Order Now

- Home

- About Us

-

Services

-

Assignment Writing

-

Academic Writing Services

- HND Assignment Help

- SPSS Assignment Help

- College Assignment Help

- Writing Assignment for University

- Urgent Assignment Help

- Architecture Assignment Help

- Total Assignment Help

- All Assignment Help

- My Assignment Help

- Student Assignment Help

- Instant Assignment Help

- Cheap Assignment Help

- Global Assignment Help

- Write My Assignment

- Do My Assignment

- Solve My Assignment

- Make My Assignment

- Pay for Assignment Help

-

Management

- Management Assignment Help

- Business Management Assignment Help

- Financial Management Assignment Help

- Project Management Assignment Help

- Supply Chain Management Assignment Help

- Operations Management Assignment Help

- Risk Management Assignment Help

- Strategic Management Assignment Help

- Logistics Management Assignment Help

- Global Business Strategy Assignment Help

- Consumer Behavior Assignment Help

- MBA Assignment Help

- Portfolio Management Assignment Help

- Change Management Assignment Help

- Hospitality Management Assignment Help

- Healthcare Management Assignment Help

- Investment Management Assignment Help

- Market Analysis Assignment Help

- Corporate Strategy Assignment Help

- Conflict Management Assignment Help

- Marketing Management Assignment Help

- Strategic Marketing Assignment Help

- CRM Assignment Help

- Marketing Research Assignment Help

- Human Resource Assignment Help

- Business Assignment Help

- Business Development Assignment Help

- Business Statistics Assignment Help

- Business Ethics Assignment Help

- 4p of Marketing Assignment Help

- Pricing Strategy Assignment Help

- Nursing

-

Finance

- Finance Assignment Help

- Do My Finance Assignment For Me

- Financial Accounting Assignment Help

- Behavioral Finance Assignment Help

- Finance Planning Assignment Help

- Personal Finance Assignment Help

- Financial Services Assignment Help

- Forex Assignment Help

- Financial Statement Analysis Assignment Help

- Capital Budgeting Assignment Help

- Financial Reporting Assignment Help

- International Finance Assignment Help

- Business Finance Assignment Help

- Corporate Finance Assignment Help

-

Accounting

- Accounting Assignment Help

- Managerial Accounting Assignment Help

- Taxation Accounting Assignment Help

- Perdisco Assignment Help

- Solve My Accounting Paper

- Business Accounting Assignment Help

- Cost Accounting Assignment Help

- Taxation Assignment Help

- Activity Based Accounting Assignment Help

- Tax Accounting Assignment Help

- Financial Accounting Theory Assignment Help

-

Computer Science and IT

- Operating System Assignment Help

- Data mining Assignment Help

- Robotics Assignment Help

- Computer Network Assignment Help

- Database Assignment Help

- IT Management Assignment Help

- Network Topology Assignment Help

- Data Structure Assignment Help

- Business Intelligence Assignment Help

- Data Flow Diagram Assignment Help

- UML Diagram Assignment Help

- R Studio Assignment Help

-

Law

- Law Assignment Help

- Business Law Assignment Help

- Contract Law Assignment Help

- Tort Law Assignment Help

- Social Media Law Assignment Help

- Criminal Law Assignment Help

- Employment Law Assignment Help

- Taxation Law Assignment Help

- Commercial Law Assignment Help

- Constitutional Law Assignment Help

- Corporate Governance Law Assignment Help

- Environmental Law Assignment Help

- Criminology Assignment Help

- Company Law Assignment Help

- Human Rights Law Assignment Help

- Evidence Law Assignment Help

- Administrative Law Assignment Help

- Enterprise Law Assignment Help

- Migration Law Assignment Help

- Communication Law Assignment Help

- Law and Ethics Assignment Help

- Consumer Law Assignment Help

- Science

- Biology

- Engineering

-

Humanities

- Humanities Assignment Help

- Sociology Assignment Help

- Philosophy Assignment Help

- English Assignment Help

- Geography Assignment Help

- Agroecology Assignment Help

- Psychology Assignment Help

- Social Science Assignment Help

- Public Relations Assignment Help

- Political Science Assignment Help

- Mass Communication Assignment Help

- History Assignment Help

- Cookery Assignment Help

- Auditing

- Mathematics

-

Economics

- Economics Assignment Help

- Managerial Economics Assignment Help

- Econometrics Assignment Help

- Microeconomics Assignment Help

- Business Economics Assignment Help

- Marketing Plan Assignment Help

- Demand Supply Assignment Help

- Comparative Analysis Assignment Help

- Health Economics Assignment Help

- Macroeconomics Assignment Help

- Political Economics Assignment Help

- International Economics Assignments Help

-

Academic Writing Services

-

Essay Writing

- Essay Help

- Essay Writing Help

- Essay Help Online

- Online Custom Essay Help

- Descriptive Essay Help

- Help With MBA Essays

- Essay Writing Service

- Essay Writer For Australia

- Essay Outline Help

- illustration Essay Help

- Response Essay Writing Help

- Professional Essay Writers

- Custom Essay Help

- English Essay Writing Help

- Essay Homework Help

- Literature Essay Help

- Scholarship Essay Help

- Research Essay Help

- History Essay Help

- MBA Essay Help

- Plagiarism Free Essays

- Writing Essay Papers

- Write My Essay Help

- Need Help Writing Essay

- Help Writing Scholarship Essay

- Help Writing a Narrative Essay

- Best Essay Writing Service Canada

-

Dissertation

- Biology Dissertation Help

- Academic Dissertation Help

- Nursing Dissertation Help

- Dissertation Help Online

- MATLAB Dissertation Help

- Doctoral Dissertation Help

- Geography Dissertation Help

- Architecture Dissertation Help

- Statistics Dissertation Help

- Sociology Dissertation Help

- English Dissertation Help

- Law Dissertation Help

- Dissertation Proofreading Services

- Cheap Dissertation Help

- Dissertation Writing Help

- Marketing Dissertation Help

- Programming

-

Case Study

- Write Case Study For Me

- Business Law Case Study Help

- Civil Law Case Study Help

- Marketing Case Study Help

- Nursing Case Study Help

- Case Study Writing Services

- History Case Study help

- Amazon Case Study Help

- Apple Case Study Help

- Case Study Assignment Help

- ZARA Case Study Assignment Help

- IKEA Case Study Assignment Help

- Zappos Case Study Assignment Help

- Tesla Case Study Assignment Help

- Flipkart Case Study Assignment Help

- Contract Law Case Study Assignments Help

- Business Ethics Case Study Assignment Help

- Nike SWOT Analysis Case Study Assignment Help

- Coursework

- Thesis Writing

- CDR

- Research

-

Assignment Writing

-

Resources

- Referencing Guidelines

-

Universities

-

Australia

- Asia Pacific International College Assignment Help

- Macquarie University Assignment Help

- Rhodes College Assignment Help

- APIC University Assignment Help

- Torrens University Assignment Help

- Kaplan University Assignment Help

- Holmes University Assignment Help

- Griffith University Assignment Help

- VIT University Assignment Help

- CQ University Assignment Help

-

Australia

- Experts

- Free Sample

- Testimonial

ACCT6005 Company Accounting Assessment 3 Case Study

Part A: This case study assignment help is designed to assess your understanding and application of knowledge using a practical case study to analyse and prepare relevant worksheet entries and financial statements for a Group.

Submission Instructions: Part A: • Submit Part A of the assessment document in a Word format and excel (see assessment question) including a coversheet. JPEG files or similar cannot be opened and will not be marked. • Submit via the Assessment link in the main navigation menu in ACCT6005 Company Accounting.

ACCT6005 Company accounting Assessment 3 Case study Part A

Assignment instructions: This assignment is to be completed using Microsoft word for the evaluation report (part a) and Excel for the entries, worksheet and Group financial statements (part b, c, d). Please use a separate sheet in excel for each separate part b, c and d.

Please ensure that your file name contains your student ID and your full name. Please ensure that you use the ‘Ref’ column in the worksheet to identify each separate consolidation entry.

Case study:

PART A (100 Marks)

Grape Ltd acquired all the issued shares of Duck Ltd for $940 000 cash on 1 July 2020.

The following information is available at this acquisition date:

The equity of Duck Ltd is provided below:

|

Share capital |

$495 000 00000 |

|

Retained earnings |

280 000 |

|

General reserve |

125 000 |

All the identifiable assets and liabilities of Duck Ltd were recorded at fair value in the statement of financial position. The company income tax rate is 30%.

The following transactions and events occurred during the year ended 30 June 2021:

1. During the year Grape Ltd sold inventory to Duck Ltd for $55,000 at cost plus 20%. Duck Ltd has sold 10% of these items externally as at 30 June 2021.

2. On 1 April 2021, Duck Ltd sold an item of inventory to Grape Ltd for $28,000. This inventory had cost Duck Ltd $20,000. Grape Ltd treated the item as plant and will depreciate it at 20% p.a.

3. Grape Ltd sold land to Duck Ltd for $25,000 which had originally cost $32,000.

4. Dividends: Duck Ltd paid $18 000 interim dividends in September 2020, and Grape Ltd declared $26 000 dividends in May 2021 (to be paid in October 2021).

5. On 1 July 2020, Grape Ltd provided an office for Duck Ltd’s administrative staff to use. Grape Ltd charges $700 per month. The last rental receipt received by Grape Ltd was on 30 April 2021.

Required:

Part (a) (36 marks)

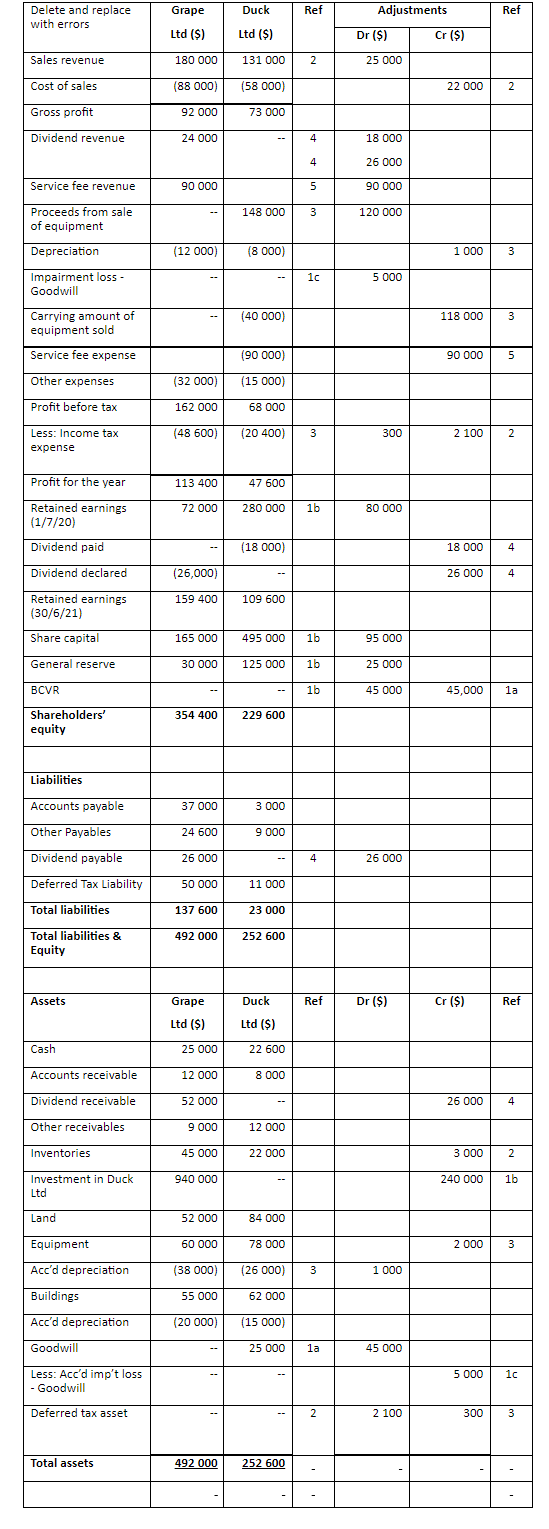

Analyse the completed worksheet attached for the Grape group. Using the information provided in the worksheet, prepare an evaluation report in word, detailing each omission and error. For each error:

1. List the accounts and amounts, which are incorrect for each consolidation adjustment.

2. Explain WHY the entry is incorrect. Include formulas where possible in your explanation.

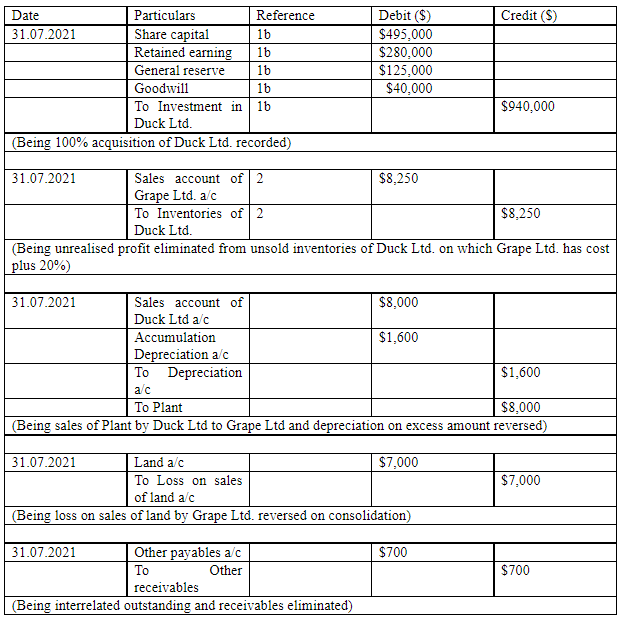

Part (b) Prepare the consolidation entries as at 30 June 2021 in excel using the template below. Include narrations for each entry: (28 marks)

|

Date |

Particulars |

Reference |

Debit |

Credit |

|

|

|

|

|

|

|

|

|

|

|

|

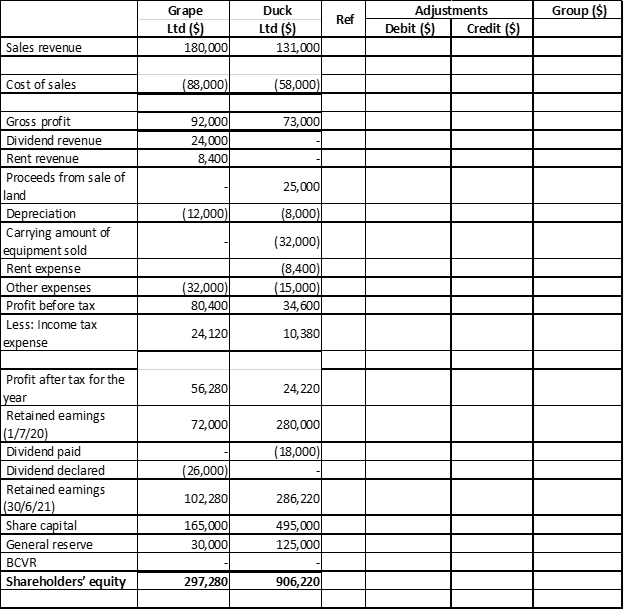

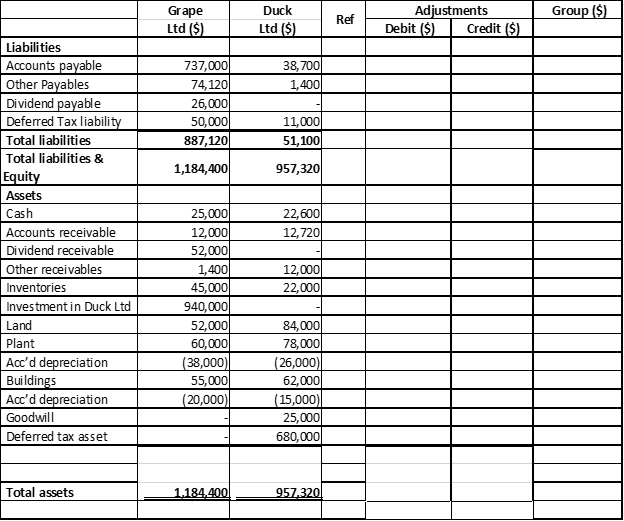

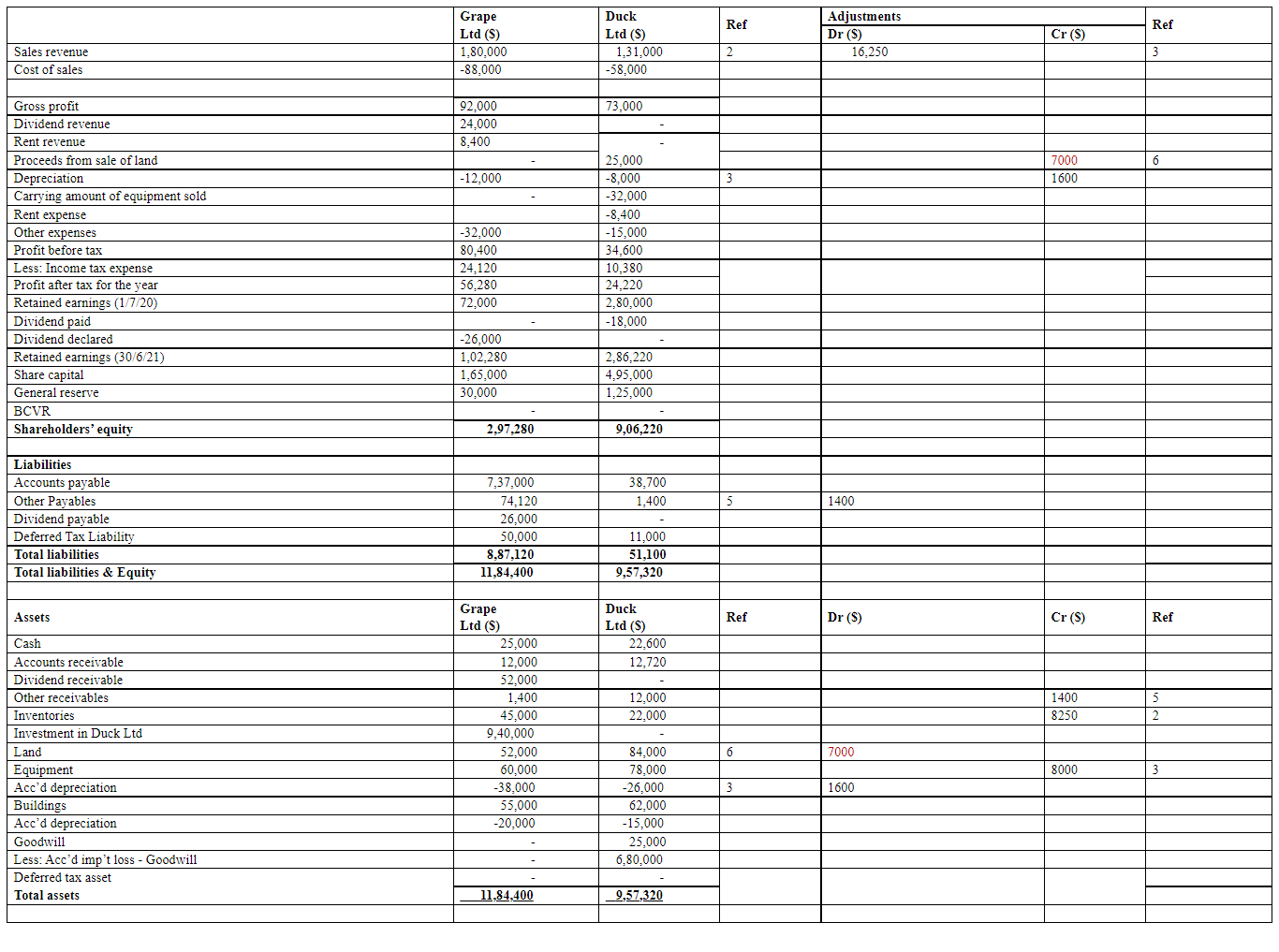

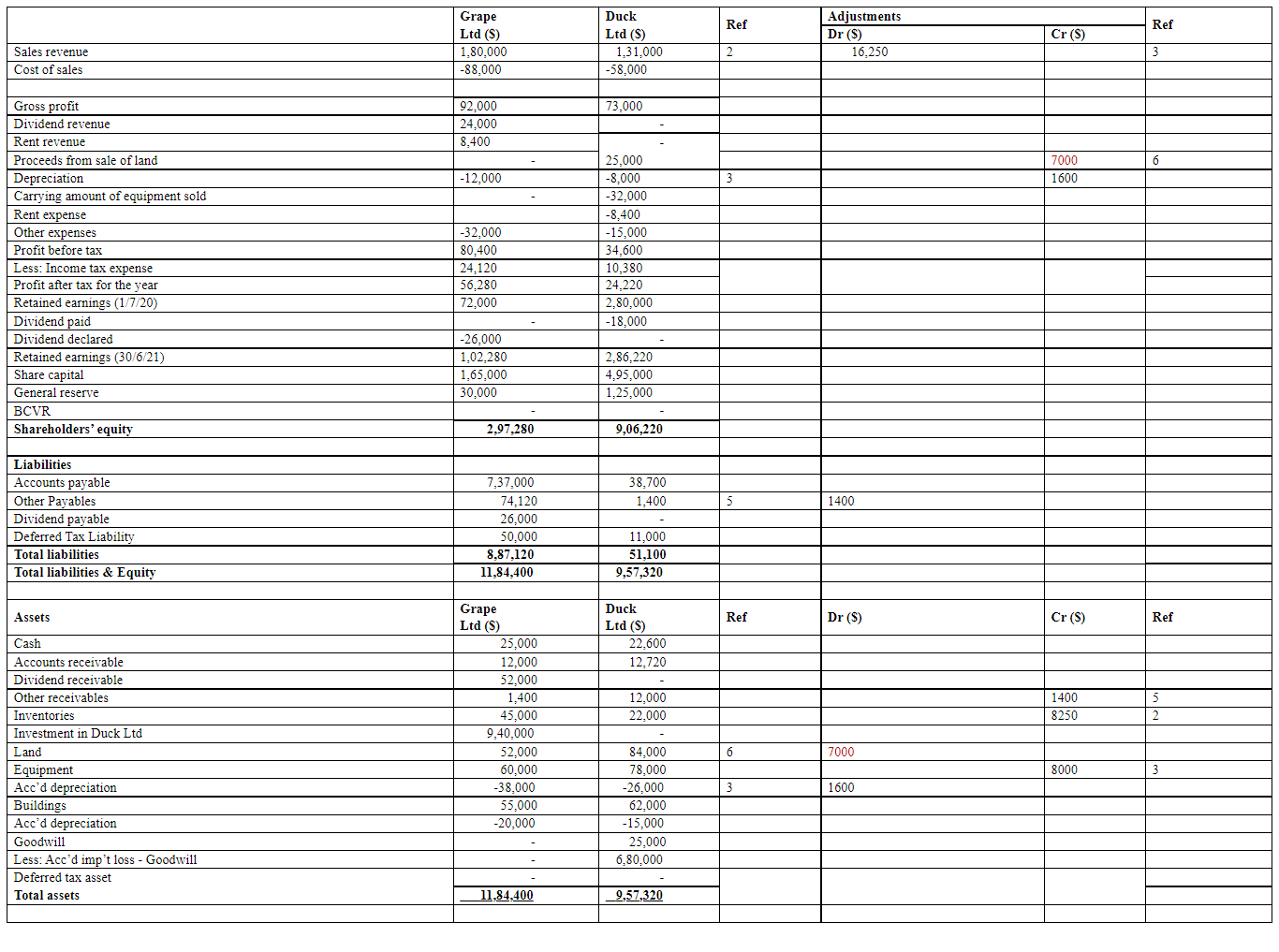

Part (c): Worksheet (24 marks)

Using excel, prepare the consolidation worksheet as at 30 June 2021, showing all entries including the corrected entries discussed in Part (a). Each entry needs to be entered as a separate amount and not entered as subtotals in the worksheet. Round your answers to zero decimal places. The worksheet template is provided below.

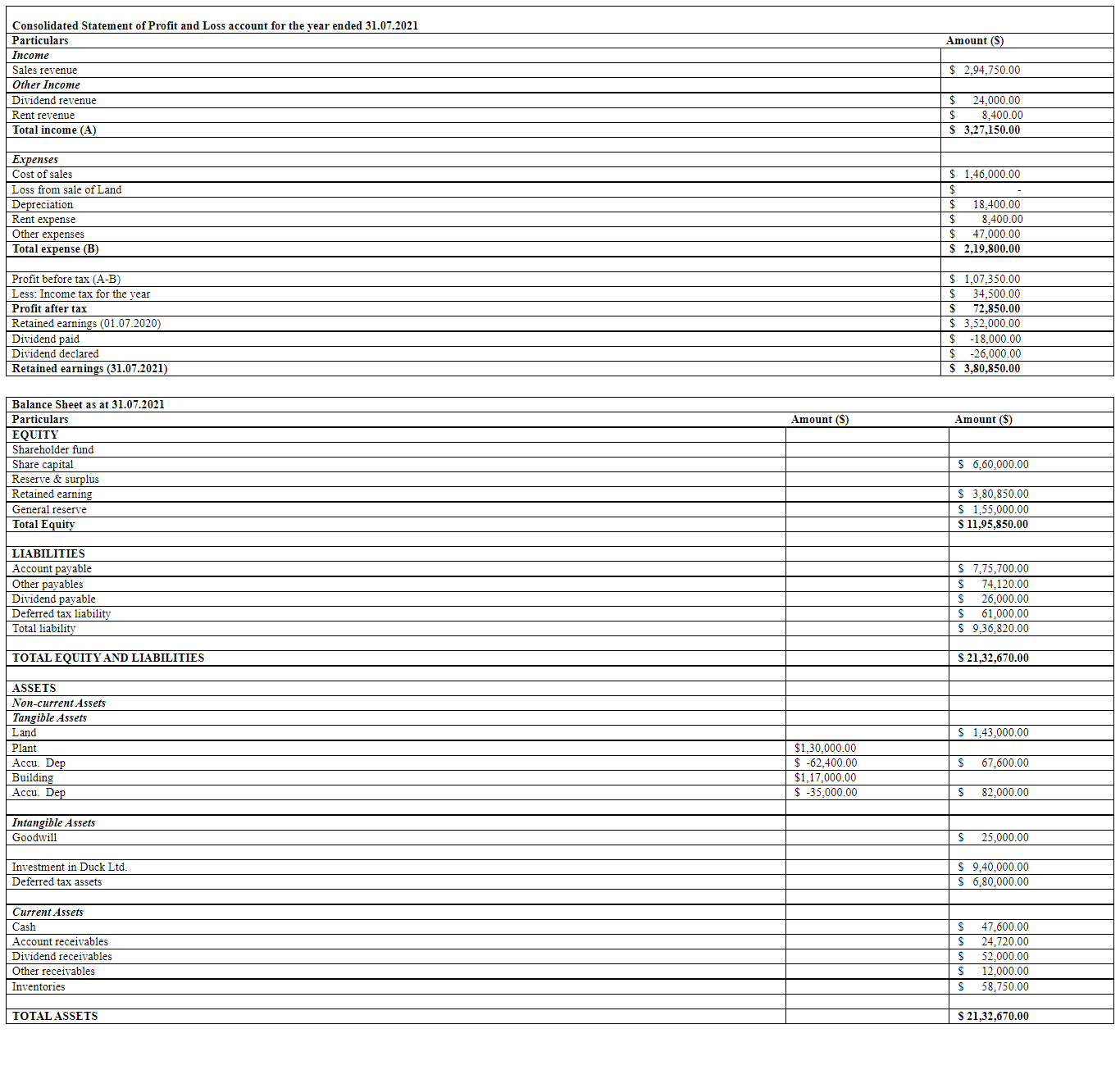

Part (d): Group financial statements (12 marks)

Using excel, prepare the Statement of Financial position for Grape Ltd as at 30 June 2021.

Solution

Part (a)

An acquisition can be defined as the difference between the price paid by the acquirer for purchasing another company and the original cost of the assets of the target company (Janice 2013).

Following entries or transaction is incorrect

Reference 1:

Adjustment in Share capital, general reserve, retained earning & BCVR is incorrect and not required.

Reference 2:

Sales revenue- The amount of $25,000 debited in the sales account and $ 22,000 credited in the cost of sales account is incorrect- because for unsold stock with Duck Ltd, to eliminate the unrealised profit of Grape Ltd. the sales should have been debited with $8250 and Inventories should have been credited with $8250

Reference 3:

Adjustment entry done in Proceeds from sales of equipment and carrying amount of sold equipment, the related depreciation & entry done in equipment ledger in asset side is incorrect. Since Duck has treated Inventory and sold to Grape for $28,000 which cost Duck ltd $20,000 Therefore, the sales account of Duck should have been debited to a tune of $8000 and Depreciation account needs to be credited by $8000*20%= $1600 (which is excess on account of group sales) and the carrying amount of the equipment plant) needs to be reduced by net $6400 to eliminate the effect of the sales.

Reference 4:

All the adjustment relating to reference 4 needs to be removed since the dividend entry has already been correctly recorded no further adjustment required. Since Duke ltd (subsidiary of Grape Limited) pays interim dividend so its post-acquisition profit so it should be recorded in the profit and loss of Grape Limited and the same has been correctly recorded (AASB 2021)

Reference 5:

The adjustment for service expenses of $90,000 is incorrect as we need to just eliminate the outstanding and payable rent expenses which are for 2 months @$700 per month. Thus the correct adjustment should be debiting other payables account and crediting other receivables account to the tune of $1400

Reference 6:

Sales of land by Grape Ltd to Duck Ltd. for $25,000 cost $32,000. Thus, the unrealised loss of $7000 needs to be eliminated.

Herein the application of AASB 10 is observed because it develops the principles for preparation, as well as presentation of the consolidated financial statement when the entity has a control over one or more than one entities (AASB 2021)

Part b)

Part c)

Part d)

Consolidated Financial Statement of Duck Ltd

References

AASB. (2021) AASB Standard. Retrieved from https://www.aasb.gov.au/admin/file/content105/c9/AASB10_08-11.pdf

Janice, L. (2013). Understanding Australian Accounting Standards. Milton, Qld.: John Wiley and Sons. Retrieved from https://lesa.on.worldcat.org/oclc/807180288

Potter, B., Howieson, B., & Chapple, E. (2019). Accounting standards setting. Emerald Publishing Limited. Retrieved from https://lesa.on.worldcat.org/oclc/1113886538

Download Samples PDF

Related Sample

- BSBPMG530 Manage Project Scope Assignment

- SAP103 Welfare Law Case Study 1

- BUA4003 Principles of Economics Report 2

- PROJ6004 Data Reporting Assignment

- MKG203 Digital Marketing Communication Assignment

- MGT600 Management People and Teams Report 3B

- BE275 Global Supply Chain and Operations Management Assignment

- AURTTA017 Carryout Vehicle Safety Inspection Assignment

- SAP102 Welfare Systems and Services in Australia 2B Essay

- Finance Coursework Assignment

- MBA401 People Culture and Contemporary Leadership Assignment

- MBA403 Financial and Economic Interpretation and Communication Assignment

- The Independent Director and Effective Corporate Governance

- EDUC1001 Language and Learning in Your Discipline Essay 3

- Impact of US China War On The Chinese Economy and Its Long Term Implications

- PUBH6012 Capstone B Applied Research Project in Public Health Assignment

- LB5231 Corporate Responsibility and Governance Essay

- PUBH6007 Program Design Implementation and Evaluation Assignment

- BMP4005 Information Systems and Big Data Analysis Assignment

- FPH201 First Peoples Culture, History and Healthcare Report 3

Assignment Services

-

Assignment Writing

-

Academic Writing Services

- HND Assignment Help

- SPSS Assignment Help

- College Assignment Help

- Writing Assignment for University

- Urgent Assignment Help

- Architecture Assignment Help

- Total Assignment Help

- All Assignment Help

- My Assignment Help

- Student Assignment Help

- Instant Assignment Help

- Cheap Assignment Help

- Global Assignment Help

- Write My Assignment

- Do My Assignment

- Solve My Assignment

- Make My Assignment

- Pay for Assignment Help

-

Management

- Management Assignment Help

- Business Management Assignment Help

- Financial Management Assignment Help

- Project Management Assignment Help

- Supply Chain Management Assignment Help

- Operations Management Assignment Help

- Risk Management Assignment Help

- Strategic Management Assignment Help

- Logistics Management Assignment Help

- Global Business Strategy Assignment Help

- Consumer Behavior Assignment Help

- MBA Assignment Help

- Portfolio Management Assignment Help

- Change Management Assignment Help

- Hospitality Management Assignment Help

- Healthcare Management Assignment Help

- Investment Management Assignment Help

- Market Analysis Assignment Help

- Corporate Strategy Assignment Help

- Conflict Management Assignment Help

- Marketing Management Assignment Help

- Strategic Marketing Assignment Help

- CRM Assignment Help

- Marketing Research Assignment Help

- Human Resource Assignment Help

- Business Assignment Help

- Business Development Assignment Help

- Business Statistics Assignment Help

- Business Ethics Assignment Help

- 4p of Marketing Assignment Help

- Pricing Strategy Assignment Help

- Nursing

-

Finance

- Finance Assignment Help

- Do My Finance Assignment For Me

- Financial Accounting Assignment Help

- Behavioral Finance Assignment Help

- Finance Planning Assignment Help

- Personal Finance Assignment Help

- Financial Services Assignment Help

- Forex Assignment Help

- Financial Statement Analysis Assignment Help

- Capital Budgeting Assignment Help

- Financial Reporting Assignment Help

- International Finance Assignment Help

- Business Finance Assignment Help

- Corporate Finance Assignment Help

-

Accounting

- Accounting Assignment Help

- Managerial Accounting Assignment Help

- Taxation Accounting Assignment Help

- Perdisco Assignment Help

- Solve My Accounting Paper

- Business Accounting Assignment Help

- Cost Accounting Assignment Help

- Taxation Assignment Help

- Activity Based Accounting Assignment Help

- Tax Accounting Assignment Help

- Financial Accounting Theory Assignment Help

-

Computer Science and IT

- Operating System Assignment Help

- Data mining Assignment Help

- Robotics Assignment Help

- Computer Network Assignment Help

- Database Assignment Help

- IT Management Assignment Help

- Network Topology Assignment Help

- Data Structure Assignment Help

- Business Intelligence Assignment Help

- Data Flow Diagram Assignment Help

- UML Diagram Assignment Help

- R Studio Assignment Help

-

Law

- Law Assignment Help

- Business Law Assignment Help

- Contract Law Assignment Help

- Tort Law Assignment Help

- Social Media Law Assignment Help

- Criminal Law Assignment Help

- Employment Law Assignment Help

- Taxation Law Assignment Help

- Commercial Law Assignment Help

- Constitutional Law Assignment Help

- Corporate Governance Law Assignment Help

- Environmental Law Assignment Help

- Criminology Assignment Help

- Company Law Assignment Help

- Human Rights Law Assignment Help

- Evidence Law Assignment Help

- Administrative Law Assignment Help

- Enterprise Law Assignment Help

- Migration Law Assignment Help

- Communication Law Assignment Help

- Law and Ethics Assignment Help

- Consumer Law Assignment Help

- Science

- Biology

- Engineering

-

Humanities

- Humanities Assignment Help

- Sociology Assignment Help

- Philosophy Assignment Help

- English Assignment Help

- Geography Assignment Help

- Agroecology Assignment Help

- Psychology Assignment Help

- Social Science Assignment Help

- Public Relations Assignment Help

- Political Science Assignment Help

- Mass Communication Assignment Help

- History Assignment Help

- Cookery Assignment Help

- Auditing

- Mathematics

-

Economics

- Economics Assignment Help

- Managerial Economics Assignment Help

- Econometrics Assignment Help

- Microeconomics Assignment Help

- Business Economics Assignment Help

- Marketing Plan Assignment Help

- Demand Supply Assignment Help

- Comparative Analysis Assignment Help

- Health Economics Assignment Help

- Macroeconomics Assignment Help

- Political Economics Assignment Help

- International Economics Assignments Help

-

Academic Writing Services

-

Essay Writing

- Essay Help

- Essay Writing Help

- Essay Help Online

- Online Custom Essay Help

- Descriptive Essay Help

- Help With MBA Essays

- Essay Writing Service

- Essay Writer For Australia

- Essay Outline Help

- illustration Essay Help

- Response Essay Writing Help

- Professional Essay Writers

- Custom Essay Help

- English Essay Writing Help

- Essay Homework Help

- Literature Essay Help

- Scholarship Essay Help

- Research Essay Help

- History Essay Help

- MBA Essay Help

- Plagiarism Free Essays

- Writing Essay Papers

- Write My Essay Help

- Need Help Writing Essay

- Help Writing Scholarship Essay

- Help Writing a Narrative Essay

- Best Essay Writing Service Canada

-

Dissertation

- Biology Dissertation Help

- Academic Dissertation Help

- Nursing Dissertation Help

- Dissertation Help Online

- MATLAB Dissertation Help

- Doctoral Dissertation Help

- Geography Dissertation Help

- Architecture Dissertation Help

- Statistics Dissertation Help

- Sociology Dissertation Help

- English Dissertation Help

- Law Dissertation Help

- Dissertation Proofreading Services

- Cheap Dissertation Help

- Dissertation Writing Help

- Marketing Dissertation Help

- Programming

-

Case Study

- Write Case Study For Me

- Business Law Case Study Help

- Civil Law Case Study Help

- Marketing Case Study Help

- Nursing Case Study Help

- Case Study Writing Services

- History Case Study help

- Amazon Case Study Help

- Apple Case Study Help

- Case Study Assignment Help

- ZARA Case Study Assignment Help

- IKEA Case Study Assignment Help

- Zappos Case Study Assignment Help

- Tesla Case Study Assignment Help

- Flipkart Case Study Assignment Help

- Contract Law Case Study Assignments Help

- Business Ethics Case Study Assignment Help

- Nike SWOT Analysis Case Study Assignment Help

- Coursework

- Thesis Writing

- CDR

- Research

.png)

~5.png)

.png)

~1.png)

.png)