- HI6028 Taxation Theory Practice and Law Assignment

- HCCSSD205 Social Justice Research Report 3

Assignment Services

-

Assignment Writing

-

Academic Writing Services

- HND Assignment Help

- SPSS Assignment Help

- College Assignment Help

- Writing Assignment for University

- Urgent Assignment Help

- Architecture Assignment Help

- Total Assignment Help

- All Assignment Help

- My Assignment Help

- Student Assignment Help

- Instant Assignment Help

- Cheap Assignment Help

- Global Assignment Help

- Write My Assignment

- Do My Assignment

- Solve My Assignment

- Make My Assignment

- Pay for Assignment Help

-

Management

- Management Assignment Help

- Business Management Assignment Help

- Financial Management Assignment Help

- Project Management Assignment Help

- Supply Chain Management Assignment Help

- Operations Management Assignment Help

- Risk Management Assignment Help

- Strategic Management Assignment Help

- Logistics Management Assignment Help

- Global Business Strategy Assignment Help

- Consumer Behavior Assignment Help

- MBA Assignment Help

- Portfolio Management Assignment Help

- Change Management Assignment Help

- Hospitality Management Assignment Help

- Healthcare Management Assignment Help

- Investment Management Assignment Help

- Market Analysis Assignment Help

- Corporate Strategy Assignment Help

- Conflict Management Assignment Help

- Marketing Management Assignment Help

- Strategic Marketing Assignment Help

- CRM Assignment Help

- Marketing Research Assignment Help

- Human Resource Assignment Help

- Business Assignment Help

- Business Development Assignment Help

- Business Statistics Assignment Help

- Business Ethics Assignment Help

- 4p of Marketing Assignment Help

- Pricing Strategy Assignment Help

- Nursing

-

Finance

- Finance Assignment Help

- Do My Finance Assignment For Me

- Financial Accounting Assignment Help

- Behavioral Finance Assignment Help

- Finance Planning Assignment Help

- Personal Finance Assignment Help

- Financial Services Assignment Help

- Forex Assignment Help

- Financial Statement Analysis Assignment Help

- Capital Budgeting Assignment Help

- Financial Reporting Assignment Help

- International Finance Assignment Help

- Business Finance Assignment Help

- Corporate Finance Assignment Help

-

Accounting

- Accounting Assignment Help

- Managerial Accounting Assignment Help

- Taxation Accounting Assignment Help

- Perdisco Assignment Help

- Solve My Accounting Paper

- Business Accounting Assignment Help

- Cost Accounting Assignment Help

- Taxation Assignment Help

- Activity Based Accounting Assignment Help

- Tax Accounting Assignment Help

- Financial Accounting Theory Assignment Help

-

Computer Science and IT

- Operating System Assignment Help

- Data mining Assignment Help

- Robotics Assignment Help

- Computer Network Assignment Help

- Database Assignment Help

- IT Management Assignment Help

- Network Topology Assignment Help

- Data Structure Assignment Help

- Business Intelligence Assignment Help

- Data Flow Diagram Assignment Help

- UML Diagram Assignment Help

- R Studio Assignment Help

-

Law

- Law Assignment Help

- Business Law Assignment Help

- Contract Law Assignment Help

- Tort Law Assignment Help

- Social Media Law Assignment Help

- Criminal Law Assignment Help

- Employment Law Assignment Help

- Taxation Law Assignment Help

- Commercial Law Assignment Help

- Constitutional Law Assignment Help

- Corporate Governance Law Assignment Help

- Environmental Law Assignment Help

- Criminology Assignment Help

- Company Law Assignment Help

- Human Rights Law Assignment Help

- Evidence Law Assignment Help

- Administrative Law Assignment Help

- Enterprise Law Assignment Help

- Migration Law Assignment Help

- Communication Law Assignment Help

- Law and Ethics Assignment Help

- Consumer Law Assignment Help

- Science

- Biology

- Engineering

-

Humanities

- Humanities Assignment Help

- Sociology Assignment Help

- Philosophy Assignment Help

- English Assignment Help

- Geography Assignment Help

- Agroecology Assignment Help

- Psychology Assignment Help

- Social Science Assignment Help

- Public Relations Assignment Help

- Political Science Assignment Help

- Mass Communication Assignment Help

- History Assignment Help

- Cookery Assignment Help

- Auditing

- Mathematics

-

Economics

- Economics Assignment Help

- Managerial Economics Assignment Help

- Econometrics Assignment Help

- Microeconomics Assignment Help

- Business Economics Assignment Help

- Marketing Plan Assignment Help

- Demand Supply Assignment Help

- Comparative Analysis Assignment Help

- Health Economics Assignment Help

- Macroeconomics Assignment Help

- Political Economics Assignment Help

- International Economics Assignments Help

-

Academic Writing Services

-

Essay Writing

- Essay Help

- Essay Writing Help

- Essay Help Online

- Online Custom Essay Help

- Descriptive Essay Help

- Help With MBA Essays

- Essay Writing Service

- Essay Writer For Australia

- Essay Outline Help

- illustration Essay Help

- Response Essay Writing Help

- Professional Essay Writers

- Custom Essay Help

- English Essay Writing Help

- Essay Homework Help

- Literature Essay Help

- Scholarship Essay Help

- Research Essay Help

- History Essay Help

- MBA Essay Help

- Plagiarism Free Essays

- Writing Essay Papers

- Write My Essay Help

- Need Help Writing Essay

- Help Writing Scholarship Essay

- Help Writing a Narrative Essay

- Best Essay Writing Service Canada

-

Dissertation

- Biology Dissertation Help

- Academic Dissertation Help

- Nursing Dissertation Help

- Dissertation Help Online

- MATLAB Dissertation Help

- Doctoral Dissertation Help

- Geography Dissertation Help

- Architecture Dissertation Help

- Statistics Dissertation Help

- Sociology Dissertation Help

- English Dissertation Help

- Law Dissertation Help

- Dissertation Proofreading Services

- Cheap Dissertation Help

- Dissertation Writing Help

- Marketing Dissertation Help

- Programming

-

Case Study

- Write Case Study For Me

- Business Law Case Study Help

- Civil Law Case Study Help

- Marketing Case Study Help

- Nursing Case Study Help

- Case Study Writing Services

- History Case Study help

- Amazon Case Study Help

- Apple Case Study Help

- Case Study Assignment Help

- ZARA Case Study Assignment Help

- IKEA Case Study Assignment Help

- Zappos Case Study Assignment Help

- Tesla Case Study Assignment Help

- Flipkart Case Study Assignment Help

- Contract Law Case Study Assignments Help

- Business Ethics Case Study Assignment Help

- Nike SWOT Analysis Case Study Assignment Help

- Coursework

- Thesis Writing

- CDR

- Research

.png)

~5.png)

.png)

~1.png)

.png)