Order Now

- Home

- About Us

-

Services

-

Assignment Writing

-

Academic Writing Services

- HND Assignment Help

- SPSS Assignment Help

- College Assignment Help

- Writing Assignment for University

- Urgent Assignment Help

- Architecture Assignment Help

- Total Assignment Help

- All Assignment Help

- My Assignment Help

- Student Assignment Help

- Instant Assignment Help

- Cheap Assignment Help

- Global Assignment Help

- Write My Assignment

- Do My Assignment

- Solve My Assignment

- Make My Assignment

- Pay for Assignment Help

-

Management

- Management Assignment Help

- Business Management Assignment Help

- Financial Management Assignment Help

- Project Management Assignment Help

- Supply Chain Management Assignment Help

- Operations Management Assignment Help

- Risk Management Assignment Help

- Strategic Management Assignment Help

- Logistics Management Assignment Help

- Global Business Strategy Assignment Help

- Consumer Behavior Assignment Help

- MBA Assignment Help

- Portfolio Management Assignment Help

- Change Management Assignment Help

- Hospitality Management Assignment Help

- Healthcare Management Assignment Help

- Investment Management Assignment Help

- Market Analysis Assignment Help

- Corporate Strategy Assignment Help

- Conflict Management Assignment Help

- Marketing Management Assignment Help

- Strategic Marketing Assignment Help

- CRM Assignment Help

- Marketing Research Assignment Help

- Human Resource Assignment Help

- Business Assignment Help

- Business Development Assignment Help

- Business Statistics Assignment Help

- Business Ethics Assignment Help

- 4p of Marketing Assignment Help

- Pricing Strategy Assignment Help

- Nursing

-

Finance

- Finance Assignment Help

- Do My Finance Assignment For Me

- Financial Accounting Assignment Help

- Behavioral Finance Assignment Help

- Finance Planning Assignment Help

- Personal Finance Assignment Help

- Financial Services Assignment Help

- Forex Assignment Help

- Financial Statement Analysis Assignment Help

- Capital Budgeting Assignment Help

- Financial Reporting Assignment Help

- International Finance Assignment Help

- Business Finance Assignment Help

- Corporate Finance Assignment Help

-

Accounting

- Accounting Assignment Help

- Managerial Accounting Assignment Help

- Taxation Accounting Assignment Help

- Perdisco Assignment Help

- Solve My Accounting Paper

- Business Accounting Assignment Help

- Cost Accounting Assignment Help

- Taxation Assignment Help

- Activity Based Accounting Assignment Help

- Tax Accounting Assignment Help

- Financial Accounting Theory Assignment Help

-

Computer Science and IT

- Operating System Assignment Help

- Data mining Assignment Help

- Robotics Assignment Help

- Computer Network Assignment Help

- Database Assignment Help

- IT Management Assignment Help

- Network Topology Assignment Help

- Data Structure Assignment Help

- Business Intelligence Assignment Help

- Data Flow Diagram Assignment Help

- UML Diagram Assignment Help

- R Studio Assignment Help

-

Law

- Law Assignment Help

- Business Law Assignment Help

- Contract Law Assignment Help

- Tort Law Assignment Help

- Social Media Law Assignment Help

- Criminal Law Assignment Help

- Employment Law Assignment Help

- Taxation Law Assignment Help

- Commercial Law Assignment Help

- Constitutional Law Assignment Help

- Corporate Governance Law Assignment Help

- Environmental Law Assignment Help

- Criminology Assignment Help

- Company Law Assignment Help

- Human Rights Law Assignment Help

- Evidence Law Assignment Help

- Administrative Law Assignment Help

- Enterprise Law Assignment Help

- Migration Law Assignment Help

- Communication Law Assignment Help

- Law and Ethics Assignment Help

- Consumer Law Assignment Help

- Science

- Biology

- Engineering

-

Humanities

- Humanities Assignment Help

- Sociology Assignment Help

- Philosophy Assignment Help

- English Assignment Help

- Geography Assignment Help

- Agroecology Assignment Help

- Psychology Assignment Help

- Social Science Assignment Help

- Public Relations Assignment Help

- Political Science Assignment Help

- Mass Communication Assignment Help

- History Assignment Help

- Cookery Assignment Help

- Auditing

- Mathematics

-

Economics

- Economics Assignment Help

- Managerial Economics Assignment Help

- Econometrics Assignment Help

- Microeconomics Assignment Help

- Business Economics Assignment Help

- Marketing Plan Assignment Help

- Demand Supply Assignment Help

- Comparative Analysis Assignment Help

- Health Economics Assignment Help

- Macroeconomics Assignment Help

- Political Economics Assignment Help

- International Economics Assignments Help

-

Academic Writing Services

-

Essay Writing

- Essay Help

- Essay Writing Help

- Essay Help Online

- Online Custom Essay Help

- Descriptive Essay Help

- Help With MBA Essays

- Essay Writing Service

- Essay Writer For Australia

- Essay Outline Help

- illustration Essay Help

- Response Essay Writing Help

- Professional Essay Writers

- Custom Essay Help

- English Essay Writing Help

- Essay Homework Help

- Literature Essay Help

- Scholarship Essay Help

- Research Essay Help

- History Essay Help

- MBA Essay Help

- Plagiarism Free Essays

- Writing Essay Papers

- Write My Essay Help

- Need Help Writing Essay

- Help Writing Scholarship Essay

- Help Writing a Narrative Essay

- Best Essay Writing Service Canada

-

Dissertation

- Biology Dissertation Help

- Academic Dissertation Help

- Nursing Dissertation Help

- Dissertation Help Online

- MATLAB Dissertation Help

- Doctoral Dissertation Help

- Geography Dissertation Help

- Architecture Dissertation Help

- Statistics Dissertation Help

- Sociology Dissertation Help

- English Dissertation Help

- Law Dissertation Help

- Dissertation Proofreading Services

- Cheap Dissertation Help

- Dissertation Writing Help

- Marketing Dissertation Help

- Programming

-

Case Study

- Write Case Study For Me

- Business Law Case Study Help

- Civil Law Case Study Help

- Marketing Case Study Help

- Nursing Case Study Help

- Case Study Writing Services

- History Case Study help

- Amazon Case Study Help

- Apple Case Study Help

- Case Study Assignment Help

- ZARA Case Study Assignment Help

- IKEA Case Study Assignment Help

- Zappos Case Study Assignment Help

- Tesla Case Study Assignment Help

- Flipkart Case Study Assignment Help

- Contract Law Case Study Assignments Help

- Business Ethics Case Study Assignment Help

- Nike SWOT Analysis Case Study Assignment Help

- Coursework

- Thesis Writing

- CDR

- Research

-

Assignment Writing

-

Resources

- Referencing Guidelines

-

Universities

-

Australia

- Asia Pacific International College Assignment Help

- Macquarie University Assignment Help

- Rhodes College Assignment Help

- APIC University Assignment Help

- Torrens University Assignment Help

- Kaplan University Assignment Help

- Holmes University Assignment Help

- Griffith University Assignment Help

- VIT University Assignment Help

- CQ University Assignment Help

-

Australia

- Experts

- Free Sample

- Testimonial

MBM BST 713 Analysing Financial Performance Assignment Sample

Assignment Brief

• You are required to produce a 2,000 word individual report containing:

An analysis of the financial performance and position of Marks and Spencer. Your analysis should be based on your calculation of basic accounting and financial ratios for 2021, and 2020 for comparative purposes; and an evaluation of the results of those calculations. In addition, your analysis should be supplemented by key data contained in the narrative sections of the 2021 annual report and other sources; (40 marks)

• a consideration of Marks and Spencer’s prospects for the foreseeable future, taking into account the challenges facing the group and its responses thereto;(30 marks) and,

• drawing on appropriate literature, an assessment of the extent to which Marks and Spencer could justifiably claim to have a diverse board of Directors. (20 marks)

The remaining 10 marks will be awarded for the presentation and structure of your report and appropriate referencing.

The report can be found here:

https://corporate.marksandspencer.com/msar2021/m-and- s_ar21_full_210602.pdf

Report Guidance:

As a guide, for the report, you should aim to devote:

• 900 words on Marks and Spencer’s past financial performance;

• 600 words on the future prospects of the group; and

• 500 words on the corporate governance aspect.

In addition, you should present the accounting ratios as a table in an appendix to your report for https://www.theassignmenthelpline.com/ (see proforma on final page); the appendix will not be included in the overall word count for the assignment. You MUST show the figures you use in the calculation of the ratios AND, if they do not come from the face of the Consolidated Statement of Comprehensive Income or the Consolidated Statement of Financial Position, you must show the exact source of the figure(s). Failure to do so will result in no marks being awarded for that calculation.

Your report should also be:

1. Word-processed;

2. Professionally presented with page numbers and having undergone a Grammar/spell-check;

3. Properly referenced (where you use words taken from a source, you must give a proper citation to that source).

Academic Misconduct

You need to be aware that this is an individual assignment. Academic misconduct will not be tolerated. Do not be tempted to copy another’s work or use another person to do the work that you should do yourself. Academic misconduct will result in an award of a zero mark, at best; at worst, the consequences could be more serious.

Submission Details:

Deadline for submission is: 11.00 AM BST, March 18, 2022. The report must be submitted via the Learning Central portal. If you have any queries or difficulties with submitting your work, please address those to the PG Hub, NOT to academic staff.

Solution

Introduction

The business environment is uncertain and dynamic that is faced by the business organization. This report provides the business performance analyses of Marks and Spencer by implementing the ratio analyses tool. It also contained the recommendation to improve the business performance of the company. It considers the foreseeable future of the company and the challenges faced by the company. Diversify board of directors has been assessed in this report.

Company outlook(MKS.L)

Marks and Spencer Group plc engaged in the industry of department stores in the sector of consumer cyclical with the total number of employees of 69577. It operates as a retail store in 5 segments. These five segments are UK Clothing & Home, UK Food, International, OCADO, and all others. It offers protein daily, ambient, dairy produce, meals dessert, and food on move products. It also provides women's wear, menswear, and clothing for kids. Apart from that company invest in real estate property. It has been founded in 1884 and headquarter in London, The United Kingdom (MKS.L 2021).

Financial review of MKS.L

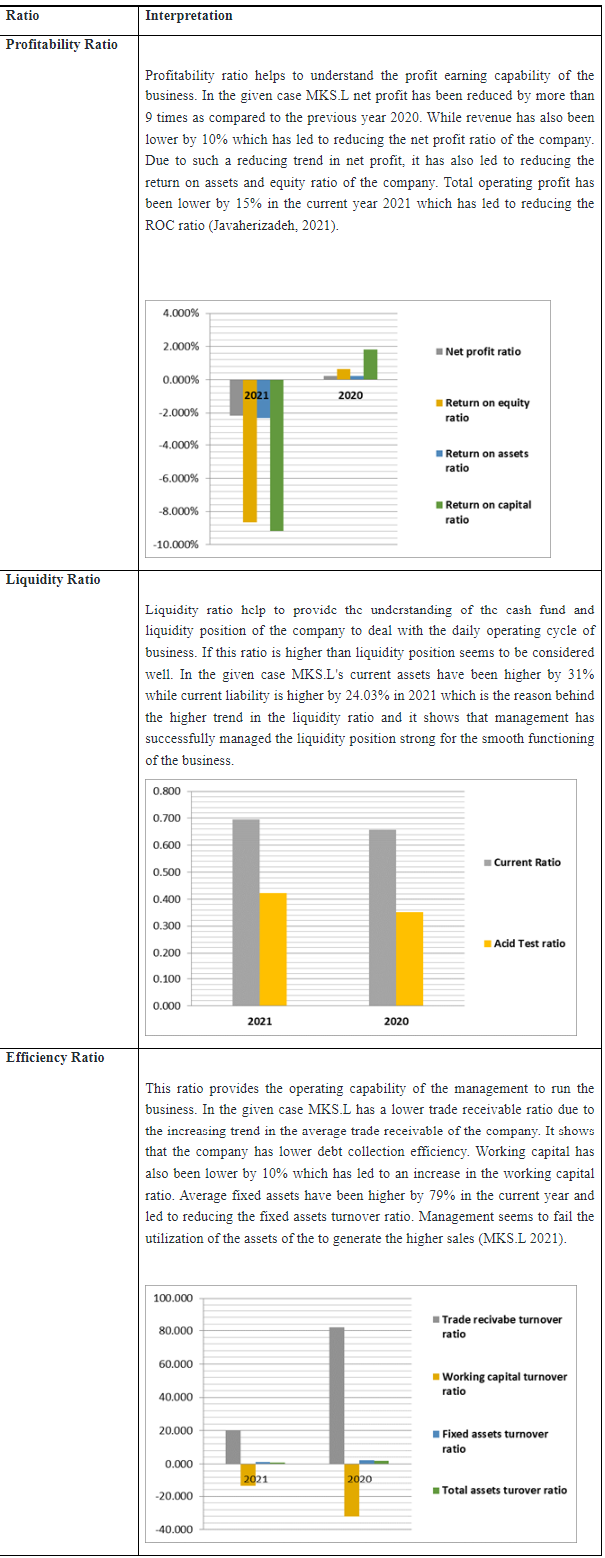

To assess the financial performance of the business organization, the ratio analyses tool is the best option. It helps to assess the financial data of the company in comparative form so that trends in each financial item can be understood easily. It considers the financial data of more than 1 year. Following are the computational ratio analyses of the Marks and Spencer Group plc:-

Core ( Financial Ratio computation)

Additional ( Interpretation , Notes to accounts)

Narratives

Hence it can be observed that MKS.L company has not performed well in the current year 2021. It needs to improve the performance by considering the cost control factor so that profitability gets positive in next upcoming years. The company needs to improve the efficiency ratio too so that operating capability can be increased and businesses will get benefit from it. The company should focus on the long-term goal and cost control should also be done by incorporating the new policy (Easton,& Zhang, 2018).

Future Prospectus

Marks and Spencer Group Plc. is a British based multinational company that runs its business in the retail sector and the headquarters of the company is located in London. The company has different lines of business which includes retail stores of clothes, food stores, and home products. The company had its presence in the industry for a long. But, in 2018 a radical plan was issued by the company where it stated that the company will be closing its 100 stores worldwide by 2022 (MKS.L 2021).

During the pandemic, the company has cut down more than 7,000 jobs, because the stores were closed and the expenses of the company were exceeding the income that the company was earning from running the stores. Moreover, again in 2021, the company has announced that other than 100, it will be closing 30 more stores, in the next 10 years, as a part of its turnaround plan. Based on the financial analysis conducted above, it can be said, that in some areas the company has been able to maintain its stance, such as the liquidity of the company is strong in 2021 in comparison to 2020. On the other hand, the efficiency ratios of the company have declined which states that the company has not been utilizing its assets to earn income for the shareholders (MKS.L 2021).

Core Analysis

In the past few years, the company is facing several issues, due to which the company had to come up with different turnaround plans, where they are deciding to close the stores. The policy of the company has always been clear, where they want to satisfy the customers by providing them valuable products. As a part of its future, the company has decided that they want to come up with stores that fit the future and will help the company to achieve its transformation goals. The strategy that a company can use is to open the right stores, at the right locations. This can be done by conducting market analysis, which will help the company to identify the central locations, where the company should open its stores. It will also help the company to close the stores in the location which is not yielding results for the company (Joshi, et al., 2021).

To achieve the future that the management has seen the company will require to indulge in some investing and renewing the new stores to target the new markets that the company is viewing. This can be done by redeveloping the existing space that is available with the company. There are several risks and issues that the company is facing, which is stopping the company from moving forward.

One such issue has been exiting of UK from EU. This has initiated the Brexit contract among, which the trade between UK and EU countries have been limited. Hence, the company has to work on its importance and make strong its third-party relationships. The company plans to do this, by focusing on customer loyalty and improving the brand experience provided to customers.

External fact analysis

Apart from this, there are several regulatory changes in SOX that are impacting the business of the company. As the regulations are changing, the risks of the company coming under scrutiny have increased and the future reporting requirements of the company has also increased. However, in the past two years, the performance of the company has declined in several aspects because of the emergence of the pandemic but, it has also helped the company to learn new things. Such as it has helped the company to understand how it can respond to the customers quickly and how important it is to maintain touch with the customers. As a result, the company immediately decided to improve their website, so that customers who cannot go to retail stores can order goods online. This involved refocusing the strategy of the company, and instead of maintaining retail stores, the company should try to shift its focus to online stores (Schleper, et al., 2021).

In the future, the company wishes to accelerate its stores, and improve the experience of customers. Also, the main issue or challenge that the company is facing is regarding its property portfolio which is aged, due to which the company is not able to focus on its earning from investment in property. Hence, the company plans to upgrade its property portfolio, which has been negatively impacted due to pandemic.

Hence, if the company implements what they have decided while keeping the sustainability aspect in mind, the company will have a bright future.

Governance practice:

The responsibilities that are borne by the board of directors of the company are very important. They are basically the agents of shareholders, who are the owners of the company. The duty of the board of directors is to manage the business effectively and formulate operating and financial strategies to ensure that the practices of the company are helping the business to grow (Zopounidis, and Passas, 2020).

Over the years, the focus has been put on the board of directors, whereas part of the regulation, it is compulsory for every company to have non-executive directors on their board. Along, with this, it is important that at least one of the non-executive directors is a person with skills and competence in accounting, finance, etc. Hence, here the importance of board diversity is dictated. When there is diversification in board, it leads to effective decision-making, it helps in better utilization of talent, and it increases the level of relationship that company has with the shareholders of the company (Dicuonzo and Dell’Atti, 2022).

Diverse board of directors

The governance of Marks and Spencer is also diversified. Over the years, there are several changes that the company has made in its board of directors, were not long back company has introduced two more non-executive directors, and the same was done by the company to ensure that their board of directors are balanced. This is done because of the uncertainties that are prevailing in the market amid pandemic and Brexit (Yukhno, 2022).

The board of directors of the company is diversified and it helps them to enhance their decision making. Some directors of the company are proficient in law and help the company to ensure that they are abiding by the legal laws. Other directors of the company are proficient in finance and help the company to take decisions amid pandemic, and how the situation can be controlled.

Recommendation

Hence, for every company in the business, it is advisable that the board of directors of the company are diversified, as it will help them to improve their choices, and will lead to better decision making. When the board of directors of the company are not diversified it leads to bad decision making, because the choices are limited, and there are no educated people who will question a decision, or who will put their opinion in front.

Conclusion:

From the above, it can be concluded that Marks and Spencer have been in the retail business for a long now, as the company had been able to make its name in the industry. However, for the past few years, the company is facing issues, due to which they have taken the decision of closing some of the stores. As a result, the company is thinking of renovating the strategies that they have currently employed, which included new stores, and diversifying the board of directors of the company.

Reference:

Aigbedo, H. 2021. An empirical analysis of the effect of financial performance on environmental performance of companies in global supply chains. Journal of Cleaner Production, 278, 121741.https://www.sciencedirect.com/science/article/pii/S0959652620317881

Annual report of the Marks and Spencer has been retrieved from https://corporate.marksandspencer.com/annualreport

Dicuonzo, G., Donofrio, F., Iannuzzi, A.P. and Dell’Atti, V., 2022. The integration of sustainability in corporate governance systems: an innovative framework applied to the European systematically important banks. International Journal of Disclosure and Governance, pp.1-15. https://link.springer.com/article/10.1057/s41310-021-00140-2

Easton, P.D., McAnally, M.L., Sommers, G.A. and Zhang, X.J., 2018. Financial statement analysis & valuation. Boston, MA: Cambridge Business Publishers. https://www.fau.edu/graduate/faculty-and-staff/programs-committee/docs/02202019/NCP-ACG5176.pdf

Javaherizadeh, E. 2021. An empirical study on the impact of female leaders and intellectual capital on the financial performance of FTSE 350 companies (Doctoral dissertation, University of West London).http://repository.uwl.ac.uk/id/eprint/8511/

Joshi, N., Gabhane, D., Devi, B. P., & Somashekhar, I. C. 2021. How social media marketing is helping in customer retention and customer engagement: A case of Marks and Spencer. SPAST Abstracts, 1(01).https://spast.org/techrep/article/view/3561

Ramzan, M., Amin, M., & Abbas, M. 2021. How does corporate social responsibility affect financial performance, financial stability, and financial inclusion in the banking sector? Evidence from Pakistan. Research in International Business and Finance, 55, 101314.https://www.sciencedirect.com/science/article/pii/S0275531919301199

Schleper, M. C., Gold, S., Trautrims, A., & Baldock, D. 2021. Pandemic-induced knowledge gaps in operations and supply chain management: COVID-19’s impacts on retailing. International Journal of Operations & Production Management.https://www.emerald.com/insight/content/doi/10.1108/IJOPM-12-2020-0837/full/html?utm_source=rss&utm_medium=feed&utm_campaign=rss_journalLatest

Zopounidis, C., Garefalakis, A., Lemonakis, C. and Passas, I., 2020. Environmental, social and corporate governance framework for corporate disclosure: a multicriteria dimension analysis approach. Management Decision. https://www.researchgate.net/profile/Alexandros-Garefalakis/publication/346060596_Environmental_social_and_corporate_governance_framework_for_corporate_disclosure_a_multicriteria_dimension_analysis_approach/links/5fbb452d299bf104cf6cf32e/Environmental-social-and-corporate-governance-framework-for-corporate-disclosure-a-multicriteria-dimension-analysis-approach.pdf

Download Samples PDF

Related Sample

- Data4400 Data Driven Decision Making and Forecasting IT Report

- BSBHRM525 Manage Recruitment and Onboarding Assignment

- LB5236 International Political Economy Report

- MGMT20144 Management and Business Context Assignment

- Accounting Coursework Assignment

- Political Decision Making Process Affecting Global Leadership in International Business

- MIS607 Cybersecurity Reports

- MKTG7512 Strategic Marketing Management Case Study

- PROJ6004 Contracts and Procurement Report 1

- MGT601 Dynamic Leadership Assignment 1 Part B

- COIT20248 Information System Analysis and Design Assignment

- BAS121A Fundamentals of Marketing Assignment

- PROJ6000 Principles of Project Management Assignment

- BUSN20016 Research in Business Assignment

- PUBH6008 Applied Research Project in Public Health

- MIS101 Information Systems for Business Assignment

- EDES105 Indigenous History and Culture

- HI6008 Business Research Project Report

- Research and Statistical Methods for Business

- MGT602 Business Decision Making Process Case Study

Assignment Services

-

Assignment Writing

-

Academic Writing Services

- HND Assignment Help

- SPSS Assignment Help

- College Assignment Help

- Writing Assignment for University

- Urgent Assignment Help

- Architecture Assignment Help

- Total Assignment Help

- All Assignment Help

- My Assignment Help

- Student Assignment Help

- Instant Assignment Help

- Cheap Assignment Help

- Global Assignment Help

- Write My Assignment

- Do My Assignment

- Solve My Assignment

- Make My Assignment

- Pay for Assignment Help

-

Management

- Management Assignment Help

- Business Management Assignment Help

- Financial Management Assignment Help

- Project Management Assignment Help

- Supply Chain Management Assignment Help

- Operations Management Assignment Help

- Risk Management Assignment Help

- Strategic Management Assignment Help

- Logistics Management Assignment Help

- Global Business Strategy Assignment Help

- Consumer Behavior Assignment Help

- MBA Assignment Help

- Portfolio Management Assignment Help

- Change Management Assignment Help

- Hospitality Management Assignment Help

- Healthcare Management Assignment Help

- Investment Management Assignment Help

- Market Analysis Assignment Help

- Corporate Strategy Assignment Help

- Conflict Management Assignment Help

- Marketing Management Assignment Help

- Strategic Marketing Assignment Help

- CRM Assignment Help

- Marketing Research Assignment Help

- Human Resource Assignment Help

- Business Assignment Help

- Business Development Assignment Help

- Business Statistics Assignment Help

- Business Ethics Assignment Help

- 4p of Marketing Assignment Help

- Pricing Strategy Assignment Help

- Nursing

-

Finance

- Finance Assignment Help

- Do My Finance Assignment For Me

- Financial Accounting Assignment Help

- Behavioral Finance Assignment Help

- Finance Planning Assignment Help

- Personal Finance Assignment Help

- Financial Services Assignment Help

- Forex Assignment Help

- Financial Statement Analysis Assignment Help

- Capital Budgeting Assignment Help

- Financial Reporting Assignment Help

- International Finance Assignment Help

- Business Finance Assignment Help

- Corporate Finance Assignment Help

-

Accounting

- Accounting Assignment Help

- Managerial Accounting Assignment Help

- Taxation Accounting Assignment Help

- Perdisco Assignment Help

- Solve My Accounting Paper

- Business Accounting Assignment Help

- Cost Accounting Assignment Help

- Taxation Assignment Help

- Activity Based Accounting Assignment Help

- Tax Accounting Assignment Help

- Financial Accounting Theory Assignment Help

-

Computer Science and IT

- Operating System Assignment Help

- Data mining Assignment Help

- Robotics Assignment Help

- Computer Network Assignment Help

- Database Assignment Help

- IT Management Assignment Help

- Network Topology Assignment Help

- Data Structure Assignment Help

- Business Intelligence Assignment Help

- Data Flow Diagram Assignment Help

- UML Diagram Assignment Help

- R Studio Assignment Help

-

Law

- Law Assignment Help

- Business Law Assignment Help

- Contract Law Assignment Help

- Tort Law Assignment Help

- Social Media Law Assignment Help

- Criminal Law Assignment Help

- Employment Law Assignment Help

- Taxation Law Assignment Help

- Commercial Law Assignment Help

- Constitutional Law Assignment Help

- Corporate Governance Law Assignment Help

- Environmental Law Assignment Help

- Criminology Assignment Help

- Company Law Assignment Help

- Human Rights Law Assignment Help

- Evidence Law Assignment Help

- Administrative Law Assignment Help

- Enterprise Law Assignment Help

- Migration Law Assignment Help

- Communication Law Assignment Help

- Law and Ethics Assignment Help

- Consumer Law Assignment Help

- Science

- Biology

- Engineering

-

Humanities

- Humanities Assignment Help

- Sociology Assignment Help

- Philosophy Assignment Help

- English Assignment Help

- Geography Assignment Help

- Agroecology Assignment Help

- Psychology Assignment Help

- Social Science Assignment Help

- Public Relations Assignment Help

- Political Science Assignment Help

- Mass Communication Assignment Help

- History Assignment Help

- Cookery Assignment Help

- Auditing

- Mathematics

-

Economics

- Economics Assignment Help

- Managerial Economics Assignment Help

- Econometrics Assignment Help

- Microeconomics Assignment Help

- Business Economics Assignment Help

- Marketing Plan Assignment Help

- Demand Supply Assignment Help

- Comparative Analysis Assignment Help

- Health Economics Assignment Help

- Macroeconomics Assignment Help

- Political Economics Assignment Help

- International Economics Assignments Help

-

Academic Writing Services

-

Essay Writing

- Essay Help

- Essay Writing Help

- Essay Help Online

- Online Custom Essay Help

- Descriptive Essay Help

- Help With MBA Essays

- Essay Writing Service

- Essay Writer For Australia

- Essay Outline Help

- illustration Essay Help

- Response Essay Writing Help

- Professional Essay Writers

- Custom Essay Help

- English Essay Writing Help

- Essay Homework Help

- Literature Essay Help

- Scholarship Essay Help

- Research Essay Help

- History Essay Help

- MBA Essay Help

- Plagiarism Free Essays

- Writing Essay Papers

- Write My Essay Help

- Need Help Writing Essay

- Help Writing Scholarship Essay

- Help Writing a Narrative Essay

- Best Essay Writing Service Canada

-

Dissertation

- Biology Dissertation Help

- Academic Dissertation Help

- Nursing Dissertation Help

- Dissertation Help Online

- MATLAB Dissertation Help

- Doctoral Dissertation Help

- Geography Dissertation Help

- Architecture Dissertation Help

- Statistics Dissertation Help

- Sociology Dissertation Help

- English Dissertation Help

- Law Dissertation Help

- Dissertation Proofreading Services

- Cheap Dissertation Help

- Dissertation Writing Help

- Marketing Dissertation Help

- Programming

-

Case Study

- Write Case Study For Me

- Business Law Case Study Help

- Civil Law Case Study Help

- Marketing Case Study Help

- Nursing Case Study Help

- Case Study Writing Services

- History Case Study help

- Amazon Case Study Help

- Apple Case Study Help

- Case Study Assignment Help

- ZARA Case Study Assignment Help

- IKEA Case Study Assignment Help

- Zappos Case Study Assignment Help

- Tesla Case Study Assignment Help

- Flipkart Case Study Assignment Help

- Contract Law Case Study Assignments Help

- Business Ethics Case Study Assignment Help

- Nike SWOT Analysis Case Study Assignment Help

- Coursework

- Thesis Writing

- CDR

- Research

.png)

~5.png)

.png)

~1.png)

.png)