Reports

SBU716 Corporate Financial Management Report Sample

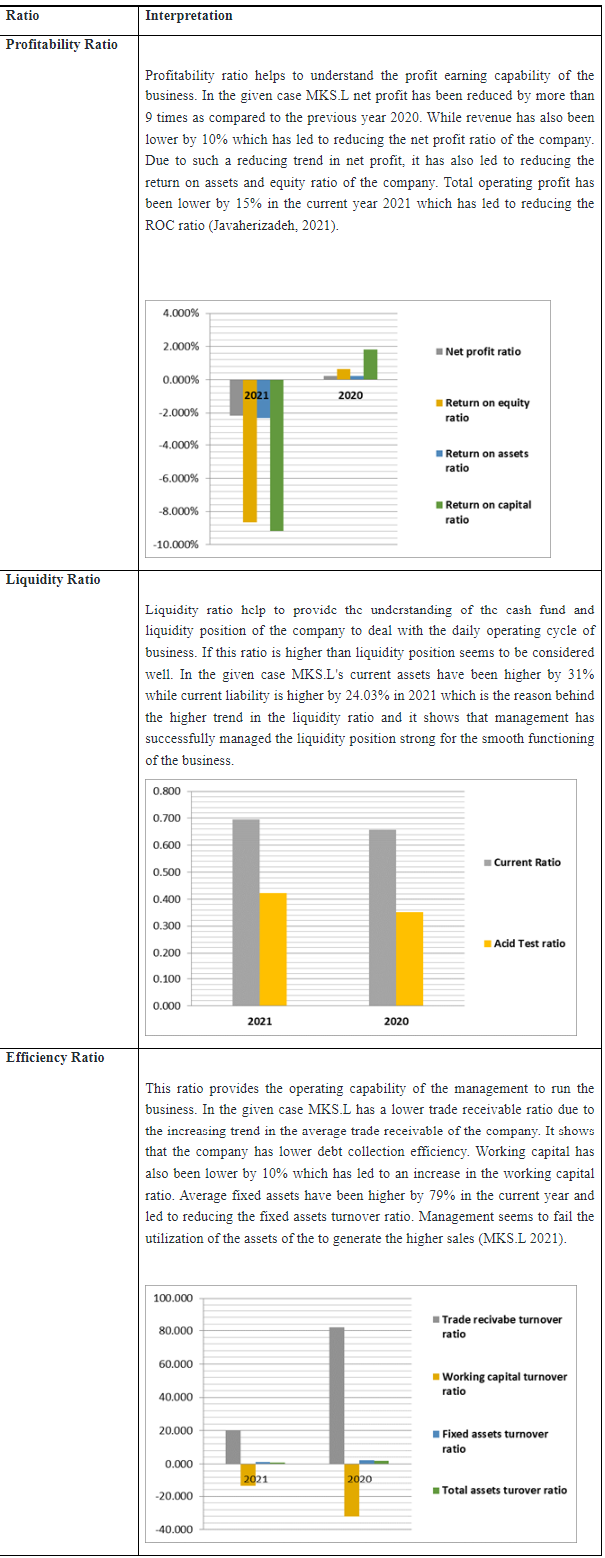

Assignment Details

As the financial manager for Company XYZ, you are tasked with conducting a comprehensive financial management assessment to support the company’s strategic decision to expand into a new industry. This case study aims to evaluate the financial structure, expected returns, and exposure to capital market volatility of the target industry. The assessment will encompass a thorough review of both equity and debt financing options while considering the prevailing economic conditions. This evaluation will serve as the foundation for

Assessment Two in this module. Although each assessment will be graded separately, they are interconnected and should be viewed as part of a cohesive analysis. You need to read the background for the company XYZ below

Task 1: Industry and Economic Landscape Analysis – 500 words

To begin with, you must select an industry that aligns with Company XYZ’s strategic goals and competencies. The choice of industry should be based on careful consideration of market opportunities and potential synergies with XYZs existing operations. Once the industry is selected, conduct a detailed analysis of the industry’s position within the current economic landscape. This analysis should identify and evaluate the primary economic factors and indicators most relevant to the industry.

Task 2: Company Analysis and Financing Options Assessment – 1000 words

Select a representative publicly traded company within the chosen industry to serve as a benchmark for your analysis. Next, conduct a critical assessment of the financing options available to the selected company for a new project within the industry. This evaluation should consider both equity and debt financing options and their implications for Company XYZ’s financial health. Analyse, expected returns and the most pertinent financial metrics for the industry including the Weighted Average Cost of Capital (WACC), market beta, and other relevant capital-structure financial ratios. The impact of current economic conditions on these financing options should also be thoroughly examined.

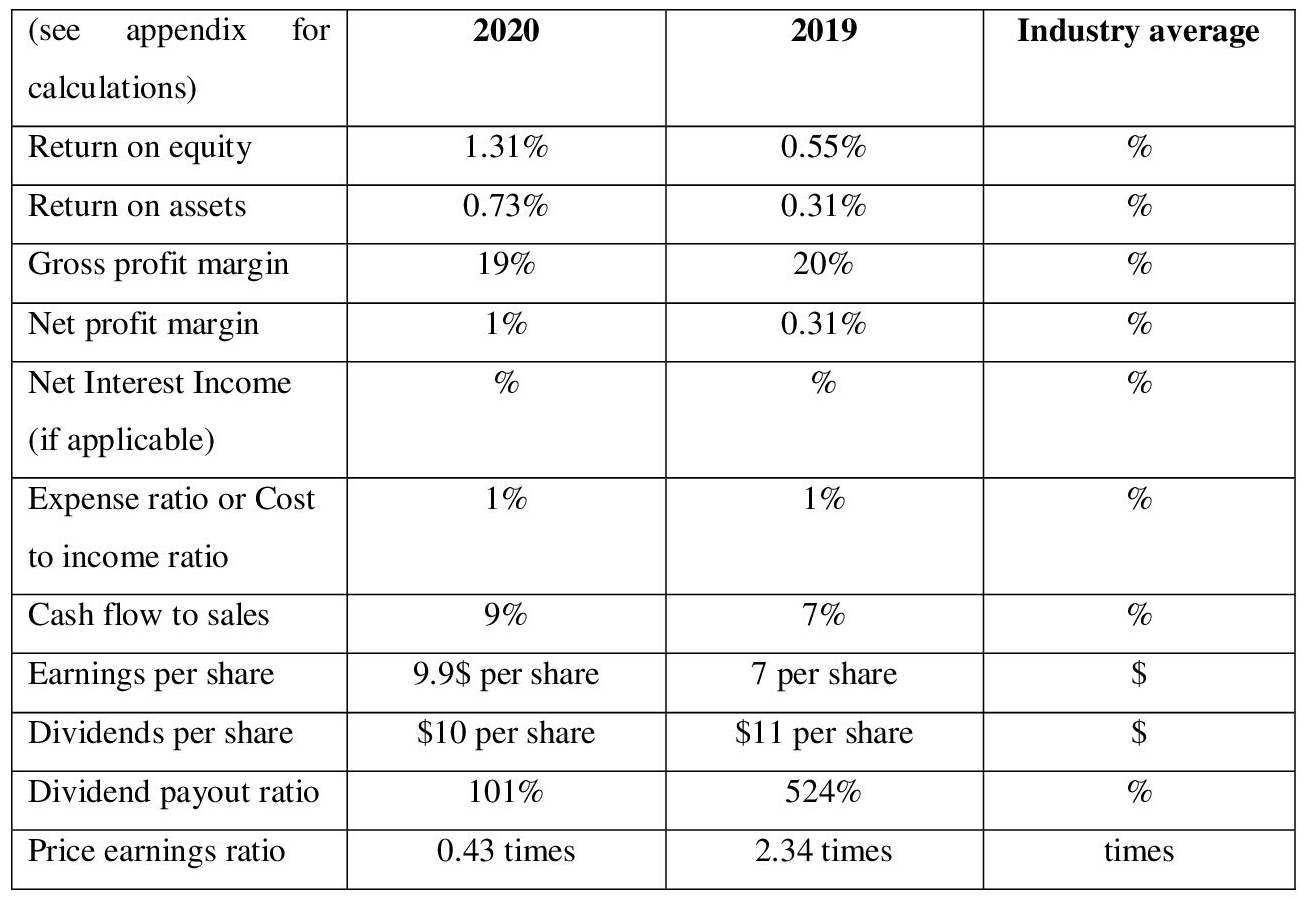

Context for Company XYZ

Background

Company XYZ, established in 2005, has grown to become a major player in the consumer electronics industry. Known for its innovation and quality, XYZ has consistently delivered cutting-edge products ranging from smartphones to smart home devices. The company has a global presence, with significant market shares in North America, Europe, and Asia. Over the past decade, XYZ has seen steady revenue growth and profitability, driven by its strong brand reputation and continuous investment in research and development.

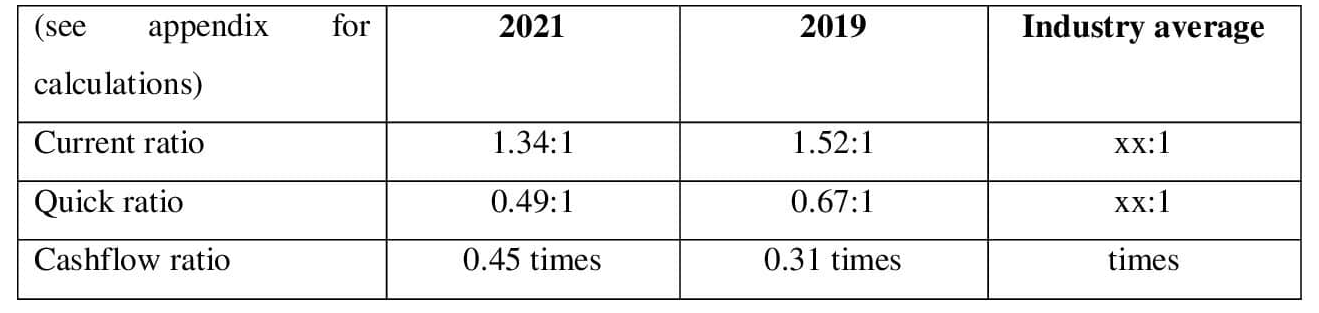

Current Market Position

In recent years, Company XYZ has maintained its competitive edge through a combination of strategic marketing, customer-centric product development, and operational efficiency. The company’s financial health is robust, with a strong balance sheet, healthy cash reserves, and low debt levels. However, the consumer electronics market is becoming increasingly saturated and competitive, prompting XYZ to seek new growth opportunities outside its traditional domain.

Strategic Vision

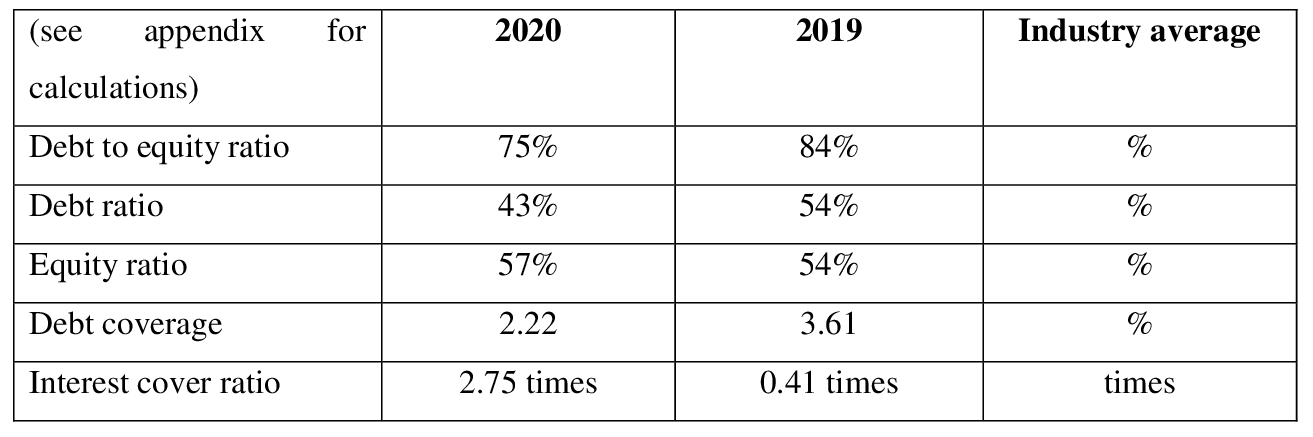

Recognizing the need for diversification, Company XYZ’s executive team has identified the exploration of new industries as a key strategic priority. This move is intended to open up new revenue streams and mitigate the risks associated with over-reliance on the consumer electronics market. The choice of industry for expansion will be determined based on thorough research and analysis conducted by the company’s financial management team.

Expansion Initiative

As part of this initiative, you, the financial manager, are tasked with conducting a comprehensive financial management assessment for the chosen industry. This assessment will serve as the foundation for Company XYZ's strategic decision-making process. Your analysis will focus on evaluating the financial structure, expected returns, and exposure to capital market volatility within the selected industry. The evaluation will encompass a thorough review of both equity and debt financing options while considering the prevailing economic conditions.

The goal is to provide detailed insights and recommendations that will guide Company XYZ in determining the viability and potential benefits of expanding into the new industry. Your findings will be crucial in shaping the company’s investment decisions and financing strategies, ensuring a successful entry and sustainable growth in the chosen market.

Solution

1. Task 1: Industry and Economic Landscape

1.1 Present Condition

Currys plc, a consumer electronics retailer based in the UK, is facing significant challenges in a dynamically changing economy. Inflation and other costs of living have slowed spending and hurt the growth of top-line sales. The company has been effecting cost control measures and has shifted emphasis on the electronic business models (Curry, 2023). However, the companies have been able to achieve these even though profit margins continue to be squeezed. Currys maintains its dominant brand personality and repeat customer base but has its fair share of threats from e-tailers. Since being founded in 1981, strategic adaptation is important to maintain the region's position in the market and financial performance.

1.2 New Industry

Currys plc intends to tap into the eager smart home solutions market, as the company is determined to meet the unprecedented consumers' want for connected devices. The new strategic scope is to supply such product categories as smart security systems, energy saving appliances, and home automation systems. Currys aims to implement a full range of services, ranging from the installation of the products it sells to offering customers support through the already well-set-up retail business it has within the consumer electronics industry. This particular decision makes much business sense fits the rapidly changing market environment and ushers the company as a futuristic provider of smart lifestyle solutions.

1.3 Opportunities

Economic conditions explain the fact that the growth of Currys plc into the smart home solutions market is pressing owing to several opportunities. Growing levels of disposable income and government incentives to increase the usage of energy efficient products drive smart appliance sales. Also, the gradual rise in urbanisation rates as well as new decentralisation policies promote home automation (Mortimer Lee, 2023). The growth prospect of the industry fully supports Currys' technological flexibility and reductions in device costs, again relevant to the company's focus on consumer electronics—a successful avenue to diversify revenue streams and bolster market tolerance.

1.4 Synergy

The smart home solutions market is highly saturated and compatible with Curry's existing business focusing on consumer electronics. The insurance products market entry efficiency is increased by the retail outlets, supply chain relations, and focus on tech orientated products of Walmart. Others are the growth in consumer expenditure on home technology, government incentives for energy efficiency in homes, and the reduced price of materials. These indicators relate well with Curry's strengths and can help create additional cross-selling opportunities and build value-added sales by bundling for the assignment help smart home offerings with existing product ranges to retain customers.

1.5 Position Of The Industry In Current Economic Landscape

Smart home solutions have been categorised as an emerging industry in today's economy, eligible for high growth. Increased consumer demand for energy-efficient smart homes is compatible with local and global environmental trends while being supported by governments. Smart devices reach more consumers due to developments in ways of incorporating smart technology in device manufacturing and the subsequent decrease in cost (Shubbar, ET. AL., 2021). Nevertheless, inflation and uncertainty in the economy can slow down impulse consumer purchasing. Still, the long-term outlook remains bright owing to higher population density, a dynamic work-from-home culture, and the need for quick and easy access in contemporary dwellings.

2. Task 2: Company Analysis and Financing Options Assessment

2.1 Chosen Company

Centrica is a British multinational energy services company based in Windsor, Berkshire, United Kingdom. Centrica was established in 1997 and serves through its energy supply division, home services division, and smart home solutions division. It directly owns the Hive brand, which provides smart home goods such as thermostats, lighting, and security (Centrica, 2023). It supplies energy to millions of customers in the UK, Ireland, and North America, with its main objective to deliver new value in energy and to improve customer satisfaction by leveraging digital technologies. Centrica has a clear focus on sustainability and a low-carbon future, accompanied by a clear position in the energy market.

2.2 Financing Option

Regarding sources of financing, it is worth noticing that Centrica plc has several choices for its further expansion and implementation of the strategy.

- Equity financing is the process of selling more shares to investors, and that allows Centrica to finance expansion, acquisitions, or technological projects without raising debt.

- Internal financing utilises corporate funds through retained earnings and operating cash flow to undertake projects to reduce borrowing and achieve a sound financial structure.

- Debt financing is the kind of financing in which the company goes to the financial market to borrow money through bonds or loans for expansion, new infrastructure, or green energy investment. This option can finance business requirements instantly while coming with a reasonable interest repayment period (Fridson and Alvarez, 2022).

- Joint Venture allows Centrica to cooperate with other firms, especially in emerging markets or introduce new products such as smart home technologies or energy sources, including alternatively powered solutions.

- Venture capital could be utilised to make direct investments into exciting next-generation startups or technologies that might dovetail with key Centrica competitive/mgmt priorities such as energy efficiency or smart home systems to ensure cutting-edge future growth/innovation.

2.3 Expected Return

Following this information, the expected return from the investment can be decided using the Net Present Value (NPV) formula. NPV, hence, is a financial tool that is used in the evaluation of a project's profitability with more emphasis on the value of money. In the present case, the NPV is GBP 2,733.15 million, the difference between the projected present value of cash inflows of GBP 7,233.15 million and the cost of investment of GBP 4,500 million.

An NPV is likely to be positive when it means that the investment is expected to create more value than the cost of the investment; hence it may form part of the profit-making plan (Dai et. al., 2022). The cash flows of Centrica plc's investment present a higher expected return than the cost of the investment; thus, the investment is financially feasible since it provides a return rate that is higher than the 10 per cent discount rate used in the analysis. From this, it can therefore be deduced that finances for the project will be healthy over the projected 5-year period.

.png)

Fig 1: NPV

(Source: Appendix)

2.4 WACC

.png)

Fig 2: WACC

(Source: Appendix)

Weighted Average Cost of Capital, is a financial ratio that serves to determine the cost of financing a company through the use of borrowed capital and otherwise through the issuance of equity. Therefore, for Centrica plc, WACC comes to 5.33%. This figure uses the cost of equity, Re, at 9.38%, and the cost of debt, Rd, at 2.16%, and the company's capital structure as a weight. Centrica's equity value stands at GBP 3,877 million (E), and Centrica's debt stands at GBP 4,103 million (D); total capital, E + D, totals GBP 7,980 million. The company uses a tax rate t of 30%, which in turn lessens the effective cost of debt. WACC, on the other hand, is the cost of capital that the company needs to obtain from the investment to satisfy both debt and equity holders of the company. Lower WACC shows better financing costs, which improves the degree of profitability.

2.5 Beta and Capital Asset Pricing Model

.png)

Fig 3: CAPM

(Source: Appendix)

In CAPM, the Beta (B) therefore quantifies the relative variability of a particular stock to the entire market; this means risk. The beta for Centrica plc is at 1.07, which indicates that the business is slightly higher than the market level in that it moves 1.07 times the market. The risk-free rate (Rf) is obtained as 4.24%, which depicts the return on a risk-free asset, and the equity market risk premium (Emrp) is calculated as 4.80%, which depicts the amount of extra return expected by an investor by investing in risky stock rather than a risk-free asset (CAPM, 2023). Thus, the cost of equity of Centrica can be measured with the help of CAPM, with the figures showing a 9.38% expected return of the company about the assessed risk factors.

2.6 Impact of Current Economic Conditions

The prevailing economic environment affects Centrica plc indeed concerning energy prices, effects of inflation, and regulatory developments. Increasing costs for energy that stem from supply chain interferences and geopolitical factors impact directly the company's energy supply service. There is the possibility of a relative increase in sales revenue in the short run since higher prices always lead to a proportional rise in operating costs, most especially in the areas of procurement and distribution. Also, wages and materials can be affected by inflation, which also affects the level of profitability of an organization. Whenever amendments in environmental laws and policies, limitations on the emission of carbon and other materials and imposition of carbon prices lead to higher costs of investments in renewable resources and modification of its infrastructures, capital intensity might increase. However, Centrica's investment in the methods of smart home solutions and energy efficiency could be a source of growth, as the consumers are also concerned about the sustainability of their energy consumption as well as the charges they have to pay for the energy sources they use.

3. Reference

.png)

Coursework

FE7052 International Corporate Finance Coursework Sample

Assignment Instruction

This coursework constitutes 100% of the assessment for this module. Students are required to write a report (3000 words) by completing the coursework questions. Students are encouraged to access company information (e.g., annual report) to conduct independent research and collect data to answer the questions.

Students are required to complete all the questions listed below in their individual report.

Students are required to construct an analysis of a multinational corporation (MNC) covering a period of a minimum of 3 years and a maximum of 10 years. The analysis should address the following questions:

- Provide a historical overview of the selected company;

- Discuss the contemporary monetary environment of the company’s home country (such as monetary history, exchange rate regime, the role of the central bank in the foreign exchange market, and any relevant exchange rate crises), and its effects on the company’s international trade flows with other economies;

- Examine the capital structure of the chosen company and analyse on its cost of capital within the selected timeframe and discuss the implications for the value of the company;

- Track and report on the chosen company’s share/bond price changes (choose one only). Illustrate the risks and returns of the company in the market within the selected timeframe and provide commentary on the future prospects of the company (Tables/Figures/Graphs are expected to be included)

- Evaluate the company’s net working capital and debate whether the company has managed its working capital efficiently, and whether it has positively affected on the company’s value;

- Debate the factors that need to be considered in the process of multinational capital budgeting and investment decisions. Analyse their impact on the multinational corporation’s value

- Provide any additional economic or political insights that could affect the chosen company’s value and its future.

Structure

- Title Page

- Executive Summary

- Table of Contents

- Introduction

- Methodology

- Analysis & Discussion

- Conclusion

- Limitations & Recommendations

- References

Solution

Introduction

This report offers a complete analysis of Apple Inc., including its historical background, financial structure and response to the global economic and political challenges. The analysis starts from the Apple's inception in 1976 and explores turning points in the company’s growth, its dependence on the U.S. monetary environment, and management of capital structure. In this scope, Apple’s share price movement, net working capital management and multinational capital budgeting are explored using data from 2020 to 2024. The report seeks to help explain factors that influence Apple’s financial decisions and strategies, and how Apple retains its market leadership in the face of a changing global environment.

Historical background

Apple Inc. is a company that commenced business in 1976 founded by Steve Jobs, Steve Wozniak, and Ronald Wayne in a garage in Cupertino, California with the aim of creating personal computers (Ahmed, 2023). Apple I was Apple’s first product, it was a simple but revolutionary machine that led to the Apple II in 1977, Apple’s first major product and which established Apple as a leader in the emerging computer industry the assignment helpline Apple went public in 1980 and generated a lot of capital and used that capital for rapid growth and innovation.

In the 1980s Apple released some very notable products, Macintosh being one of them in 1984 (Little and Greene, 2020). This product solidified Apple as a company known for the innovative design first used in the Macintosh which is one of the first mass market personal computers with a graphical user interface (GUI). However, in 1985 it was an internal power struggle that saw Jobs depart from the company. There were then issues with leadership, wildly inconsistent product launches and declining market share for Apple over the following years. During this period, Apple also released a product, like the Newton PDA, which was a failure for the company, but showed a willingness to try new things in technology, in an effort to catch up with competitors like Microsoft.

Apple’s turning point was 1997 when Jobs returned as CEO and reimagined Apple’s product strategy around a much leaner approach. In his tenure, Apple introduced a string of iconic products in the 2000s: iMac, iPod, iPhone and iPad. When Apple introduced the iPhone in 2007, the tech industry began to revolve around the iPhone and was ushered into the era of Apple consumer electronics. This helps the company build a strong global brand and financial success based on ecosystem integration, high quality design, and user-friendly interfaces.

Currently, Apple remains the industry leader in technology and has expanded to services and wearables, with consistent dedication to innovation, quality and prioritisation of user experience. It is still one of the world’s most valuable companies, a symbol of cutting-edge technology and design excellence.

Contemporary Monetary Environment of the Home Country

Apple has a very strong dependence on the US monetary environment especially the Federal Reserve policies as a major determinant of both the cost and operation of Apple’s business across the world. Interest rate as a policy instrument under the Federal Reserve impacts on the capital structure of Apple since the firm balance sheet has tended towards a greater debt-equity ratio in the recent past. Apple has created an environment where all the companies in the Apple environment are able to generate revenues and be profitable. So, when Apple creates wealth, they do not only spend more on research and development to produce even better products that consumers enjoy but also take better care of their employees and suppliers for this every firm wants to be associated with Apple supply chain (Yifu and Wang, 2022). But the rising rates of interests have raised the cost of borrowing hence affecting the ability of Apple to use debt as it has been used in the past. Sustaining the balance on the capital structure will therefore be essential for Apple to continue on its innovation investments and therefore, debt management strategy will be imperative.

The stability of the U.S dollar as well as the moderate movement of currency by the Federal reserve is also propitious to Apple since most of its sales are in foreign countries. Since Apple generates the majority of its revenues in dollars, every time the dollar rises, as it is the case currently, global sales in other currencies are worth less and this puts pressure on the company’s gross margins. In 1994, Apple had a net profit of US $390 million from overseas markets and US $310 million from its local market (Rao, 2021). The Federal Reserve intervenes occasionally in foreign exchange markets for this purpose and aids Apple in part by diminishing some of the fluctuation caused by currency exchange rates; nevertheless, currency exchange rates remain a risk that Apple continuously seeks to hedge.

Inflation is another problem in the present monetary environment prevalent in the United States that is directly and indirectly impacting Apple. The latest inflation fright has raised expenses for inventory, transportation, and manufacturing throughout Apple’s value chain. Despite the fact that in the past Apple has been able to fully or partially transfer some costs to consumers given its popularity and brand awareness, the constantly high inflation rate in the U.S and other countries may constrain this capability without a negative impact on consumer sales. Furthermore, since Inflation should recognise that several founders and some Supreme Court judges regarded the concept of unbacked paper currency unfavourably (Yahya, 2022). To deal with this, Apple regularly reviews its supplier relationships and procurement mixes while at other times may even switch to lower-price countries to counter cost increases.

Monetary policy being tight in a bid to tame inflation has more ramifications to consumer’s buying capacity especially where inflation is high like in US. Monetary policy has not only resulted in increased wealth and greater wealth disparity but has also led to elevated consumer price inflation through the wealth effect on consumption demand (Ferguson and Storm, 2023). However, it is worth remembering that Apple has always been a company that produces high quality goods and has numerous loyal customers, which is why it has survived similar situations before.

Capital Structure in the Cost of Capital

Apple’s approach to capital structure indicates that it maintains a nice blend of debt and equity over the recent period. From the data obtained from 2021 to 2024, there is an evident show that the company has a higher leveraged position, specifically, a higher debt to equity ratio that Apple prefers to use debt to finance the company. The debt equity ratio, which was at its highest at 195.3 percent in 2022, slightly declining at 153.3 percent in 2024. This capital structure may be due to Apple preferred reducing shareholders’ dilution via low-interest debts for the funding of operations, acquisitions and share repurchases as Trade-off Theory dictates. In this theory, the company aims at maximising the advantage of interest tax deductibility while minimising the cost of financial distress that exists in Apple as a result of its efficient cash flows as well as high profitability (Wang, 2023).

.png)

The percentage of Debt and Equity again unfolds the financial model of Apple Inc. Debt was the most given attention between 2020 and 2023, with an average of 60 – 66% of capital structure, while equity which was equally important was 33.9% – 39.9% (Apple Inc., 2024). It also in indication to approach of Apple in terms of its use of debt to enhance the Shareholder Value and the firm’s Weighted Average Cost of Capital (WACC). Thus, seeing that Apple’s weighted average cost of capital is at 5.8% and where the after-tax cost of debt stands at 2.98% Apple has optimised on the cost of capital but at the same time creating room for significant investment in its innovation and market development. The fact that the cost of debt is lower than cost of equity confirm that Apple reaps a lot of benefits from debt leveraging. Here

The cost of equity financing is estimated at 10.17%.

The case of Apple shows that the changes in capital structure have also coincided with the changes in this cost over the period (Gugler, Szücs & Wohak, 2023). Thus, as long as debt has remained a large part of the capital structure, Apple’s WACC remains relatively low, indicating sound working of the value of the agency model. This focus on a low WACC is consistent with the Pecking Order Theory which postulates that firms have a strategic preference to reliance on internal funds and debt, and external sources of equity only if internal sources are inadequate. The idea of capital cost with the focus placed on Apple’s financial strategy-based shows that the corporate goal is to reduce capital costs while creating a locked-in insolvency condition. Such wise use of debts, coupled with the strong earnings and cash flow of Apple inflicts the evidence of an appropriate capital structure that envisages continuing growth effectively supporting shareholder value. By carefully managing its capital structure, Apple has ensured its cost of capital for funding its strategic plan in an economic liberal scneario (Rhee, 2023).

Share Price Movement for Apple and its Market Analysis

Seasonal fluctuations evident from the above graph of Apple Company share price in the last five fiscal years reveal that shares are sensitive to both company performance as well as the overall market status. From the analyses made for the period between 2020 and 2024, Apple’s average recoveries are between 63% and 76.9% in the years that formed the basis of the revenue calculation. This phenomenal growth is consistent with the general market rebound after the first period of COVID-19 pandemic, when many technology stocks, particularly those related to tech-enabled products and work from home solutions, boomed. Using our wide range of products, and growing ecosystem, Apple was targeting large market share, and creating shareholder returns; better than the S&P 100’s 32 percent for that year.

.png)

Figure 1Annual performance

Source: Self-Created

In 2021 Apple rose up nearly 30% to trump the S&P 100 average return of 21% Y/Y 2021. This performance clearly pointed to the fact of the company’s strength and its innovation-based growth model which was evident in the consumer demand of the company’s products and or services such as introducing new products into the market or new software versions among others. The market conditions currently are quite good: low interest rates enable buying stocks with the help of borrowed funds, preferences for investments in tech shares. Indeed, the ability to sustain high returns in this environment made investors endorse Apple while confirming its market superiority in the new technologies sector (Uwihirwe and Bazimya, 2022).

But as we move into these years, 2022 could have been Apple’s year of loss since its annual return was at -8.8% and far from its previous results. This decline was aggravated by specific market conditions such as developments like; increasing interest rates, inflation fears, or disruptions of some major supply lines which bogged down the technology industry. While the S&P 100 posted a 29% gain that year, Apple business limitations, elevated manufacturing costs and rather weak consumer electronics sales were in evidence. Nonetheless, from an Apple perspective, the fundamentals of the business remained sound and would simply need to wait for the right environment to turn things around, or right the ship, again (Simic and Jovicic, 2023).

Apple successfully returned 24.5% for the fiscal year ended 2023 and outperforms S&P 100 that had a negative rate of return of 21% mainly because of persistent economic instability and fluctuation in the stock market. This is evident by Apple’s strong financial performance during this period with effective cost control, appropriate product positioning and diversified source of revenue as a way of managing risks that afflicted other businesses and portraying investor confidence. This resilience goes well with Apple’s other characteristics of being a stable investment with low beta of 1.24 than the market.

Evaluation of the Net Working Capital Management for Apple

An analysis of the working capital cycle of Apple Company for the past four years shows a working capital management that is proactive to reduce the holding of non–current assets and at the same time enhancing liquidity. From 2021 to 2024, the current assets have increased from $ 134,836 million to $ 152,987 million in total due to the on-going investment in inventory and receivables (Apple Inc., 2024). However, current liabilities recorded a steeper growth, which stood at $125,481m in 2021 and projected to be $176,392m in 2024; with the growth rate of 22.7% in 2022 and 21.4% in 2024. The increase in liabilities beyond a corresponding increase in assets had a negative effect on the current ratio and volatile net working capital.

.png)

Figure 2 Working capital

Source: Self-created

This liquidity trend is reflected in Apple’s current ratio where figures have scaled down from 1.07 in 2021 to a projected; 0.87 in 2024. Last year the ratio reduced to 0.88, which implies that current liabilities were more than the current assets implying that Acme may have a constraint in its short term-liquidity. While it multiplied a little in the year 2023 for some reason, the ratio is back down in the year 2024. This current ratio variability shows that Apple implemented a risky working capital management level, which corresponds with the working capital principle of not locking capital in assets to finance even more profitable or high return activities (Kiymaz Haque and Choudhury, 2024).

In line with this interpretation, the net working capital figure more overshadows this by declining from $9,355 million in 2021 to negative territory by 2024 at -$23,405 million. This shift showed that Apple commonly use current liabilities to fund short-term activities to avoid to taint its cash flow toward longer-term investments with more attractive returns, for instance, on research and developmental costs or expenses on plant and machinery.

Apple strategy is in accord with the concept known as the Aggressive Working Capital Management Theory where companies work towards optimising return by minimising working capital needs while holding lower liquidity buffers. This approach however is relatively risky, hence complements Apple’s strong cash flow profile and high profitability, which affords the company sufficient flotation to mitigate for liquidity risks (JOY, 2021).

Key Contemplations in Multinational Capital Budgeting

In multinational capital budgeting, several factors of core importance to sustaining and growing corporate value confront Apple. The first area is exchanging rate risk, which poses a major threat to its international business because changes in the rates can hugely impact the earnings. To reverse this, Apple has over the years engage in hedging to counter this risk as it seeks to balance its cash flows across its operations in different countries while also seeking to shield its earnings from volatility from the foreign exchange market.

Apple's main strength resides in the manufacture of remarkable goods that appeal to consumers (Cai and Chen, 2024). The capital allocation decisions in Apple are affected by the various tax systems since some countries impose better tax treatments. For example, the tax differential has been used by the Apple to maximise after-tax returns, increasing the general returns on global investment. Corporate tax planning is still paramount for Apple to decrease on its tax liability around the globe as it complies with the dynamic changes in taxation laws especially in the regions that are changing their tax laws concerning international income.

Other sources of risk for Apple include market fluctuations and uncertain regulatory environment which are always considered when preparing budget. In order to invest initially, Monetary independence is impacted by a myriad of factors, including monetary policy, inflation rates, and financial laws (Ali et al., 2023). Challenges including restrictions to data privacy, technology exports, and environmental measures in places like the EU not only add a cost hurdle to Apple’s operations but also restrict its operations flexibility.

Additional Economic or Political Insights

Apple currently exists in a broad external environment with strong economic and political forces that play a crucial role in determining the strategic directions and organisational outcomes of the firm. Of course, one of the most pressing concerns is the trade conflict that is still happening between the USA and China today. Since apple relied heavily on manufacturers in China, tariffs and restrictions make production expensive and thereby may cause a rise in the company’s selling price to customers. In the context of the new great power rivalry, the US-China trade war, the COVID-19 pandemic, labor and transport costs, and sustainability pressure, the restoration of manufacturing capabilities has begun to receive more public attention, with the news media focusing more attention on stories of American companies bringing production back in-house.

Home (Zeng and Zhang, 2024). It also has competition between the U.S and China in the geopolitical front as a challenge. For instance, the U.S has gradually restricted the sale of high-tech components like semiconductor chips to China. Thus, these restrictions may limit its production or force it put into other suppliers, eventually, lead to the fact that it will become more expensive for Apple to produce something with high-technology components such as iPhones and MacBooks to mention but a few.

Legal forces in the operation of Apple business in the European Union include data privacy regulation, antitrust, and environmentalism. GDPR for example imposes strict data protection laws on Apple, hence the need to spend a lot of money in data protection and making sure all its services align with what is offered in Europe. Legal requirements that are environmental also force Apple to embrace sustainable management of its supply chain and products.

Conclusion

The analysis demonstrates Apple Inc’s strategic resiliency to innovative, while securing financial stability amidst the ever-varying market and geopolitical conditions. The key findings reveal how Apple has used debt leverage, responded to monetary policies and hedged against currency risks to continue its growth and market position. Despite the pressures of inflation, interest rate increases and regulatory constraints, Apple's capital structure and market driven strategies allow Apple to continue to create shareholder value and maintain competitive advantage. Finally, overall Apple’s ability to adapt to new markets, its continuing focus on high quality, and high-quality oriented products reaffirm Apple as the industry leader in a fast-changing global environment.

Limitations and recommendations

Limitations of this report include reliance on secondary sources of data, which may not adequately capture real time shifts or specific Apple strategies, and fixed period analysis which may not adequately capture long term trends. In addition, finer segment based financial data could further enhance the accuracy of profitability assessment of Apple’s product lines. Based on Apple’s ongoing AI and environmental sustainability expansion work, future research should also consider how this will shape Apple’s financial and operational strategies. Continuous investment in sustainable practices as well as improving the global supply chain resilience and close monitoring of regulatory changes in the U.S., the EU and China are recommended actions.

References

.png)

.png)

Research

MCR006 Financial Management Research Report 2 Sample

This assessment consists of one part a research-based topic.

Part A 40 marks weight 20%

Students will be required to research the topic relating to the concept of the definition and application of the CAPM (Capital Asset Pricing Model) model. Explain the concept of the Capital Asset pricing Model (CAPM) and how it is utilised to determine the required return on a share. Explain why Beta is important and how it is calculated.

Required

a) The paper should include information about how CAPM is calculated and how it is applied and interpreted. One to one and a half(11⁄2) pages. Students should research and provide a minimum of 3 referneces.20 marks

b) A final requirement is to calculate the three-year Beta for a publicly listed company from those companies listed on the ASX. 20 marks

c) Students can use an excel spreadsheet to calculate an provide detail in the report using a snapshot into the word document and provide a brief explanation of the company and a brief interpretation of your calculation. (Half page for calculation and half page for brief description of company and interpretation).

Solution

1. Introduction

CAPM or Capital Asset Pricing Model represents the type of financial model that is used by corporate finance for describing the relationship of security risks and the market. “Investment bankers” use it for analyzing individual stocks and portfolios. In this study, the application and concept of CAPM is being calculated. For Assignment Help, The three-year Beta of IBM Technology Corporation for 2021, 2022 and 2023 is being calculated. The required return on share is being calculated and the interpretation and calculation of CAPM is evaluated.

2. Application and Concept of CAPM

CAPM helps in calculating the expected rate of return from investments that is used for determining the prices of individual securities like stocks. As an important part of “corporate finance” and “investment banking”, CAPM looks at the relationships between the riskiness of the investment and the inherent risk of the market at large. The “Capital Asset Pricing Model” is considered a “theoretical pillar” in “modern finance” (Andrei et al., 2021).

.png)

Figure 1: Capital Asset Pricing Model

(Source: Wallstreetprep, 2023)

CAPM models help in describing the relationship between the risk of investing and the expected return on security. It helps in showing that the “expected Return on security” is considered equal to the “risk-free return” plus a premium that is based on a “beta of the security”. CAPM helps in creating an idealized portrayal of the financial markets regarding price securities and determining the “expected return on capital investments”. It provides a methodology for translating quantifying the risk to estimates of expected return on Equity. Capital Asset Pricing Model is one of the most used asset pricing models in modern securities theory (Latunde et al., 2020).CAPM helps in evaluating the fair value of the stock when the risk changes and other factors in the market make the investment riskier. CAPM provides a way for estimating the “required return” required. Modern CAPM models are considered the first equilibrium models for the “pricing of financial assets” and the “first asset pricing models” for maximizing investors' utility under various conditions (Chen et al., 2021). Investors tend to implement their “investment decisions” for building “efficient portfolios” in the case of a "mean-variance framework” (Ayub et al., 2020).

3. Three-year Beta of IBM

.png)

Figure 2: Three-year Beta Chart of IBM

(Source: Self-created)

Beta is considered the measure of a volatile and systematic “risk portfolio” in comparison to the market as a whole which is used for evaluating “capital assets”. The “Beta Capital Asset pricing model” helps describe the relationship of the “expected return” and “systematic risk”. It is used as a method for pricing “risky securities” and for “generating estimates” of the “expected return of assets” by considering both the “risk of the assets” and the “cost of capital”. The “three-year Beta” of IBM for the years 2021, 2022 and 2020 came at -.42. As the Beta turned out to be negative, it implies that the stock price of IBM moved in the market opposite direction. It indicates an inverse relation to the market.

4. Evaluating Required Return on Share

For calculating the required rate of return it is important to subtract the “risk-free rate of return” from the “market rate of return”. The CAPM model helps in providing useful outcomes for the required stock returns. For calculating the expected return on an Asset it is required to utilize the CAPM formula: “Expected Return=Risk free rate+ volatility/beta*(market return-risk free rate”. For calculating the “cost of Equity” using the CAPM formula the rate of return a company will pay to its equity investors. For the companies that pay dividends, the dividend capitalization model can be used for calculating the “cost of Equity”. CAPM metric helps in calculating other financial metrics. It is being used for calculating the expected return in comparison total cost of capital and the risk of assets. CAPM requires the “rate of return” on the general markets, the “beta value” on the stock known as the “market risk premium”. Ways to predict the “expected return on share” is to compute the “mean of share prices” (Liew, 2020). The “beta of the share” helps in describing the relation of the returns with that of the financial market and the volatility provided as a measure which will help in providing an idea of how far the stock will fall.

5. CAPM calculation and interpretation

CAPM formula is: “Expected Return on Investments”=”the risk-free rate the beta (or risk) of the investment”*the “expected return on the market” –“risk-free rate”. For calculating the CAPM Beta, it is required to subtract the “expected market return” from the “expected investment return” which is the dividend as the result of “market return minus the risk returns”. In the case of CAPM interpretation, the returns that are related to the security with a Beta of 1.0 will help in exhibiting returns in line with the broader market. A higher Beta implies Greater potential returns and risks. The company with the highest potential returns process the highest Beta.

The “overvaluation” and “undervaluation” of CAPM is a critical concept. If the rate of return is considered, more than the “expected return” then it will be considered as an “overvalued security”. If the “rate of return” is considered less than the “expected return”, it will be regarded as an “undervalued security”. CAPM formula will help in evaluating the share value when the risk and time value of the money are being evaluated in comparison to the expected return. An important aspect of CAPM denotes the concept of “undervalued and overvalued securities” as the “rate of return” is considered greater than the “expected return” which will be considered as an “overvalued security”.

6. Conclusion

CAPM plays an important role in evaluating whether the stock is valued or not when the “time value” and “risk” of the money are being compared. With the “expected return”, it is possible to evaluate whether the “current price” of the stock is found to be accordant with the “likely return”. CAPM helps in estimating the return on capital investments. The “three-year Beta” of IBM came at the negatives while implying the price movements are against the market trend.

7. Reference List

.png)

Reports

FNCE623 Capital Budgeting Assignment Report 1 Sample

The case is open ending. The way you collect data may affect the results. You must collect or estimate the related data if you can’t find them in the question.

THE ASSIGNMENT MUST BE DONE INDIVIDUALLY. ANY ACADEMIC INTEGRITY

ISSUES WILL BE REPORTED TO ACADEMIC OFFICE.

Vita Smart Ltd is a leading high-tech company which is incorporated in Surrey, BC. The company wants to add a lab equipment in Dec 2023. They hired you, a UCW graduate, to prepare a capital budgeting plan for the project. Do you recommend the company to accept the project or not?

Below is the information that your manager provided:

1. The approximate cost of the machine would be $210,000, with another $10,500 in shipping and handling charges. It would also cost an additional $2,0500 to install the equipment and $500 tuning fee.

2. The equipment would be set up in an unused space at the company’s main plant. The plant space could be leased out to another lab for $11,000 per year.

3. The machinery has an economic life of 5 years, but the manager didn’t know the CCA classification and CCA rate. He estimated that the machinery is expected to have a salvage value of $18,000 after 4 years of use.

4. The new product line would generate incremental sales of 1,350 units per year for 4 years and they are expected to grow 5% per year.

5. The variable cost per unit is estimated in $50 per unit in the first year. Each unit can be sold for $210 in the first year.

6. The sales price and cost are both expected to increase due to inflation. The fixed costs are estimated to be $90,000 per year and would increase with inflation. The manager ask you to do the research about the inflation rate in recent years.

7. The company hired 3 workers to operate the new equipment and provided them 100 hours paid training according to BC minimum wage. They will work on the production line 35 hours per week under a four year contract with a 15 working days paid leave. The manager estimated the inventory level will increase 5% of the total sales every year due to expansion. The accounting teams said the new project won’t affect A/R and A/P accounts in the future 4 years.

8. The company received $25,000 Research fund from BC government and decided to use 20% of them to do a market research on the new project.

9. The manager has concerns about the potential effects on other products when introducing the

new equipment. Currently, he estimated a 2.5% decrease in sales revenue.

10. The firm is a small business which taxable revenue under $300,000. The project is considered by the financial department to be as risky as the company. The financial department has estimate that the total WACC is 12% including $8,000 interest paid every year.

Requirements

Part I: Project analysis. Total 85 marks. Q1: 8 marks, Q2-Q12, 7 marks.

Write 4 or more complete sentences for each question in a Word file. Do not write in an essay format.

References are not necessary unless the questions require. No word limitation in this part.

1. State the steps and process of Capital Budgeting.

2. What are the principles in determining incremental cash flows?

3. What’s the definition of sunk cost? Which cash flow(s) is the sunk cost in the case and why?

4. What’s the definition of opportunity cost? Which cash flow(s) is the opportunity cost in the case and why?

5. What’s the definition of externality? Which cash flow(s) is the externality in the case? Are they positive or negative?

6. What’s definition of NOWC? Which cash flow(s) reflect the change of NOWC in the case?

7. What’s CCA in Canadian accounting practice. Estimate the CCA class of the asset in the case and explain.

8. What are CCA claim methods according to CRA guidance?

9. Why is the interest included in the cash flow estimation? What’s the current interest rate of business loan in BC now? Include reference website(s) where you obtain the data.

10. Is wage a direct cost or an indirect cost? How mush is the minimum wage in BC currently?

Include reference website(s) where you obtain the data.

11. Why is tax shield important in a business operation? How much is business tax rate in BC and Federal? Include reference website(s) where you obtain the data.

12. Will inflation be included in cash flow estimation? What’s most recent inflation rate in Canada?

Include reference website(s) where you obtain the data.

Part II: Project Evaluation. (Total 15 marks)

Using an Excel spreadsheet:

• Find the NPV of the project by using the pro forma financial statement method to determine cash flows.

• Set up the necessary equations by referencing to the input variable cells. The spreadsheet must be formula driven; do not put any numbers in equations, must use cell references.

• Use Excel’s built-in functions wherever possible

Present this assignment in a professional way. It is your responsibility to communicate clearly to the marker.

Solution

Part 1:

1. Steps of capital budgeting

The steps of capital budgeting will include a thorough analysis of the business and how it is going to conduct the business operations over the period. For Assignment Help, Here, for the capital budgeting purpose, the chronological steps should be taken into consideration in the ascending order:

1. Idea generation

2. Proportional for the project where the formal understanding of the potential risk will be identified.

3. Estimation of cash flow: in the cash flow estimation, the overall project analysis will be done. This is because, the effectiveness and the efficiency of the cash flow assumptions will help the organization to improve the company's financial performance.

4. Project evaluation: In this segment, the application of the capital budgeting tools, such as the net present value analysis, internal rate of return, payback period and others, will be calculated, The analysis will provide a detailed understanding of the profitability and another solvency related aspect of the investment.

5. Project selection and ranking: based on the outcomes of the project evaluation process, if the company is considering multiple opportunities, then it will rank the project depending on the profitability and another aspect, which will help the company to select the best and most preferred option.

2. The principles of determining the incremental cash flow:

Determining the incremental cash flows provides a critical step in the capital budgeting process. It involves the identification of the cash flows, which are directly related to any particular investment project because of the additional inclusion in operations. The implementation of the revenue will help the organization to understand how efficiently the project can do and add profit to the shareholder's value.

The principles of determining the incremental cash flows for the business are discussed

1. Relevance: the first preference for determining the incremental cash flow will include the relevance, which will consider that only the relevant income and expenses should be included for the evaluation purpose. Hence, the sunk cost should be eliminated.

2. Time horizon: One of the basic aspects for determining the incremental cash flow will include the time horizon determination, which is the defined period at which the company can generate the incremental cash flow out of the business.

3. Differential principle: The differential principle will include the incremental cash flows directly related to a particular project and not being generated in response to any other project.

4. Opportunity cost: For the incremental cash flow generation, if the company sacrifices their existing revenue or substitutes the use of any particular asset that is used for a different purpose then it will be considered as an opportunity cost, and it should be considered as an expense.

5. Externalities: the externalities will record the side effects of the project, which will impact the performance of the already existing businesses or product sales. Certain externalities will have a positive or negative impact depending on the positioning of the business.

6. Taxes: the taxes are the incremental aspect of revenue, and they should be accounted for by determining the value of incremental cash flow.

7. Working capital movement: The movement in the working capital requirement for the business will be considered an essential aspect of the incremental cash flow.

8. Terminal value: The terminal value will be considered as the amount of cash flow generated or spent on the closure of the proposed investment.

3. Definition of sunk cost and which cash flows should be considered as sunk cost for Vita Smart Ltd.

Definition

The sunk cost can be considered as the expense that is already incurred, and it will not be recovered.

cash flow, which should be considered as sunk cost

Here, the market research cost is taken from the grant for $5000. It is considered as the sunk cost because it has no relation with the acceptance or rejection of the project.

4. Definition of opportunity cost: cash flow that should be considered the opportunity cost for Vita Smart Ltd.

Opportunity cost

The opportunity cost can be considered as the expense for forgiving any opportunity to generate any alternative income because of the selection of any particular project. For the instrumental cash flow calculation, the opportunity cost should be considered as an expense for the business as the company is forgiving the chances of generating an alternative revenue because of the new investment.

Opportunity cost for the project:

In the given case scenario, the leasing of the land will be considered as the opportunity cost. This is because, the company was the opportunity to lease the place for $11000 per year.

5. Definition of externality, which cash flows should be considered externality and the given case scenario and the assessment of their positive and negative aspects.

Definition of externality

For the incremental cash, the determination of any project's externalities suggests a particular project's impact on other project revenue. There will be positive or negative externalities because of the particular project. Suppose any particular project is increasing the revenue of the alternative products available for the business. In that case, it will be considered a positive externality. On the contrary, if the project minimizes the sales revenue of other projects, then it will be considered as an negative externality.

Externalities for the proposed plan

Based on the calculation and the information provided by the company, the decrease in the revenue by 2.5% will be considered as the externalities for the business, and it will be considered as the negative externality. Here, the case study is silent about the sales revenue for the alternative project. Therefore, the current forecast of its sales is considered as the basis of the decrease in revenue for the other projects.

6. Definition of NOWC, cash flow indicating the NOWC:

Definition:

NOWS stands for the net operating working capital for the business. It is an expense, which will be employed in the accounts that are receivable and inventory and the accounts that are payables will partially finance it. In most of the cases, it is assumed that the entire working capital invested into the business will be recovered at the terminal period.

NOWC for the company

In the given case scenario, because of the increase in revenue, the working capital requirement for the business is increased by 5% every financial year as compared to the previous financial year's working capital requirement.

7. CCA in Canadian accounting practice, and the estimation of the class of assets in accordance with CCA:

The term CCA, in accordance with Canadian accounting practices, will be considered as the capital cost allowance, which is available for deduction in taxation purposes. It is an expense of the business for the capital expenses made by the organization. Here, CCA has been classified into different kinds of classes of assets.

Class of asset as defined with a specific rate of capital and available for the financial year:

Determination of the class of asset:

Based on the information available for the asset, it will be a class 8 asset, which includes specific property that is not included in another class of asset, like furniture and appliances and costing more than $500. The applicable cca for the "class 8" assets is 20%.

8. the CCA claim methods in accordance with the CRA guidance:

In accordance with the CRA guidelines, the organization can use the capital cost allowance in the following method

- Straight line method: Under the straight line method, the company will be getting the same amount of capital cost allowance, which can be calculated by deducting the salvage value from the cost of acquisition and it will be divided by the period or the life of the asset.

- Diminishing balance method: Under the diminishing balance method, the company will use the undepreciated capital cost multiplied by the diminishing balance rate.

- Double declining balance method: Under the double declining balance method, the company will use the double depreciation of the straight-line method as the initial percentage for getting the maximum depreciation in the initial years.

In order to claim the capital cost allowance in accordance with the Canadian income tax rules, the depreciation can be claimed by using the form t2125, which is the statement of the business and professional activities. At first, the company will require to identify the class of asset and the depreciation rate for the same as it to claim the capital cost allowance (www.canada.ca, 2023).

9. The interest included in the cash flow estimation and the current interest rate of the business loan in BC:

The interest expenses should be included in the cash flow estimation because it is an integral part of the cash outflow, which is relevant for a particular project itself. For instance, if the organization has included debt financing for the capital resourcing of the particular project, then it will be required to pay for the interest expenses, which will be specific to this project itself, and it will make a significant cash outflow out of the business. Hence the interest expense should be included in the cash flow consideration.

However, if the management applies the wacc as the discounting rate, then, the company is considering the cost of debt financing account as the way to average the cost of capital, including the weight of debt capital. Hence, the company is automatically considering the cost of interest for the project discounting purpose. However, if the company is not using the average cost of capital, then in such a case, the company will be required to include the interest expenses as an expense in the cash flow estimation.

The interest rate in British Columbia

The average interest for British Columbia is almost 5.25% for small-scale organizations. However, the interest will depend upon the liquidity position and other aspects of the business (tradingeconomics.com, 2023).

10. Assessment of the wage's expenses, determination of the minimum wages in BC

Assessment of the wage expenses

The wages can be direct and indirect depending on the nature of expenses. In the given case scenario, each employee worked a hundred 1835 hours over the period, which includes 35 hours of weekly working along with 15 days of week off, which is the total payment for 2345 hours. The wage expenses in the case study are a direct expense because these wages are paid for operating production equipment.

The correct minimum wage rate in British Columbia is $16.75 (news.gov.bc.ca, 2023).

At the same time, here and in many cases, the wages can consider as indirect costs if the wages costs are not associated with the production.

11. Importance of tax shield for the business operation and determination of the business tax rate in BC:

The tax shield can be considered as the items for which the company can get the deduction for taxation purposes. Because of those expenses, the company's tax liability will be reduced. However, for sure, it is like depreciation. The tax shield will minimize the tax expenses for the business, and there will be no cash flow for the same.

In accordance with the small business organization, the applicable business tax rate in British Columbia is 9% only (www.canada.ca, 2023).

12. Inclusion of the inflation in the cash flow estimation and the most recent inflation rate in Canada

Inflation is an integral part of the cash flow estimation because it will impact the cash generation process because of the general increase in the prices for the product. Therefore, the inflation should be adjusted with all expenses like the increase in revenue order product prices, direct material expenses, overhead expenses and others.

Considering the recent year inflation trend, it is identified that in recent financial years, inflation has increased by a significant portion because of global volatility. However, it will not exist in the future. Hence, for a better understanding of the situation, the 5-year average inflation, which is 3.27%, is considered (ycharts.com, 2023).

Part 2: project evaluation

Finding the net present value (NPV):

For the investment analysis purpose, the net present value will be used where the project cash flows will be discounted by the cost of capital, which is 12%. Suppose the present value of the future cash inflow is more than the cash outflow at the present value. In that case, the project can be considered for investment purposes because then it will serve the minimum required rate of return to the investor (pienaar, 2021). Based on the calculation, it is identified that the project identified by Vita Smart Limited cannot be selected because it is generating a negative net present value of $229120.04.

Reference

.png)

Reports

FINM4100 Analytics in Accounting, Finance and Economics Report 2 Sample

Your Task

• Create a report on Blockchain in the context of Fintech and RegTech.

• This task is to be done as an individual.

.png)

Assessment Description

Learning Outcomes: LO2, LO4 and LO5

Background: Blockchain is an emerging technology of great importance in Finance, Economics and Accounting. It impacts the way we deal with and monitor financial transactions, trade, identify ourselves, and is having an impact on auditing and regulation.

Imagine that you are a compliance manager in a financial institution. Your company wants to use blockchain for three purposes

1. As a mechanism for secure digital transactions and smart contracts

2. As a way of managing digital identities

3. To offer clients the chance to invest in cryptocurrencies however, the executives are not sure of all of the benefits of these applications or possible ethical, legal and privacy issues.

You are to explain what blockchain is, explain these uses (applications) and how it will benefit yourself and the company auditors in a report, as outlined below.

Assessment Instructions

Do your initial research from the workshops then find relevant articles on the internet to support your statements. You are to write a report as follows:

A. Introduce the idea of blockchain and its applications in general.

B. Briefly explain the applications that we are focussing on here (1,2 & 3 above, i.e. secure

digital transactions and smart contracts, digital IDs and investment in cryptocurrencies).

C. There have been dramatic fluctuations in cryptocurrency prices with current values a fraction of what they were 12 months ago. What are your views on the future of cryptocurrencies?

What are their pros and cons?

D. Describe the benefit blockchain can offer auditors and compliance officers and subsequent

positive impact on the organisation.

E. Assess possible ethical and privacy implications of the applications at the financial institution at which you are imagining that you work. The impact could be on staff and/or customers.

F. Use at least ten relevant references and the Harvard referencing style. References must be

relevant to what you are discussing in each paragraph.

G. Taking care with your report structure and novel written presentation.

Solution

A. Blockchain: A Brief Introduction

In recent years, Blockchain technology has become a massive interest among business organizations, government enterprises, and academics. Blockchain has the capability to provide transparent, secured, and tamper-proof solutions to stakeholders. Blockchain is considered the digital ledger of a particular transaction that is copied and distributed across the various network in a computer system. After every transaction, each of the blocks holds various information that gets updated in the participants' ledger. An entry, once made using blockchain technology, cannot be changed. Everyone who participates in the chain of transactions plays a vital role in the network.

In specific terms, blockchain is a distributed database that can be accessed by everyone. This means every individual can get a copy of a new record that is entered into a database, but no individual can make any changes to the data once it has been recorded in the system.

Application of Blockchain in General

Some applications of blockchain are:

• Cryptocurrency- cryptocurrency is a digital currency that is designed to be a medium of exchange wherein every coin ownership is recorded in the decentralized ledger. As cryptocurrencies make use of 'decentralized control', they are not controlled by any individual person or the government. Blockchain technology is popularly used in cryptocurrency, where all the transaction information is stored, which is not possible to hack or change. Every person can buy, sell or deal in cryptocurrency and be a part of this network.

• Cars- Blockchain technology provides a secure and digital certificate for every car. Odometer fraud is very popular, where a dealer can tamper with the odometer and make a car appear to be a newer and less worn-out car. Thus, the customer ends up paying a huge amount of money than the actual worth of the car. Using blockchain technology, the regular odometer can be replaced with modern ones that are directly connected to the internet and can write the mileage of the car to the blockchain.

• Legal Documents- to keep a good track of data over a longer period, blockchain technology is preferably suitable. Using this technology, legal documents like intellectual property, patents, and even notaries can be secured.

• Digital Voting- Currently, voting is conducted through EVM (electronic voting machine), which are special computers that run based on proprietary software. "EVM hack" can be a major problem that can disrupt the election. Therefore, blockchain technology can be used to cast votes as it is not possible to tamper with data that are recorded in blockchain technology.

B. Application of Blockchain in Specific Tasks

Secure digital transactions and smart contracts

Smart contracts are programs that are stored on a blockchain that starts running when the predetermined conditions are met. Smart contracts are mainly used to automate the execution of a particular agreement so that every participant can come up with a certain outcome without any involvement of an intermediary that can cause time loss. When a particular transaction is completed, the blockchain has updated the parties who have granted permission can check on the results (Javaid, 2022).

Blockchain as a way of managing digital identity

Blockchain is a highly trusted mechanism that can even manage digital identities. Using blockchain technology, users get the power to have better control over their own digital identity. Blockchain puts control over individuals' personal data rather than making the data public or sharing the information with industry giants. As a result, it ensures all digital data are secured and easily traceable (Ku-Mahamud et al., 2019).

Chance to invest in cryptocurrency

Cryptocurrencies are the major part of blockchain technology that was mainly designed to transfer value. Most investors use this technology to store values as the technology is highly protective, and data cannot be tampered with easily. The data are end-to-encrypted, and investors hold them for growth.

C. Fluctuation in the price of cryptocurrency

There are different kinds of cryptocurrencies that are available in the market. Some of the popular ones include Bitcoin BTC, Ethereum ETH, Tether USDT, and USD Coin USDC. Currently, the price of Bitcoin BTC is 17,392.88, whereas the price 12 months back was $48,187.22.

The fluctuations in the overall cryptocurrency are due to the poor macroeconomic conditions and the recent bankruptcies in the world of cryptocurrency. Bitcoins, one of the largest cryptocurrencies in the world, started in 2022 with a positive notion, but within a year, the price of BTC is constantly falling from $50000 levels to $15000 levels (Aziz, 2019).

Not only Bitcoins but the whole crypto world is incurring a great fluctuation due to many downfalls. This includes the Russia-Ukraine war and inflationary rise, which led to an increase in the cost of living. Interest rates in U.S. and U.K. are rising, which is another cause of uncertainty in the crypto prices. Fluctuations are noticeable in the crypto prices as China considers cryptocurrency transactions to be illegal. Fluctuations are also due to the new tax regime in India. Furthermore, the collapse of the largest cryptocurrency exchange, FTX, has caused great damage to the prices of cryptocurrency.

The fear of global recession had a great impact on equities and currencies. As a result, cryptocurrency will likely notice some revival in 2023. Most investors are losing confidence to invest in cryptocurrencies as crypto firms have insufficient liquidity and are father leading to bankruptcies. According to some research, inflation can be a key factor in Bitcoin prices in 2023 (Haar and Money, 2021).

Cryptocurrency is the fastest and cheapest mode to transfer money through a decentralized system that does not collapse at any point in time. Cryptocurrency uses blockchain technology, an infrastructure that inherently secures all transactions. It is not possible for any hacker to hack the entire transaction in a single chance, so cryptocurrency is much more secure (Al Mashhour and Abd Aziz, 2019).

Whereas investing in cryptocurrency is quite a difficult task as one must acquire knowledge of cryptocurrency, which takes time and effort an individual. Cryptocurrency fully works upon digital natives, an individual who might not understand the concept of cryptocurrency.

D. BENEFITS OF BLOCKCHAIN

Benefits to Auditors

Blockchain is the buzzword of the decade. Every individual, irrespective of their age, is curious about what this meta byproduct is and how they can utilize the same in their lives and in their businesses to reap its benefits and minimize manual work. This has led to a sharp uprise in the use of blockchain technology and has resultantly increased the work of auditors and regulators. But it is not without benefits to them, some of which are stated below:

1. Blockchain technology is available to only those users and entities that have been granted specific access to the network. This ensures that no one meddles with the data stored in the blockchain (Smith and Castongua, 2020).

2. Analytics deployed in the blockchain is robust and foolproof. The data that the blockchain system consists of is stored systematically and consistently in a structured manner. This enables the complex procedures and analysis to be performed can be done reliably across the network, and dashboards are updated as soon as possible.

3. Blockchain-enabled solutions solve a crucial auditing limitation relating to testing checking or sampling (Bonyuet, 2020). Auditors, because of the shared ledger technology of blockchains, can now check 100% of the items in a population and not resort to sampling. The shared ledger technology, which includes several counterparties, can be audited in real-time, and any fraudulent activities can be inquired into simultaneously as they are taking place. For instance, the internal audit department of big audit firms has the option to maintain a read-only node on the blockchain environment. As per Deloitte US, auditors do so that "they can monitor and flag transactions in real-time and they can potentially use analytics to automate auditing of routine transactions."

Benefits to Compliance officers

Besides being of immense benefit to the auditor, blockchain technology also makes the work of compliance officers easy because it supports smart contracts, which makes the contract risk compliance more automated, allowing compliance officers to shift from manually testing CRC to more automated testing of its functions and performance, which is a higher value role (Okazaki, 2018).

E. Ethical and Privacy Implications

Privacy Implications

Data is the biggest asset that this generation is going to use. Since all companies across the globe, big or small, are heavily reliant on data and store massive amounts of it on various networks, the question of safety of the same is bound to arise. Data privacy, also called information privacy, provides a suitable protocol for collecting, processing and storing data to ensure that it is properly managed.

With blockchain, the growing implication of privacy of personal information is increasing by the day. A lot of personal data tends to be protected with the General Data Protection Regulation, and for the rest, it is forbidden unless one has the basis, legally, to move ahead with its usage (Salmon and Myers, 2019). Some growing trends that hamper the confidentiality motives in data privacy have been noticed like -

a. Growing misinformation- Most people resort to the internet to get any information about anything they want, and this provides a fertile ground for the users to fall into fraudulent traps and lose their money even- if they are irresponsible.

b. Monitoring employee performance- Since the culture of bringing your own device (BYOD) is on the rise, employers find it increasingly difficult to monitor the activities of employees and the expenses that are being incurred on them. This saw a rise also during the pandemic wherein employees worked from home, and the world ended up on zoom calls instead of physical meets.

Ethical Implications

Blockchain technology has turned out to be a disruptive technology that has the potential to bring about major positive implications to the lives of people on the internet (Sharif and Ghodoosi, 2022). However, as is the case with any upcoming techno-giant, the ethical considerations are to be considered and discussed so that we humans still manage to have some degree of control over the negative side effects (Tang et al., 2019). Some ethical considerations are-

a. Environmental Impacts - Public blockchain networks such as bitcoin engage with unverified networks, and unreliable participants and so have to use networks like proof of work which involves mining. Mining, in turn, requires massive amounts of hardware that requires massive amounts of electricity. This, of course, is harmful to the environment and poses ethical threats. Going forward, an alternative needs to be developed to make this system sustainable.

b. Problem of anonymity- Ransomware can be enabled by public networks like bitcoin. A software system can be easily attacked, data stolen, and the hacker can demand payment in bitcoin, which one will have to make without any knowledge of the attacker or the loss suffered. Also, since such blockchain networks are not regulated centrally or legally, no actions can be taken.

References

.png)

Case Study

FIN600 Financial Management Case Study 2 Sample

Context

The purpose of the assignment is to provide you with the opportunity to apply the knowledge and skills acquired in FIN600 Financial Management, to a practical task, involving the use of ‘real world’ accounting information. This is intended to consolidate your accounting knowledge and skills.

Instructions

The basic requirement is to undertake a general financial analysis, comparing financial position and performance over the two most recent financial years, of an ASX listed company. Your Learning Facilitator will provide the details of the ASX listed company. The annual report for the chosen company should be available on the company website and/or will be provided by your Learning Facilitator.

Note: Assessment 2 submissions based on the incorrect company or a company not chosen by the Facilitator will be regarded as a Non-Submission and no grade will be allocated.

Non-Submissions of Assessment 2 will prohibit a Supplementary assessment for the student.

The analysis should consider each of the following financial ratios:

- Profitability and market performance

- Efficiency

- Liquidity

- Capital structure

Note: Please use the ‘consolidated’ data in conducting your analysis. You are only required to look at the most recent financial report. For those ratios which involve averages, you will calculate an average for the most recent year only, the prior year ratio calculation will NOT consider average calculations.

Points to consider

i. You are encouraged to seek and use additional public information about the company from sources, other than the annual report (for example, the internet, journal articles, newspapers, and business magazines).