Case Study

ACCM6000 Capstone Accounting and Governance Case Study 2 Sample

Assignment Details

Your Task

Analyse the corporate governance practices of a given organisation and identify challenges in terms of sustainability and risk. Interpretandcritically analyseorganisational risk and sustainability practice, prepare a written memorandum, and deliver a presentation that addresses challenges and opportunities.

As the capstone unit, this subject requires students to bring together their accounting and governance knowledge and techniques developed within prior subjects and throughout this course and apply these to the interpretation, analysis and critique of present-day business and governance practices to identify problems and to propose solutions. Building on students' in-depth understanding of relevant theories and practices already developed in accounting and governance and their proficiency in the tools and techniques, this assessment further develops research, analytical, critical thinking and problem-solving skills demanded by the accounting profession in the 21st Century.

This is an individual assessment that requires an analysis of a [given] case study/scenario, out of class and the preparation of a memorandum for submission by Turnitin

Following are the general instructions for completing this assessment.

1. Read and analyse the case study, paying attention to the business context and any issues and concerns facing stakeholders.

2. Based on the issues identified in the case study, conduct research of academic journals, professional practitioner literature and recent news releases relating to "best practice corporate governance," "sustainability," and "risk management practices."

3. Based on your analysis, prepare a written memorandum (1,500 words) to those charged with governance that addresses the different views and positions of the stakeholders and investors presented in the case study along the following lines:

a. Provide advice and recommend corporate governance practices which will positively contribute to the business strategy and goals presented in the case study.

b. Provide a summary of the significance, benefits, and challenges of producing sustainability and other non-financial reports for the business operating in the specific industry presented in the case study.

Solution

1. Introduction

Since its founding in 2016, Moka Restaurant Group (MRG) has carved out a position for itself. Renowned dietitian Suzy Cartier mounted it. This employer is pleased with its portfolio of innovative consuming thoughts, which incorporates Moka, Supper Club, Feast, and Zoom. This logo has received popularity for its creative technique in culinary studies, all while specializing in presenting inexpensive consuming alternatives acquired from sustainable carriers. As a result, paintings are being achieved to draft a document to look at MRG's company governance practices, consisting of a look at the business enterprise's governance shape, sustainability applications, and operational nuances.

2. Memorandum

2.1 Problems or Issues of Concern Facing Stakeholders

To protect the openness of fashionable-reason financial reviews for foremost users, corporations are required by way of the General Requirements Standard underneath IFRS S1 to post extensive statistics concerning sustainability-associated dangers and possibilities. The four major pillars of this general are key overall performance indicators, method, governance, and risk management. At the moment, businesses need to make sure that their sustainability disclosures fit their GPFR, publish substantial records at each degree in their supply chain, and encompass sustainability disclosures into their every-year financial statements related to the problems or troubles of dealing with stakeholders (Shahwan, 2020).

- Related Party Transactions: To save you from conflicts of interest and make sure that positive transactions match marketplace language, MRG's insurance requires openness and trustworthy dealing in related party transactions. However, concerns about independence and justice are raised via the discretionary authority positioned in important people for The assignment helpline.

- Financial Performance Measures: MRG's acknowledgement of an upward push in income and the next discount in funding demonstrates the use of traditional accounting requirements to assess the company's overall performance.

- Sustainability Practices: MRG is aligned with the growing variety of accounting systems that emphasize social and environmental obligation on the subject of sustainability. However hard situations concerning the safety of packaging and the precision of detailed facts highlight how essential correct reporting and danger evaluation are to sustainable accounting approaches (Jejeniwa, 2024).

- Risk Management: The structure of a risk committee demonstrates that MRG respects organization governance requirements and acknowledges the need for hazard oversight. However, the committee's early detection of ownership-associated risks points to the need for greater thorough danger identification and manipulation, taking operational, monetary, and regulatory concerns into consideration.

2.2 Corporate Governance Advise

The International Accounting Standards Board (ISSB) has released IFRS S1 and S2, aiming to improve sustainability disclosure quality and address environmental and social issues. These standards follow four pillars: metrics and objectives, governance, and strategy. Metrics and objectives evaluate an organization's performance; governance is the framework for implementing these methods; and strategy is the plan for achieving its objectives. These guidelines aim to establish international standards for sustainability in the future (Grossi and Argento, 2022).

- Risk management: This is the technique through which the enterprise acknowledges and manages the various dangers it faces. It is the responsibility of companies and organizations to offer records about sustainability possibilities and risks, in addition to their rules concerning them.

- Transparent Governance Structure: Create an easy governance form that describes the jobs, obligations, and decision-making procedures of executives, directors, and key control teams of workers. This shape seeks to grow openness, lessen conflicts of interest, and impose specific necessities.

- Diverse Board Composition: To better fit with MRG's goal of growth and innovation inside the culinary landscape, aim for a large board with a diverse variety of backgrounds, stories, and points of view. Independent administrators ought to carry governance knowledge and corporation-precise facts to the discussion.

- Risk Management Integration: Include risk manipulation methods in strategic decision-making techniques, which include habitual checks of risks related to enterprise operation management, assets, lawful obligations, and supply chain. The risk committee should be unbiased and effective in figuring out, comparing, and mitigating risks (Al-Attar, 2021).

- Ethical Conduct and Compliance: Incorporate extra details on conflicts of interest, moral conduct, and regulatory compliance. Make sure that the Code of Ethics and its tips are always observed, and provide clear and reliable techniques for handling court cases.

- Sustainability Integration: Consider sustainability in all factors of business, from waste management to shopping components. Improve reporting and disclosure of sustainable practices to meet organization necessities and stakeholder expectancies (Kastiel and Nili, 2021).

2.3 Producing Sustainability and Other Non-Financial Reports For The Business

2.3.1 Significance

For numerous reasons, Moka Restaurant Group (MRG) finds it necessary to produce sustainability and various non-financial criticisms. First of all, MRG places a strong emphasis on sustainability, nutrition, and community involvement in their enterprise and inventive and visionary comments (Puttri and Novianti). As a result, stakeholders expect responsibility and openness about the company's sustainability policies, along with traders, clients, and regulators.

MRG's operations, including sourcing additives and waste management, heavily rely on sustainable techniques. By generating non-economic perspectives, MRG can continuously improve and monitor its operations. By monitoring performance indicators like energy consumption, waste generation, and dealer compliance, MRG can identify areas for optimization and innovation. This approach promotes a sustainable lifestyle throughout the business, coordinating operational techniques with the company's overall goals.

2.3.2 Benefits

For Moka Restaurant Group (MRG), generating sustainability and specific non-economic checks can have good-sized advantages. First and foremost, it fosters more transparency, which increases thoughtfulness and confidence among those engaged. By using strength-inexperienced machinery, getting chemicals from sustainable businesses, and being transparent about their sustainability activities, MRG may show their commitment to moral business practices and draw in clients and shoppers who are socially conscious (Naciti et. al., 2022).

Furthermore, such viewpoints offer a level on which MRG may additionally spotlight its unique value proposition and set itself out in a crowded marketplace. In addition to strengthening logo loyalty among customers who cost sustainability, highlighting tasks like donating food to charities and taking part in recyclable packaging corporations is going beyond just pleasant social responsibility. Making non-financial assessments also promotes innovation and non-save-you improvements. Regulators' or purchasers' remarks can inspire MRG to improve its techniques, guaranteeing adherence to necessities while also enhancing operational efficiency and generating top-notch merchandise. Moreover, the exams function as a valuable inner device for general universal performance assessment and strategic making plans.

2.3.3 Challenges

Producing sustainability reports and non-monetary reporting for the eating place business presents a multitude of problems for MRG. These difficulties are coupled with the intrinsic qualities of the arena. This entails handling perishable goods, fierce competition, and moving customer preferences (Almashhadani and Almashhadani, 2021). Achieving a balance between sustainability and profitability is a chief task. This company specializes in procuring its materials from sustainable sources and seeks to decrease waste through initiatives like precise component control and identifiable packaging, among others, to strike a balance between its financial viability and its environmental responsibility.

The MRG governance rules' associated birthday celebration transaction policy and code of ethics call for a rigorous evaluation of their compatibility with sustainability goals. The different trouble is navigating the complexities of hazard control. This indicates that even though MRG hooked up a hazard committee to oversee various dangers, which include belongings-related and operational risks, ongoing oversight remains vital for different chance mitigation measures like group of workers termination, hypersensitivity disruption, patron accidents, and others. Strong chance management procedures are also required within the eating place quarter, as is evident from the temporary menu adjustments brought on via substances that had been unavailable across the supply chain.

3. Issues and Recommendations

Issues: Moka Restaurant Group (MRG) has challenges in its operations associated with perishable inventory, client preference volatility, and competitiveness that make it tough to use inexperienced control practices at the same time as also growing profitability. The greatness of the information presented and the way it pertains to statistics integrity in sustainability reporting, coping with associated annual transactions, and a robust emphasis on risk management are a few crucial factors (Almashhadani, 2021).

Recommendations: MRG can enhance its governance by absolutely outlining duties and responsibilities, stopping conflicts of interest, and improving transparency. It must additionally investigate boardroom diversity and implement effective change control procedures. Addressing moral issues and enhancing sustainability control can improve stakeholder self-belief and make contributions to the employer's long-term improvement (Castrillón, 2021). Ensuring moral requirements and addressing sustainability worries can also contribute to MRG's fulfilment.

4. Conclusion

MRG is enforcing company governance concepts like IFRS 1 and IFRS 2 to transform into a market chief. This approach aligns with business standards and could create a robust relationship between the commercial enterprise and stakeholders. Reducing the sustainability Tough circumstances will protect the business, ensure continuity, and maximize opportunities for future expansion. Developing a successful commercial business version and increasing sustainable value need a holistic approach to governance and sustainability.

4. References

.png)

Essay

BUACC5930 Accounting Concepts and Practice Essay Sample

The written essay should include (but not be limited by) a discussion about the following issues:

- a (brief) history of the company and how it formed

- its key initial success drivers, financial milestones or achievements

- any major changes in its structure over its life – ie mergers/demergers/major capital management programs etc

- the generally accepted reasons that may have caused financial difficulty

- the social impact of its failure – both internally (ie staff) and externally, across the wider business community and society in general

- internal and external environmental considerations/factors

- a summary of the lessons learned

SUGGESTED FORMAT, APPROACH AND MARKING ALLOCATIONS

I. TITLE PAGE

Your title or cover page needs to convey the main information about your assignment. It must look

professional and include:

The Course Code and Name

The title of the assessment task

Name of the Course-Coordinator and of your tutor

Trimester, year and date of submission

II. INTRODUCTION

The Introduction should give an overview of your essay, possibly covering the following aspects:

Purpose of the essay

A summary of key themes, ideas, aspects covered or findings

Abridged findings/recommendations.

III. BACKGROUND: COMPANY OVERVIEW/HISTORY

A (brief) history of the company and how it formed

Initial success drivers, financial milestones or achievements

Any major changes in its structure over its life – ie mergers/demergers/major capital management programs etc

Other relevant information

IV. BODY OF ESSAY: ANALYSIS AND DISCUSSION

The main body of the essay should provide a critical evaluation of the internal and external environmental factors impacting the entities financial crisis and/or collapse. This may include a discussion and analysis around (but not limited to) the following aspects:

Environmental analysis (SCEEFLPTD); Social, Cultural, Economic, Environmnetal, Financial, Legal-regulatory, Political, Technological, Demographic.

Generally accepted reasons that caused its financial difficulty - should be identified, discussed and, where possible, explained.

Impact of its failure – both internally (ie staff) and externally, across the general business community, society and wider environmental context.

Summary of the key lessons learned

V. CONCLUSIONS AND FINDINGS

The Conclusion is your evaluation or summary of the major points and key findings (summary of lessons learned) as detailed in the Analysis and Discussion. The Conclusion should always be concise and must not contain any new information. It should draw the information together and summarise what you have found.

VI. RECOMMENDATIONS

Your recommendations are the culmination of all your work and should deliver a well rounded and thoughtful ending to your essay. The material in the body of your essay provides the basis for your considerations. The conclusion provides a summary of your deliberation over your findings. The recommendations provide the reader with your considered opinions of what would be the best decision(s) to make, or course(s) of action to follow (moving forward), based on your research and critical analysis.

For this assignment your recommendations should be directed towards both the internal management directors of the company and also any interested external stakeholders.

Solution

Abstract

The essay, report analysis, summaries and make a suitable recommendation over the financial and non financial aspects of Australia company. here as part of requirement of this essay, we have selected Commonwealth Serum Laboratories, an Australia Leading health care company for the assignment help operate in health care industry. the primary reason for selected of this company is that.

Introduction of Business Environment

Every business operates under the complex and competitive business environment and it is all upon the business to manage its exitance under the competitive culture, similarly, The healthcare industry operates within a complex and dynamic business environment that is influenced by a variety of factors such as economic, political, social, and environmental conditions. In this context, it is crucial for healthcare companies to understand the key drivers of their business environment to effectively manage risks and identify opportunities. One of the key economic factors that influence the healthcare industry is commodity prices. The demand for minerals and metals is largely dependent on the global economy, and fluctuations in commodity prices can have a significant impact on the profitability of healthcare operations.

In addition to that, healthcare companies must navigate regulatory frameworks and tax policies that vary widely across different jurisdictions. Changes in government policies can affect healthcare operations by imposing new taxes or regulations or by altering the conditions for obtaining licenses and permits. (Seaward, L., Morgan, D. and Thomson, A., 2023) The healthcare industry is also subject to social and environmental pressures, as stakeholders demand greater transparency and accountability for the impact of healthcare on local communities and the environment. This has led to increased scrutiny of healthcare companies' social and environmental practices, as well as greater demand for responsible and sustainable healthcare practices. Finally, the healthcare industry is subject to a range of technological innovations and disruptions, including automation, digitization, and the use of artificial intelligence. These developments are changing the nature of healthcare operations, creating new opportunities for efficiency and productivity, but also posing new challenges for the industry.

About The Selected Company

Commonwealth Serum Laboratories (CSL) is an Australian biotech company established in 1916 as a division of the Department of Health. It became a statutory authority in 1992 and was later privatized in 1994, listed on the Australian Securities Exchange. The company operates in over 30 countries and has major facilities in Australia, the United States, Germany, Switzerland, and the United Kingdom.

CSL specializes in developing and manufacturing vaccines, plasma derived therapies, and pharmaceuticals. Its primary focus is on producing plasma derived products like immunoglobulins, clotting factors, and albumin. These products are used to treat immune deficiencies, bleeding disorders, and respiratory diseases. Apart from plasma-derived products, CSL also develops and markets vaccines, including influenza, meningococcal, and shingles vaccines. The company is renowned for its contribution to vaccine research and development, and in 2020, it was among the first companies to develop a COVID-19 vaccine. CSL is regarded as one of the world's leading biotech companies and has won several awards for its innovative products and contributions to the industry

Some of The Key Successful Factors

CSL has made several significant contributions to the healthcare industry, particularly in the areas of vaccine development, production of plasma-derived products, research and development, and global reach. One of CSL's most important contributions has been in the development of vaccines. CSL developed the world's first influenza vaccine in 1944, which has played a crucial role in the prevention and control of influenza outbreaks globally. In recent years, CSL has also developed vaccines for diseases such as meningococcal disease, human papillomavirus, and whooping cough, helping to prevent the spread of these diseases and improving the health outcomes of people around the world. CSL is also a leading producer of plasma-derived products, including immunoglobulins, albumin, and clotting factors. (investors.csl.com. (n.d.). CSL Annual Report 2022. ) These products are used to treat a variety of medical conditions, including immune deficiencies, bleeding disorders, and shock. The availability of these life-saving treatments has had a significant impact on the lives of millions of people worldwide, enabling them to lead more normal and healthy lives. CSL's focus on research and development has also resulted in the development of innovative therapies for rare and serious medical conditions. For example, CSL's treatments for haemophilia and von Willebrand disease have been game-changers in the treatment of these rare bleeding disorders, enabling patients to manage their conditions and live longer, healthier lives. (investors.csl.com. CSL Annual Report 2022.)

Finally, CSL's global reach allows it to have a significant impact on healthcare worldwide. Operating in more than 30 countries and supplying products to customers in over 60 countries, CSL is able to provide life-saving treatments to people around the world who may not have access to them otherwise. This global presence also allows CSL to collaborate with researchers, clinicians, and policymakers globally, helping to advance the development of new treatments and improve healthcare outcomes worldwide. CSL's contributions to the healthcare industry are significant and far-reaching, from the development of life-saving vaccines to the production of vital plasma-derived products, and the development of innovative therapies for rare medical conditions. CSL's global reach allows it to have a positive impact on the health and well-being of people around the world, making it a key player in the healthcare industry.

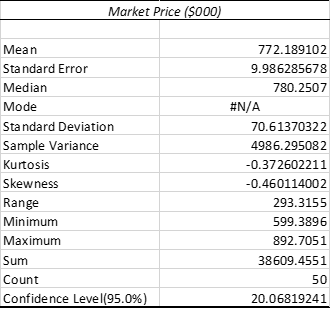

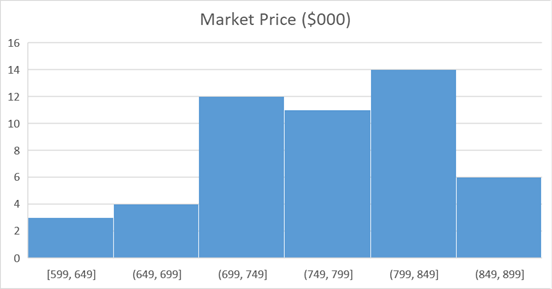

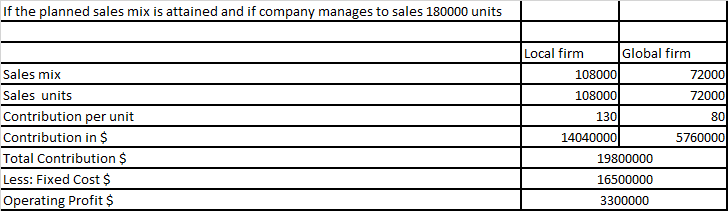

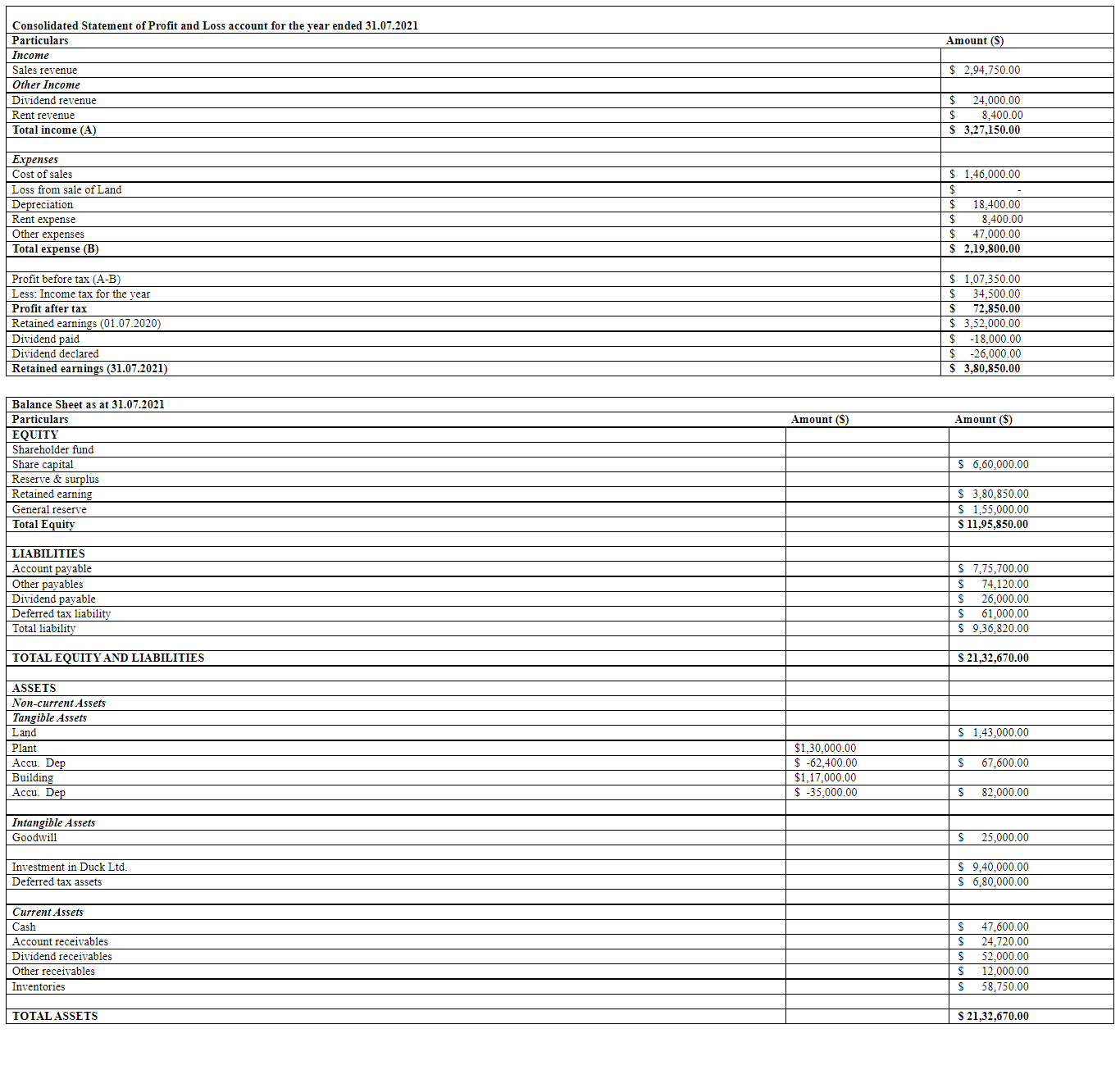

The annual report of past few years shows the summaries picture as follow.

In the year of 2020, company has ensure the earning growth by more then 20% as compare to previous years, the growth in earning was $9.8 billion as again the past year earning. (AusIMM. (2021).

Similarly, the free cash flow generated in the year of 2020 was $9.4 billion, this amount was 28% higher in the year as again the previous years.( Annual Report. (2020.).

The average return on assets in past few years was 28% which is again above the industry annual growth rate.

The high earning of company shows the high potentiality of company to convert its weakness into the strength.

The past divided distribution was average between 2 to 5 $ which shows the effective earning of 5 to 10 percentage which is again the fixed return on investment which are above the risk free rates. The company has long history for payment of dividend along with consistency.

Corporate Restructure

Over the years, CSL has made strategic acquisitions that have propelled it to become a leading global biopharmaceutical company. One of its notable acquisitions is ZLB Bioplasma AG, a Swiss plasma company based in Bern. This acquisition allowed CSL to expand its plasma collection capabilities and establish a stronger foothold in the European market. CSL also acquired Aventis Behring, a biotechnology company that was known for its expertise in developing and manufacturing plasma derived and recombinant therapeutic proteins. With this acquisition, CSL Behring was born and became a global leader in the development of life saving immunoglobulins and coagulation factors. In addition to these acquisitions, CSL also acquired Nabi, a plasma collector with US roots who contributed to the creation of CSL Plasma, the world's leading plasma collection business. CSL now has access to a vast network of plasma collecting facilities across the US, Europe, and Asia thanks to this acquisition. CSL purchased the Novartis influenza vaccine company and integrated it into its operations under the name Seqirus in order to better diversify its vaccine portfolio. Seqirus is currently the second-largest influenza vaccine manufacturer in the world and an important participant in the worldwide influenza pandemic.

In the areas of gene modification and cell transport technology, CSL also made important acquisitions. The acquisition of Calimmune, a pioneer in gene-modification and cell transport technologies, enabled CSL to increase the scope of its cell therapy offerings. Furthermore, CSL purchased Vitaeris, a biopharmaceutical business that is working to develop clazakizumab as a potential treatment for organ transplant recipients who are experiencing rejection.

Through these strategic acquisitions, CSL has built a diverse portfolio of innovative products and technologies that allow it to meet the evolving needs of patients and healthcare providers around the world. With a rich history and a strong commitment to research and development, CSL is poised to continue leading the way in the biopharmaceutical industry.

General Observation

CSL is a highly successful company with several key strengths. One of its main strengths is its track record of strong financial performance, which is demonstrated by its consistently impressive revenue and profit growth and its solid balance sheet. Another strength is its diversified portfolio of assets across various commodities, which helps to minimize the risks associated with commodity price fluctuations and changing demand. It is generally observe that CSL is also known for its operational excellence, which is reflected in its strong safety record, efficient production processes, and effective supply chain management. This has allowed the company to provide high-quality products and services to its customers consistently. In addition to that The company invests heavily in research and development, and it has a strong focus on innovation. By developing several proprietary technologies and processes, CSL has improved its operational efficiency, reduced costs, and minimized its environmental impact. CSL has a robust system of corporate governance that includes a strong board of directors, independent oversight committees, and a focus on transparency and accountability. This has helped to build trust with stakeholders and maintain the company's reputation as a responsible corporate citizen.

Internal and External Factors

CSL, like any other company, is influenced by both internal and external factors. Internal factors that can affect the company's success include the quality of management, corporate culture, workforce, and financial resources. Effective leadership, a strong culture of safety and sustainability, a skilled and diverse workforce, and the availability of financial resources can all help CSL improve productivity and drive innovation.

On the other hand, external factors such as market conditions, government regulations, technological advancements, and environmental and social factors can impact CSL's operations and profitability. Changes in market prices and demand, government policies, new technologies, and increasing scrutiny of the industry's environmental and social impact can all have a significant impact on CSL's performance. Therefore, CSL needs to adapt to these external factors to remain competitive and successful

How company can achieve its financial goals

There are numbers of corporate strategy through which an business entity can achieve its financial goal. One of them is the adoption of cost cutting strategy, where the non productive expenses and outflows are minimise and control. This strategy were being adopted by the CSL Ltd. The said company has achieve its financial goals is to focus on cost cutting measures. The company can analyze its operations and find ways to reduce expenses, such as optimizing its supply chain or reducing energy consumption. In addition to that, Another way for CSL to achieve its financial goals is to increase production of its mining and metal products. This can be done by expanding existing operations or acquiring new mining assets. Adoption and improvement of overall working efficiency, through adoption of new technology the new technology can help the business in avoiding certain expenses and cost which are not a part of expenses, new technology can help to improve the efficiency of its operations, such as by implementing new technologies or streamlining its processes. This can help the company reduce costs and increase productivity.

Conclusion

The above stated discussion indicate that CSL has strong potentiality to convert all opportunities into the business growth, in addition to that company can deliver more then what is normally expected by investors. the continues growth and efficient operation of company show the strong relation with all investors as well as stakeholders.

Reference

.png)

Reports

TACC606 Accounting Business Report Sample

Name of the Student

Name of the University

Author’s Note

Table of Contents

Introduction:

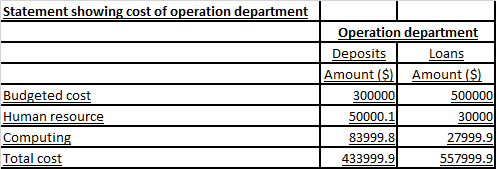

Accounting for property, equipment and plant is considered an important element to record the right value of assets in the company’s financial statement. Generally, Net PPE value is determined by Gross PPE, plus Capital Expenditure, minus Accumulated depreciation. In this business report, ranges of measurement are being discussed. Different companies are recorded PPE following different accounting methods at the end of the financial report (Chadda and Vardia, 2020). However, the matter is most important to present such financial records in a most realistic and accurate way. Information about the significant portion of total assets of an entity will be discussed after assessing financial reports of two ASX listed companies: Goodman Group and Genesis Energy Ltd. In short, the objective of the business research report is to discuss and evaluate various disclosures related to PPE recoded by each company.

Evaluate PPE disclosure of the selected companies:

According to AASB116, all tangible items are measured as PPE if they are in use of the production process or in operation as a lease or purchased. However, this standard is generally recorded as PPE which expected to be used during more than the one accounting period. Thus better position of PPE indicates that the company was in good condition to exhaust their expenditures over the period. Goodman group, the chosen company measured their items of PPE at fair value of the cost at the recognition date. Interestingly, the figure of PPE has been increased over the last 3 years. In 2020, PPE was 115.60 $M and 128.7 $M was recorded in 2021. Here Goodman group leases their office buildings, office equipment and motor vehicles. Certain investment properties and developments classified as stocks are also built on land held under claiming interests of leaseholds. The company measures and recognizes an accurate application of asset and a “lease” liability at the date of initiation of lease agreement. The financial note clearly discussed that the chosen company initially measured the asset value at cost plus direct costs incurred considering estimating costs for reinstating the underlying asset or the place where it is situated, deducting any lease incentives collected. On the other hand, the lease liability of the company measured initially at the current value of the payment of rental which are yet to be made payment on the date of the commencement, less discounted incremental borrowing rate. After such initial measurement, the lease liability is determined at cost of amortization and interest expense.

In case of Genesis Energy limited, the valuation of PPE was based on a discounted cash flow model prepared by the management of the company. The recorded financial report in 2020 clearly disclosed that the asset value 3485.04$M which was high compare to the previous year 3367.70$M.Interestingly, the second chosen company valued their assets based on unobservable market data which is based on fair valuation method. Thus the valuation of the property of the company is based on a lot of assumptions. Depreciation of the assets is generally calculated in the method of straight line where the projected value of assets is being reviewed annually. Here the leased assets of the company are recorded at cost less accumulated depreciation and losses of impairment. The leased asset is being depreciated throughout the term of lease.

Validation to add items in PPE for that measured used:

It is completely valid to add items in PPE model of both the companies gives the measured used. During the scaling of the business, it is important to add one or several items of assets which might be obtained in exchange for a “non-monetary” asset or assets, or may be to position PPE between non-monetary and monetary (Prodanova,et al., 2022). The cost of such an item will be assessed at fair price unless the substitute transaction lacks substances related to commercial. However, the fair value of the adding items in PPE is reliable measurable if the possibilities of the several estimates within the range can be considerably assessed and practiced or the inconsistency in the range of fair value measurements is not considerable for that adding up assets.

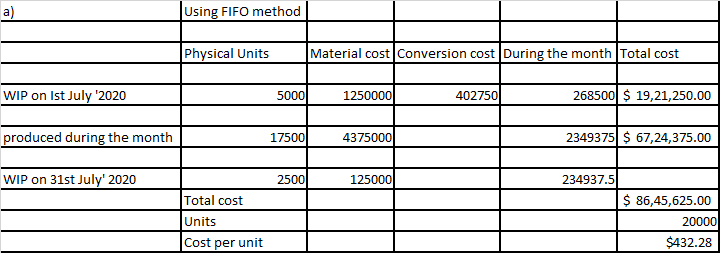

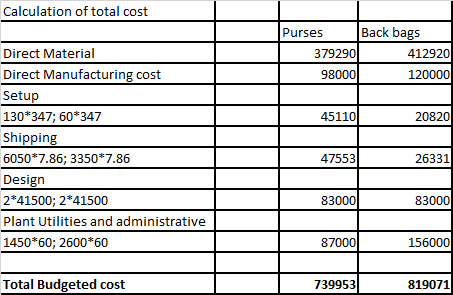

Interpretation of total amount of PPE in the financial statement:

Plant, Property and Equipment are generally interpret the total amount long term fixed assets of the company which is tangible, identifiable and expected to generate an economic return for more than one operating cycle of the company. Here the total value of PPE can be derived from Gross PPE with adding up capital expenditures, less accumulated depreciation for the financial year. Based on the recent year’s reports of Genesis Energy LP, the company has been expecting to invest in fixed assets to sustain growth by aiding in operations.

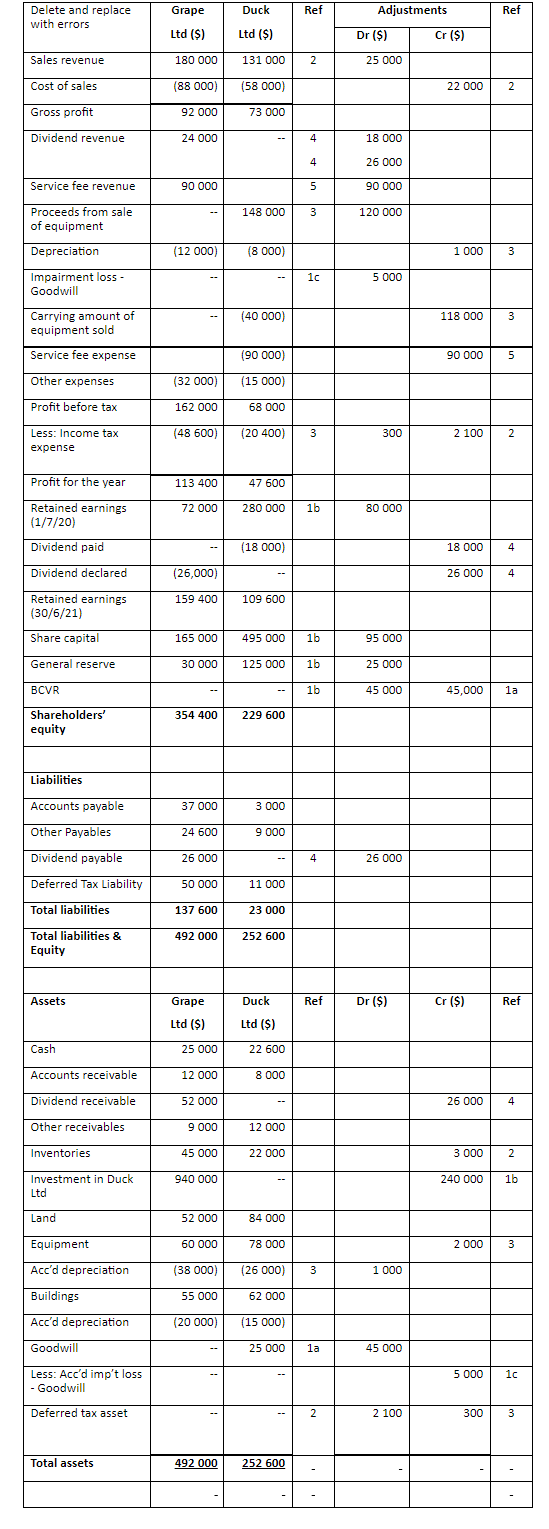

.png)

(Source: Genesis-energy LP, 2021)

Initially, the carrying values of PPE items were valued at costs which are significant in relation to the total costs. Here Genesis Energy Company practiced revaluation method. Generation assets were revalued at 30th June 2021 to $3273.2 million resulting in a net gain of revaluation of $191.5 million. Here the carrying value of assets in June 2020 derived from $3177.2 at fair value of cost deducting accumulated depreciation and impairments which reduced the end carrying value of assets from $3662.5 to $3367.7 million (accumulated depreciation figure $294.9 million. It has been found from the financial report (specifically in Balance sheet) that assets were generated through following revaluation method $191.50 million. Interestingly, accumulated depreciation was increased from the year June 2020 ($535.1 million) to June 2021 ($570.7 million).

On the other hand, investment in plant, property or equipment of Goodman Group has been increased which disclosed in their financial report from $115.6 million to $128.7 million. Investment properties are carried at fair value. Here the fair value of stabilized investment properties of the Goodman Group is calculated considering present prices in an active market for similar properties in the same condition and location and also allowing for same lease and other contracts. The “carrying” value of PPE at the end of the financial year interprets the amount of newly acquired assets list of capital expenditure, and net gain from fair value adjustments and so on.

.png)

(Source: Goodman Group, 2022)

The value of assets are initially measured at cost plus any direct costs associated like labour costs, to restore the underlying assets less any lease incentives received over the particular period. In this way, total amount for PPE is being interpreted from the statement of financial.

Measurement comparison used by the several companies for same type “items” in PPE and finding inconsistencies, if any:

PPE is measured as per revaluation model or cost model by many companies considering the benefits as per the company’s financial requirements over the period (Karim, Islamand Bhuyan, 2020). PPE firstly recorded at its costs, consequently priced either using a revaluation model or cost and depreciated later, which indicates that such “depreciable” amount can be comprised on a methodical basis over the useful life of PPE. The carrying amount of PPE under the cost model, is generally being measured at its cost less accumulated loss and accumulated depreciation for impairment of assets. Goodman Group has been used such cost model in contrast of Genesis energy LP which used revaluation model for measuring PPE items for their company. Under the revaluation model, an asset is recorded at the revalued amount less depreciation which is accumulated and any losses of impairment. Generally the management of the company uses this revaluation method to ensure most accurately the fair value of PPE (Prodanovaet al., 2022). However, the business entities can switches from cost model to revaluation model, but there is no need for applying this change in the accounting policies. The chosen company, Genesis energy has previously experienced fluctuation in fair value of some items of PPE. Thus, all items of property, plant, and equipment was then revalued by the management and reported accordingly. Compare to cost model, the revaluation model helps to avoid inconsistencies of assets and the reporting figure in the financial statements that ascertain different values or cost at different date. Revaluation gain is recorded in the balance sheet as equity as a separate capital reserve, called “revaluation surplus”. On the other part, revaluation loss is being booked in the “statement of income” as considering expense. However, if there is some balance in the revaluation surplus presents in the accounts of the company from any previous revaluation gains of the same asset, that surplus of revaluation amount will be adjusted first and accounted for. Any excess revaluation loss will be recorded in the statement of income of companies. In that circumstances and for treating those surpluses and losses, the company will measure their PPE items of similar categories under revaluation model. As cost model is relatively simpler than other model of PPE measurement and it is based on cost of historical principles, inconsistency can be found in the fair value changes of PPE over the period.

Considerable factors that important for setting up accounting policies for the company relating to PPE:

Accountants need to evaluate various factors before establishing company accounting policy relating to PPE. In case of structuring of PPE model for the company, all the factors such as useful life of the asset, depreciation method for PPE, correctly determination of value of assets, policy for PPE impairment and so on.

Detailed discussion of above mentioned factors are as follows:

Functional life of an asset: Useful life is generally indicates approximate efficacy period imposed on a range of the business entity’s properties. This information provided by the accountant is valuable for setting up accounting policies to PPE because useful life of assets forecasts end at the point where assets are anticipated to become outdated. The design of the valuable life of each asset, premeditated in years can be practiced as a reference to make the depreciation plans for inscribing outflows associated to investment purchase of goods for the company.

Depreciation method for PPE: Choosing right depreciation method for PPE valuation is significant as the accounting standard defines such depreciated value is a systematic allocation of fund over its useful life which can be used for cash collection or capital generation for the business. The carrying amount of PPE items can be measured by applying “straight line” method or reducing method or unit of production method. For instance, Genesis Energy uses the straight line method for valuing long lived assets to cover the total costs of an asset over its lifespan instead of recovering their purchase costs on an immediate basis. In accelerated method for PPE calculation, which generally creates more depreciation in early phase of the fixed asset. It considers the point of income tax which is a reasonable factor to make difference the value of assets for this reason.

Appropriate asset valuation: It is indeed an important factor for PPE to make an accurate asset valuation which is all about setting the right value of property including inventories, houses, equipment or land. It is typically happened when the management of the company is to make a decision to sold, taken over or insured their fixed assets. Such perfect valuation thus is significant factor for PPE to generate maximum cash for the growth of the business in future.

Impairment policy of PPE: As prescribed in accounting policy, an accountant must not carry an asset in the firm’s financial statements an exceeding highest amount which might be recovered through its sale or use. If the carrying amount of asset exceeds the recoverable amount, the asset is described as impaired then (Hladika, Gulin and Bernat 2021). Thus the accountant must maintain such impairment policy to provide the right information to the stakeholders of the company. In case the accountant find its fair market value of PPE items is less than its carrying amount then, it should be recorded as impairment loss for that difference. Therefore, accountant practitioners must be practiced their impairment policy of PPE with full conviction and clarity in books of accounts.

Initial and consecutive recognition criteria of PPE: An Accountant must initially measure their PPE items at its costs. However, there is a choice of subsequent measurement. The criteria of the recognition must be fulfilled with discussing the matter with the management of the company. For instance, Genesis Energy LP used revaluation model for the PPE recognition after initial measurement of assets at its costs. On the contrary, Goodman Group used cost model and allocate depreciable asset value on a periodic basis over its useful life. Here the fair value variations were being ignored while accounting those records into book.

Detailed observation on succeeding measurement of PPE:

Initially PPE must be recorded at its cost which includes purchase price of the asset adding up duty of import, directly associated costs (cost of installation, freight in, site preparation cost, testing, professional fees, and inescapable costs such as disassembling, removing and reinstating the site cost. Policy setters however, will definitely choose either the cost or the revaluation model in the subsequent phase of measurement of PPE. Under paragraph 6 of AASB 116, items of PPE are tangible in nature and expected to be used for more than one period. Thus subsequent measurement policies of PPE need to have an immense importance for the accounting practitioners. For the purpose of accounting, entities need to be measured subsequent expenditures for determining if it may be capitalized or treated as expense at the time of occurrence.

However, the asset recognition criteria must be fulfilled in case of subsequent PPE expenditures. It means that future economic benefits or the ability to contribute to the objectives of the entities for delivering goods or services for one that one accounting period can be capitalized. On the contrary, subsequent measurement for that expenditure on an item of PPE that fails to meet the recognizing criteria of asset at paragraph 7 of AASB 116 shall be considered as expense and positioned in the income statement of the company’s financial records at the end of the reporting period. Under the model of cost, if fair value calculates correctly, the value of the asset then should be calculated at its cost value, subtracting “accumulated depreciation” less “loss of impairment”.

To categories most PPE, AASB specifies the accounting treatment of PPE while recording the books of accounts in the financial statement at the end of the financial year. The cost model incorporates items of PPE being held at a lower price of depreciation and loss of impairment. On the other hand, the carrying amount of PPE whose fair price can be quantified reliably utilizing the revaluation model. In other words, where reliable cost measurement can be attained it is like that the expenditure would produce future economic benefits in case of subsequent expenditure on an item of PPE are for a part of replacement, major inspection, and enhancement or for safety or environment equipment. Here the fluctuations of fair value can be measured and accounted for at the end of the financial period. Under this model, the accountant shall take asset’s carrying value at its PPE’s fair value at the time of the revaluation less any following accumulated depreciation and loss of impairment. In other words, the asset is carried at the rate of revaluation if the model of revaluation is being practiced. This formula of measuring PPE items under this revaluation model is the fair value less asset’s cumulative depreciation along with any lack of impairment.

Recommendations to accounting standard setters related to PPE measurements:

Perfect policy choices must be taken considering the use of the PPE items of an entity. Interestingly, accounting standard setters are already discussed that such assets must be measured considering either the expense model or the model of revaluation. This is completely a management oriented decision whether which model will be choices later in the subsequent expenditure measurement of PPE items. As per the cost model, if fair value can be measured truthfully, the asset shall be priced at its cost subtracting “accrued depreciation” less loss of the value of impairment. On the other hand, the revalued sum is equal to fair value at the time of revaluation less following up any accrued losses of impairment and depreciation under the method of revaluation model. According to AASB 116, it is recommended to practitioners that all assets in the same group can be re-examined if one value is revalued. For instance, if the management of an entity wishes to revalue its equipments or buildings, and recorded to have five buildings and ten machineries, then it will re-evaluate all number of equipment and buildings of that entity. For simplicity reason, the cost model is always preferred and easy to measure PPE items for subsequent measurement purpose over revaluation model. However, an important recommendation for changing one measurement model to another can be taken place by any entity for better presentation of fluctuations of fair value where cumulative depreciation is calculated and any lack of impairment.

Conclusion:

The above report clearly discussed principles considered for identifying items of PPE as prescribed the accounting standards. However, different companies are followed different policy to record subsequent expenditures of entities after the initial measurement of PPE at cost. The above chosen both companies are followed different measurement policy for their PPE items. It makes it rational for PPE to be calculated at “Cost plus other accumulation” for obtaining the item of PPE’s definite cost for prospective purposes of valuation. The sum of the less accrued depreciable asset moves to the statement of performance (B/S) and the fee over the period goes at a cost to the P/L statement. Undeniably, both the chosen firms attain the right depreciation amount of assets and fulfilled requirements of overseas reporting from any assessment. Thus PPE reporting and measurement process is vital for any business firms at the financial year end.

Appendix:

Goodman Group Balance Sheet 2021-2022

Genesis Energy, LP Balance Sheet

References:

.png)

Reports

5011SP5 Accounting for Management M Report Sample

Learning Objectives addressed in this assessment:

CO1: Apply basic accounting principles and concepts to understand what accounting information is, what it means and how it is used;

CO2: Explain the significance of accounting information in the business environment;

CO3: Read and interpret financial reports and apply knowledge to critically analyse corporate financial and non-financial information.

Graduate Qualities developed by this assessment:

GQ1: You need to operate effectively upon fundamental accounting practical knowledge;

GQ2: You are prepared for lifelong learning and professional practice;

GQ3: You are working to be an effective business-related problem solver;

GQ4: You can work autonomously and independently;

GQ5: You are committed to ethical action & social responsibility for business activities.

GQ6: You can communicate effectively in written language.

This assessment involves 2 (two) parts: (1) a Written Business Consultation Report (80%); (2) an Oral Presentation of your Consultation Report to Company A (20%). Your total marks for this assessment will be based on the successful completion of both tasks.

This assessment can be completed individually, or in a group of no more than two students (These two students must enrol in the same class to complete the oral task together).

Required:

Write a consultation report for CSL Limited

(1) Choose CSL, a pharmaceutical company from the list of Selected ASX Listed

Pharmaceutical Companies, which is provided as a separate file under Assignment on the course website. One company will be CSL Limited (ASX: CSL) (that has been specified earlier) and the other will be used as a benchmark for analysis against CSL Limited.

Note: If you cannot find an appropriate company when following the above selection rules, you may randomly select a company from the list. However, you need to clearly state the reason for the selection you make in your assignment.

(2) After selecting the two companies, go to the company information database DatAnalysis

Premium via the UniSA Library website. Under Company Reports, search for the companies you selected according to their ASX Codes or part of the company's names. Next, go to Financial Data to review these companies’ financial statements for the financial years from 2020 to 2022 (should 2022 data are not available for the company chosen, you can use data from 2019 to 2021). Hint: Provide a Full Analysis of these Companies’ Financial Ratios across 3 years.

(3) Based on the available data, calculate 3 (three) years (2020-2022) financial ratios of CSL Limited and the selected benchmarking company. Based on these ratio results, analyse and compare the financial performance of these 2 (two) companies. Your calculation and comparative analysis should focus on any 2 (two) of the following four points (explain why you choose these two):

a) Which company is more profitable and generates healthier returns?

b) How well are the two companies managing their resources? Do you think Company A is more efficient in managing its assets compared with the benchmarking company?

c) Can Company A meet its short-term debts? How is its liquidity compared with the bench marking company?

d) Do you think Company A will stay in operation in the long term? How is its long-term financial stability compared with the benchmarking company?

Your answer should be supported by sufficient evidence (i.e. financial statement data and/or ratio results) and analysis. You can also review the annual reports of the two companies for the last three years (Annual Reports are available to download in DatAnalysis Premium), and use the information disclosed in these reports to complement your answers. For example, whether there are issues of concern mentioned in the annual reports that can imply Company A’s financial health and risks and how this might influence your comparative results.

(4) Go to the benchmarking company’s website and investigate whether and how it reports information about sustainability issues, such as carbon emissions, energy consumption, or community contributions, in its annual reports or stand-alone sustainability, CSR (corporate social responsibility), or environmental reports. Do you think Company A should follow what the benchmarking company is doing? Do you support the view that they have performed optimally for its sustainability reporting by Company A, or do you think the company should

prioritise profit growth more? Explain your views.

Solution

Introduction

Rationale for Selected Company

Financial Ratio Analysis

Company Selection

Hydration Pharmaceuticals Company Limited is a consumer product company that sells tablet liquid and powder products in the North American markets of Canada and the United States. For Assignment Help, Healthy Hydrated Solution markets sit in overlaps of over-the-counter medicines, functional vitamins, and mineral and vitamin supplements, which will help, boost health and wellness with a range of rehydrating products.

CSL Limited is an Australian Biotechnology company that develops, manufactures, and conducts research and market products for preventing serious medical human conditions. CSL Limited is considered a global biotechnology company with dynamic portfolios of life-saving medicines for treating immune deficiency and haemophilia, an immune deficiency, and a vaccine for preventing influenza (Csl, 2023).

Rationale for Selected Ratios

In this study, Hydration Pharmaceuticals Company Limited will be chosen as the benchmark company as both companies are multinational companies and these companies have significant changes in their revenue growth in each financial year. Both of these companies are involved in dealing with chemical products and both of the countries have an origin in developed economies.

Financial Analysis of CSL Limited

Liquidity Analysis

The liquidity Ratio for CSL Limited for the years 2020, 2021, and 2022 came at 3.01, 2.38 and 2.51 respectively. In financial markets, investors will conduct investment discussions with the level of risk perception and available information and study business trends (Jermsittiparsert et al., 2019).

Profitability Analysis

From the ratio analysis, it can be stated that CSL Limited experienced growth in its profitability while Hydration Pharmaceuticals Company Limited experienced significant losses for the three financial years of 2020, 2021 and 2022. The Cash Ratio of CSL Limited for the financial years 2020, 2021, and 2022 was .55, .58 and 1.4.

Financial Analysis of Hydration Pharmaceuticals Company Limited

Liquidity Analysis

Financial ratio plays a vital role in revealing corporate financial soundness, which helps enterprises maintain their competitive positions achieve stable development and eliminate potential risks (Kliestik et al., 2020). The current ratio is considered the liquidity ratio, which helps to analyze if the firm possesses enough resources to meet its short-term liabilities. It is generating by dividing the total current assets by Current liabilities.

The liquidity ratio of Hydration Pharmaceuticals Company Limited for the years 2020, 2021 and 2022 came at 9.02, 7.43 and 7.4. A current ratio above two implies that the company possesses enough current assets than liabilities for meeting its short-term debt obligation. The current ratio of less than one will imply that the company will face significant difficulty in meeting its debt obligations.

Profitability Analysis

Hydration Pharmaceuticals Company Limited's Current ratio came above 6 for three financial years. It implied that the company possesses enough cash and is more than capable of meeting its debt obligations. The gross profit Margin is calculated by dividing the gross profit by the revenue of the company. In certain situations, due to a sudden decrease in revenue because of external factors company may experience a negative gross profit margin ratio. The Cash Ratio of Hydration Pharmaceuticals Company Limited for 2020, 2021, and 2022 came at 7.2, 5.1 and 5.18 respectively.

The negative gross profit margin ratio of Hydration Pharmaceuticals Company Limited implies that the company has not been able to control its costs of production. From the financial report of Hydration Pharmaceuticals Company Limited, it is found that the company experienced a severe net loss for the financial year and generated a loss per share. The revenue of Hydration Pharmaceuticals Company Limited for the years 2020, 2021, and 2022 came at 6127178$, 3756695$, and 296285$ while the net loss came at 8951661$, 743663$ and 3434151$. The loss per share for 2020, 2021, and 2022 came at .06$, .01$, and .12$ respectively.

Comparative Analysis

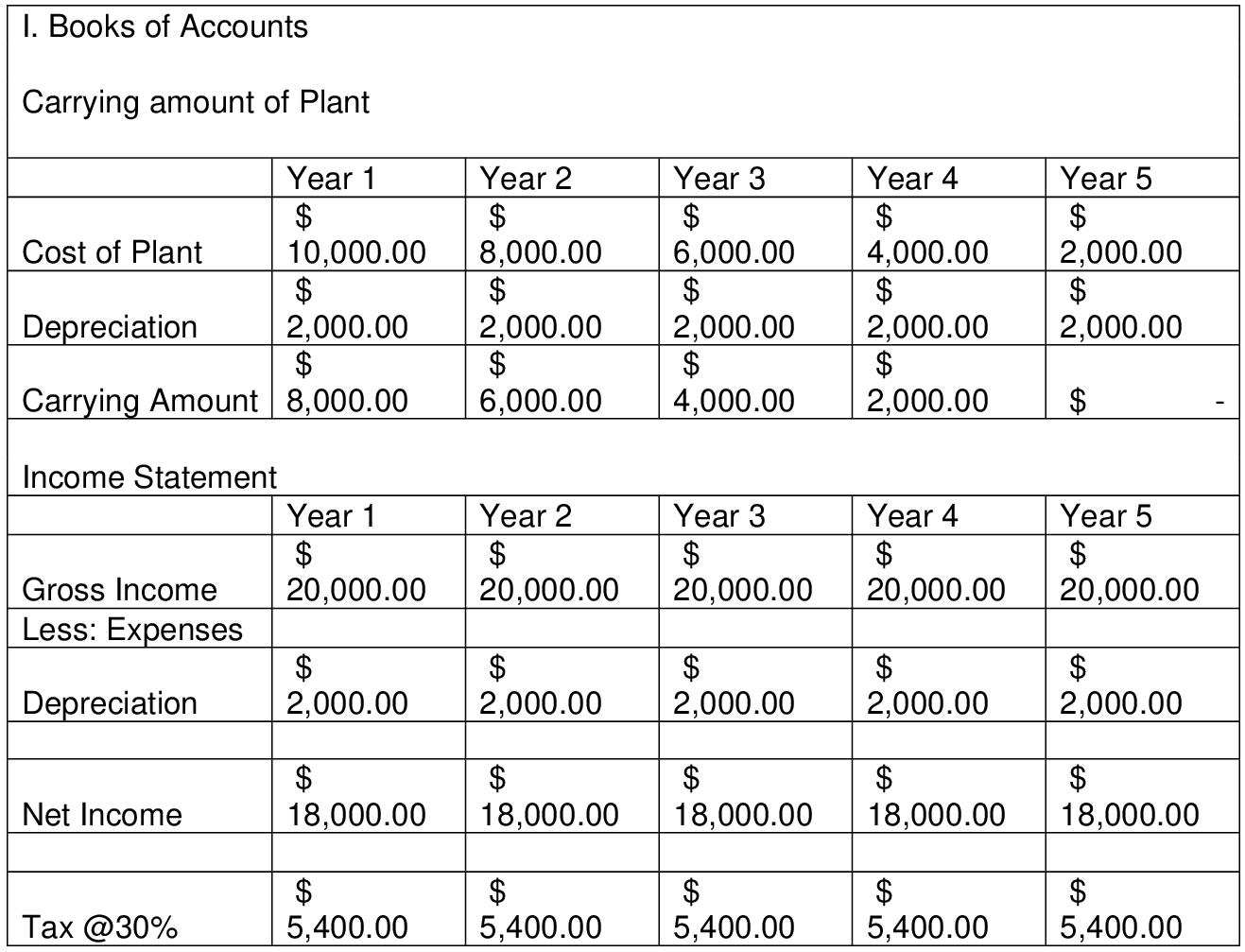

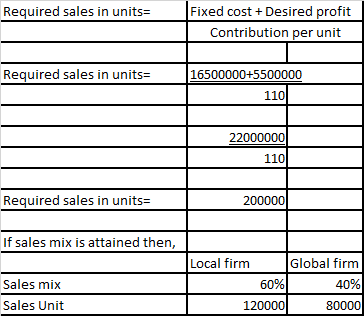

Profitability Ratio

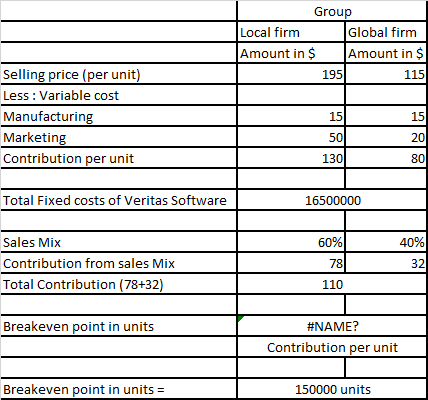

.png)

Figure 1: Profitability Ratio of CSL Limited

(Source Self-created)

Financial statements include the income statement, balance sheet cash flow statement, and accompanying notes (Brown et al., 2022).From the data obtained from, the financial statements from 2020, 2021, and 2022 of CSL Limited and Hydration Pharmaceuticals Company Limited, it is found that CSL has agreed to health reasons for its sustained growth. Hydration Pharmaceuticals Company Limited has incurred significant losses for the three financial years. CSL Limited was more profitable and generated healthier returns. It also experienced significant growth in its profitability that is considered vital for maintaining the company's sustainable growth. Ratio analysis plays an important role in improving diagnostic accuracy (Pascal et al., 2021). It can be agreed with the fact that Company A (CSL Limited) is more efficient in managing its assets in comparison to Company B (Hydration Pharmaceuticals Company Limited). Even with greater revenue and asset Hydration Pharmaceuticals Company Limited have been unable to conduct effective utilization of its resource to enhance its business performance on the other hand, CSL Limited with less revenue and cash in hand have been able to generate sustainable and healthy profits while conducting its business operation in the three financial years.

Liquidity Ratio

The capital market plays a vital role in meeting the capital needs of the business world for developing and being sustainable (Pattiruhu, 2020). In accordance with the benchmark Company (Hydration Pharmaceuticals Company Limited), it can be stated that the liquidity ratio of the benchmark company is greater than that of CSL Limited. The liquidity ratio of Hydration Pharmaceuticals Company Limited is considered to be greater than 5. In case of meeting short-term debts, Hydration Pharmaceuticals Company Limited will be able to meet its short-term debt obligations while CSL Limited will face significant challenges in meeting its short-term debt obligation as its current ratio is significantly low and it poses significant liabilities in comparison to its assets.

.png)

Figure 2: Liquidity Ratio

(Source Self-created)

Pre-components Percentage Analysis is used to compare one account to the total account (Sihombing et al., 2022). From the analysis, it is concluded that Company A will be able to stay in operation in the long term. The Hydration Pharmaceuticals Company Limited has experienced significant losses over the three consequent years. The company was experiencing yearly losses while CSL Limited will be able to stay in operation for the longer term as the company was experiencing more than 10% revenue growth in each financial year. Hydration Pharmaceuticals Company Limited is experiencing a steep decline in its revenues and is experiencing severe losses so it will be significantly challenging the company to sustain in the longer run.

.png)

Figure 3: Quick Ratio of Hydration Pharmaceuticals Company Limited

(Source Self-created)

Sustainability Reporting Initiatives

Corporate Social responsibility is considered as a management concept where companies integrate environmental and social concerns in their business operations and interactions with stakeholders. The emission of greenhouse gasses from the combustion of fossil fuel is related to the earth's climate warming and air pollutants, contribute to global warming. CSR is significantly generalized in categories like environmental responsibility, human responsibility, and economic responsibility. It helps companies build credibility and trust with their stakeholders. Hydration Pharmaceuticals Company Limited’s environmental and social issues are reported in its financial statements. The annual financial statement implies that the company operations are not regulated by any kind of environmental regulations under any kind of commonwealth law. Long-term incentives is intended to reward executives’ sustainable long-term growth. It is aligned with shareholder interests. Hydration Pharmaceuticals Company Limited is required to allocate a significant percentage of its net profits towards corporate social responsibility activities. It manufactures rehydration electrolyte products and the company educates the causes of management.

Should CSL Follow the Same

Company A (CSL Limited) should not be following Company B (Hydration Pharmaceuticals Company Limited) in reducing its environmental emissions. The key energy sources of CSL manufacturing factories are considered as natural gas and electricity (Csl, 2023). In CSL plasma network centers electricity is the main source of energy. Combined manufacturing and CSL plasma Centre have significantly contributed to MOT of CSL energy Consumption and greenhouse emissions. As part of its sustainability strategy, CSL has adopted for sustainable future for employees, patients, and communities. CSL announced Carbon emissions that serves as a transparent roadmap for decarbonizing global operations by cutting down carbon emissions. CSL announced the building of cell-based influenza vaccines CSL proprietary and Q fever vaccine. CSL facilities will help implement onsite renewable energy generation, electrification to reduce reliance on natural gas, reclaiming water reuse, and heat recovery for the waste management process.

In the year 2020, CSL Limited announced its first emission reduction targets. Based on its targets, CSL Limited has committed to a 40% reduction in Scope 1 and Scope 2 emissions by the year 2030 using the averages of CSL's FY19-21 emissions as the basis (Csl, 2023). CSL has announced them by the year 2023 it seeks to reduce emissions, which is associated with its operation, and ensure suppliers will contribute 67% per cent of Scope 3 Emissions are associated with science-based target initiatives and CSL targets are being aligned to limit global warming to 1.5 degrees Celsius. In addition to climate resilience, emission reduction and energy are considered as key components in CSKL corporate sustainability strategies and are committed to proactively adapting and mitigating climate changes. CSL supports the use of proper mechanisms for addressing climate change, which are consistent with international approaches and are designed to encourage investment and innovation in GHG emission mitigation technologies while also limiting adverse effects on national economies.

Sustainability Reporting by CSL Limited

Company A (CSL limited) should implement its sustainability initiatives as the world is moving towards an eco-friendly approach it will help in maintaining the company's sustainable growth in the long run. CSL Limited's commitment to a healthier approach implies delivering to both the planet and its people. CSL Limited seriously takes this responsibility to further maintain environmental considerations in buying which will help in delivering a sustainable world for the next century. CSL Limited recognizes responsible management and efficient use of natural resources that are vital for a company's sustainable growth. CSL Limited recognizes that responsible management and efficient use of natural resources are key to the company's suitable growth and will help in implementing its ability to deliver an effective and reliable supply of life-saving medicines. CSL Limited supports meeting the goals of the Paris Agreement for avoiding the worst climate change impacts that are being identified by the intergovernmental panel on climate change. CSL Limited continues to execute the sustainability strategy for integrating sustainability considerations in business decisions and reducing carbon emissions (CSL, 2023).

Conclusion and Recommendation

To conclude we can state that, the consultancy report of Hydration Pharmaceuticals Company Limited and CSL Limited consultancy report has been prepared. The financial position of the two companies for the three financial years has been analysed to evaluate the financial health of the company. The liquidity ratio and the gross profit margin ratio have been evaluated for three years to evaluate the company's financial performance. Hydration Pharmaceuticals Company Limited has incurred a significant amount of losses in the three financial years of 2020, 2021, and 2022 while CSL Limited has experienced significant growth in its profitability that will help in maintaining its sustainable and healthy growth. In terms of reducing environmental emissions and implementing CSR responsibilities, CSL Limited has a significant edge over Hydration Pharmaceuticals Company Limited. CSL Limited has specific emission reduction targets while operations of Hydration Pharmaceuticals Company Limited are not under the jurisdiction of Commonwealth Law. To improve the business performance CSL Limited and Hydration Pharmaceuticals Company Limited can adopt further clarification of their business plan and adopt a flexible financing structure, which will help in improving their business operations and help in maintaining long-term sustainable growth.

Recommendations

- Evaluating and Clarifying Business Plan :

A business plan is a road map for financial, marketing, operational, and financial standpoints. Hydration Pharmaceuticals Company Limited will have to adopt modern technologies in its cost of production to reduce its operational cost, for the company to be able to experience profitability growth in each financial year. A sustainable business plan is required to be adopted and proper evaluation must be done to deal with the shortcomings. In the case of CSL Limited, the Company has to continue its business operations and avoid acquiring further liabilities or it may face bankruptcy for being unable to meet its debt obligations. Proper experts must be hired to implement an effective business plan that will help in maintaining sustainable growth of the company and maintain environmental ethics while continuing its business operations.

- Adopting Flexible Financing Structure

Financing structure refers to the mix of equity and debt, which are used by a company to finance its operations. Hydration Pharmaceuticals Company Limited has to implement asset utilization to increase its revenue generation and reduce its operational costs. For example, the company may allocate some jobs to ex-employees with expertise, which will significantly improve the quality of the output. Employees can be provided with flexible working hours to increase their productivity. In the case of CSL Limited, the company must focus on reducing its liabilities and implement debt restructuring so that it will not affect its business operations. It will help CSL Limited to avoid the chances of bankruptcy and avoid being sued for debt.

Reference list

.png)

Coursework

BE167-7-AU: Accounting and Finance for Managers Assignment Sample

AIM:

This assessment aims to provide you with an opportunity to reflect on the concepts you have learnt during the course of Accounting and Finance for Managers lectures and seminars. It will assist you in developing your ability to apply concepts to practice in the light of your experience while qualifying for the master’s degree.

You are required to write a report analysing the financial performance of a selected publicly listed company (please refer to submission guidelines for the choice of the company) for the latest THREE consecutive years, as a minimum. The report should include the following:

REQUIREMENTS:

a) Provide an introduction with a background of the business in question (e.g. strategy, prospects, competitor analysis, SWOT analysis).

b) Calculate at least three profitability ratios of your choice to support your analysis. Critically evaluate the profitability position of the company.

c) Calculate at least three efficiency ratios of your choice to support your analysis. Critically evaluate how the resources of the business are managed.

d) Calculate at least three investment ratios of your choice to support your analysis. Critically evaluate the investment position and potential opportunities of the company.

e) “Although ratios offer a quick and useful method of analysing the position and performance of a business, they suffer from problems and limitations” (Atrill and McLaney, 2019, p. 234). Do you agree with this statement? Discuss with examples from the above analysis to support your argument. Briefly indicate the alternative approaches to overcome limitations of ratio analysis.

Solution

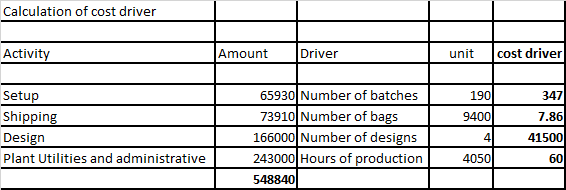

1. Introduction

Clarksons is one of the reputed companies which provide robust solutions for shipping companies. The company's brief introduction is presented in the report along with its strategies, future prospects, competitor analysis and an internal evaluation of the company using the SWOT matrix. For Assignment Help, The report also analyses the performance and financial health of the company by utilising several ratios. Lastly, the report discusses the limitation of these ratios and provides an alternative considering their limitations.

1.2 Company Background

Clarksons is a firm that works across departments to ensure that everything it does is supported by data, made possible by technology, and carried out by the most capable workers in the industry (Clarksons.com, 2022). The breadth of the company's reach, the quality of its connections, and the comprehensiveness of its service offering combine to produce exceptional outcomes. As a long-term business associate, it advises customers on the best course of action throughout the shipping process (Clarksons.com, 2022).

1.3 Company Strategy

The company's strategy is to strengthen its position as a leading provider of services throughout the marine, offshore, commerce, and energy industries to provide its customers with tailored business strategies that help them make more informed choices (Clarksons.com, 2022). The company's commitment to Renewables and sustainability competence puts it in a prime position to spearhead this crucial shift as the market moves inexorably toward an increasingly sustainable future (Clarksons.com, 2022).

1.4 Future Prospects

The company's prospect is to adapt to the ever-changing needs of the global marine, offshore, commerce, and energy industries via its market-leading technologies and analytics to facilitate wiser, healthier international trade (Clarksons.com, 2022).

1.5 Competitor Analysis

.png)

.png)

Table 1: Clarksons’ Competitor Analysis

(Source: Created by author)

1.6 SWOT Analysis

.png)

.png)

Table 2: Clarksons’ SWOT Analysis

(Source: Created by author)

2. Profitability Ratio Analysis

The profitability ratio compares operating expenses, sales, and equity to illustrate Clarksons' capacity to generate profits. A greater ratio is preferable since it indicates that Clarksons is well-positioned to sustainably generate profits (Bigel, 2022). In light of the importance of profitability ratios, the following three ratios are calculated to determine Clarksons' profitability.

2.1 Gross Profit Margin

The term "gross profit margin" refers to the amount of money left over after expenses have been subtracted from sales. The number is standard and essential as a fundamental indicator of Clarksons’ financial health (Bigel, 2022).

.png)

Table 3: Clarksons’ GPM Analysis

(Source: Clarksons.com, 2022)

It can be observed from the above table that Clarksons’ revenue in FY 2020 declined, which is directly attributed to the pandemic. For example, ocean freight from Chinese ports declined by 10.1% during the pandemic. Air freight volumes declined by 19%, causing a significant halt in the logistics industry (Ifc.org, 2021). However, even with the fall in revenue during the pandemic, Clarksons maintained a consistent GPM of 96% throughout the analysis period with slight fluctuations. It, therefore, indicates that the company is in good financial health and has the capacity to maintain its profitability.

2.2 Return on Assets

Clarksons’ capacity to create profit from its assets may be measured by calculating its return on assets. In other words, Return on Assets (ROA) is a metric used to assess how effectively Clarksons’ management is able to transform its entire balance sheet assets into net income (Hilkevics and Semakina, 2019).

.png)

Table 4: Clarksons’ ROA Analysis

(Source: Clarksons.com, 2022)

It is evident from the above table that the company incurred massive losses during FY 2019 and 2020. It can be seen that in FY 2019, the company incurred a £10.9 million net loss, and in the following FY 2020, it incurred a £25.8 million loss (Clarksons.com, 2022). It can also be observed that the company’s total asset has also decreased by £46.7 million from the previous year. The fall in total assets is primarily due to the decrease in right-of-use assets Clarksons.com, 2022). Moreover, during the pandemic, container freight rates surged dramatically, which led to losses. Higher than-average prices were charged when shipping to South America and western Africa (Unctad.org, 2019). Freight rates connecting Asia and the eastern coast of North America increased by 63% between 2020 to early 2021, while prices between China and South America increased by 443% (Unctad.org, 2021). However, as the pandemic subsided, the logistics industry recovered, which is evident from the increased net income of the company and positive ROA of 8%.

2.3 Operating Profit Margin

Operational performance metrics (OPMs) measure how well Clarksons’ operations are managed. A healthy business, for instance, is one that has higher operating profit growth than sales growth (Faello, 2015).

.png)

Table 5: Clarksons’ OPM Analysis

(Source: Clarksons.com, 2022)

It is evident from the above table that the company had an operating profit of £1.4 million; however, due to the net losses, the company's OPM stood at -13% in FY 2019 (Clarksons.com, 2022). It worsened during FY 2020 when the company incurred operating losses of £14.7 million. It is due to a significant increase in administrative costs, which included data populating, research spending, and employee training (Clarksons.com, 2022). Expenses for depreciating intangible assets having limited lifetimes, such as a company's Forward Order Book on an acquisition and Trade name and non-contractual commercial relationships (Clarksons.com, 2022). However, in FY 2021, the company incurred operating profits of £70.8 million. It was primarily due to increased revenue in FY 2021, which was greater than the administrative expense, even though it increased in FY 2021.

3. Efficiency Ratio Analysis

It examines the extent to which Clarksons makes effective use of its assets and liabilities. Clarksons may use this information to gauge whether or not its investments in people and machinery are yielding satisfactory returns (Faello, 2015). In light of the importance of the efficiency ratio, the following calculations are conducted to determine Clarksons' efficiency in managing its resources to generate profits.

3.1 Inventory Turnover Ratio

The inventory turnover ratio quantifies how often Clarksons sells and restocks its goods over a certain time frame. If Clarksons has a high inventory turnover ratio, it means it efficiently moves through its stock (Bigel, 2022).

.png)

Table 6: Clarksons’ IT Analysis

(Source: Clarksons.com, 2022)

It can be observed from the above table that Clarksons' IT ratio has gradually decreased over the three FYs. From FY 2019 to FY 2021, the company's IT ratio decreased from 15.05 times to 11.79 times. It implies that the company is not efficiently moving its stock in the given period. A declining IT ratio means that the company's inventories are being held back and increasing its cost of goods sold, as observed in the above table (Hilkevics and Semakina, 2019).

3.2 Asset Turnover Ratio

The asset turnover ratio gives insight into the Clarksons’ productivity. In a nutshell, it shows how much money Clarksons is making for every dollar it has invested in its physical assets (such as land, structures, machinery, cash on hand, accounts receivable, and inventory) (Bigel, 2022).

.png)

Table 7: Clarksons’ AT Analysis

(Source: Clarksons.com, 2022)

The AT ratio of Clarksons is below the standard ratio of 1. It means that the company is able to generate only £0.57 for every £1 worth of the asset. It is a bad sign for the company as it cannot maximise its assets to generate revenue greater than £1 against its assets (Bigel, 2022). It is because the company has increased its assets over the period, which is not proportionate to its revenue growth. The primary reason for the company's total assets to increase is the increase in its accounts receivable, as observed in the financial statement. According to the financial statements, the number of accounts receivable increased due to the grouping of past dues (Clarksons.com, 2022).

3.3 Receivable turnover Ratio